Industry Section

Strong Expectations for a December Rate Cut; Bitcoin Consolidates in a Sideways Range

Summary

-

Macro Environment:

The U.S. November ISM Services Index expanded at the fastest pace in nine months, indicating that the services sector has fully recovered from the impact of the government shutdown and that Q4 economic growth remains resilient. Meanwhile, the “mini-nonfarm” ADP employment report unexpectedly undershot expectations and fell to a more than two-year low, further strengthening market expectations for an interest-rate cut at next week’s FOMC meeting. U.S. equities—especially the Russell 2000 small-cap index and rate-sensitive sectors—were boosted and closed higher.

-

Crypto Market:

Bitcoin’s rebound stalled at the 94k resistance level and continues to oscillate between 91.7k–94.1k, with its market dominance rising slightly. Altcoins followed the broader market’s rebound, with L2 and DeFi sectors leading gains driven by the Ethereum upgrade. However, their overall trading-volume share continued to edge down, suggesting liquidity has yet to meaningfully rotate outward.

-

Project Developments

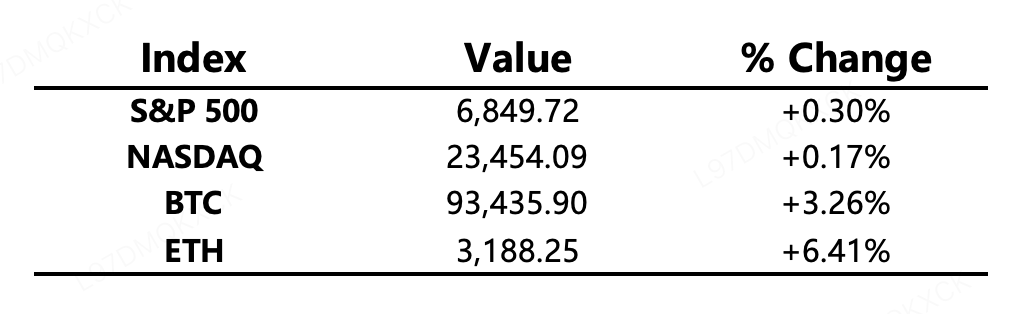

Major Asset Performance

Crypto Fear & Greed Index: 26 (vs. 28 24 hours ago), indicating Fear.

What to Watch Today

-

SEC Investor Advisory Committee to hold an online meeting on Dec 4 to discuss corporate governance and tokenization of securities.

Macro Updates

-

Bond investors warn the U.S. Treasury over the potential appointment of Hassett as Federal Reserve Chair.

-

U.S. November ADP Employment: -32,000 (vs. +10,000 expected; previous +42,000).

Regulatory Landscape

-

Connecticut orders Kalshi, Robinhood, and Crypto com to halt sports betting operations.

-

SEC Chair: SEC must continue advancing tokenization; the Bitcoin market-structure bill is close to passage.

-

UK passes legislation recognizing cryptocurrencies and stablecoins as legally protected personal property.

-

SEC halts approval of high-leverage ETFs over risk concerns.

-

U.S. House Republicans confirm “Operation Choke Point 2.0” targeting Bitcoin and crypto companies.

Industry Highlights

-

KuCoin once again nominated for U.Today’s Top Crypto Exchange award in 2025.

-

Charles Schwab: to offer Bitcoin and Ethereum trading services in early 2026.

-

Ethereum completes the Fusaka upgrade, entering a twice-yearly hard-fork cadence.

-

Polymarket announces launch of its U.S. version app on X.

-

First U.S. LINK spot ETF launches with USD 37.05M first-day net inflows.

-

Reuters: WLFI to launch its RWA product in January next year.

-

CME introduces a Bitcoin Volatility Index.