Industry Edition

Liquidity Expectations Warm Up, Fueling a Risk Asset Rebound

Summary

-

Macro Environment:

Strong demand in Japan’s government bond auction eased investor concerns that a more hawkish BOJ could push long-term JGB yields higher and trigger a reversal of carry trades. In addition, Trump hinted that Kevin Hassett is his preferred candidate for the next Fed Chair, reinforcing market expectations for dovish monetary policy next year. The Federal Reserve officially ended QT and injected USD 1.35 billion into the banking system via overnight repo operations. Improving liquidity expectations boosted risk assets, with all three major U.S. stock indices closing higher, led by tech stocks.

-

Crypto Market:

Macro tailwinds, combined with Vanguard—the world’s second-largest asset manager—listing a Bitcoin ETF, drove a strong rebound in Bitcoin. BTC almost fully retraced the previous day’s losses, with intraday volatility reaching 9.9% and a high of 92.3k. Altcoins followed the broader market upward, with meme sectors leading the gains. However, altcoin trading volume share declined, suggesting traders remain cautiously optimistic.

-

Project Developments:

-

Trending tokens: SUI, PIEVERSE, MEME

-

SUI: Coinbase opened SUI trading for New York users

-

PIEVERSE: Short squeeze pushed price up 60%, with open interest doubling; funding rates remain negative, recently widening to -0.17%

-

MEME sector: Broad rally across PENGU, TURBO, BRETT, PIPPIN, PUMP, WIF, USELESS, and others

-

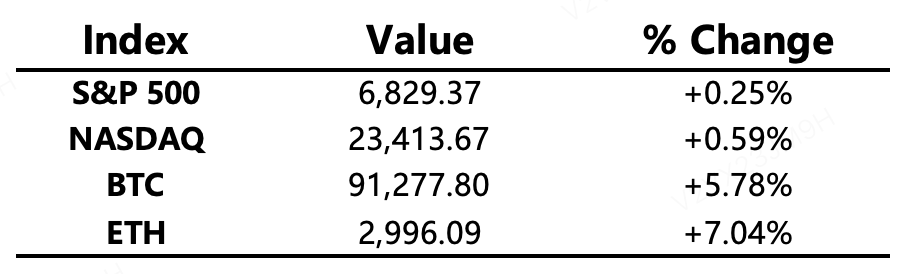

Major Asset Movements

Crypto Fear & Greed Index: 28 (vs. 23 twenty-four hours ago) — Fear

What to Watch Today

-

Jupiter will launch the first ICO on its DTF platform: HumidiFi

-

Dubai Blockchain Week 2025 takes place from December 3–4

Macro Economy

-

U.S. President Trump: new Fed Chair will be announced early next year; strongly hints at selecting Kevin Hassett

-

U.S. Treasury Secretary Besant expects GDP growth to reach 4% in 2026

-

The Federal Reserve officially ended its 3.5-year QT cycle and injected USD 1.35 billion via overnight repos

Policy Signals

-

U.S. SEC Chair Paul Atkins: innovation exemptions for crypto firms will take effect in January

-

China’s NDRC: will follow frontier technologies including AI, blockchain, and privacy-preserving computation, and strengthen foundational data research

Industry Highlights

-

KuCoin launched its new KuCoin Feed, a one-stop content hub aggregating market news, announcements, key highlights, and platform events

-

Vanguard began allowing customers to trade cryptocurrency ETFs and mutual funds on its brokerage platform

-

Kalshi raised USD 1 billion at an USD 11 billion valuation; Kraken acquired tokenized-asset platform Backed Finance

-

Strategy CEO: company raised USD 1.4 billion in reserve capital through stock sales, easing Bitcoin sell-pressure

-

CME launched a Bitcoin Volatility Index

-

Ten European banks—including BNP Paribas, ING, and UniCredit—formed Qivalis, aiming to launch a euro-denominated stablecoin in late 2026

-

Sony Group plans to issue a USD-denominated stablecoin next year

Expanded Analysis of Industry Highlights

KuCoin Launches its New KuCoin Feed

The launch of KuCoin Feed is a significant initiative for user experience and information integration, aiming to increase user efficiency in obtaining information and making trading decisions by aggregating market news, announcements, key highlights, and platform events into a one-stop content hub. In an environment where crypto market information is fragmented and updated rapidly, this move is expected to enhance platform stickiness and help users quickly translate information insights into trading actions, thus solidifying KuCoin's position as a comprehensive trading platform.

