Cara untuk Menjalankan Dagangan

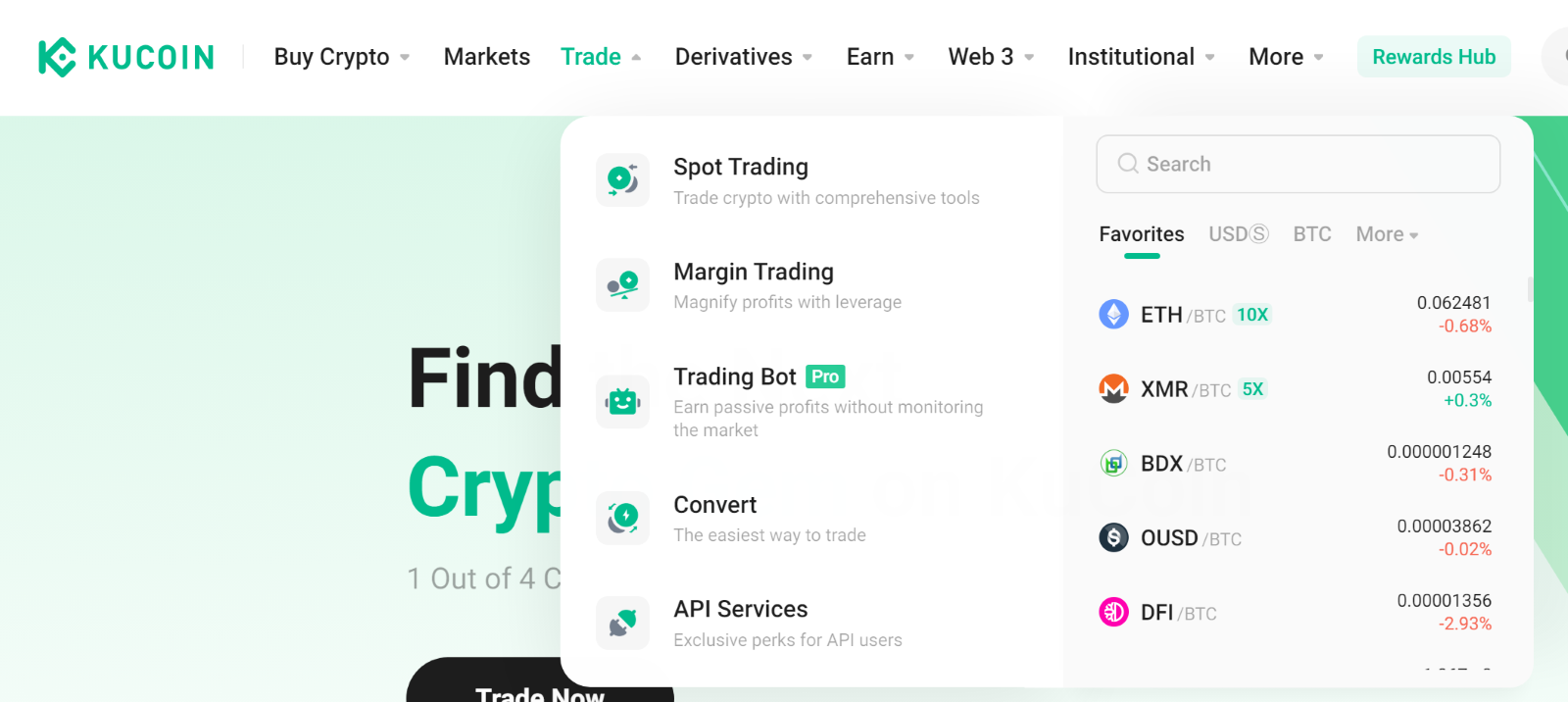

Langkah 1: Akses Platform

Web: Cari Dagang di bar navigasi sebelah atas, kemudian pilih Dagangan Semerta. Ini akan membawa anda terus ke halaman dagangan.

Aplikasi: Hanya ketik Dagang.

