KuCoin Ventures Weekly Report: Bitcoin Consolidation, GameStop & Strive Enter Treasury Race, as Hyperliquid & InfoFi Heat Up

2025/06/03 09:22:50

KuCoin Ventures Weekly Report: Bitcoin Consolidation, GameStop & Strive Enter Treasury Race, as Hyperliquid & InfoFi Heat Up

1. Weekly Market Highlights

Trump Administration and Family Prepare to Establish Bitcoin Reserve, GameStop Acquires Thousands of Bitcoins

In March this year, U.S. President Donald Trump signed an executive order directing the Treasury Department to establish a “Strategic Bitcoin Reserve” and a “U.S. Digital Asset Reserve,” incorporating cryptocurrencies seized through criminal or civil proceedings into the reserve. According to Arkham data, the U.S. government holds 198,000 BTC from criminal seizures, valued at over $20 billion. At the Bitcoin 2025 conference this week, Crypto Czar David Sacks stated that, under Trump’s crypto reserve executive order, the government could acquire additional Bitcoin in a budget-neutral manner without increasing taxes or debt, though implementation would require support from the Treasury or Commerce Departments.

Beyond government actions and official statements, Trump family businesses are actively planning for additional Bitcoin reserves. The Trump Media & Technology Group (TMTG), which operates the social media platform Truth Social and is controlled by the Trump family, announced this week that it has secured subscription agreements with 50 institutional investors. TMTG plans to raise $2.5 billion through a private placement ($1.5 billion in common stock and $1 billion in convertible bonds) to create a Bitcoin treasury, marking one of the largest such transactions among publicly listed companies. The acquired Bitcoin may also integrate into its social media operations, including subscription payments, potential platform utility tokens, and other transactions on Truth Social and Truth+.

Additionally, several publicly traded companies continue to purchase Bitcoin to capture its price appreciation potential and boost their stock prices, offering traditional stock market investors crypto exposure without direct coin ownership. Notably, GameStop announced this week that it has acquired 4,710 Bitcoins, valued at over $500 million. GameStop previously triggered a historic short squeeze in early 2021, when retail investors, coordinated via Reddit’s WallStreetBets forum, aggressively bought its stock, driving the share price from a few dollars to tens of times higher, inflicting massive losses on hedge funds shorting the stock and forcing some to cover their positions urgently.

Leveraging the “Trump brand effect,” Bitcoin’s market enthusiasm is expected to continue rising, attracting more public companies to acquire Bitcoin as an asset reserve. Meanwhile, GameStop’s multi-hundred-million-dollar Bitcoin purchase is not merely a financial strategy but also extends its narrative of “challenging the establishment and old money.” As a symbol of decentralized finance, Bitcoin embodies the idea of disrupting traditional banking systems and fiat currencies, aligning closely with GameStop’s “rebellious” ethos. This move has sparked strong resonance within meme culture and the crypto community.

