KuCoin वेंचर्स साप्ताहिक रिपोर्ट 20250421-0427

2025/04/29 01:13:17

KuCoin वेंचर्स साप्ताहिक रिपोर्ट: कॉर्पोरेट SOL भंडार वृद्धि, टैरिफ तनाव कम, BTC ETF दैनिक प्रवाह 3-महीने के उच्चतम स्तर पर, और मॉड्यूलर सार्वजनिक चेन/DeAI इन्फ्रास्ट्रक्चर का संघर्ष और विकास

1. साप्ताहिक बाजार हाइलाइट्स

BTC से SOL तक: पारंपरिक कंपनियां तेजी से अपने कॉर्पोरेट खजाने की रणनीतियों में Solana जोड़ रही हैं

कॉर्पोरेट बैलेंस शीट्स में क्रिप्टो परिसंपत्तियों को शामिल करना अब नई बात नहीं है। BTC द्वारा स्थापित उदाहरण का अनुसरण करते हुए, MicroStrategy ने बिटकॉइन को अपनी प्राथमिक खजाना आरक्षित परिसंपत्ति के रूप में बड़ी मात्रा में अधिग्रहण करके इस कदम की शुरुआत की, यहां तक कि परिवर्तनीय बांड निर्गम के माध्यम से अतिरिक्त खरीदारी को वित्तपोषित किया। विशिष्ट बाजार चक्रों के दौरान, इस रणनीति ने न केवल एक मुद्रास्फीति बचाव के रूप में और उच्च वित्तीय रिटर्न की खोज के रूप में कार्य किया, बल्कि इसके शेयर मूल्य को भी काफी बढ़ावा दिया, BTC और कॉर्पोरेट मूल्य के बीच एक आपसी सुदृढ़ीकरण गतिशील बनाते हुए। इसने कॉर्पोरेट परिसंपत्ति प्रबंधन में क्रिप्टो परिसंपत्तियों की व्यापक स्वीकृति के लिए नींव रखी।

हालांकि, जैसे जैसे BTC को "डिजिटल गोल्ड" के रूप में मान्यता प्राप्त हो रही है और इसकी मूल्य गतिविधियाँ कम अस्थिर हो गई हैं, उच्च अल्फा रिटर्न की संभावना कम हो गई है, जिससे इसकी भूमिका व्यापक मैक्रोइकोनॉमिक और बाजार भावना रुझानों के साथ संरेखित बीटा एक्सपोज़र प्रदान करने की ओर स्थानांतरित हो गई है। इस पृष्ठभूमि के खिलाफ, Solana (SOL), अपने उच्च जोखिम और विकास संभावनाओं के साथ, कंपनियों के लिए अधिक बढ़त की तलाश में एक नया पसंदीदा बनकर उभरा है।

नई ताकतें: निवेश संस्थानों और पारंपरिक कॉरपोरेट्स द्वारा द्वंद्वीय अपनाना

मुख्यधारा की ऑपरेटिंग कंपनियों के इस क्षेत्र में प्रवेश करने से पहले, क्रिप्टो उद्योग से निकट संबंध रखने वाले निवेश फंड पहले से ही सक्रिय हो रहे थे। कनाडाई निवेश फंड जैसे SOL Global Investments और Sol Strategies ने 2025 तक प्रत्येक में 260,000 से अधिक SOL टोकन जमा कर लिए थे। SOL को होल्ड करने के अलावा, उन्होंने सक्रिय रूप से स्टेकिंग और व्यापक Solana इकोसिस्टम में निवेश में भाग लिया। इस प्रारंभिक भागीदारी से Solana के दीर्घकालिक मूल्य में पेशेवर निवेशकों के मजबूत विश्वास की झलक मिलती है।

