Secure Your Digital Assets: Get a Crypto Wallet Today

2026/01/07 13:57:02

In the digital age, cryptocurrency has emerged as a popular form of investment and transaction. As more individuals and businesses embrace this digital currency revolution, understanding how to securely manage these assets becomes imperative. To get started, one of the first things you need is a crypto wallet. But what exactly is a crypto wallet, and how do you get one? This guide will walk you through the basics of crypto wallets, the different types available, and how to choose the best one for your needs. With the right wallet, you can ensure the safety and accessibility of your digital assets, paving the way for a successful cryptocurrency journey.

A crypto wallet is a digital tool that allows you to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and others. Unlike a traditional wallet that holds physical money, a crypto wallet stores the private keys you need to access your cryptocurrency on the blockchain. These private keys are crucial, as they authorize transactions and give you control over your digital assets. Without them, you cannot access or transfer your cryptocurrencies.

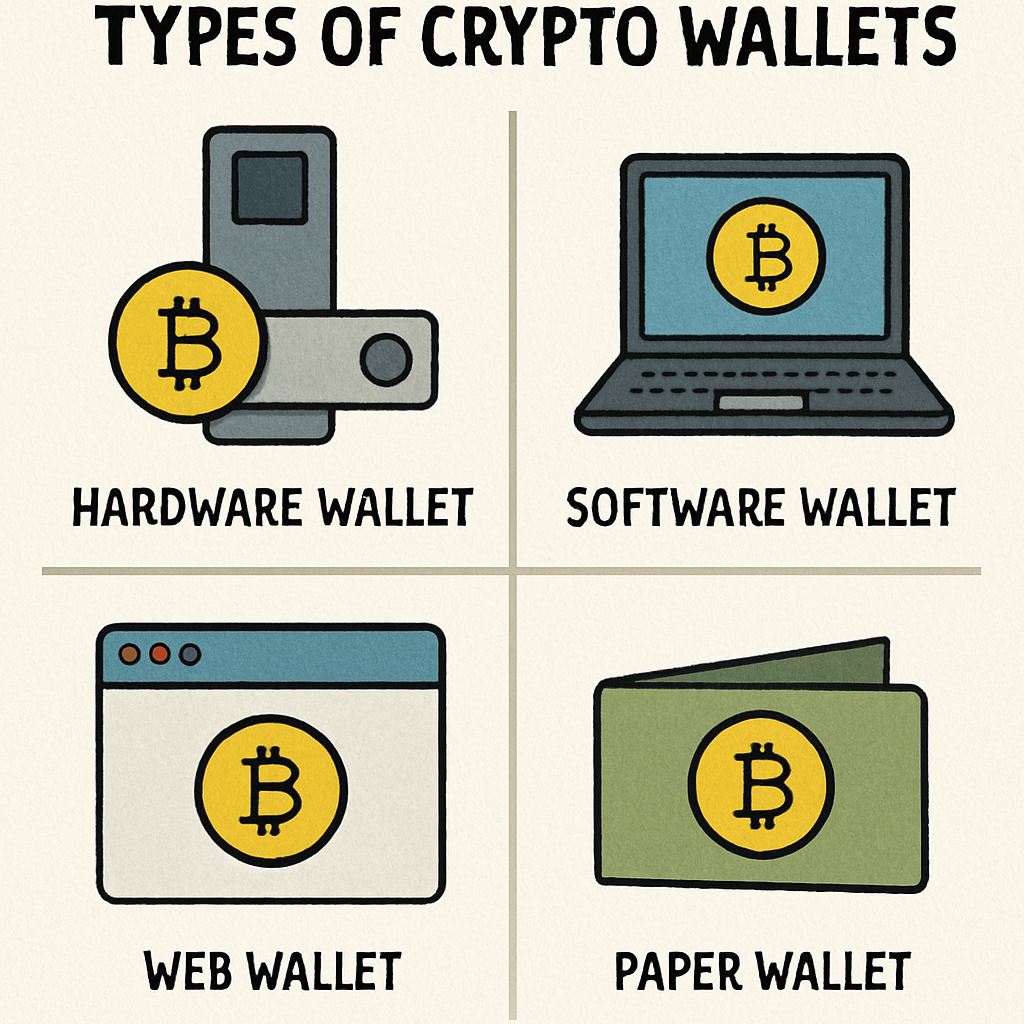

Crypto wallets come in various forms, each designed to offer different levels of convenience and security. While some are as simple as a mobile app, others might be more complex, like hardware devices or printed paper. The key is to understand the functionality and security features of each type so you can make an informed decision that aligns with your needs and risk tolerance.

