Industry Report

Summary

• Macro Environment:

Market expectations for a Bank of Japan (BOJ) rate hike in December have surged to 80%, raising concerns of a repeat of the global market turmoil triggered by the BOJ’s unexpected YCC adjustment in December 2022. A broad unwinding of yen carry trades could pressure risk assets, especially amid year-end liquidity drought. In the U.S., the November ISM manufacturing PMI remained below the expansion threshold for the ninth consecutive month, with the employment component continuing to weaken. Against the backdrop of liquidity stress and economic worries, U.S. equities partially retraced last week’s gains, and December began with a clear risk-off tone.

• Crypto Market:

BOJ rate-hike fears first spilled over into crypto markets. Sentiment worsened further after Strategy CEO Phong Le mentioned on a podcast that the firm “may be forced to sell BTC if its stock price falls below NAV and financing channels dry up.” Bitcoin briefly plunged 7.2% intraday to the 83.8k support level before staging a technical rebound. Altcoins saw relatively limited selling pressure, and thinning sell walls pushed their market dominance up slightly to 41.4%.

• Project Updates

-

Trending Tokens: LINK, MON, FARTCOIN

-

LINK: Grayscale’s Chainlink ETF will list on NYSE Arca

-

MON: Monad generated $151.6k in fees in its first week, surpassing Arbitrum and ranking 9th across all chains

-

GIGGLE: Fee-based buybacks fell short of expectations; GIGGLE dropped over 25%

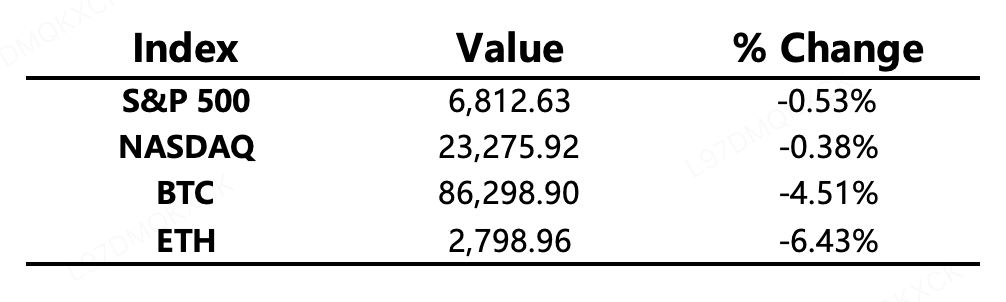

Major Asset Movements

Crypto Fear & Greed Index: 23 (vs. 24 yesterday) — Extreme Fear

What to Watch Today

-

CME Group & CF Benchmarks launch two new Bitcoin volatility indices

-

ENA token unlock: 0.64% of circulating supply, valued at ~$27.2M

-

Grayscale Chainlink ETF begins trading on NYSE Arca

Macro Updates

-

Trump: Fed chair pick “already decided”; odds of Kevin Hassett being appointed rise from 55% to 78%

-

Federal Reserve officially ends quantitative tightening (QT)

-

U.S. November ISM Manufacturing PMI contracts for the ninth straight month

Regulatory & Policy Developments

-

Crypto derivatives exchange Bitnomial to launch the first CFTC-regulated crypto spot trading platform

-

Fed governor Michelle Bowman to unveil new rules governing competition among banks, fintechs, and crypto firms, including stablecoin oversight

-

Bank of Israel warns of large stablecoin transaction volumes and calls for stronger regulation

-

South Korean lawmakers plan to fully pass the Digital Asset Basic Act by January 2026

-

Japanese government preparing to tax crypto trading income at a flat 20% rate

Industry Highlights

-

KuCoin launches KuCoin Alpha, expanding on-chain innovation within its ecosystem

-

Strategy bought 130 BTC last week for $11.7M

-

BitMine accumulated 96,798 ETH, boosting total holdings to 3,726,499

-

Kalshi partners with Solana to migrate its prediction markets on-chain

-

Goldman Sachs acquires Innovator for $2B, adding a BTC-linked ETF to its product lineup

-

Swiss supermarket chain Spar now accepts Bitcoin and crypto payments

-

HashKey passes HKEX listing hearing; aims to list within 2025

-

CoinShares: digital asset investment products saw $1.07B net inflows last week

-

U.S. spot Bitcoin ETFs saw $3.5B in net outflows in November, the largest since February

-

Ripple receives MAS approval for a full payment services license

-

Sony Bank to issue a USD-pegged stablecoin in the U.S.

-

Vanguard to begin offering crypto ETF trading on Tuesday

Expanded Analysis of Industry Highlights

KuCoin launches KuCoin Alpha, expanding on-chain innovation within its ecosystem

-

The launch of KuCoin Alpha signals that Centralized Exchanges (CEXs) are actively blurring the lines with Decentralized Finance (DeFi). As a project discovery platform, it aims to attract early-stage Web3 projects and allows users to trade on-chain assets without needing external wallets, even offering zero-fee trading incentives. This not only enhances user experience and security but, more significantly, positions KuCoin as a potential incubator and launchpad for nascent Web3 projects, solidifying its standing in the crypto innovation landscape.