Langkah 2: Pilih Pasangan Dagangan

Pada halaman dagangan, cari pasangan dagangan yang ingin anda jalankan dagangan. Untuk memperdagangkan KCS sebagai contoh, anda akan menaip “KCS” ke dalam bar carian.

Langkah 3: Membuat Pesanan

Di bahagian bawah antara muka dagangan, anda akan menemui panel untuk beli atau jual. Ia terdapat enam jenis pesanan yang boleh anda pilih. Jenis-jenis pesanan ini ialah pesanan had, pesanan pasaran, pesanan had henti, pesanan pasaran henti, pesanan one-cancels-the-other (OCO), dan pesanan hentian jejakan. Berikut merupakan beberapa contoh cara untuk membuat setiap jenis pesanan dan cara ia berfungsi:

i. Pesanan Had: Pesanan had membolehkan anda membeli atau menjual mata wang kripto pada harga yang tertentu atau lebih baik.

Sebagai contoh, andaikan harga semasa KCS dalam pasangan dagangan KCS/USDT ialah 4 USDT. Anda ingin menjual setiap satu daripada 100 KCS pada harga sebanyak 5 USDT. Untuk berbuat demikian, anda boleh membuat pesanan had untuk 100 KCS pada 5 USDT.

Pertama sekali, anda akan memilih Had. Kemudian, masukkan 5 USDT untuk harga, 100 KCS untuk jumlah, dan klik Jual KCS untuk mengesahkan pesanan anda.

ii. Pesanan Pasaran: Pesanan pasaran melaksanakan beli atau jual dengan segera, pada harga terbaik semasa yang tersedia di pasaran.

Ambil pasangan dagangan KCS/USDT sebagai contoh. Dengan mengandaikan harga semasa KCS mencapai 4.1 USDT, dan anda membuat keputusan untuk menjual 100 KCS dengan cepat. Untuk berbuat demikian, keluarkan pesanan pasaran. Sistem memadankan pesanan jual anda dengan pesanan beli yang sedia ada di pasaran, memastikan pelaksanaan segera. Pesanan pasaran merupakan cara yang terbaik untuk membeli atau menjual aset dengan cepat.

Bagi senario di atas, anda akan memilih Pasaran, memasukkan 100 KCS untuk jumlah, dan mengklik Jual KCS untuk mengesahkan pesanan.

Catatan: Memandangkan pesanan pasaran adalah diisi dengan serta-merta, ia tidak boleh dibatalkan. Ia adalah dipadankan dengan harga pembuat pesanan terbaik yang tersedia dan dipengaruhi oleh kedalaman pasaran, jadi ia adalah penting untuk anda memberi perhatian terhadap perkara ini semasa anda membuat pesanan anda. Butiran pesanan dan transaksi anda boleh didapati di bawah Sejarah Pesanan dan Sejarah Dagangan.

iii. Pesanan Had Henti: Pesanan had henti ialah perdagangan bersyarat yang menggabungkan pesanan had anda dengan pesanan henti.

Untuk membuat pesanan had henti , anda menetapkan hentian (harga henti), harga ( harga had), dan masukkan kuantiti (jumlah token yang anda beli atau jual). Apabila harga henti dicapai, pesanan had akan dibuat berdasarkan harga had dan kuantiti yang ditetapkan.

Ambil pasangan dagangan KCS/USDT sebagai contoh. Andaikan harga semasa KCS ialah 4 USDT. Anda yakin rintangan harganya adalah sekitar 5.5 USDT, menunjukkan bahawa sebaik sahaja harga KCS mencapai tahap tersebut, ia tidak mungkin akan meningkat dengan selebihnya dalam tempoh pendek. Oleh itu, harga jualan terbaik anda ialah 5.6 USDT, namun anda tidak ingin memantau pasaran 24/7 hanya untuk memaksimumkan keuntungan ini. Dalam senario sedemikian, anda boleh memilih untuk membuat pesanan had henti.