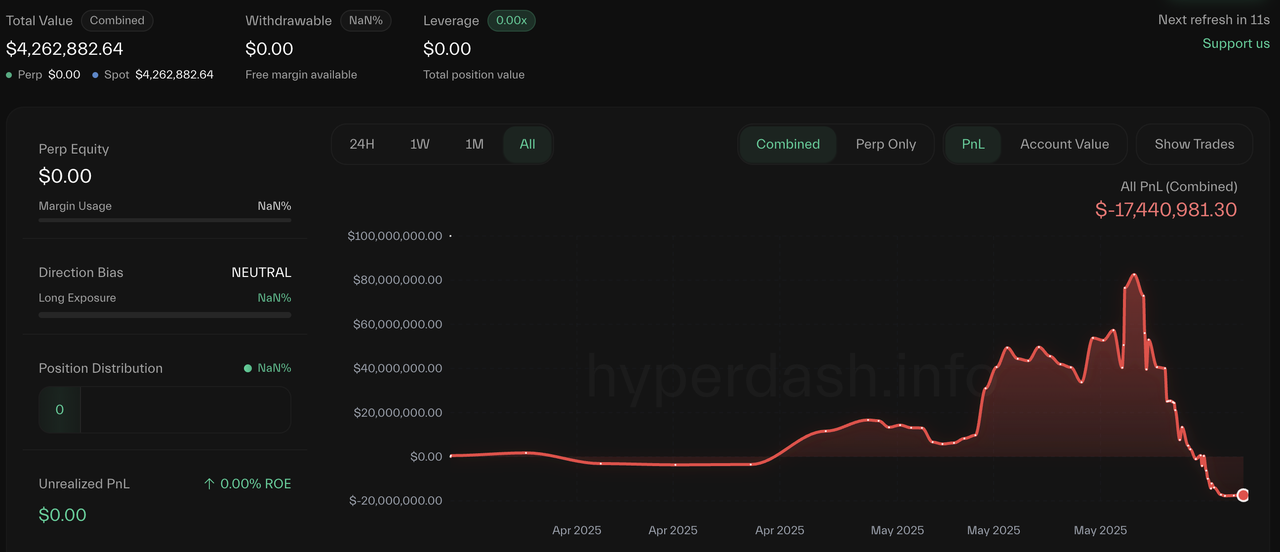

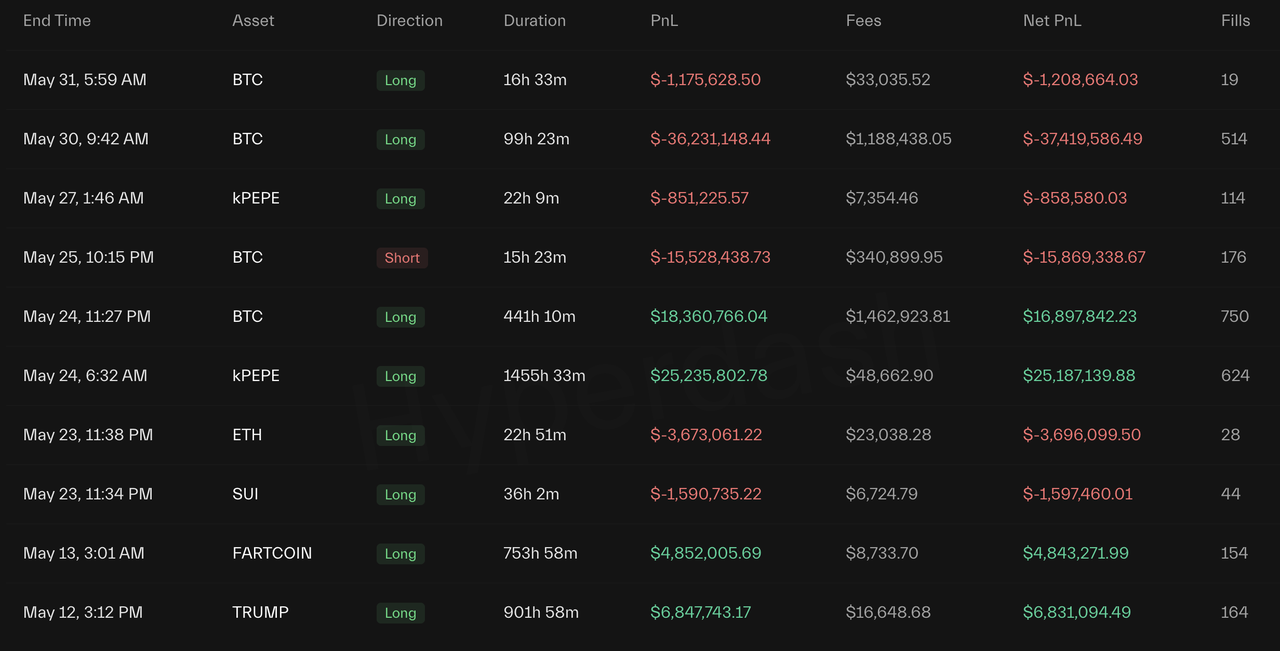

James Wynn’s Dramatic Trading Journey: Peak Profits Exceed $80 Million, But a Drawdown to Losses in Mere Days

A trader named James Wynn gained fame on Hyperliquid for employing 40x high leverage, managing massive positions worth hundreds of millions (at times exceeding $1 billion), and leveraging Twitter influence to publicly call trades. At one point, Wynn achieved profits of $87 million in transparent Hyperliquid operations. However, a drawdown to partial liquidation, resulting in nearly $100 million in losses, occurred within just a few days. Wynn’s losses primarily stemmed from a BTC short position closed on May 25, which incurred over $15.8 million in losses, and a BTC long position closed on May 30, which lost more than $37.4 million. After closing the losing short position, Wynn reversed to a long position, only to suffer another massive loss. All of Wynn’s trade openings, closures, and liquidations are publicly verifiable on Hyperliquid. Fueled by Wynn’s popularity in CT, some traders engaged in copy trading or inverse trading, amplifying capital influence. This even led to the emergence of new on-chain copy-trading products tracking prominent Hyperliquid traders.

