Everything You Need to Know about Crypto Lending

Blockchain is, without doubt, one of the most sensational innovations in the contemporary era. It offers a vast range of revolutionary products and services, including a digital alternative to fiat currencies such as the dollar, euro, yen, etc. As this technology keeps appealing to a broader audience, it is no wonder that the traditional finance industry is gradually integrating itself into the crypto sector. Naturally, this also applies to the lending industry.

Several crypto enthusiasts often prefer to "HODL" their assets until the prices appreciate. However, similar to the uneasy feeling you get about leaving your cash idle in a bank with meager interests, many crypto enthusiasts feel uneasy just waiting for better times and higher prices. Therefore, a commonly asked question amongst the community is, “How can I increase your cryptocurrency holdings?” This is where the concept of crypto lending comes in. Not only will it help lenders receive significant interest on their investment, but it will also allow borrowers to use it as collateral, thereby unlocking the value of their digital assets.

What Is Crypto Lending?

Simply put, crypto lending is an alternative investment strategy that allows investors to lend cryptocurrency to borrowers in exchange for interest. In essence, this system comprises two parties – the lender and the borrower.

Note that this is not a loan without collateral. The lender receives interest from the borrower in exchange for the loan, while borrowers deposit crypto assets as collateral to secure investors' investment. This serves as a guarantee for the lender; if anything goes wrong, they can use this collateral as a form of compensation.

How Does Crypto Lending Work?

Cryptocurrency lending mode of operation is similar to p2p lending. Lenders and borrowers get to connect via an online platform. However, instead of fiat currency, crypto lending transactions use cryptocurrencies.

Crypto lending may vary based on the platform used; however, the primary concept remains the same. Lenders make their crypto assets available at set rates. Generally, users often lend their crypto assets for two primary reasons: margin lending and personal use. Once a lender's fund is available, the borrower - who has concluded that a particular coin’s price will appreciate - will ask to lend a part of the fund available at that moment. The borrower will then repay the loaned cryptocurrency with the assigned interest rate over a certain time period.

How to Invest in Crypto Lending

Before going any further, it is vital to note that there are two categories of cryptocurrency platforms, centralized and decentralized. Each category's pros and cons will ultimately influence the decision regarding which platform you will want to use.

Centralized platforms allow borrowers and lenders to agree on every vital detail, terms, and condition of the loan. However, the downside is that the platform oversees the transfer of lending and management, which some people might not like. On the other hand, decentralized platforms eliminate third parties' influence in managing the loan to decide the best crypto lending rates for you.

In a nutshell, crypto-lending is the process of lending digital assets through crypto exchanges or different lending sites with an interest rate.

Crypto Lending Investment: What to Pay Attention to

The primary thing you should note as an investor is the collateral presented against the loan. The collateral's worth should be more than that of the loan, usually in cryptocurrencies such as ETH and BTC.

Several platforms implement an LTV (Loan-to-value) ratio of approximately 58%, which denotes that borrowers will get less than 58% of the offered collateral's worth.

Owing to its volatility, crypto collateral is subject to sudden depreciation, resulting in a significant loss on the lender's end.

