KuCoin Ventures Weekly Report: Trump Pardons CZ, Igniting Market Sentiment; Bitcoin Outperforms Amid Macro Divergence; Exchange Wallets Accelerate the 'x402' Narrative

2025/10/27 10:15:02

1. Trump Pardons CZ While Claiming No Personal Acquaintance; Family Crypto Ventures Clear Over $1B in Profits

Last week, U.S. President Donald Trump signed a full pardon for Binance founder Changpeng Zhao (CZ). White House Press Secretary Karoline Leavitt stated that the action was an exercise of constitutional authority to rectify the Biden administration’s “overzealous prosecution” of the cryptocurrency sector. CZ pleaded guilty in 2023 to violations of the Bank Secrecy Act, stepped down as Binance CEO, and facilitated a $4.3 billion settlement with the U.S. Department of Justice.

In media interviews, Trump maintained he does not know CZ personally, rhetorically asking whether he was “that crypto person.” The pardon rationale hinged on assurances from close associates that CZ committed no crime, while framing the case as political persecution by the prior administration—a narrative consistent with Trump’s broader critique of “weaponized” DOJ tactics against political adversaries and targeted industries. The individuals Trump referenced as “people around me” are likely susceptible to influence from certain lobbying groups and figures.

The crypto community has interpreted the pardon as a clear bullish catalyst, fueling a sharp rebound across major assets. CZ, post-pardon, reiterated his commitment to positioning the U.S. as the global crypto hub. Bloomberg analysts suggest the development removes legal overhang, potentially clearing a path for CZ’s return to leadership and deeper integration between Binance and its U.S. subsidiary, Binance.US.

A mid-October Financial Times investigation revealed that Trump and family entities generated more than $1 billion in pre-tax profits from crypto ventures over the past year, including digital trading cards, memecoins, stablecoins, and DeFi projects. Key revenue streams include approximately $427 million from TRUMP and MELANIA memecoins, $550 million from World Liberty Financial (WLFI), and $2.17 billion in USD1 stablecoin sales. Separately, Binance secured a $2 billion investment from Abu Dhabi’s MGX in March 2025, with USD1 designated for settlement—potentially routing transaction-fee economics back to Trump-affiliated entities.

Recent weeks have seen a surge in high-leverage, high-conviction whale activity flagged for possible insider edges. Notable example: a trader who opened a short position ahead of the October 11 flash crash, booking $160 million in profits. Speculation links the wallet to White House-adjacent networks, though no conclusive evidence has surfaced. However, on-chain sleuth ZachXBT recently exposed a Hyperliquid 50× leverage “genius” as a serial fraudster, underscoring that statistical anomalies do not automatically imply privileged access.

2. Weekly Selected Market Signals

Market Divergence Amid Macro Tailwinds: Bitcoin Outperforms as Altcoin Liquidity Tightens, Market Holds Breath for "Super Central Bank Week"

Last week, positive macroeconomic signals, such as expectations of a Russia-Ukraine ceasefire, slowing inflation, and anticipated rate cuts, seamlessly transmitted from traditional markets to the crypto space. However, this resulted in severe internal structural divergence.

With global markets navigating an economic data vacuum from the U.S., strong Q3 earnings reports from American companies provided a much-needed shot in the arm, bolstering risk assets across the board. On the geopolitical front, while subtle signs of de-escalation emerged in the Russia-Ukraine conflict diplomatically, renewed airstrikes over the weekend introduced fresh uncertainty, and intense fighting continues on the battlefield. The international gold price ended its nine-week rally, driven by profit-taking and the tentative easing of geopolitical tensions.

In the crypto market, Bitcoin reacted most positively to rate cut expectations, surging past $110,000, while Ethereum reclaimed the $4,000 mark. Bitcoin's implied volatility quickly receded after the spike, indicating that market sentiment stabilized and anxiety eased following the price increase. On the other hand, the CMC Altcoin Index hit a 90-day low, reflecting bearish sentiment in the altcoin market. Lacking follow-through buying and sufficient retail demand, altcoin liquidity was further drained as capital consolidated into Bitcoin, a flight to the safety of a broader consensus asset.