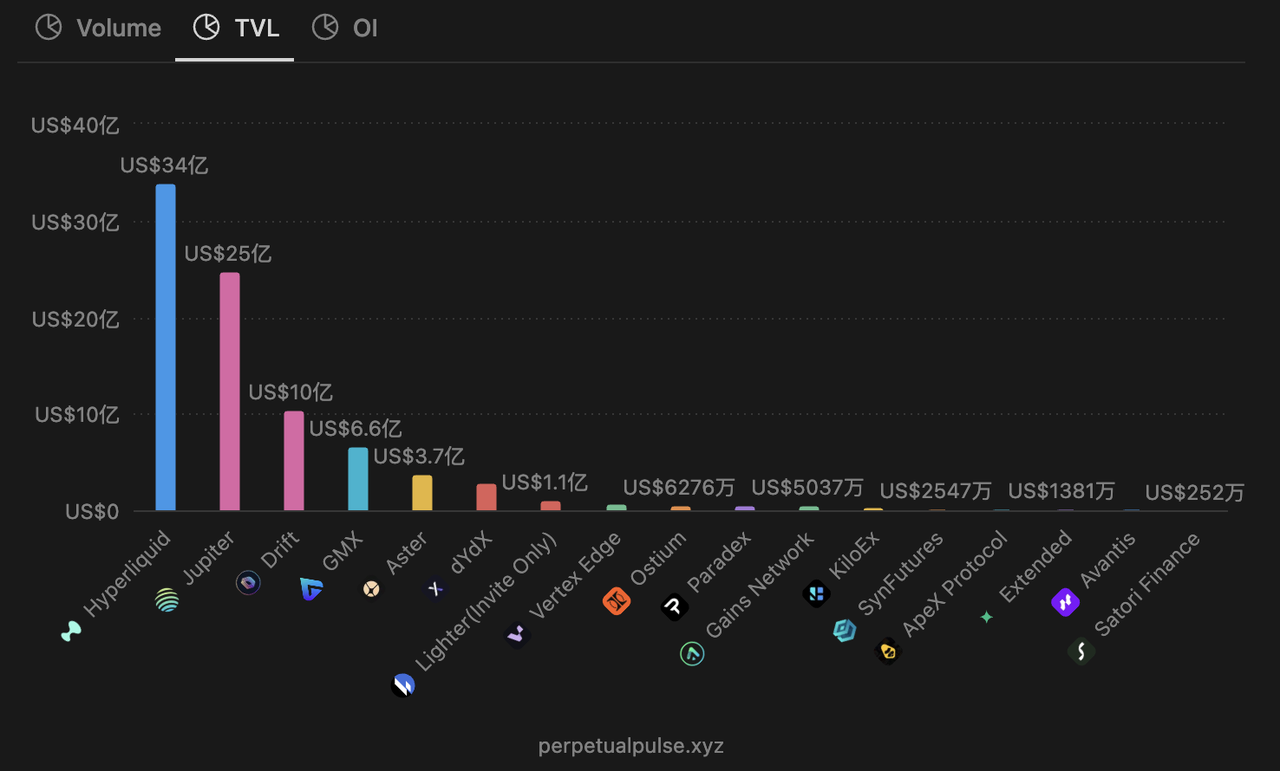

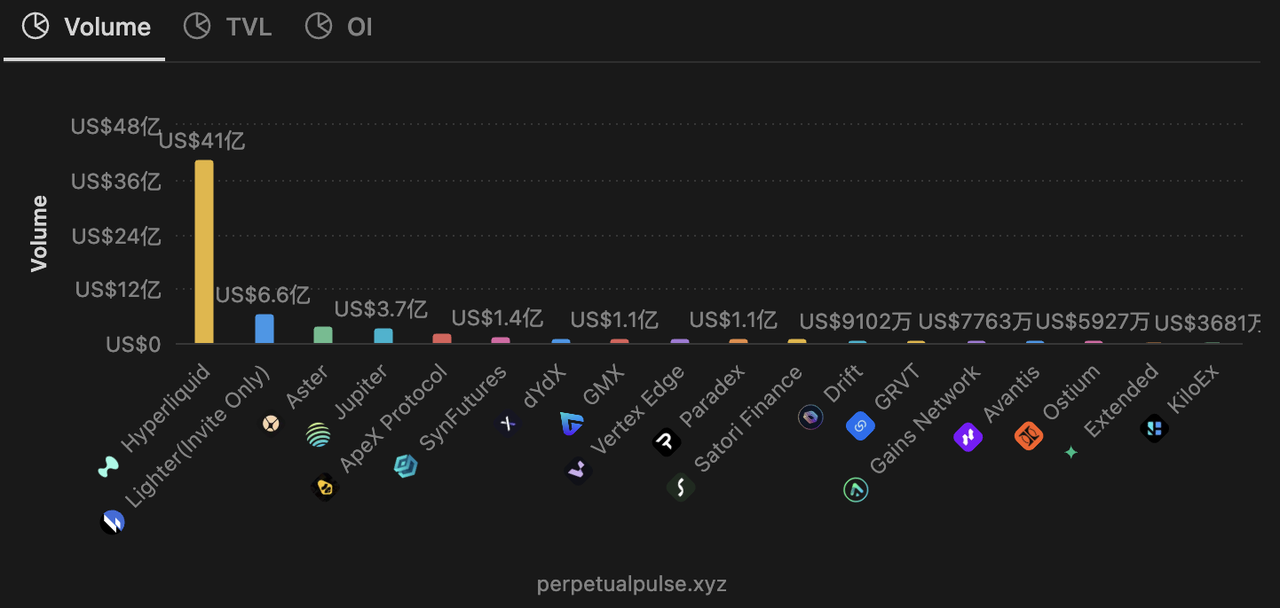

Data Source: https://www.perpetualpulse.xyz

Driven by the fervor surrounding James Wynn’s gambler-like trading style, Hyperliquid’s assets reached $3.4 billion in USDC, surpassing many CEXs. Hyperliquid leads on-chain perp protocols with its daily trading volume and open interest. In May, Hyperliquid’s perp volume hit a record high of over $240 billion, capturing more than $70 million in fees. Hyperliquid’s robust profitability continues to spur the emergence of new on-chain perp protocols, with nearly 20 active on-chain perp exchanges currently in the market, based on incomplete statistics. While trading mechanisms can be replicated, interfaces and user experiences optimized, and trading volumes temporarily boosted through competitions or point incentives, the formidable barrier of stablecoin-denominated clean asset scale remains a hard strength difficult to challenge in the short term. It is foreseeable that the battle for the “second place” in the race beyond Hyperliquid will grow increasingly intense.

2. Weekly Selected Market Signals:Crypto Sentiment Cools, Capital Inflows Slow, as Strive Raises Funds to Chase Bitcoin "Alpha" Outperformance

Source: TradingView, 25/06/02

BTC Spot ETFs Experience Largest Single-Day Net Outflow Since March

Source: SosoValue, 25/06/02

After reaching all-time highs, Bitcoin's price has pulled back and is currently consolidating at high levels. Due to a temporary lack of new compelling narratives relevant to retail investors, overall crypto market sentiment has cooled, with the Fear & Greed Index returning to "Neutral" from "Greed." From a macro perspective, the annualized growth rate of global M2 has slowed, and Bitcoin's weekly MACD indicator also suggests convergence. The US Dollar Index (DXY) is consolidating in a bottom range, collectively pointing to the current market's high-level consolidation. Notably, Bitcoin spot ETFs have recently experienced net outflows, indicating that some capital has opted for profit-taking after the new highs.

