BTC/AUD Market Dynamics: Global Risk Aversion and Regulatory Clarity (24 November 2025)

2025/11/25 02:42:02

I. Current BTC/AUD Price Snapshot

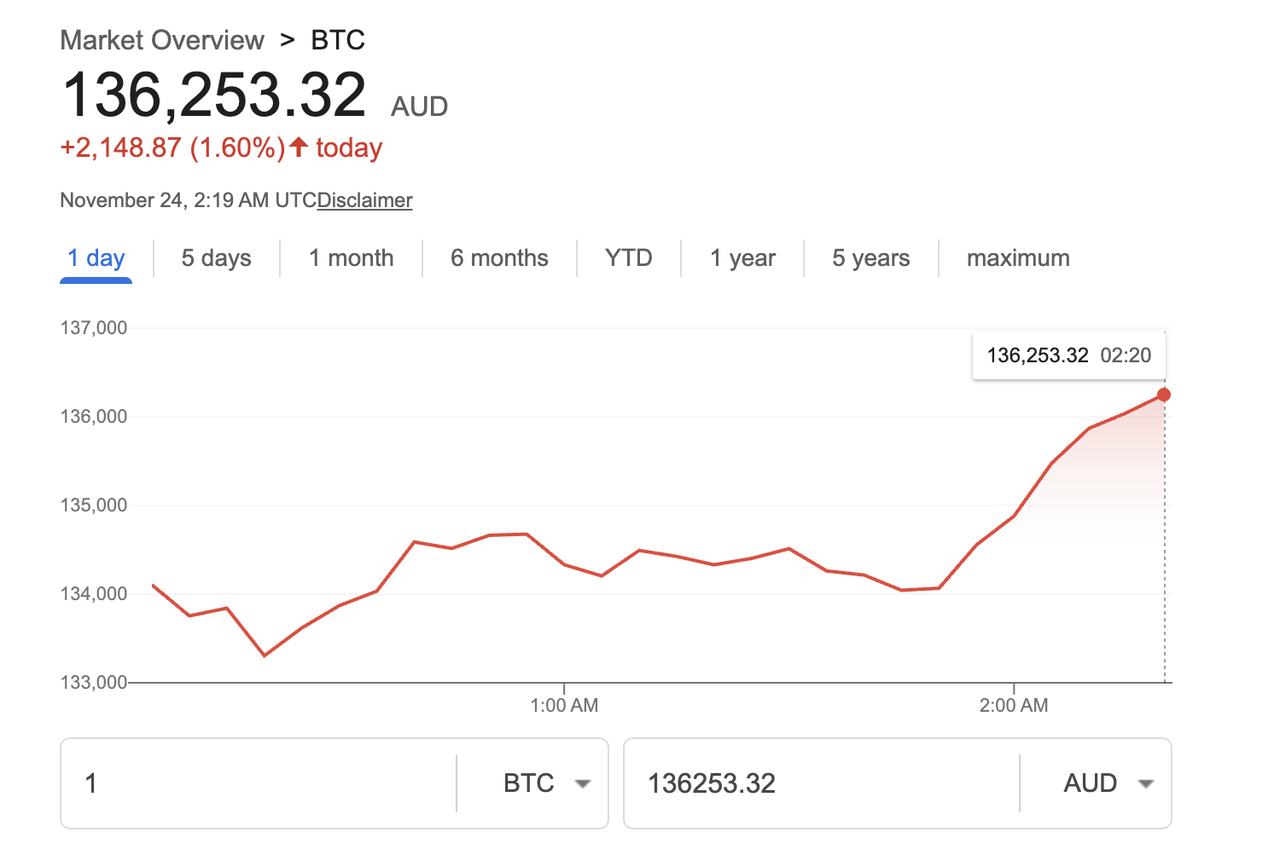

As of 24 November 2025, the BTC/AUD exchange rate is trading at approximately A$136,000.

-

Recent Trend: The market has undergone a significant and prolonged correction. Bitcoin's price has plummeted from its October peak, reflective of a sharp deterioration in global market sentiment.

-

Price Drivers: The current market slump is fundamentally driven by a prevalent 'risk-off' sentiment among global investors, strongly linked to uncertainties surrounding US interest rate policy and the stretched valuations in the technology sector.

II. Crypto Market Dynamics: Volatility and the Enhanced Risk Asset Status

Market Sentiment and Sell-Off Pressure

-

Heightened Correlation with Risk Assets: BTC's price movement is increasingly mirroring technology stock indices such as the Nasdaq, effectively undermining the "digital gold" safe-haven argument. Investors are treating Bitcoin as a highly liquid, speculative asset to be liquidated when faced with macroeconomic ambiguity.

-

Corporate Exposure: As prices sink to lows not seen since April, companies with substantial Bitcoin holdings ("crypto treasuries") face considerable pressure. A breach of certain key price averages could trigger further institutional selling, exacerbating market liquidity concerns.

-

Massive Liquidations: The acute market decline has been compounded by extensive forced liquidation of leveraged positions, with this structural contagion acting as a critical amplifier of the short-term price collapse.