Strategy bought 130 BTC last week for $11.7M

-

MicroStrategy's continuous purchasing behavior, as one of the largest corporate Bitcoin holders, is a key metric of institutional conviction in Bitcoin's long-term value. While the purchase volume is small relative to its total holdings, acquiring it at an approximate average price of $89,960/coin demonstrates unwavering confidence in that price range, affirming its "buy and hold" strategy regardless of short-term market volatility. This sustained capital inflow provides robust fundamental support to the market.

BitMine accumulated 96,798 ETH, boosting total holdings to 3,726,499

-

BitMine's large-scale accumulation of Ethereum (ETH) further establishes its position as one of the largest corporate holders of the asset globally. While this may signal the company’s long-term bullish conviction regarding the unique value of its Ethereum holdings (e.g., through staking or derivatives construction), such concentrated ownership also raises questions about its financial sustainability (given the potentially high average cost of ETH) and the possible impact on market liquidity.

Kalshi partners with Solana to migrate its prediction markets on-chain

-

The partnership between Kalshi, a prediction market exchange regulated by the U.S. Commodity Futures Trading Commission (CFTC), and Solana is a significant regulatory-DeFi integration case. Migrating prediction markets onto the Solana chain will leverage Solana’s high speed and low cost for instant trade settlement and greater transparency. This provides Kalshi with crypto-native infrastructure and brings compliant, attractive financial products to the Solana ecosystem, accelerating the mainstream adoption of decentralized prediction markets.

Goldman Sachs acquires Innovator for $2B, adding a BTC-linked ETF to its product lineup

-

Goldman Sachs' acquisition of Innovator ETF Management, and the subsequent addition of a Bitcoin-linked ETF product, indicates that major traditional financial giants are quickly integrating crypto-related offerings through acquisition to meet the risk management needs of their high-net-worth clients and financial advisors for digital assets. This deal underscores the growing appeal of structured products (like defined-outcome ETFs) in traditional finance and signals the formal acceptance of Bitcoin as an emerging asset class by top Wall Street firms.

Swiss supermarket chain Spar now accepts Bitcoin and crypto payments

-

The acceptance of Bitcoin and cryptocurrencies by the Swiss supermarket chain Spar is another crucial milestone in the retail adoption of crypto. Switzerland's crypto-friendly regulatory environment provides fertile ground for such large-scale daily consumption integration. The integration of retail payments is a key demonstration of crypto's "utility," as it not only boosts transaction volume but, more importantly, increases the exposure and acceptance of digital assets in the daily lives of ordinary citizens.

HashKey passes HKEX listing hearing; aims to list within 2025

-

HashKey passing the HKEX listing hearing is a historic moment for the cryptocurrency industry in Hong Kong and Asia. As one of the first fully licensed crypto exchanges in Hong Kong, its listing signifies regulatory recognition and support for the crypto business sector. While the company may still face short-term losses, the IPO aims to solidify Hong Kong's status as a global Web3 hub and provide institutional capital with a regulated, compliant channel to invest in the Asian digital asset space.

CoinShares: digital asset investment products saw $1.07B net inflows last week

-

CoinShares data showing net inflows of $1.07 billion into digital asset investment products in a single week is an extremely strong signal. It indicates that institutional investors and wealth management firms are reaching new heights of interest in crypto assets. Despite recent volatility in U.S. spot Bitcoin ETFs, this massive inflow may represent an acceleration of global institutional capital allocation, potentially directed towards broader digital assets or European ETP products.

U.S. spot Bitcoin ETFs saw $3.5B in net outflows in November, the largest since February

-

The $3.5 billion in net outflows from U.S. spot Bitcoin ETFs in November, the largest since February, reflects profit-taking after a rally or uncertainty regarding the macro economy/Fed policy. Despite the significant size of the outflow, given the large overall AUM of the ETFs, this is likely considered part of the pressure for a short-term price correction. It highlights that institutional flows are not unidirectional and that short-term capital movements remain susceptible to market sentiment and risk aversion.

Ripple receives MAS approval for a full payment services license

-

Ripple obtaining the full Payment Services License from the Monetary Authority of Singapore (MAS) is a significant victory for its global compliance strategy. Singapore is a vital fintech hub in Asia, and the license enables Ripple to offer a wider, more regulatory-certain range of digital payment services in the region, including its stablecoin RLUSD and XRP-related services. This strengthens Ripple's position in cross-border payments and demonstrates its commitment to operating within regulated frameworks.

Sony Bank to issue a USD-pegged stablecoin in the U.S.

-

Sony Bank's plan to issue a USD-pegged stablecoin in the U.S. is another major move by a tech and entertainment giant into the digital currency space. The stablecoin is expected to be used for payments related to Sony content (such as PlayStation games, anime, movies), indicating the deep integration of Web3 payments with the digital entertainment industry. This move will leverage Sony's vast user base, driving the stablecoin's utility in mainstream consumer and entertainment sectors, and further establishing the importance of stablecoins in the payment landscape.

Vanguard to begin offering crypto ETF trading on Tuesday

-

Vanguard finally offering crypto ETF trading is a hugely significant milestone. As one of the world's largest asset managers, Vanguard is known for its conservative investment strategy and massive retail base. This move demonstrates that even the most traditional financial institutions cannot ignore the client demand and market liquidity generated by crypto ETFs. It opens the door for millions of conservative investors who previously couldn't access crypto products through the Vanguard platform, signaling the further mainstreaming of crypto asset allocation.