हालांकि, मुख्यधारा कॉर्पोरेट चेतना में SOL के प्रवेश का वास्तविक टर्निंग पॉइंट क्रिप्टो क्षेत्र के बाहर की कंपनियों की भागीदारी के साथ आया। उपभोक्ता वस्तु कंपनी Upexi (Nasdaq: UPXI) ने $100 मिलियन निजी प्लेसमेंट की घोषणा की, जिसका नेतृत्व क्रिप्टो ट्रेडिंग दिग्गज GSR Markets ने किया, और $94.7 मिलियन SOL खरीदने और कॉर्पोरेट ट्रेजरी रिजर्व स्थापित करने के लिए आवंटित करने की योजना बनाई। इसी तरह, फिनटेक फर्म Janover (Nasdaq: JNVR), सुस्त रियल एस्टेट मार्केट का सामना करते हुए, अपने होल्डिंग्स में लगभग 164,000 SOL टोकन जोड़ने की योजना घोषित की, जिससे कुल होल्डिंग्स लगभग 317,000 टोकन तक बढ़ गई। उनके फंडिंग स्रोतों में नकद रिजर्व और Pantera Capital, Kraken, और अन्य प्रमुख क्रिप्टो संस्थानों से जुटाए गए परिवर्तनीय बॉन्ड शामिल थे। इस क्रॉस-इंडस्ट्री मूव का सुझाव है कि SOL क्रिप्टो-नेटिव दुनिया से व्यापक कॉर्पोरेट एसेट एलोकेशन क्षेत्र में विस्तार कर रहा है।

BTC Beta के रूप में, SOL Alpha के रूप में: कॉर्पोरेट एसेट एलोकेशन के लिए एक नई तर्क प्रणाली

Upexi और Janover जैसी अपेक्षाकृत छोटी, उच्च-जोखिम-झुकाव वाली कंपनियों के लिए SOL को होल्ड करना एक क्लासिक Alpha रणनीति का प्रतिनिधित्व करता है: DeFi, DePIN और अन्य क्षेत्रों में Solana इकोसिस्टम के विस्तार पर दांव लगाना, जबकि BTC की तुलना में अधिक मूल्य लोच और उच्च रिटर्न प्राप्त करने का लक्ष्य रखना। मौलिक रूप से, यह Solana की भविष्य की विकास क्षमता पर एक दांव है, कंपनी के भविष्य मूल्य के एक हिस्से को नेटवर्क की सफलता से जोड़ना, ताकि बेहतर शेयरधारक रिटर्न प्रदान किया जा सके।

हालांकि, SOL को एक कॉर्पोरेट ट्रेजरी संपत्ति के रूप में स्थान देने से महत्वपूर्ण जोखिम भी जुड़े हुए हैं। सबसे पहले, SOL की मूल्य अस्थिरता BTC से कहीं अधिक है, जो महत्वपूर्ण वित्तीय स्थिरता जोखिम पैदा करती है। दूसरा, Solana का नेटवर्क पहले आउटेज और अन्य इंफ्रास्ट्रक्चर चुनौतियों का सामना कर चुका है। इसके अलावा, वैश्विक क्रिप्टो विनियामक नीतियां अनिश्चित बनी हुई हैं, जो कंपनियों को संभावित अनुपालन झटकों के प्रति संवेदनशील छोड़ती हैं। अधिक व्यवहारिक रूप से, पारंपरिक फर्मों के पास ऐसी अत्यधिक अस्थिर संपत्तियों को सुरक्षित रूप से प्रबंधित करने और प्रभावी ढंग से उपयोग करने के लिए आंतरिक क्षमताओं की कमी हो सकती है, जिससे उन्हें परिचालन और निष्पादन जोखिमों का सामना करना पड़ता है।

कुल मिलाकर, पारंपरिक कंपनियों द्वारा उनके SOL होल्डिंग्स को बढ़ाना एक उभरती और उल्लेखनीय प्रवृत्ति को दर्शाता है। यह नए उभरते Layer 1 इकोसिस्टम की संभावनाओं में बढ़ते संस्थागत विश्वास को दर्शाता है और BTC की स्थापित कथा से परे नए विकास प्रेरकों की खोज को संकेत देता है। हालांकि, इस चरण में, यह पूरी तरह से मान्य मुख्यधारा की प्रवृत्ति के बजाय उच्च-जोखिम, उच्च-इनाम फ्रंटियर प्रयोग बना हुआ है—जिसे वास्तव में परिपक्व होने के लिए अधिक समय, अधिक उदाहरण, और अधिक नियामक स्पष्टता की आवश्यकता होगी।

2. साप्ताहिक चयनित बाजार संकेत

BTC $95,000 पर वापस उछला, टैरिफ राहत, BTC ETF इनफ्लोज़ और M2 फेक न्यूज़ के बीच...