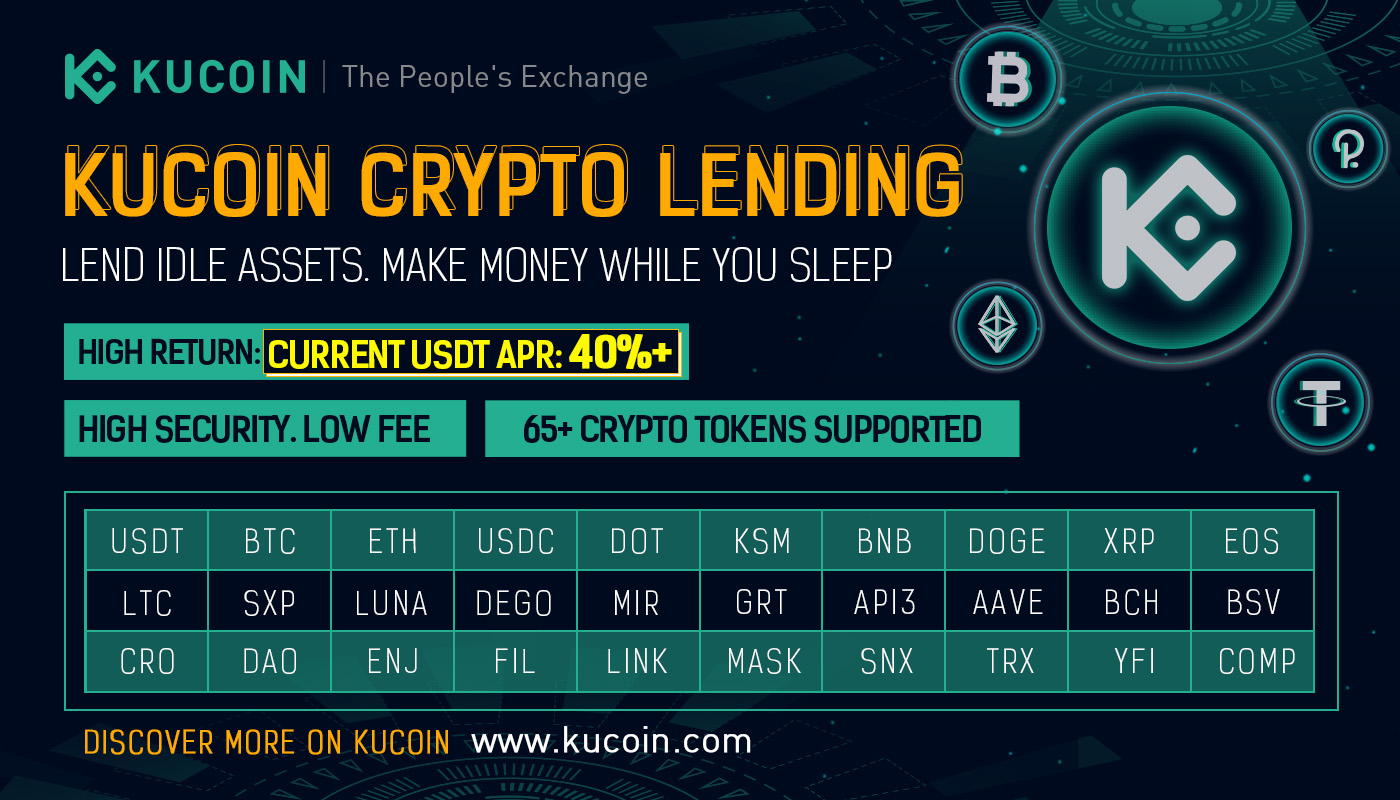

KuCoin Lending Platform

The list of cryptocurrency lending platforms is quite long and will keep growing as time passes. While they all have their distinctions in the mode of operation and services offered, some stand above the others. KuCoin Lend is one of the best crypto lending platforms in terms of services it provides to its users.

KuCoin Margin Trade supports customers to lend limited cryptocurrency to other customers for Funding markets and to charge interest. You can find how to lend in this video.

Safety is the single-most-important issue to every user, whether they are holding funds or lending them. The KuCoin Lend platform offers a comprehensive risk control system that ensures the protection of every users' assets. KuCoin Lend platform not only fits some users' financial needs, but it also favors users that like to store piles of coins.

Is Crypto Lending Safe?

One of the more commonly asked questions by people looking to delve into the crypto lending space is - is crypto lending safe? The answer to this question will greatly depend on the preferred platform.

Advantages of Crypto Lending

Multiple advantages accompany crypto lending. As a lender, it offers you an income-generating opportunity by lending your digital assets to the users, offering the ones they are not using at the moment or planning to sell. This presents a profitable opportunity as this form of lending can generate higher interest than traditional savings.

Crypto lending is also a swift process than traditional lending because creating a lenders account only takes minutes. Besides, KuCoin crypto lending platform also has tools that ensure the automatic payment of funds and interests to the lenders.

Considering the range of benefits this system offers, it seems like it is a flawless one; but it isn't. There are some risks you should expect as a lender and as a borrower.

Crypto Lending Risks

Every aspect of the finance industry has its risks - none is entirely risk-free. Although risks may be fairly low in the crypto lending system, there are some things you must be aware of before deciding to venture into the sector.

1)Absence of regulation

The regulatory structure surrounding digital assets such as Bitcoin is rapidly changing. This may complicate the process of debt collection whenever a borrower defaults on the loan.

The cryptocurrency market is well-known for its inconsistent or non-existent regulatory structure. While some countries are trying to reduce adoption by banning the use of cryptocurrencies, others are slowly trying to regulate it. Hence, there is no global regulatory agreement. Due to this issue, legal crypto-related problems often experience varying treatments depending on the country of residence or jurisdiction. Therefore, suppose any loan defaulting occurs, recovering your assets or interest may be pretty complicated.

2)Transactions with international borrowers

Crypto lending is a process that borrowers and lenders from all around the world can participate in. However, the partial or full anonymity of cryptocurrencies leaves room for potential abuse. It may be challenging to take steps towards debt-collection against individuals who do not reside in the same country. This risk may and may not affect you, as some platforms solved this problem already by implementing various functionalities.

3)BTC and other cryptocurrencies' volatility

One major downside of crypto-based loans is the overall volatility of the underlying cryptocurrency. For instance, if a borrower is to pay $1000 in Bitcoin and the lent-out BTC value doubles over the loan term, the lender will surely lose half of their investment as the borrower will only repay the $1000 worth of Bitcoin.

4) Digital theft

Several Bitcoin lending and investment platforms may require you to hold your asset on their platform. However, this method of holding funds is extremely unsafe, mainly because you do not own the private keys to your wallet. On top of that, these platforms have traditionally been targeted by hackers.

5)Platform failure

Due to the absence of legislation, multiple crypto lenders tend to depend on their loan transaction platforms. However, most of these platforms are currently weak and financially unstable, which may cause them to fail at any time. Hence, conducting comprehensive research before selecting a crypto lending platform is a necessity. KuCoin has a long and successful history of keeping its customers safe and satisfied.

Conclusion

Cryptocurrency lending is a fairly easy opportunity to earn passive income if you possess digital assets you do not currently need. Furthermore, it is also a viable option for anyone that wants to trade cryptocurrency but doesn't have enough time to deal with the intricacies and challenges involved with trading. Regardless of the pros, exercise restraint and caution. If you aren't sure which platform to trust, it’s best to conduct more research until everything is clear. Here at KuCoin, we are always ready to provide you with the information that you are looking for.

Find the Next Crypto Gem on KuCoin!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download