Industry Update

Fed Turns Dovish, Risk Assets Rebound Across the Board

Summary

-

Project & Ecosystem Updates

-

Trending Tokens: HBAR, XRP, TNSR

-

TNSR: Coinbase acquired Vector, a Solana-based project developed by Tensor. Tensor burned 21.6% of unvested tokens and redirected 100% (up from 50%) of marketplace fees to the TNSR treasury.

-

OKX Lists ZEC: Privacy sector tokens—including ZEC, XMR, CC, and DCR—continued to gain traction.

-

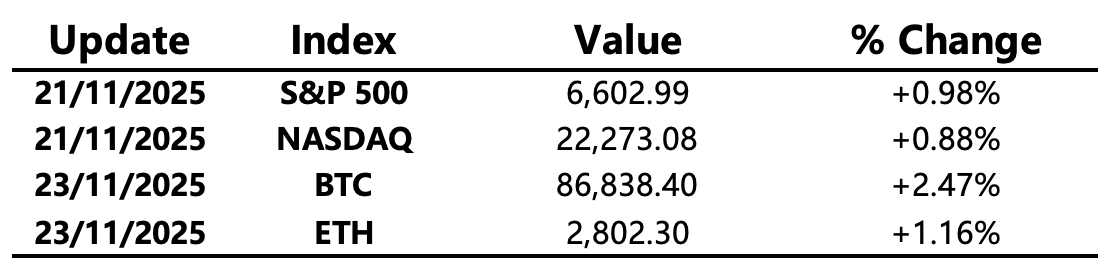

Major Asset Performance

Crypto Fear & Greed Index: 19 (vs. 13 twenty-four hours earlier), classified as Extreme Fear

Key Events to Watch Today

-

Grayscale DOGE and XRP spot ETFs list on NYSE Arca

-

SGX Derivatives launches crypto perpetual futures contracts

-

Monad mainnet and MON token go live

Macro Updates

-

U.S. Bureau of Labor Statistics: October CPI release canceled; November CPI will be released on December 18

-

University of Michigan survey: U.S. Consumer sentiment falls to one of the lowest levels on record

-

Fed’s Williams reiterated room for near-term rate cuts; traders increased bets on a December cut, with a 69.4% probability of a 25 bps reduction

-

U.S. November S&P Global Composite PMI (flash): 54.8, a four-month high; services PMI accelerated while manufacturing PMI slowed

-

U.S. Treasury Secretary Bessent: Government shutdown caused a permanent $11 billion hit on U.S. GDP

-

Japan’s cabinet approved an economic stimulus package totaling over ¥21 trillion

Policy & Regulatory Trends

-

U.S. SEC to hold a roundtable on December 15 to discuss crypto privacy issues

-

Six major Japanese asset managers express interest in launching crypto funds

Industry Highlights

-

U.S. Treasury Secretary Bessent spotted at a Bitcoin-themed bar in Washington

-

Grayscale DOGE and XRP spot ETFs to list Monday on NYSE Arca

-

Coinbase Bitcoin Premium Index remains negative for the third consecutive week

-

Bitwise CEO increases Bitcoin holdings at around $85,000

Expanded Analysis of Industry Highlights

-

U.S. Treasury Secretary Bessent spotted at a Bitcoin-themed bar in Washington

Expansion and Analysis:

-

Political Signal: This unexpected public appearance was widely interpreted by the crypto community and market participants as a clear signal of the U.S. federal government's supportive stance towards Bitcoin and the broader digital asset space.

-

Secretary's Stance: Treasury Secretary Scott Bessent has been viewed as a pro-crypto official since his nomination. He has previously spoken publicly about the need for the U.S. to become a global digital asset hub and has explored policies, including the possibility of establishing a strategic Bitcoin reserve.

-

Venue Symbolism: The bar, named Pubkey, is located in Washington and has a sister location in New York. Its association with political figures makes the brand a unique symbol of the intersection between politics and crypto culture.

-

Grayscale DOGE and XRP spot ETFs to list Monday on NYSE Arca

Expansion and Analysis:

-

Listing Details: The Grayscale Dogecoin Trust is expected to be renamed the Grayscale Dogecoin Trust ETF (GDOG) and is scheduled to begin trading on the NYSE Arca exchange on Monday, November 24th.

-

Market Impact: The listing of spot ETFs offers retail investors a new avenue to purchase these cryptocurrencies through traditional brokerage accounts without directly holding the tokens. This typically leads to increased institutional capital inflow and could provide significant upward price support for both DOGE and XRP.

-

XRP's Significance: XRP has received specific attention due to its prior legal dispute with the SEC. The approval for its spot ETF listing further affirms XRP's tradability and asset legitimacy within the U.S. regulatory environment, which is highly important for the Ripple ecosystem.

-

Coinbase Bitcoin Premium Index remains negative for the third consecutive week

Expansion and Analysis:

-

Index Definition: The Coinbase Bitcoin Premium Index measures the price difference between Bitcoin on Coinbase (which is predominantly retail-driven in the U.S.) and the average price on major global exchanges.

-

Meaning of Negative Premium:

-

A negative index value indicates that Bitcoin is trading at a lower price on Coinbase compared to the global average.

-

This is generally interpreted as a signal of increased selling pressure, weaker market demand, and decreased risk appetite from U.S. retail or institutional investors.

-

-

Market Context: This negative trend coincided with the price decline of Bitcoin in November, falling to the $85,000 range. The persistent negative premium for three consecutive weeks suggests that the selling pressure in the U.S. market is not a short-term phenomenon and reflects sustained bearish sentiment.

-

Correlation with Other Metrics: The negative premium may be associated with outflows from U.S.-listed Bitcoin ETFs, further confirming the risk-off sentiment among U.S. investors towards crypto assets.

-

Bitwise CEO increases Bitcoin holdings at around $85,000

Expansion and Analysis:

-

CEO Confidence: Bitwise is a prominent crypto asset management firm. The decision by its CEO, Hunter Horsley (or Chief Investment Officer Matthew Hougan), to increase Bitcoin holdings as the price approached the critical psychological and technical support level of $85,000 sends a strong signal of confidence to the market.

-

Contrarian Strategy: The buying activity occurred during a period of market-wide bearish sentiment and falling prices, demonstrating a contrarian investing philosophy. This suggests a belief that the current price level is undervalued and represents a prime buying-the-dip opportunity.

-

Institutional View: Bitwise has previously made bullish forecasts, such as predicting a Bitcoin price of $200,000 by the end of 2025. Buying at $85,000 is consistent with their long-term bullish outlook, suggesting they view the current drop as a temporary correction.

-

Market Impact: The personal investment decisions of institutional leaders and well-known investors are often viewed as "smart money" movements. These actions can help stabilize market sentiment and attract other long-term investors.