पिछले सप्ताह, BTC लगभग 10,000 पॉइंट्स बढ़ा, और संक्षेप में $95,000 पर वापस आ गया। मुख्य चालक अमेरिका-चीन टैरिफ तनावों में कमी और ट्रेड वॉर के कम होने की धारणा थी। जवाबी टैरिफ के दौर के बाद, अमेरिकी अधिकारियों ने पिछले सप्ताह संभावित टैरिफ राहत का संकेत दिया, जिसमें खज़ाना विभाग ने कहा कि चीन के साथ टैरिफ गतिरोध अस्थिर है और चीन से अलग होने का कोई इरादा नहीं जताया। व्हाइट हाउस ने अमेरिका-चीन समझौते की ओर प्रगति का संकेत दिया, और ट्रंप ने कहा कि उनके पास फेड चेयर पॉवेल को हटाने की कोई योजना नहीं है। इन घटनाक्रमों ने अमेरिकी डॉलर और स्टॉक फ्यूचर्स को मजबूत किया, साथ ही BTC ने आशावाद की लहर पर सवारी की। हालांकि, "राहत" और "कम होना" का मतलब समाधान नहीं है। अमेरिका द्वारा सकारात्मक टैरिफ समाचार के संकेत देने के बावजूद, चीन ने लगातार बातचीत में शामिल होने से इनकार किया है, जिससे दीर्घकालिक टैरिफ और व्यापारिक अनिश्चितता बनी हुई है। BTC जोखिम संपत्ति की तरह व्यवहार करना जारी रखता है, जो अमेरिकी शेयरों के साथ निकटता से संबंधित है।