There are several types of crypto wallets, each with its own advantages and disadvantages. Understanding these can help you choose the right one for your needs. It's important to weigh factors such as security, ease of access, and the frequency with which you plan to use your wallet. By familiarizing yourself with the different options, you can better protect your assets while ensuring that transactions remain convenient and straightforward.

Hot Wallets

Hot wallets are connected to the internet, making them easy to access and use. They are convenient for frequent transactions but are considered less secure than cold wallets due to their online nature. This constant internet connection makes them more susceptible to cyber-attacks and hacking attempts. However, for users who engage in regular trading or transactions, the accessibility and speed of hot wallets can be a significant advantage.

Despite their vulnerabilities, hot wallets have become a popular choice for many cryptocurrency enthusiasts due to their user-friendly interfaces and quick setup processes. They often come equipped with features like integration with cryptocurrency exchanges, making it easier to buy and sell digital assets. To mitigate risks, users should employ strong security practices, such as using complex passwords and enabling two-factor authentication.

Cryptocurrency Wallet Apps

A cryptocurrency wallet app is a type of hot wallet that you can download on your smartphone or computer. These apps allow you to manage your crypto assets easily. These applications are designed with user experience in mind, offering intuitive interfaces that make managing digital currencies straightforward, even for beginners.

The convenience of having a wallet app on your smartphone means you can conduct transactions on-the-go, making it a preferred option for those who need constant access to their funds. However, given their online nature, it's crucial to ensure your device is secure and the app is downloaded from a reputable source. Regular updates and vigilant monitoring of app permissions can further enhance security.

Web Wallets

Web wallets are accessed through a web browser. They offer convenience and ease of use, but they can be vulnerable to hacking. Always ensure you are using a secure, reputable service. Web wallets are often provided by cryptocurrency exchanges, allowing users to store their funds directly on the platform where they trade.

While web wallets offer the advantage of accessibility from any device with an internet connection, they also pose significant security risks. It's essential to verify the credibility of the service provider and look for additional security features like encryption and two-factor authentication. Users should be cautious of phishing sites that mimic legitimate services and always check the URL before logging in.

Cold Wallets

Cold wallets are offline storage options for your cryptocurrencies. They are considered more secure than hot wallets because they are not connected to the internet. This isolation from the online world significantly reduces the risk of cyber attacks, making them an ideal choice for long-term storage of large amounts of digital assets.

Cold wallets come in various forms, including hardware devices and paper wallets. They require a bit more effort to set up and access, but the enhanced security they offer is worth the extra steps. For anyone serious about safeguarding their investments, cold wallets provide peace of mind, knowing that their assets are protected from online threats.

Hardware Wallets

Hardware wallets are physical devices that store your private keys offline. They are highly secure and are the best option for storing large amounts of cryptocurrency. Examples include Ledger Nano S and Trezor. These devices often resemble USB drives and come with additional security features like PIN protection and recovery seeds.

The main advantage of hardware wallets is their immunity to computer viruses and malware, as they do not connect to the internet. This makes them an excellent option for those who prioritize security over convenience. When using a hardware wallet, it's essential to purchase from a reputable source and ensure the device is genuine to avoid counterfeit products.

Paper Wallets

A paper wallet is a physical printout of your public and private keys. While secure, they require careful handling and storage to avoid loss or damage. Paper wallets are considered one of the most secure ways to store cryptocurrency, as they are immune to online threats.

However, the reliance on physical security means you must take precautions to protect the paper from physical damage, loss, or theft. It's advisable to create multiple copies and store them in safe, separate locations. Despite the potential risks, paper wallets remain a popular choice for long-term storage due to their simplicity and offline nature.

How to Get a Crypto Wallet

Now that you know the types of wallets available, let's look at how to get a crypto wallet. Setting up a wallet is a crucial step in your cryptocurrency journey, as it determines how you will manage and protect your digital assets. It's important to approach this process with careful consideration to ensure you select the right type of wallet for your needs.