Data Source: CoinMarketCap

Overall sentiment in the spot ETF market was subdued. Bitcoin ETFs saw a total net inflow of $446 million last week, whereas Ethereum ETFs experienced a net outflow of $243 million, marking the second consecutive week of minor outflows. Despite the U.S. government shutdown delaying approvals, enthusiasm for new ETFs remains high, with 155 crypto-related ETF applications—covering 35 digital assets including SOL and XRP—currently pending before the SEC, signaling intense competition. Notably, VanEck submitted an application for a staked Ethereum ETF based on the Lido protocol. In Hong Kong, the Securities and Futures Commission (SFC) officially approved Asia's first spot Solana ETF, the "ChinaAMC Solana ETF," which began trading on the Hong Kong Stock Exchange on October 27. Although Hong Kong regulations permit staking services for crypto spot ETFs, this particular Solana ETF does not include a staking feature.

Data Source: SoSoValue

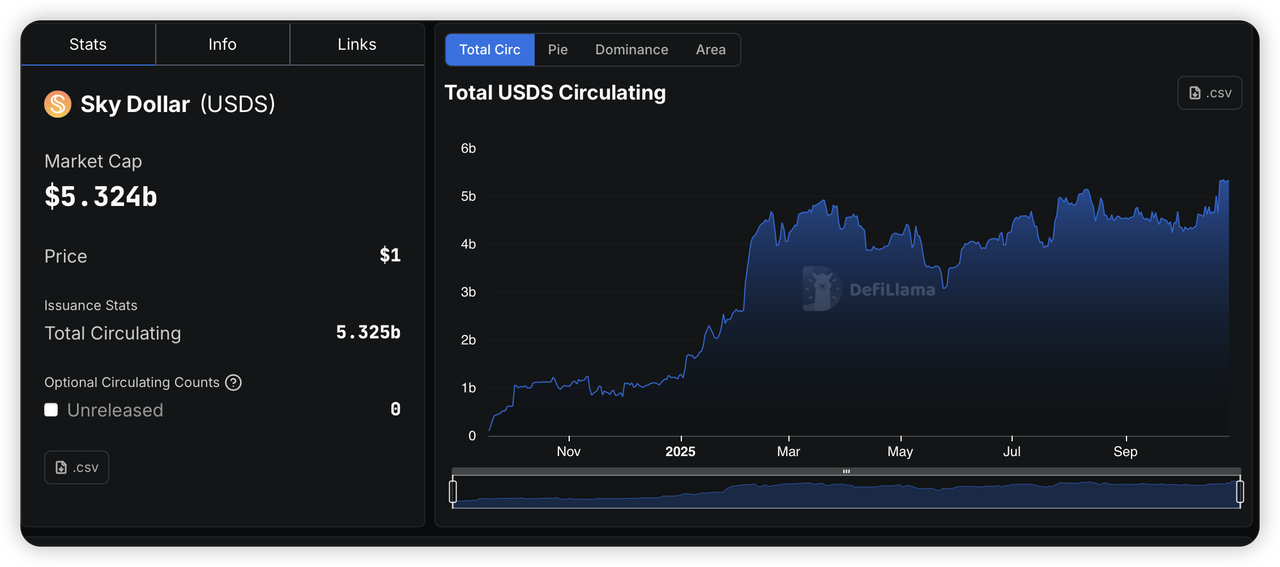

The growth of stablecoins has moderated since the beginning of October. The circulating supply of USDS surpassed the $5 billion mark on October 22, reaching a new all-time high of $5.32 billion. Last Friday, Zelle, the payment network operated by several major banks that processed nearly a trillion dollars in transactions last year, officially announced plans to leverage stablecoin technology for its international remittance business. This follows Zelle's earlier announcement of its intention to issue its own stablecoin under the GENIUS Act.