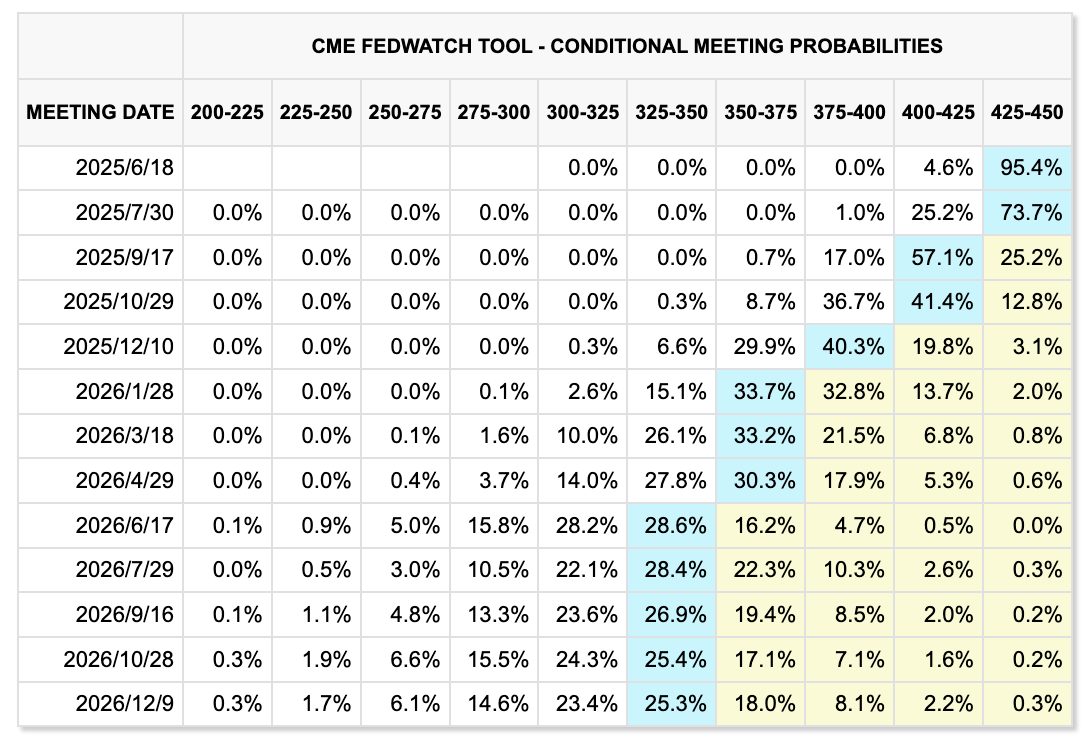

Source:FED WatchTool, 25/06/02

Last week, the Federal Reserve released the minutes from its early May meeting. The record shows that policymakers generally believe the economy faces greater uncertainty than before. Therefore, it is appropriate to remain cautious on interest rate cuts, preferring to wait until the impact of factors like (potential future or current) trade policies (such as tariff adjustments) becomes clearer before considering action. Despite some pressure to cut rates, the Fed maintained its cautious stance. This reflects policymakers' concerns about the recent rare simultaneous pressure on US stocks, bonds, and currencies, as well as the potential weakening of US Treasuries' safe-haven status and the underlying market sentiment and decision-making logic's long-term impact on the US economy. According to the latest data from the CME "FedWatch Tool," traders generally do not expect rate cuts in June or July, with current expectations for two rate cuts within the year, totaling approximately 50 basis points.