Vanguard Begins Allowing Customers to Trade Cryptocurrency ETFs and Mutual Funds on its Brokerage Platform

As one of the world's largest asset managers, Vanguard's move signals a major shift in attitude and a mainstream acceptance of crypto assets by traditional financial giants. Previously cautious or even opposed to cryptocurrencies, Vanguard now allowing the trading of crypto ETFs and mutual funds will open the floodgates for trillions of dollars from long-term capital pools, especially retirement funds (like 401(k) accounts). This will greatly enhance the legitimacy, liquidity, and institutional trust of the crypto market (particularly Bitcoin and selected altcoins).

Kalshi Raises USD 1 Billion at an USD 11 Billion Valuation; Kraken Acquires Tokenized-Asset Platform Backed Finance

This indicates that the prediction market and tokenized asset sectors are experiencing explosive growth and rapid consolidation. Kalshi's valuation doubling in just a few weeks highlights the intense institutional and retail interest in platforms that allow trading on real-world events. Concurrently, Kraken's acquisition of Backed Finance shows that crypto exchanges are actively integrating tokenized securities and Real World Assets (RWA) into their ecosystems. This not only broadens the intersection between traditional finance and cryptocurrency but also signals that the product offerings of digital asset platforms will become more sophisticated and institutionalized.

Strategy CEO: Company Raised USD 1.4 Billion in Reserve Capital Through Stock Sales, Easing Bitcoin Sell-Pressure

MicroStrategy (Strategy) raising a large amount of USD cash reserves through stock sales, which is intended to support its preferred stock dividends and debt interest payments, reduces the risk of being forced to sell its substantial Bitcoin holdings during severe market volatility to meet financial obligations. This strategic move stabilizes the company's balance sheet, assuring creditors and shareholders that it has sufficient fiat reserves to manage short-term market fluctuations, thereby indirectly alleviating market concerns about a potential large-scale "forced sell-off" of Bitcoin, and solidifying its position as a "Bitcoin strategy" company.

CME Launches a Bitcoin Volatility Index

The launch of the Bitcoin Volatility Index (BVX/BVSX) by the CME (one of the world's largest derivatives markets) is a key indicator of market maturity, providing institutional investors with sophisticated tools for risk management. These indices, based on CME's regulated Bitcoin options contracts, offer a forward-looking, market-based measure of the expected volatility of the Bitcoin price over the next 30 days. It functions similarly to the traditional market's "fear index" (like the VIX), enabling institutions to calibrate their trading and hedging strategies more precisely, pushing the Bitcoin derivatives market toward higher transparency and professionalism.

Ten European Banks—Including BNP Paribas, ING, and UniCredit—Form Qivalis, Aiming to Launch a Euro-Denominated Stablecoin in Late 2026

The formation of Qivalis marks a unified strategic defensive and offensive posture by the European traditional financial industry in the digital currency space, aimed at challenging the current USD-dominated stablecoin market. This euro stablecoin project, backed by top banks, will operate within the EU's MiCAR regulatory framework, using blockchain technology to provide 24/7, low-cost cross-border payments and digital asset settlement. The goal is to strengthen the euro's monetary sovereignty in the digital economy and offer a credible, compliant euro-based settlement standard for European businesses and consumers in the digital asset market.

Sony Group Plans to Issue a USD-Denominated Stablecoin Next Year

Sony Group's plan, through its Sony Bank, to issue a USD-denominated stablecoin is a major attempt by a large global conglomerate to integrate Web3 technology into its core business ecosystem. The stablecoin's primary goal is for use in payments for digital content subscriptions within the Sony Group, such as gaming (PlayStation), animation, and video. This move aims to reduce reliance on traditional credit card payment systems, thereby lowering transaction costs and improving customer payment convenience. This not only enhances the internal capital efficiency of the "Sony economic circle" but also demonstrates the immense application potential of Web3 payment infrastructure in the entertainment and media industries.