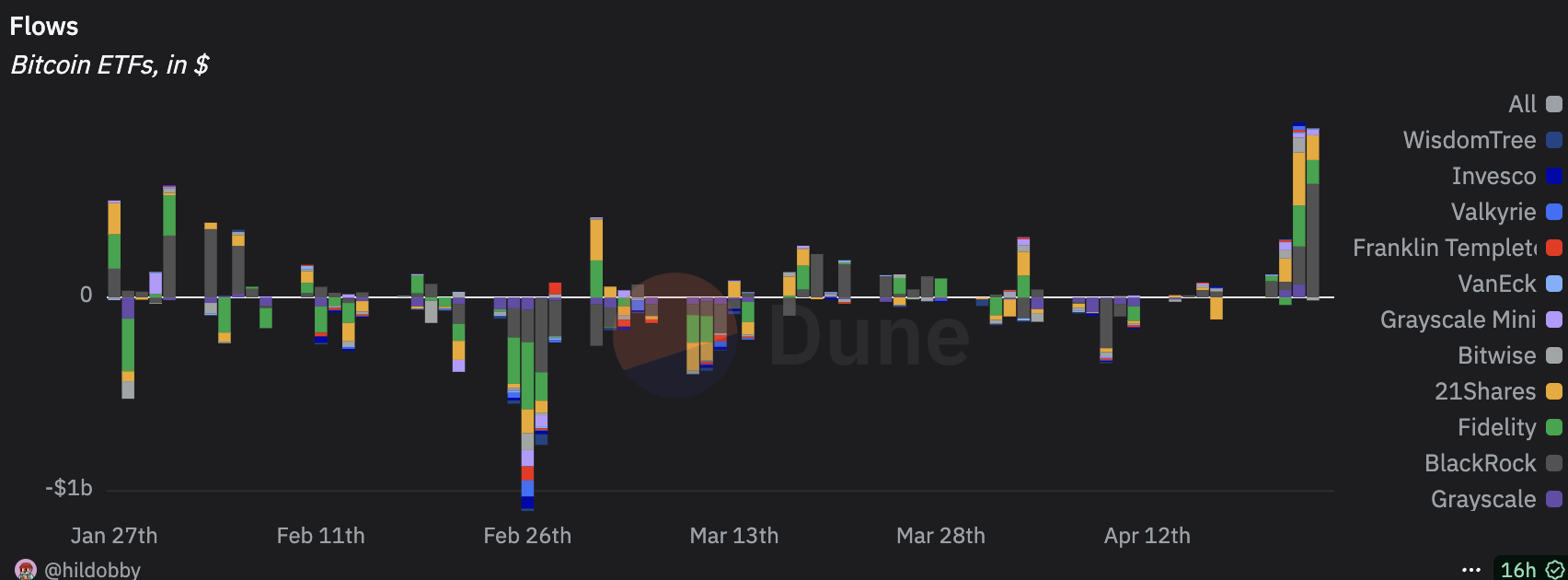

सकारात्मक नीति संकेतों ने वास्तविक खरीद शक्ति में अनुवाद किया, जिसमें BTC ETFs के माध्यम से संस्थागत निवेश ने मूल्य वृद्धि को महत्वपूर्ण रूप से प्रेरित किया। पिछले गुरुवार और शुक्रवार, BTC ETFs ने पिछले तीन महीनों में अपनी उच्चतम दैनिक शुद्ध प्रवाह दर्ज की।

विशेष रूप से, बुलिश भावना के बीच, CT पर प्रसारित एक TradingView चार्ट, जो ग्लोबल M2 मनी सप्लाई में तेज वृद्धि को BTC की मूल्य प्रवृत्ति के साथ दिखाता है, वायरल हो गया। प्रभावशाली व्यक्तियों ने यह घोषणा की कि BTC जल्द ही $100k को पुनः प्राप्त कर सकता है या यहां तक कि $200k तक बढ़ सकता है, जिससे समुदाय में उत्साह बढ़ गया। ऐतिहासिक डेटा यह सुझाव देता है कि ग्लोबल M2 मनी सप्लाई (कुल वैश्विक नकद + बैंक डिपॉज़िट + आसानी से सुलभ पैसा) और BTC की कीमत के बीच एक सकारात्मक संबंध है, जिसमें BTC आमतौर पर लगभग दो महीने पीछे रहता है। इसका श्रेय बढ़ी हुई तरलता को जाता है जो धीरे-धीरे स्थिर-सप्लाई वाले BTC की कीमत को प्रवाहित और बढ़ाती है। हालांकि, ग्लोबल M2 में रिपोर्ट की गई वृद्धि भारत के M2 में कथित 1,000% की उछाल के कारण थी, जो अंततः TradingView पर डेटा त्रुटि निकला।

इस सप्ताह, तीन परियोजनाओं की घोषणा की गई, जिनके फंडिंग राउंड $10 मिलियन से अधिक थे, प्रत्येक Ethereum, Bitcoin, और Solana इकोसिस्टम में

Symbiotic ने $29 मिलियन का सीरीज A राउंड Pantera Capital के नेतृत्व में सुरक्षित किया, जिसमें Coinbase Ventures ने भाग लिया

इस राउंड के बाद, Symbiotic की कुल सार्वजनिक रूप से खुलासा की गई फंडिंग $34.8 मिलियन तक पहुंच गई, जिसमें इसका पिछला बीज राउंड Paradigm द्वारा नेतृत्व किया गया था। Symbiotic ने एक यूनिवर्सल स्टेकिंग फ्रेमवर्क पेश किया, जिसका उद्देश्य स्टेकिंग के माध्यम से सुरक्षा को बढ़ाना है, जिससे L1 या L2 टोकन को कोलैटरल के रूप में उपयोग किया जा सके। वर्तमान में, Symbiotic का TVL $880 मिलियन है, जो इसे रेस्टेकिंग सेक्टर में तीसरा सबसे बड़ा प्रोटोकॉल बनाता है, हालांकि यह EigenLayer के $7.98 बिलियन और Babylon के $4.68 बिलियन से काफी पीछे है। Symbiotic का स्टेकिंग फ्रेमवर्क EigenLayer के AVS के समान है, जो अन्य नेटवर्क या प्रोटोकॉल को रेंटल आय के बदले साझा Ethereum मेननेट-स्तरीय सुरक्षा प्रदान करता है और इंफ्रास्ट्रक्चर श्रेणी के अंतर्गत आता है। हालांकि, एक उल्लेखनीय मुद्दा है L2 सार्वजनिक ब्लॉकचेन की अधिकता और समरूपता। एक और चुनौती यह है कि रेस्टेकिंग प्रोटोकॉल और विभिन्न LST प्रोटोकॉल के टोकन बड़े पैमाने पर उपयोगिता रहित हैं, और उपयोगकर्ता TVL-चालित खेलों से थक रहे हैं।