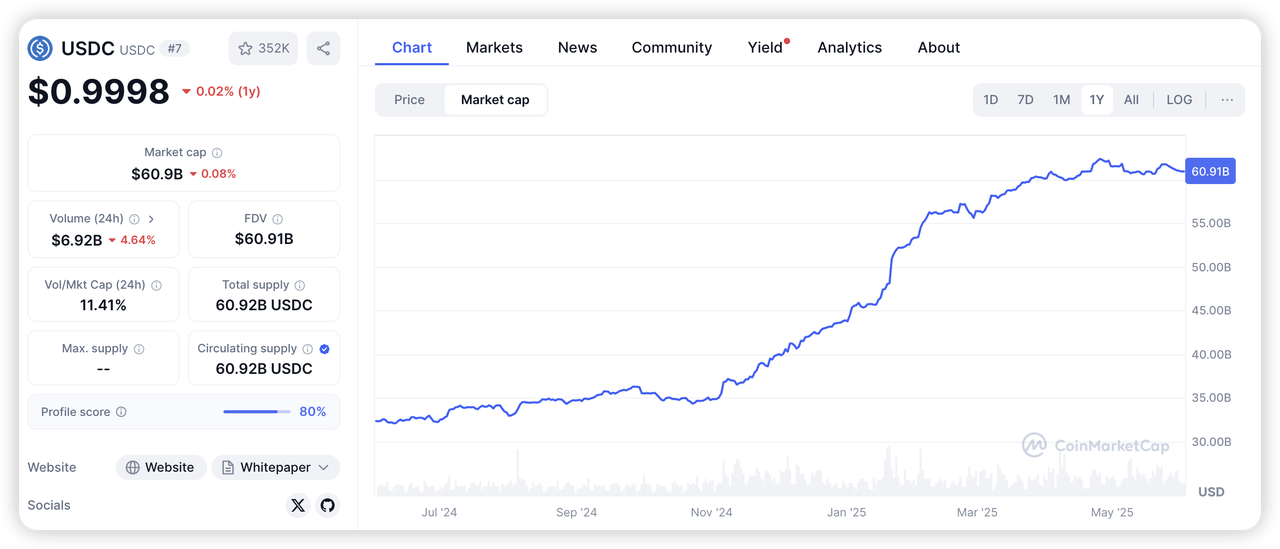

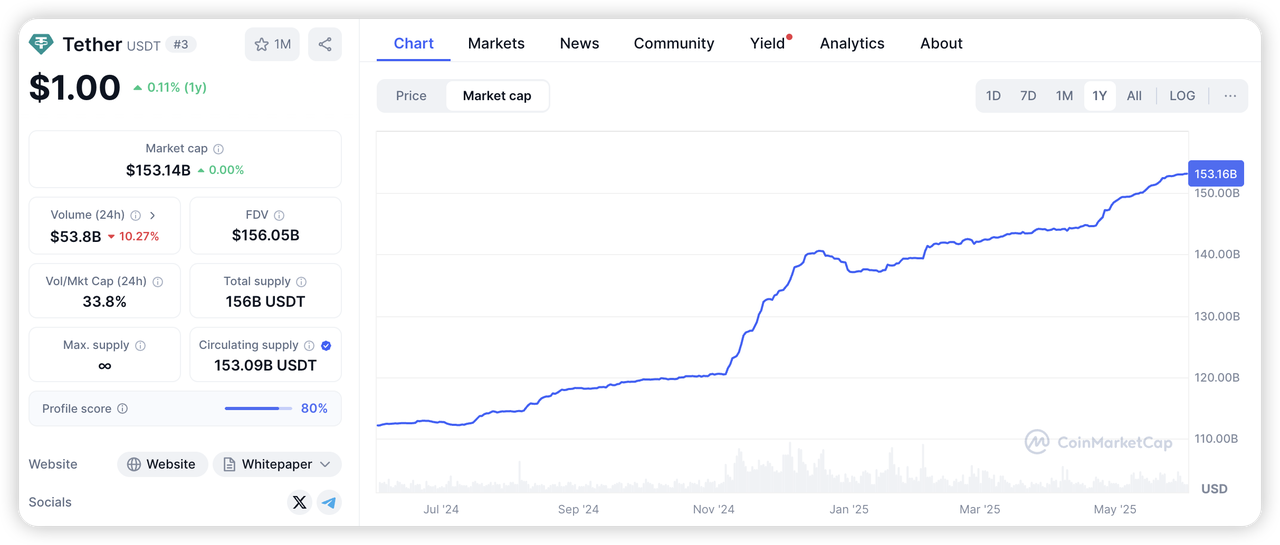

Source: CoinMarketCap, 25/06/02

Regarding stablecoins, USDC's total issuance has been consolidating at high levels since April, with growth somewhat stagnating. While USDT issuance continues to see modest growth, its pace has also slowed. Overall, despite Bitcoin's price briefly hitting new highs, the momentum of capital flowing into the crypto market through the two main channels of ETFs and stablecoins has weakened. The overall capital situation shows a degree of wait-and-see sentiment, failing to sustain the euphoria seen during the previous highs.

However, there are also long-term positive signals in the market. Just last week, the US Department of Labor, continuing the Trump administration's crypto-friendly stance, formally rescinded the "extreme caution" regulatory guidance issued by the previous Biden administration regarding investment in cryptocurrencies within 401(k) retirement accounts. This policy shift means US employers will face fewer legal hurdles when offering crypto assets like Bitcoin as options in retirement plans. If regulators further clarify and permit 401(k) plans to invest in crypto assets in the future, it would not only directly introduce new capital but could also set a precedent for pension funds in other countries and regions, thereby attracting more long-term global capital into the crypto market. Although funds may not flow in immediately in the short term, its long-term potential is significant and represents an important long-term driver for the market.