Data Source: DeFiLlama

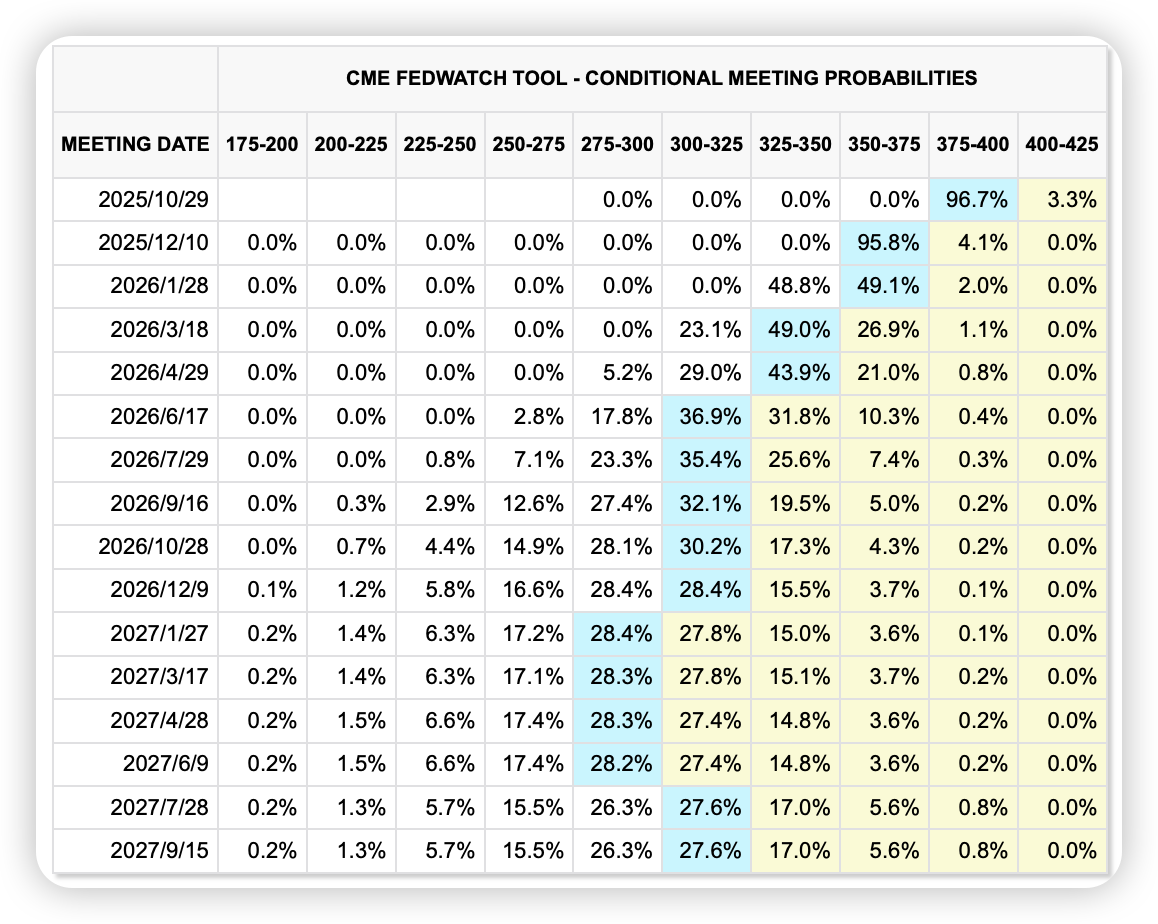

Last week, the latest data from the U.S. Bureau of Labor Statistics showed that September inflation figures were all lower than expected, reinforcing expectations for a Federal Reserve rate cut. The market has now almost fully priced in consecutive rate cuts from the Fed for this week's meeting and in December, with a 25 basis point cut widely anticipated as the core logic supporting current liquidity expectations.

