Industry Update

Core PCE in Line With Expectations, Strengthening Fed Rate-Cut Outlook

Summary

-

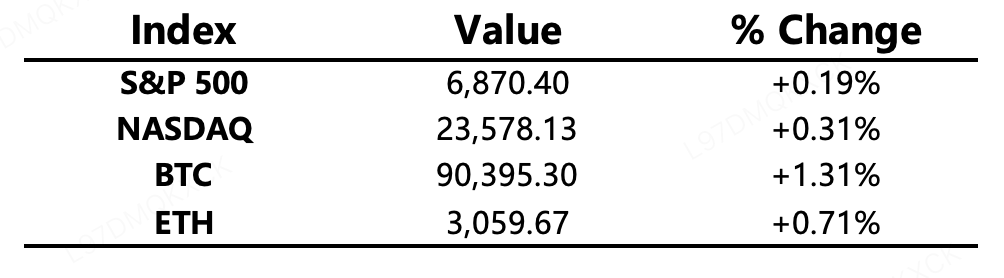

Macro Environment: U.S. September core PCE rose 2.8% YoY, matching expectations. The University of Michigan’s inflation expectations index fell to its lowest level of the year. These data reinforced expectations for a rate cut at this week’s FOMC meeting, with FedWatch showing an 86.2% probability of a 25bp cut in December. U.S. equities rallied across all three major indexes, with the S&P 500 once again approaching all-time highs.

-

Crypto Market: Total market cap declined over the weekend amid muted trading. Bitcoin dipped below 88k before rebounding, with its dominance ticking slightly higher. Altcoins fell broadly with shrinking volume. Ahead of this week’s Fed meeting, uncertainty accumulated and market sentiment slid into the “extreme fear” zone.

-

Project Developments:

-

Hot tokens: PENGU, FARTCOIN, GLMR, PIEVERSE

-

PENGU: Ohio Congressman Mike Rulli changed his profile picture to a Pudgy Penguins NFT

-

On-chain meme activity rebounded; leaders such as FARTCOIN and DEGEN rose

-

GLMR: Moonbeam released its Q3 operational report, showing continued growth in gaming activity

-

PIEVERSE: Launched x402/x402b AI payment agents on Base

-

Major Asset Movements

Crypto Fear & Greed Index: 20 (same as 24 hours ago), Extreme Fear

What to Watch Today

-

U.S. releases October PCE Price Index

-

Fed “shadow chair” Kevin Hassett speaks at the CEO Council Summit

-

Stable public blockchain to launch its mainnet

-

France’s second-largest banking group BPCE to support crypto buying/selling for customers

Macro Data

-

U.S. 1-year inflation expectations (Dec preliminary): 4.1%, vs. expected 4.5%, previous 4.5%

-

University of Michigan Consumer Sentiment Index (Dec): 53.3, vs. expected 52.0

-

U.S. September core PCE MoM increased 0.2%, in line with expectations

Policy Direction

-

South Korea proposes requiring crypto exchanges to assume strict liability for damages regardless of fault

-

U.S. SEC Chair: The entire financial system will shift toward Bitcoin and crypto within a few years; tokenization is the future, and all U.S. markets could move on-chain within two years

-

Indiana introduces a bill allowing public pension funds to invest in Bitcoin

-

U.S. prosecutors recommend a 12-year sentence for Do Kwon

-

China’s National Internet Finance Association and six other regulators issued a risk alert on illegal virtual-currency-related activities

-

Pakistan signals tightening crypto regulations after meetings with Binance

Industry Highlights

-

Bank of America to allow financial advisors to recommend crypto assets

-

MicroStrategy CEO: Company’s USD reserves can support operations for at least 21 months without selling Bitcoin

-

Western Union launches a stablecoin payment card

-

France’s BPCE Group now allows customers to buy and sell cryptocurrencies

-

Grayscale submits filing for a SUI ETF

-

ONDO submits a tokenized securities roadmap to the SEC

-

Jensen Huang: “Bitcoin is a form of stored energy.”

-

FINRA: U.S. investor appetite for crypto continues to decline

-

Michael Saylor posts a new Bitcoin tracking update, potentially indicating further accumulation

Expanded Analysis of Industry Highlights

-

Bank of America to allow financial advisors to recommend crypto assets

Bank of America (BofA) is taking a major step by allowing its wealth management advisors to recommend crypto asset allocation to clients, likely focusing initially on regulated products such as spot Bitcoin ETFs. This decision signals a shift in the attitude of major traditional financial institutions toward cryptocurrencies, viewing them as a viable investment and potentially advising clients on a modest allocation of 1% to 4% within their portfolios. This move provides a compliant channel for more mainstream investors and helps further integrate crypto assets into the traditional financial system.