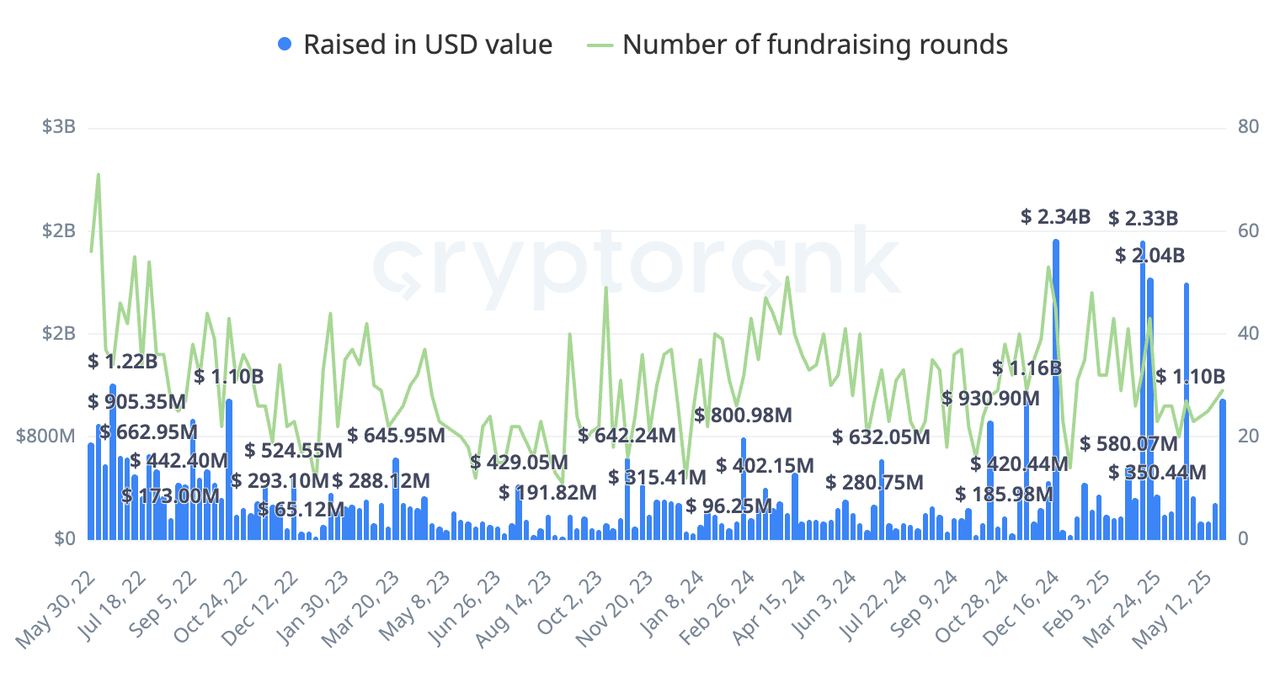

Souorce:cryptorank, 25/06/02

Last week, total single-week funding in the primary market exceeded $1.1 billion, a relatively high level for recent times. This funding round was primarily driven by several Bitcoin investment firms adopting strategies similar to MicroStrategy, such as Strive, Twenty One, and Metaplanet.

Strive Asset Management Secures $750M in Funding to Advance "Alpha-Generating" Bitcoin Strategy

Strive Asset Management, in conjunction with Asset Entities, announced a $750 million private investment to fund its initial phase of Bitcoin acquisitions. The goal is to establish Strive as a leading Bitcoin treasury company focused on long-term outperformance against Bitcoin itself. The company also indicated it is eyeing the approximately $7.9 billion in Mt. Gox Bitcoin claims and is committed to building its own Bitcoin treasury. In early May, Strive Asset Management had announced plans to merge with Nasdaq-listed Asset Entities (ASST), aiming to transform into a publicly traded Bitcoin treasury company that actively accumulates and manages Bitcoin through aggressive strategies via a reverse merger.

Recently, Strive CEO Matt Cole outlined the company's plan to deploy "alpha-generating strategies" designed to exceed Bitcoin's baseline returns. This contrasts sharply with traditional Beta strategies, which simply involve buying and holding Bitcoin long-term. The specific strategies include:

-

Leveraging Section 351 Tax-Deferred Bitcoin Financing:

-

Offering a Section 351 tax-deferred exchange of Bitcoin for public company equity. Current Bitcoin holders can exchange their Bitcoin for shares in the merged company at a 1:1 value (no markup), potentially deferring capital gains tax.

-

The cap for Bitcoin accumulation through this exchange is estimated at around $1 billion (subject to tax constraints) and is a one-time opportunity.

-

The transaction is expected to be completed in the summer of 2025, with the merged company valued at approximately $265.5 million.

-

-

Acquiring Distressed Companies at a Discount to Obtain Cash for Bitcoin Accumulation:

-

Planning to acquire publicly traded companies (especially biotech firms) whose market capitalization is below their net cash value, thereby obtaining cash at a discount to purchase Bitcoin.

-

Strive's presentation mentioned that the biotech sector has significant "trapped cash," with an estimated opportunity exceeding $30 billion. Strive plans to leverage its team's network and M&A experience in this area.

-

-

Utilizing Structured Instruments to Accumulate Bitcoin:

-

Leveraging its expertise in fixed income and options (CEO Matt Cole previously managed a $70 billion fixed income portfolio) to implement institutional-grade strategies for accumulating Bitcoin in a non-dilutive (or minimally dilutive) manner, aiming for superior risk-adjusted returns.