Arch Network ने Pantera Capital के नेतृत्व में सीरीज A राउंड में $200 मिलियन के मूल्यांकन पर $13 मिलियन जुटाए।

इस राउंड के बाद, Arch Network की कुल सार्वजनिक रूप से घोषित फंडिंग $20 मिलियन तक पहुंच गई, जिसमें इसका पिछला सीड राउंड Multicoin द्वारा नेतृत्वित था। Arch Network का उद्देश्य Bitcoin L1 पर एक ऐसा प्लेटफ़ॉर्म बनाना है जो क्रॉस-चेन ऑपरेशन्स की आवश्यकता के बिना एप्लिकेशन निष्पादन को सक्षम बनाए। इसका मुख्य घटक, ArchVM, Solana की eBPF ब्रांच से व्युत्पन्न है और Rust में लागू किया गया है। ArchVM, Bitcoin के BitVM और Atomicals AVM के साथ, एक समान अवधारणा का प्रतिनिधित्व करता है लेकिन Bitcoin L1 पर स्मार्ट कॉन्ट्रैक्ट्स या एप्लिकेशन इंटरैक्शन को सक्षम बनाने के लिए विभिन्न दृष्टिकोणों के साथ। जबकि यह दृष्टि महत्वाकांक्षी है, तकनीकी चुनौतियाँ महत्वपूर्ण हैं। एक समय में चर्चित BitVM चर्चा से गायब हो गया है, और Atomicals के मुख्य डेवलपर्स ने काफी हद तक पीछे हट गए हैं, जिससे प्रोजेक्ट CTO (कम्युनिटी टेकओवर) स्थिति में है। Arch अपनी घोषित दृष्टि को प्राप्त कर सकता है या नहीं, यह देखना बाकी है।

Nous Research ने Paradigm के नेतृत्व में $1 बिलियन वैल्यूएशन पर $50 मिलियन Series A राउंड में सुरक्षित किए

इस राउंड के बाद, Nous Research की कुल सार्वजनिक रूप से घोषित फंडिंग $70 मिलियन तक पहुँच गई, जिसमें इसका पिछला सीड राउंड Distributed Global और Delphi Digital, सहित अन्य द्वारा समर्थित था। 2022 में स्थापित, Nous Research एक ओपन-सोर्स रिसर्च DAO है जो AI शोधकर्ताओं से मिलकर बना है, जिसकी कुछ शोध पत्रों का Meta और DeepSeek द्वारा संदर्भ दिया गया है। इसका लक्ष्य ओपन-सोर्स मॉडल विकसित करना है, जो इन मॉडलों को प्रशिक्षित करने के लिए टोकन-प्रोत्साहित वितरित प्रशिक्षण विधियों के माध्यम से Solana का एक प्रमुख घटक के रूप में उपयोग करता है। Nous के GitHub रिपॉजिटरी को 2.5k से अधिक स्टार्स मिले हैं। जबकि Nous के द्वारा टोकन जारी करने की संभावना कम है, एक AI रिसर्च संगठन के रूप में Web2 में उल्लेखनीय प्रभाव के साथ, इसका AI और क्रिप्टो एकीकरण का अन्वेषण आशाजनक है। यह देखना बाकी है कि क्या यह इस इंटरसेक्शन में नई ऊर्जा और नवाचार ला सकता है, सच्चे व्यावहारिक उपयोगिता की ओर बढ़ते हुए।