Untuk berbuat demikian, pilih Had Henti, dan tetapkan harga henti sebanyak 5.5 USDT, harga had sebanyak 5.6 USDT, dan tetapkan kuantiti kepada 100 KCS. Kemudian, klik Jual KCS untuk membuat pesanan. Apabila harga mencapai atau melebihi 5.5 USDT, pesanan had akan dicetuskan, dan sebaik sahaja ia mencapai 5.6 USDT, pesanan had anda pasti akan diisi.

iv. Pesanan Pasaran Henti: Pesanan pasaran henti merupakan pesanan untuk membeli atau menjual aset sebaik sahaja harga mencapai harga tertentu ("harga henti"). Ia adalah serupa dengan pesanan had henti, tetapi sebaik sahaja harga henti dicecah, ia menjadi pesanan pasaran dan akan diisi pada harga pasaran tersedia yang seterusnya.

Ambil pasangan dagangan KCS/USDT sebagai contoh. Andaikan harga semasa KCS ialah 4 USDT. Anda yakin rintangan adalah pada 5.5 USDT, dan bahawa harga tidak mungkin akan meningkat dengan selebihnya dalam tempoh pendek sebaik sahaja ia mencapai tahap tersebut. Sekali lagi, anda tidak mahu perlu memantau pasaran 24/7 hanya untuk menjual pada harga terbaik. Dalam situasi ini, anda boleh memilih untuk membuat pesanan pasaran henti.

Untuk berbuat demikian, anda akan memilih Pasaran Henti, menetapkan harga henti sebanyak 5.5 USDT, kuantiti sebagai 100 KCS, kemudian mengklik Jual KCS. Apabila harga mencapai atau melebihi 5.5 USDT, pesanan pasaran dicetuskan dan akan diisi pada harga pasaran tersedia yang seterusnya.

v. Pesanan One-Cancels-the-Other (OCO): Pesanan ini membenarkan anda untuk membuat dua pesanan pada masa yang sama; pesanan had dan pesanan had henti. Bergantung kepada cara pasaran bergerak, satu pesanan membatalkan pesanan yang satu lagi sebaik sahaja salah satu daripada mereka dilaksanakan.

Ambil pasangan dagangan KCS/USDT sebagai contoh, dan andaikan harga KCS ialah 4 USDT. Anda yakin harga terakhir KCS lama-kelamaan akan menurun, sama ada selepas meningkat kepada 5 USDT dan jatuh, atau jatuh terus dari kedudukan ia berada sekarang. Oleh itu, anda berhasrat untuk menjual sekurang-kurangnya 3.6 USDT, sejurus sebelum harga jatuh di bawah tahap sokongan sebanyak 3.5 USDT.

Untuk berbuat demikian, pilih OCO, tetapkan harga anda kepada 5 USDT, henti kepada 3.5 USDT (mencetuskan pesanan had sekiranya harga mencapai 3.5 USDT), had kepada 3.6 USDT, kuantiti kepada 100, dan kemudian klik Jual KCS.

Untuk mengetahui lebih lanjut tentang cara untuk membuat dan menggunakan pesanan OCO:

https://www.kucoin.com/blog/everything-you-need-to-know-about-oco-orders-kucoin-tutorial