-

-

Immediate Financing Flexibility via Reverse Merger for Rapid Business Deployment:

-

Unlike SPACs or IPOs, a reverse merger gives SAM immediate access to a public equity shelf registration, enabling swift financing.

-

The company plans to expand this shelf registration to over $1 billion post-transaction for further Bitcoin accumulation through equity and debt offerings.

-

Overall, Strive's new strategy is highly ambitious, seeking to combine complex tools from traditional finance with Bitcoin's vast potential, while also innovating on the Bitcoin treasury company model similar to MicroStrategy (specifically through its alpha-generation focus). However, the complexity and execution difficulty of its strategies inevitably come with corresponding risks. The market's reception of this model and its subsequent operational performance are worthy of long-term tracking and attention.

3. Project Spotlight

InfoFi Sector Competition Intensifies as Attention Economy Models Emerge

Kaito Yapper Faces Challenges as Cookie Snaps Enters the Fray

Kaito's Yapper product previously gained market traction in the InfoFi space by incentivizing KOL content creation and $KAITO stakers through airdrops. However, amid allegations of manipulated attention share allocation within its Pre-TGE Arena, AI Agent data platform Cookie seized the opportunity, launching its Cookie Snaps feature and formally entering the InfoFi sector.

Cookie Snaps' inaugural collaboration is with MakerDAO to incubate its DeFi protocol Spark, which primarily offers stablecoin savings and USDS lending collateralized by major assets such as BTC and ETH. The points mechanism of Cookie Snaps is similar to Kaito's Yap points, designed to reward users for analyzing crypto projects and KOLs, and sharing quality content. Current observations suggest the competitive intensity within the Snaps ecosystem is considerably lower than that of Yapper.

Kaito's Inaugural IAO: LOUD – An Attention Economy (3,3) Game Theory Experiment

Kaito incubated its new project, LOUD, through its Initial Attention Offering (IAO), marking a bold experiment in attention economy mechanisms.

-

Core Mechanism: LOUD aims to incentivize KOLs to generate and convert attention for the project, rather than relying on the token's intrinsic fundamentals. Its reward system is skewed towards top contributors who generate the most attention. The project utilizes Kaito AI's Yapper system to quantify users' "attention value" based on posting frequency, influence (Smart Followers), and content quality. Notably, LOUD's attention share on the Kaito Yapper platform once reached as high as 69%.

-

Tokenomics and Incentives: The $LOUD token itself possesses no inherent utility. The project team established a liquidity pool on Meteora with a high 4% transaction fee. Weekly, 72% of these transaction fees (distributed in $SOL) are allocated to the top 25 Yappers. This design aims to prevent immediate selling pressure from Yappers receiving $LOUD tokens, while simultaneously incentivizing more creators to compete for rankings, thereby amplifying overall influence.

-

Separation of Yappers and Holders: LOUD's mechanism astutely separates content creators (Yappers) from token holders. Yappers can focus on content creation without needing to hold $LOUD, achieving "incentive segregation" and insulating them from token price volatility. Under this model, the groups responsible for revenue accumulation (converting popularity into trading volume) and revenue distribution (rewarding top attention contributors) may not entirely overlap. Additionally, Kaito stakers also share 18% of the transaction fees. The essence is to leverage a (3,3) game theory model to foster spontaneous creation and dissemination among participants, ultimately maximizing "Mindshare" and achieving a win-win outcome.

-

Market Performance: As of 11:00 AM (GMT+8) on June 2nd, $LOUD's Fully Diluted Valuation (FDV) was approximately $11.9M, representing about 0.6% of Kaito's FDV. Pre-sale returns were substantial, reaching up to 116x:

-

Priority Access: 0.2 SOL -> 225,000 LOUD (~$23.26 SOL equivalent)

-

Community Access: 0.05 SOL -> 56,250 LOUD (~$5.81 SOL equivalent)

-

The rise of the InfoFi sector and attention economy models injects new narratives into the market. For VC firms, this signals opportunities to capture high-growth Alpha in platform-level tokens and early-stage ecosystem projects like LOUD, while also demanding in-depth assessment of sustainability, manipulation-resistance, and long-term user stickiness of innovative mechanisms (e.g., (3,3) attention game theory, incentive segregation), and vigilance towards intense platform competition. Conversely, for retail investors, it is crucial to recognize that such 'attention-driven' projects often couple high return expectations with extreme risk; their 'no intrinsic value' characteristic can readily foster bubbles. Understanding how incentive mechanisms shape market behavior, enhancing discernment of KOL and project hype, and avoiding herd mentality are paramount.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.