3. प्रोजेक्ट स्पॉटलाइट

Initia लॉन्च: मॉड्यूलर अवधारणाओं को पुनर्जीवित करना? रोलअप लिक्विडिटी विखंडन को संबोधित करना

वर्तमान बाजार में, केवल एक और L1 ब्लॉकचेन या L2 रोलअप समाधान लॉन्च करना अब पर्याप्त रूप से आकर्षक नहीं है। बाजार सहभागियों को आमतौर पर अतिरिक्त कथाओं को शामिल करने की आवश्यकता होती है—या तो लिक्विडिटी तंत्र के साथ नवाचार करना, जैसा कि Berachain द्वारा उदाहरण दिया गया है, या AI चेन या RWA चेन जैसी कथाओं के माध्यम से अवधारणात्मक ढाँचों का विस्तार करना। Initia के सफल मेननेट लॉन्च और इसके बाद Binance लिस्टिंग में किन कारकों ने योगदान दिया है?

मुख्य मूल्य प्रस्ताव उद्योग की प्रमुख समस्याओं को सीधे संबोधित करने में निहित है। विभिन्न वर्चुअल मशीनों (EVM, MoveVM, CosmWasm, आदि) और टूलचेन में नेविगेट करते समय डेवलपर्स द्वारा सामना की जाने वाली विखंडन चुनौतियों को हल करने के लिए, Initia ने Interwoven Stack पेश किया है। यह फ्रेमवर्क न केवल कई निष्पादन वातावरणों को समायोजित करता है बल्कि एकीकृत टूलकिट भी प्रदान करता है जिसे Rollup निर्माण और परिनियोजन को काफी सरल बनाने के लिए डिज़ाइन किया गया है। यह डेवलपर्स को प्रोग्रामिंग भाषा या वातावरण की परवाह किए बिना एप्लिकेशन नवाचार पर ध्यान केंद्रित करने में सक्षम बनाता है, जबकि Rollups और Initia L1 के बीच सहज एकीकरण सुनिश्चित करता है।

तरलता के दृष्टिकोण से, Initia का Enshrined Liquidity और Vested Interest Program, कुछ हद तक Berachain के POL (Protocol-Owned Liquidity) के समान, L1 स्तर पर तरलता को एकत्रित करता है। इन कार्यक्रमों के माध्यम से बाजार भागीदारी प्रोत्साहन के ज़रिए संसाधन पारिस्थितिकी तंत्र DApps और Layer 2 समाधानों में वितरित किए जाते हैं, जिससे डेवलपर्स, DApp उपयोगकर्ताओं और INIT टोकन धारकों/स्टेकर्स के बीच एक संतुलित गेम थ्योरी डायनेमिक बनाया जाता है ताकि आपूर्ति और मांग के बीच दक्षता और संतुलन हासिल किया जा सके।

फिर भी, Initia महत्वपूर्ण चुनौतियों का सामना करता है। चेन-स्तरीय प्रोत्साहन तंत्र वाली परियोजनाएं अब दुर्लभ नहीं हैं; यहां तक कि स्थापित प्रोटोकॉल जैसे Uniswap को UniChain के लॉन्च के बाद तरलता को आकर्षित करने के लिए पर्याप्त सब्सिडी की आवश्यकता होती है। समानांतर में कई VMs का समर्थन करने की रणनीति के तहत, प्रत्येक वातावरण के लिए पर्याप्त संसाधन और अनुकूलन सुनिश्चित करना चुनौतीपूर्ण बना रहता है। इसके अलावा, Cosmos पारिस्थितिकी तंत्र और अन्य VM वातावरण के भीतर शीर्ष डेवलपर्स के लिए प्रतिस्पर्धा करते हुए, उभरती प्रतिभाओं को विकसित करने की आवश्यकता निरंतर कठिनाई पेश करती है।