-

MicroStrategy CEO: Company’s USD reserves can support operations for at least 21 months without selling Bitcoin

The CEO of MicroStrategy disclosed that the company has built a USD reserve of $1.44 billion, primarily raised through the sale of Class A common stock, which is intended to cover preferred stock dividends and interest payments on outstanding debt. This reserve is sufficient to support the company's operations and debt obligations for at least 21 months, effectively easing market concerns that the company might be forced to sell its massive Bitcoin holdings to meet liquidity needs during a price downturn, thereby reinforcing its long-term strategy as a "Bitcoin development company."

-

Western Union launches a stablecoin payment card

Western Union has launched a payment card called the "Stable Card" that supports pre-loading with stablecoins, aiming to help users living in high-inflation economies (such as Argentina) maintain purchasing power stability. This move is part of Western Union's broader digital asset strategy, which also includes plans to issue its own stablecoin (USDPT) in the first half of 2026 and build a settlement system based on the Solana blockchain, merging its vast global remittance network with emerging digital currency technology.

-

France’s BPCE Group now allows customers to buy and sell cryptocurrencies

BPCE Group, a major French banking group (Banque Populaire/Caisse d’Épargne), is now allowing customers to buy and sell cryptocurrencies (including Bitcoin, Ethereum, Solana, and USDC) directly within its Banque Populaire and Caisse d’Épargne mobile applications. The service will initially cover approximately 2 million customers and is planned to gradually expand to its entire 12 million retail customer base by 2026. This marks a key step for a major European bank towards offering integrated digital asset trading services to compete with FinTech companies.

-

Grayscale submits filing for a SUI ETF

Grayscale Investments has filed an S-1 registration statement for a Sui Trust with the U.S. Securities and Exchange Commission (SEC), an initial step toward creating a SUI Exchange-Traded Fund (ETF). This move indicates the leading digital asset manager's confidence in the long-term value and growth potential of the Sui network ecosystem. If approved, it would provide traditional investors with a regulated and convenient way to gain exposure to the SUI price without the need for direct management of private keys or wallets.

-

ONDO submits a tokenized securities roadmap to the SEC

Ondo Finance submitted a roadmap for tokenized securities to the U.S. Securities and Exchange Commission (SEC), advocating for supporting both direct and intermediated pathways for tokenized securities ownership and suggesting that the SEC should support the integration of public, permissionless distributed ledger technology (DLT) systems into financial markets. As a market leader in the RWA (Real World Assets) tokenization space, Ondo's roadmap aims to promote regulatory clarity to facilitate the wider adoption and distribution of its tokenized products (such as tokenized U.S. Treasuries, money market funds, etc.) in the United States.

-

Jensen Huang: “Bitcoin is a form of stored energy.”

NVIDIA CEO Jensen Huang, discussing the context of Artificial Intelligence (AI) and energy consumption, put forth the view that "Bitcoin is a form of stored energy." He further explained that Bitcoin takes excess energy and converts it into a new currency form that can be easily transported and carried anywhere. This statement places Bitcoin in the macro narrative of energy transition and efficiency, moving beyond purely financial asset discussions, and emphasizing its potential for energy arbitrage and utilizing wasted energy on a global scale.

-

FINRA: U.S. investor appetite for crypto continues to decline

A research report released by the Financial Industry Regulatory Authority (FINRA) indicates that the willingness of U.S. investors to buy cryptocurrencies is declining, which is linked to an overall reduction in risk appetite. The report notes that the proportion of investors considering new or additional crypto purchases has fallen from 33% in 2021 to 26% in 2024, with a particularly significant decline in risk appetite among investors under the age of 35. This trend suggests that in the context of increasing macroeconomic uncertainty, investors are shifting toward a more cautious investment attitude and behavior.

-

Michael Saylor posts a new Bitcoin tracking update, potentially indicating further accumulation

Michael Saylor, the founder of MicroStrategy, posted a new Bitcoin tracking update on social media. Although he did not disclose specific purchase details, this is usually interpreted by the market as an indication that the company is about to announce a new round of Bitcoin accumulation. Saylor's posts of this nature typically precede official regulatory filings by MicroStrategy, suggesting that his firm belief in Bitcoin's strategic value remains unchanged, and the company is continuing to use its corporate strategy to increase its Bitcoin reserves.