Key Global Regulatory Progress

-

US SEC's Next Phase of 'Crypto Project': The US Securities and Exchange Commission (SEC) clarified the subsequent stage of its "Project Crypto" in November. The primary goal is to provide greater legal certainty via a formal Token Taxonomy. The SEC Chair suggested that many token transactions are no longer classified as securities, which is expected to help market players delineate regulatory boundaries.

-

Stablecoin Bills and Broader Legislation: Whilst regulatory bills continue to advance in the US Congress, the signing of the GENIUS Act (The Stablecoin Innovation Act) into law establishes regulatory safeguards and consumer protection policies for USD-pegged stablecoins.

-

Global Fragmentation Warning: The Financial Stability Board (FSB) cautioned in November that the implementation of global crypto regulations remains incomplete and fragmented, which fails to adequately address growing systemic risk. This poses ongoing compliance hurdles for firms operating across different jurisdictions.

III. Australian Economy Influence: The RBA's Stance on Rates

The BTC/AUD rate is sensitive to the strength of the Australian Dollar (AUD) against the US Dollar, which is driven by domestic Australian monetary policy.

RBA Maintains Cash Rate

-

Rates Kept Steady: The Reserve Bank of Australia (RBA) determined on 4 November 2025 to keep the official cash rate unchanged at 3.60%.

-

Persistent Inflation: The RBA noted that recent inflation figures (Q3 core inflation at 3.0% annual rate) were higher than expected, indicating persistent inflationary pressures within the economy. The RBA anticipates inflation to remain above 3% throughout much of 2026.

-

Impact on BTC/AUD: The RBA's decision to maintain rates, alongside diminished market expectations for future cuts, generally acts to buttress the Australian Dollar (AUD). A stronger AUD can potentially exert downward pressure on the nominal BTC/AUD price, as the appeal of AUD-denominated assets rises.

Australian Regulatory Update: ASIC Guidance on Digital Assets

The Australian Securities and Investments Commission (ASIC) issued important updated guidance on 29 October 2025, which aims to provide clarity and facilitate innovation while enhancing investor protection. This guidance, primarily through Information Sheet 225 (INFO 225), is critical for investors in the BTC/AUD market.

-

Digital Assets as Financial Products: ASIC has clarified that numerous digital assets, including stablecoins, wrapped tokens, tokenised securities, and certain digital asset wallets, are considered financial products under existing Australian law.

-

Implication: This means that many providers dealing in these specific assets will now be required to hold an Australian Financial Services Licence (AFSL). Licensing mandates the full spectrum of consumer protections under the law.

-

Custody and Asset Segregation: ASIC's guidance reinforces existing obligations for the custody of assets, formally extending them to cover crypto-assets.

-

Key Requirement: Licensees must ensure client crypto-assets are segregated on-chain from other assets, with unique public and private keys maintained to prevent asset commingling. This is a crucial investor protection measure.

-

-

Transitional Relief and No-Action Position: Recognising the time required for firms to adapt, ASIC has granted a sector-wide 'no-action' position until 30 June 2026.

-

What this Means: Firms dealing in these newly classified digital assets have a defined period to consider the guidance, apply for AFSLs, and meet the higher compliance standards before ASIC takes enforcement action (though ASIC reserves the right to act against egregious misconduct).

-

Frequently Asked Questions (FAQ): Focus for Australian Investors

The following section addresses common concerns for Australian investors in the current volatile BTC/AUD market, adhering to UK English conventions.

Q1: Why has the BTC/AUD price dropped so sharply recently? A: The recent pronounced drop in the BTC/AUD price is primarily attributable to sweeping global macroeconomic factors. The main culprits include Ebbing US Fed Rate Cut Expectations (US Fed will maintain elevated interest rates for longer) and pervasive Risk Aversion (investors liquidating high-risk digital holdings when global economic forecasts are uncertain).

Q2: How does the Australian RBA's interest rate decision affect BTC/AUD? A: Decisions by the Reserve Bank of Australia (RBA) to maintain or signal future rate increases generally bolster the strength of the Australian Dollar (AUD). A stronger AUD means a comparatively smaller amount of local currency is required to purchase Bitcoin (downward pressure on the BTC/AUD price), and higher stable rates enhance the appeal of traditional AUD assets, causing a shift in capital allocation away from riskier cryptocurrencies.

Q3: How does ASIC's new guidance impact my investment on an Australian exchange? A: The guidance primarily introduces higher regulatory standards, which is ultimately beneficial for consumer protection. This involves Increased Scrutiny (exchanges dealing in certain assets must apply for an AFSL) and mandates stricter custody, risk management, and disclosure. These enhanced regulatory standards contribute to Investor Confidence in the long term.

Q4: Is Bitcoin still considered "Digital Gold"? A: In the immediate term, Bitcoin's "Digital Gold" narrative is severely challenged, as recent price action shows it behaving more like a high-risk (high-beta) tech stock. During the recent market downturn, traditional safe-haven assets (physical gold, US dollar) exhibited relative stability while Bitcoin fell sharply. However, the Long-Term View persists among many investors who still regard Bitcoin as a potential hedge against fiat currency devaluation.