Initia का अभिनव दृष्टिकोण ध्यान देने योग्य है, क्योंकि तरलता मुद्दों और डेवलपर अनुभव के प्रति इसका विचार उद्योग-व्यापी चिंताओं को दर्शाता है। हालांकि, अवधारणा से लेकर सफल पारिस्थितिकी तंत्र कार्यान्वयन तक की यात्रा लंबी और चुनौतीपूर्ण बनी हुई है। विशेष रूप से, Initia की टीम में Terraform Labs के पूर्व सदस्य Zon और Stan Liu शामिल हैं—एक ऐसी परियोजना जिसमें दोनों, किंवदंती उपलब्धियां और सतर्कता भरे सबक हैं। क्या Initia अपने पारिस्थितिकी तंत्र भागीदारों का नेतृत्व कर सकता है और Cosmos को उसके सुनहरे युग में बहाल कर सकता है जो उसने LUNA के शिखर के दौरान अनुभव किया था, यह देखना बाकी है।

FLock.io ने कंप्यूटिंग पावर और इंफ्रास्ट्रक्चर प्रदान करने के लिए Alibaba के Qwen AI Model के साथ साझेदारी की।

डिसेंट्रलाइज्ड AI प्रशिक्षण प्लेटफॉर्म FLock.io ने अलीबाबा क्लाउड के साथ एक रणनीतिक साझेदारी की घोषणा की है ताकि अलीबाबा के Qwen बड़े भाषा मॉडल और क्लाउड कंप्यूटिंग इंफ्रास्ट्रक्चर पर आधारित वर्टिकल डोमेन और सामान्य AI मॉडल विकसित किए जा सकें। यह सहयोग Web3 AI प्रोजेक्ट और Web2 बड़े भाषा मॉडल के बीच आधिकारिक कार्यान्वयन साझेदारी का एक अपेक्षाकृत दुर्लभ उदाहरण प्रस्तुत करता है, जिससे बाजार में महत्वपूर्ण चर्चा उत्पन्न हुई है।

FLock.io एक डिसेंट्रलाइज्ड AI प्लेटफॉर्म है जो फेडरेटेड लर्निंग, ब्लॉकचेन तकनीक और कम्युनिटी भागीदारी मॉडल को जोड़ता है ताकि AI विकास में दक्षता, गोपनीयता और सहयोग का संतुलन बनाए रखा जा सके। इस प्लेटफॉर्म की तकनीकी नींव फेडरेटेड लर्निंग है, जो—अपने FL Alliance क्लाइंट के माध्यम से—कई पार्टियों को स्थानीय डेटासेट्स पर मॉडल प्रशिक्षण की अनुमति देता है, जबकि केवल मॉडल पैरामीटर का आदान-प्रदान करता है, कच्चे डेटा को नहीं, इस प्रकार डेटा गोपनीयता को संरक्षित करता है। वास्तव में, फेडरेटेड लर्निंग के माध्यम से Flock का दृष्टिकोण ब्लॉकचेन की क्षमता के साथ अच्छी तरह से मेल खाता है, जो तब काम करता है जब कंप्यूटिंग पावर और डेटा वितरित होते हैं। इस मेल ने Flock.io को पिछले वर्ष के दौरान प्रमुख संस्थागत निवेशकों से $9 मिलियन का वित्तपोषण हासिल करने में सक्षम बनाया है।

MEME AI या AI फ्रेमवर्क प्रोजेक्ट्स के विपरीत, जो अवधारणाओं और उपयोगकर्ता यातायात पर जोर देते हैं, FLock.io ने व्यावहारिक कार्यान्वयन और सहयोगों के माध्यम से खुद को अलग किया है। अलीबाबा के साथ अपनी बाहरी साझेदारी से परे, इसने Io.net जैसे क्रिप्टो-नेटिव प्रोजेक्ट्स (कंप्यूटिंग पावर प्रामाणिकता/अखंडता को सत्यापित करने के लिए PoAI पेश करते हुए) और Akash Network (सरलीकृत नोड तैनाती समाधान प्रदान करते हुए) के साथ सहयोग किया है। इसके अतिरिक्त, Web3 Agent और Text2SQL Agent जैसे उत्पादों के माध्यम से, FLock.io ने DeAI सहयोगी नेटवर्क अवधारणा को लागू करने की दिशा में काम किया है। ऐसे कार्यान्वयन और साझेदारियां न केवल इसके ग्राहक आधार का विस्तार करती हैं बल्कि बाजार का ध्यान आकर्षित करने के लिए एक व्यावहारिक दृष्टिकोण भी प्रस्तुत करती हैं—जो अन्य प्रोजेक्ट्स द्वारा अनुकरण किए जाने योग्य एक रणनीति है।