Data Source: CME FedWatch Tool

Key Events to Watch This Week:

-

Oct 30: FOMC interest rate decision and press conference with Fed Chair Powell; ECB press conference.

-

Oct 30: Bank of Japan interest rate decision and economic outlook report, followed by a speech from Governor Kazuo Ueda.

-

Oct 31: China will release its official October Manufacturing PMI.

This week is a "Super Central Bank Week," with the U.S., Japan, and Europe all announcing monetary policy decisions on October 30. In the U.S. stock market, tech giants like Apple and Amazon are set to report their earnings.

Primary Market Observations

Last week, major events in the crypto primary market revolved around M&A and strategic financing. Projects with existing tokens, such as Open Campus and Sign, announced new strategic funding rounds, while Inveniam Capital Partners announced the acquisition of the veteran decentralized cloud storage project, Storj. Digital asset prime broker FalconX announced its acquisition of crypto asset manager 21Shares for an undisclosed amount, with the merged entity set to develop crypto funds focused on derivatives and structured products. The following primary market projects are particularly noteworthy.

Coinbase's Capital Markets Ambition: Acquiring Echo to Build a Closed-Loop Ecosystem from Issuance to Trading

Last week, Coinbase announced its acquisition of the fundraising platform Echo for $375 million, its eighth acquisition this year following deals for Deribit, LiquiFi, and UpOnly. The company stated that this acquisition is a key step in its strategy to build an "on-chain primary market," aiming to create a seamless pipeline from project creation and financing to secondary market trading.

Echo, founded by crypto OG and top KOL Cobie, simplifies community investment through group-based private sales and its public sale tool, Sonar. Cobie, with 861k followers on X (formerly Twitter), is also the host of the UpOnly podcast and a co-founder of Lido Finance, having been active in the crypto space since 2012. Just one day before the Echo acquisition, Coinbase spent $25 million to purchase and burn an "UpOnly" NFT, a move designed solely to compel the revival of Cobie's podcast, which has been on hiatus for three years.

In May 2025, Echo launched Sonar, a self-hosted token sale tool that allows projects to conduct compliant fundraising on chains like Hyperliquid, Base, and Solana. It utilizes a time-weighted deposit mechanism where participants deposit USDT or USDC; the longer the deposit duration, the larger the token allocation, on a first-come, first-served basis.

-

Echo Platform (Private Sales): At its core, Echo is a community-driven private investment platform. It enables community members to pool funds to participate in early-stage private rounds that were previously exclusive to VCs and institutional investors. This solves the access problem for retail investors. Notable deals include a $300,000 round for Ethena and a rapid $10 million financing for MegaETH.

-

Sonar (Public Sales): Sonar is a public offering tool that functions as a "self-hosted" launchpad. It allows projects to bypass traditional intermediaries and conduct public token sales directly on their chosen blockchain with self-determined terms. The market views this as a more transparent and compliant iteration of the ICO model. The stablecoin L1 project Plasma successfully raised $50 million through Sonar.

With competition in the exchange trading business becoming increasingly intense, Coinbase is expanding its territory to build a one-stop, on-chain capital markets solution that covers the entire lifecycle from project inception and primary market financing to secondary market trading.

Stablecoin Narrative Heats Up as Stable's $825M Pre-Deposit is Snatched Up by "Scientists"

Last week, Stable, a Layer 1 blockchain for USDT developed in close collaboration with Tether, became the center of market attention. Its first-round pre-deposit of $825 million was filled almost instantly, sparking widespread discussion. Stable is a high-performance blockchain designed specifically to provide a high-speed, low-cost settlement network for USDT, with plans to offer features like gas-free transfers and institutional-grade compliant privacy transactions.