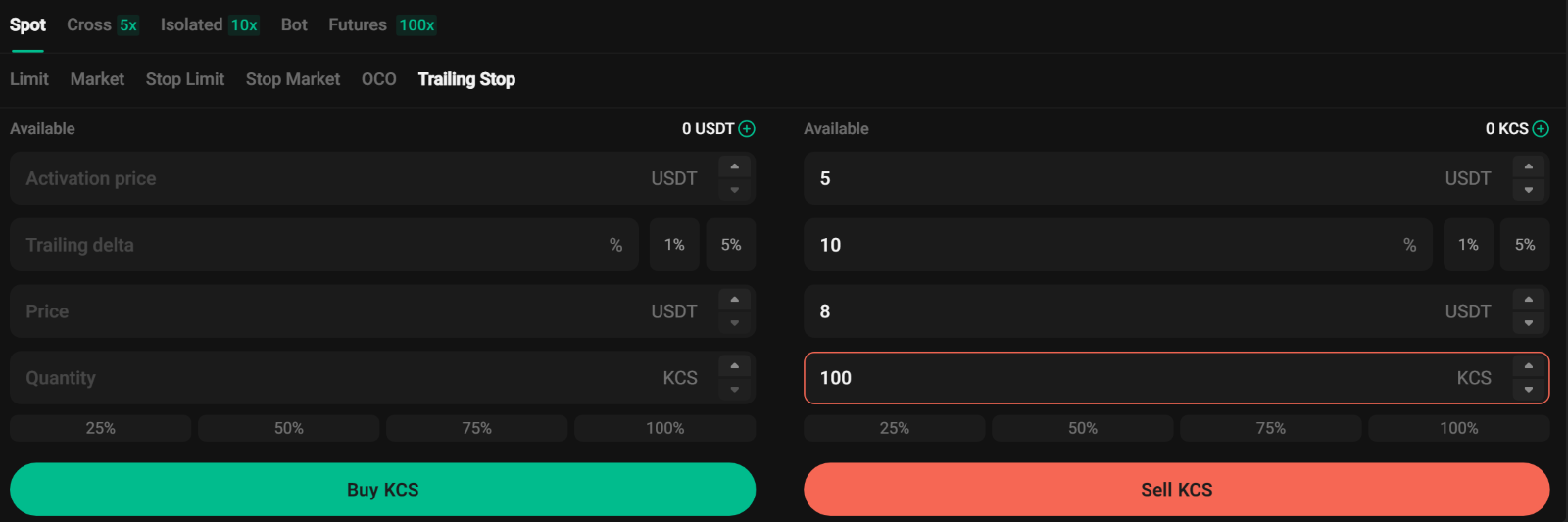

vi. Pesanan Hentian Jejakan: Ini merupakan versi pesanan henti biasa yang diubah suai. Ia secara automatiknya melaraskan harga henti pada peratusan tetap di bawah atau di atas harga pasaran. Apabila harga pasaran memenuhi kedua-dua syarat henti dan peratusan, pesanan had dicetuskan. Dengan pesanan beli jejakan, anda dapat mula membeli dengan segera ketika pasaran mula meningkat selepas mengalami kejatuhan. Begitu juga, dengan pesanan jual jejakan, anda dapat mula menjual dengan segera apabila pasaran mula jatuh selepas trend menaik. Hentian jejakan melindungi keuntungan dengan membenarkan dagangan untuk kekal terbuka dan terus menjana keuntungan, selagi pergerakan harga memihak kepada pengguna. Dagangan kemudiannya ditutup jika harga berubah hala tuju sebanyak peratusan tertentu.

Ambil pasangan dagangan KCS/USDT sebagai contoh, dan andaikan harga KCS ialah 4 USDT. Anda menjangkakan harga KCS akan meningkat kepada 5 USDT, dan selepas ia terus meningkat, ia paling banyak akan menjejak semula sebanyak 10% daripada tahap tertentu sebelum anda mempertimbangkan untuk menjual lagi. Bagi senario ini, anda akan menetapkan harga jualan anda pada 8 USDT. Strategi anda adalah untuk membuat pesanan jual pada 8 USDT, dan satu lagi hanya apabila harga mencecah 5 USDT dan mengalami penjejakan semula sebanyak 10%.

Untuk berbuat demikian, pilih Hentian Jejakan, tetapkan harga pengaktifan kepada 5 USDT, delta jejakan kepada 10%, harga kepada 8 USDT, kuantiti kepada 100, kemudian klik Jual KCS.

Untuk mengetahui lebih lanjut tentang pesanan hentian jejakan:

https://www.kucoin.com/announcement/en-instructions-on-kucoin-trailing-stop-orders