वर्तमान में बिखरे हुए बाजार ध्यान के माहौल में, परियोजना टीमें उपयोगकर्ता रुचि को आकर्षित करने के लिए विभिन्न तरीकों का उपयोग कर रही हैं। जबकि कई परियोजनाएं DeAI नैरेटिव अवधारणाओं को बढ़ावा दे रही हैं, अपेक्षाकृत कम ने तकनीकी कार्यान्वयन और प्रभावी साझेदारी स्थापित करने पर ध्यान केंद्रित किया है। DeAI क्षेत्र का विकास अभी अपने प्रारंभिक चरणों में है। वर्तमान स्थिति के आधार पर, इस क्षेत्र में आधारभूत संरचना का व्यापक ध्यान और अनुप्रयोग केवल तब उभर सकता है जब वास्तव में बड़े पैमाने पर उपभोक्ता DeAI अनुप्रयोग दिखाई दें। उस समय, विभिन्न आधारभूत संरचना परियोजनाओं द्वारा स्थापित तकनीकी क्षमताएं, सेवा मूल्य, और सहयोगी नेटवर्क—अवधारणाओं और नैरेटिव से परे—उनके बाजार स्थानों के महत्वपूर्ण विभेदक बन जाएंगे।

FLock.io की Alibaba Cloud के साथ साझेदारी एक उल्लेखनीय केस स्टडी का प्रतिनिधित्व करती है, हालांकि नैरेटिव और बड़े पैमाने के अनुप्रयोग के बीच एक बड़ा अंतराल बना हुआ है। दीर्घकालिक दृष्टिकोण से, बाजार अंततः इन परियोजनाओं का मूल्यांकन वास्तविक उत्पाद प्रदर्शन और उपयोगकर्ता मूल्य के आधार पर करेगा, न कि अवधारणात्मक अटकलों पर।

KuCoin Ventures के बारे में

KuCoin Ventures, KuCoin एक्सचेंज का अग्रणी निवेश शाखा है, जो वैश्विक स्तर पर शीर्ष 5 क्रिप्टो एक्सचेंजों में से एक है। Web 3.0 युग की सबसे विघटनकारी क्रिप्टो और ब्लॉकचेन परियोजनाओं में निवेश करने का उद्देश्य रखते हुए, KuCoin Ventures वित्तीय और रणनीतिक रूप से क्रिप्टो और Web 3.0 बिल्डरों का गहन अंतर्दृष्टि और वैश्विक संसाधनों के साथ समर्थन करता है।

एक सामुदायिक-अनुकूल और अनुसंधान-प्रेरित निवेशक के रूप में, KuCoin Ventures Web3.0 आधारभूत संरचना, AI, उपभोक्ता ऐप, DeFi और PayFi पर ध्यान केंद्रित करते हुए पोर्टफोलियो परियोजनाओं के पूरे जीवन चक्र के दौरान करीबी रूप से काम करता है।

अस्वीकरण:यह सामग्री केवल सामान्य जानकारी प्रदान करने के उद्देश्य से दी गई है, किसी भी प्रकार के प्रतिनिधित्व या वारंटी के बिना, और इसे वित्तीय या निवेश सलाह के रूप में व्याख्यायित नहीं किया जाना चाहिए। KuCoin Ventures किसी भी त्रुटियों या चूक, या इस जानकारी के उपयोग से उत्पन्न होने वाले किसी भी परिणाम के लिए उत्तरदायी नहीं होगा। डिजिटल संपत्तियों में निवेश जोखिमपूर्ण हो सकता है।

डिस्क्लेमर: इस पेज का भाषांतर आपकी सुविधा के लिए AI तकनीक (GPT द्वारा संचालित) का इस्तेमाल करके किया गया है। सबसे सटीक जानकारी के लिए, मूल अंग्रेजी वर्जन देखें।