Due to extremely high market expectations, Stable's initial pre-deposit event turned into a high-speed race between on-chain "scientists" and whales. Between 15 to 20 minutes before the official announcement, a massive amount of capital had already been deposited. After the official announcement, fewer than 200 addresses managed to participate successfully. The instant sell-out left many retail users who joined at the announced time empty-handed. On-chain data reveals that sophisticated participants, with keen on-chain monitoring, had identified the deposit contract address ahead of time. To ensure their success, these addresses not only prepared large amounts of capital in advance but also used gas fees far above the market average to front-run transactions, resulting in the majority of the allocation being locked up before the public announcement.

This "instant sell-out" clearly reflects the market's fervent enthusiasm. Although the event sparked community debate about fairness, it has not dampened long-term optimism for the Stable project. This incident highlights that permissionless, on-chain fundraising, while open to all, can easily become a game for a few whales and technically savvy individuals due to informational and technical asymmetries. This can lead to poor initial token distribution and alienate the broader community from the outset. In contrast, platforms like Echo, by introducing mechanisms like KYC, individual caps, and lottery or guaranteed allocation models, can promote more "equal opportunity," though at the cost of restricting participation for some users.

The challenge of how to embrace the native on-chain ethos while preventing monopolization by "scientists" and whales to provide a sense of fair participation for a wider user base remains a critical issue that requires further exploration and experimentation.

