Industry Update

U.S. Markets Closed for Thanksgiving, Global Trading Activity Remains Muted

Summary

-

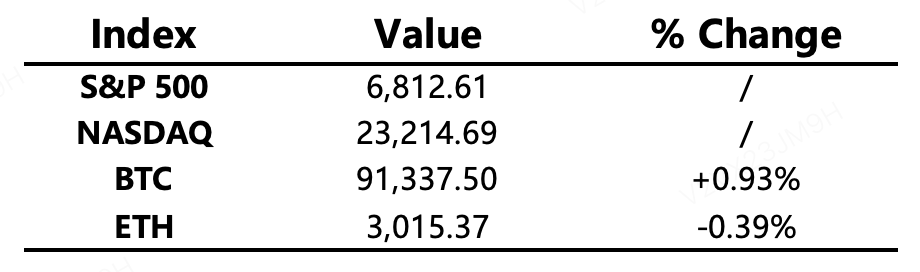

Macro Environment: U.S. markets were closed for the Thanksgiving holiday, leading to subdued trading across global markets and limited volatility. U.S. equity futures ended the shortened session nearly flat, with S&P 500 index futures edging up by less than 0.01%.

-

Crypto Market: With no guidance from U.S. equities, crypto market volatility remained low. Bitcoin briefly approached $92,000 before retracing and narrowing its gains, ending the day up 0.93%. ETH traded in a tight range around the $3,000 level. Altcoins showed no clear sector trends or active hotspots.

-

Project Developments

Major Asset Movements

Crypto Fear & Greed Index: 25 (up from 22 twenty-four hours ago), categorized as Extreme Fear

What to Watch Today

-

U.S. markets close early for the Thanksgiving holiday

-

JUP unlock: 0.76% of supply, valued at approximately USD 12.5 million

Macro Economy

-

U.S. markets closed for Thanksgiving

Policy Trends

-

Ripple’s RLUSD approved for use in Abu Dhabi Global Market as a recognized fiat-backed token

-

UK FCA launches a regulatory sandbox for stablecoins; Debt Management Office explores expanding Treasury bill issuance

Industry Highlights

-

KuCoin donates HKD 2 million to support relief efforts related to the Tai Po fire in Hong Kong

-

Multiple high-inflation countries are accelerating adoption of crypto assets as alternative stores of value

-

Upbit suffers a ₩54 billion hack on the Solana network

-

Bitwise updates its spot Avalanche ETF filing, proposing staking integration

Expanded Analysis of Industry Highlights

KuCoin donates HKD 2 million to support relief efforts related to the Tai Po fire in Hong Kong KuCoin announced a donation of HKD 2 million to aid recovery efforts following the major fire incident in Tai Po, Hong Kong. The contribution will go toward supporting affected residents, rebuilding damaged infrastructure, and assisting frontline rescue organizations. This initiative reflects KuCoin’s continued strategy to strengthen its community involvement in Asia and enhance its public image as a socially responsible global crypto exchange.

Multiple high-inflation countries are accelerating adoption of crypto assets as alternative stores of value As inflation remains elevated in countries such as Argentina, Turkey, and Nigeria, more individuals are turning to cryptocurrencies — particularly Bitcoin and stablecoins — as protection against currency depreciation. Increased mobile wallet penetration and localized P2P crypto trading platforms are further driving adoption. Experts believe this trend demonstrates the growing role of digital assets in emerging markets as a hedge against unstable monetary policy and weak national currencies.

Upbit suffers a ₩54 billion hack on the Solana network South Korea’s largest exchange, Upbit, experienced a security breach involving more than ₩54 billion (approximately USD 40 million) worth of assets linked to the Solana ecosystem. Upbit has temporarily suspended affected withdrawals while conducting a full investigation and strengthening wallet protections. The incident raises renewed concerns about the security of hot wallets and highlights vulnerabilities in rapidly growing blockchain ecosystems like Solana.

Bitwise updates its spot Avalanche ETF filing, proposing staking integration Bitwise has revised its spot Avalanche ETF application to the U.S. SEC, introducing a framework that would allow the fund to participate in AVAX staking. If approved, this would mark one of the first regulated investment products offering institutional investors direct exposure not only to the underlying token but also to its staking yield. The proposal underscores increasing competition among issuers to innovate beyond standard spot crypto ETFs.