Step 1: Decide on the Type of Wallet

Consider how often you plan to access your cryptocurrency and how much security you need. If you are a beginner or want easy access, a hot wallet might be a good start. For long-term storage, consider a cold wallet. Evaluating your usage habits and security priorities will guide you in choosing between the convenience of hot wallets and the security of cold wallets.

Understanding your investment goals can also influence your decision. For instance, if you anticipate frequent trading, a hot wallet with exchange integration might be beneficial. Conversely, if you're holding assets for long-term appreciation, a hardware wallet offers superior protection. Balancing accessibility with security is key to selecting the right wallet type.

Step 2: Choose a Crypto Wallet Provider

Research and compare different wallet providers. Look for security features, user reviews, and ease of use. For beginners in Australia, options like Kucoin and Swyftx are popular. It's important to choose a provider with a strong reputation and transparent security measures to protect your assets.

Consider the level of customer support offered by the provider, as this can be crucial if you encounter any issues. Reading reviews and seeking recommendations from experienced users can provide valuable insights into a provider's reliability and performance. A well-established provider with a track record of security and user satisfaction is often a safe choice.

Step 3: Create Your Wallet

For a Hot Wallet

-

Download the App: If you choose a cryptocurrency wallet app, download it from the official website or app store. Ensure the app is legitimate by checking reviews and verifying the developer.

-

Set Up an Account: Follow the app's instructions to create an account. You may need to verify your identity. Use a strong, unique password to enhance security.

-

Secure Your Wallet: Set a strong password and enable two-factor authentication if available. Regularly update your app to benefit from the latest security enhancements.

For a Cold Wallet

-

Purchase a Hardware Wallet: Buy from a reputable seller. Avoid buying second-hand devices to reduce the risk of tampering. Ensure the device is sealed and untampered upon receipt.

-

Install the Wallet Software: Follow the manufacturer's instructions to install the necessary software on your computer. Keep your computer secure and free from malware.

-

Create a Backup: Write down your recovery phrase and store it securely. This phrase is essential for recovering your funds if your device is lost or damaged.

Step 4: Obtain Your Wallet Address

Once your wallet is set up, you will be given a wallet address. This is a unique identifier you will use to receive cryptocurrency. It's important to double-check this address before sharing it for transactions to prevent sending funds to the wrong address.

Your wallet address acts like a bank account number, allowing others to send cryptocurrency to your wallet. However, unlike a bank account number, it's often recommended to generate a new address for each transaction to enhance privacy.

Step 5: Fund Your Wallet

To start using your wallet, you'll need to add some cryptocurrency. You can do this by buying crypto through an exchange and transferring it to your wallet address. Ensure you understand the fees associated with transferring funds and choose a time when network congestion is low to minimize costs.

Before transferring large amounts, it's wise to test with a small amount to ensure the process goes smoothly. Once confirmed, you can proceed with larger transactions. Always verify the recipient's address and double-check details before initiating a transfer to avoid costly mistakes.

Best Practices for Crypto Wallet Security

Security is paramount when dealing with cryptocurrencies. Here are some tips to keep your crypto wallet secure. Following these practices can significantly reduce the risk of unauthorized access and protect your digital assets from potential threats.

-

Use Strong Passwords: Always use complex passwords and change them regularly. A strong password is your first line of defense against unauthorized access.

-

Enable Two-Factor Authentication: This adds an extra layer of security to your wallet. It's a simple yet effective way to protect your account from unauthorized access.

-

Keep Your Software Updated: Regular updates ensure you have the latest security patches. Developers continually enhance security features to protect against new threats.

-

Backup Your Wallet: Keep multiple backups of your recovery phrase in different locations. This ensures you can recover your wallet even if one backup is lost or damaged.

-

Be Wary of Phishing Scams: Never click on suspicious links or provide your private keys to anyone. Always verify the authenticity of websites and emails claiming to be from your wallet provider.

Conclusion

Choosing the right crypto wallet is crucial for safely managing your digital assets. Whether you opt for a convenient hot wallet or a secure cold wallet, understanding your options and following best security practices will ensure your cryptocurrency is protected. As you venture into the world of crypto, remember that your wallet is your key to accessing and controlling your investments. Choose wisely and stay informed to make the most of your cryptocurrency journey. By staying vigilant and proactive, you can navigate the complexities of digital currency with confidence and security.