3. Project Spotlight

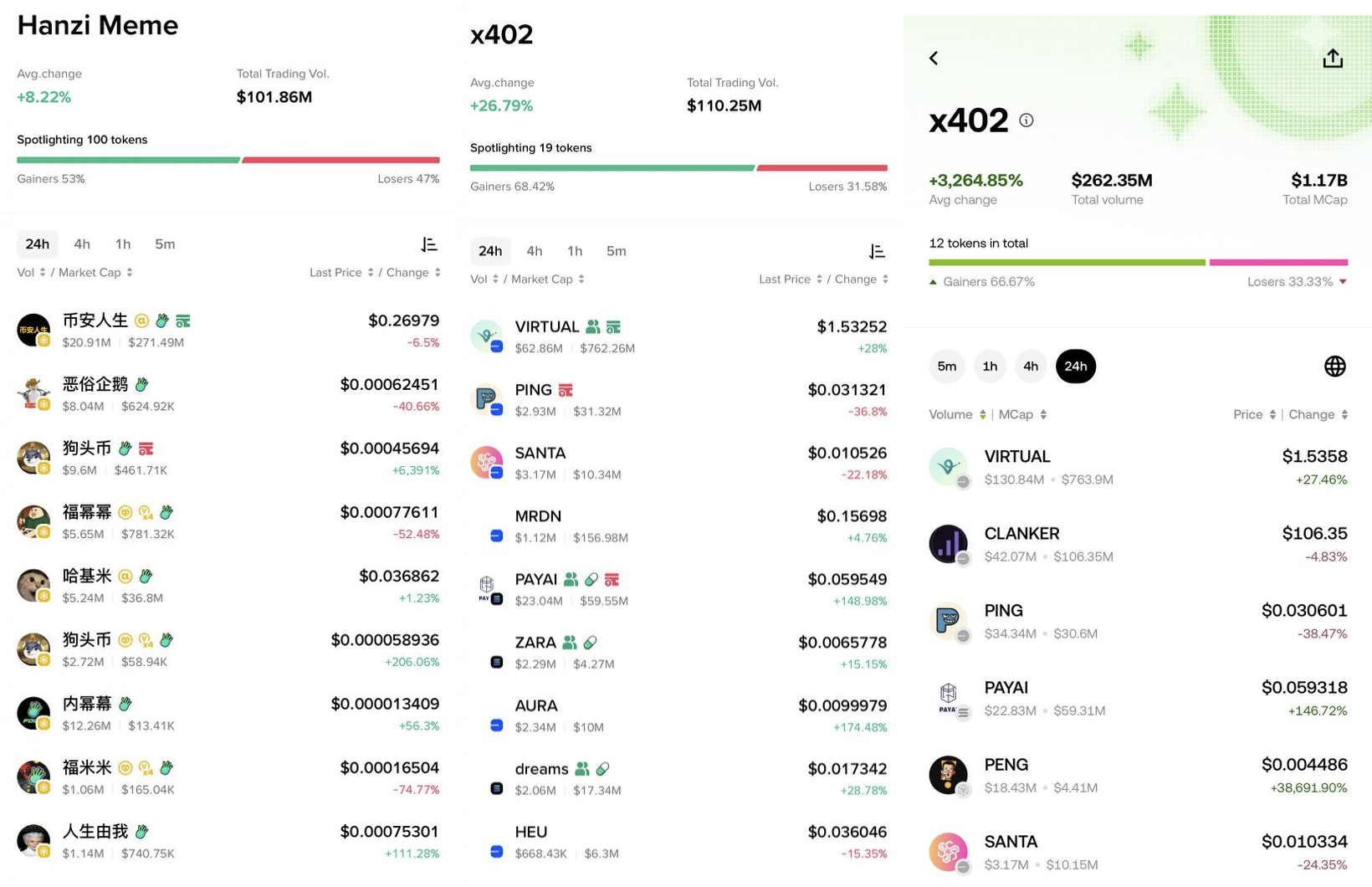

From Hanzi MEME to x402: Exchange WEB3 Wallets Accelerate Sentiment and Turn “Hot Topics” into Trading

Over the past week, market attention rotated smoothly from the emotion-driven peak of Hanzi MEME to the more technical x402 narrative. The former was ignited by cultural symbols and social amplification; the latter brought the imagination of “pay-per-use” to the forefront. What truly accelerated this handover was the rapid onboarding of these themes by major exchange wallets—surfacing related assets in visible lists, moving discussion signals to front-end interfaces, and enabling one-click execution. As a result, chatter no longer stopped at “I heard about it”; it quickly translated into actual orders and fills.

On Binance, the wallet market page added a dedicated “Hanzi Meme” section, and Binance Futures listed the Hanzi MEME “币安人生,” lifting the narrative into a clear, front-stage entry point. At the same time, Solana unveiled its Chinese brand name (“索拉拉”), and a Base co-founder engaged in Chinese around “Base 人生,” bringing Western and Chinese discourse into sync and briefly pushing Hanzi MEME to a platform-wide traffic peak.

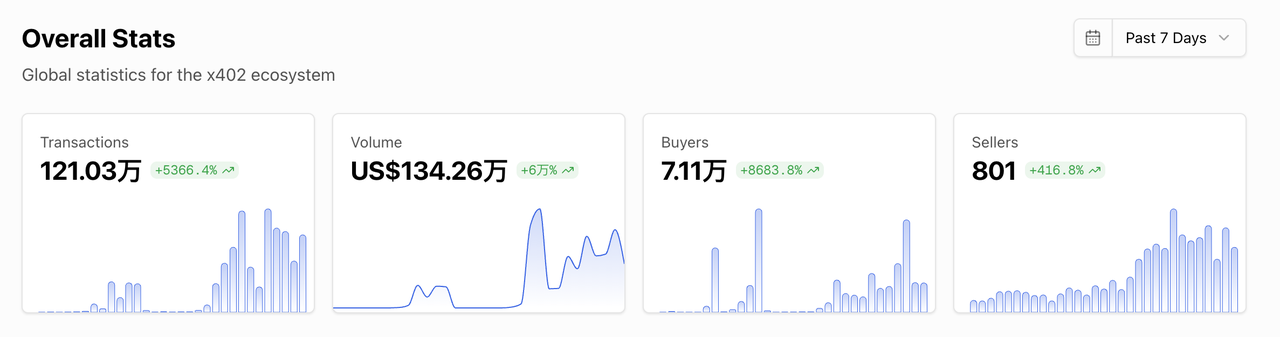

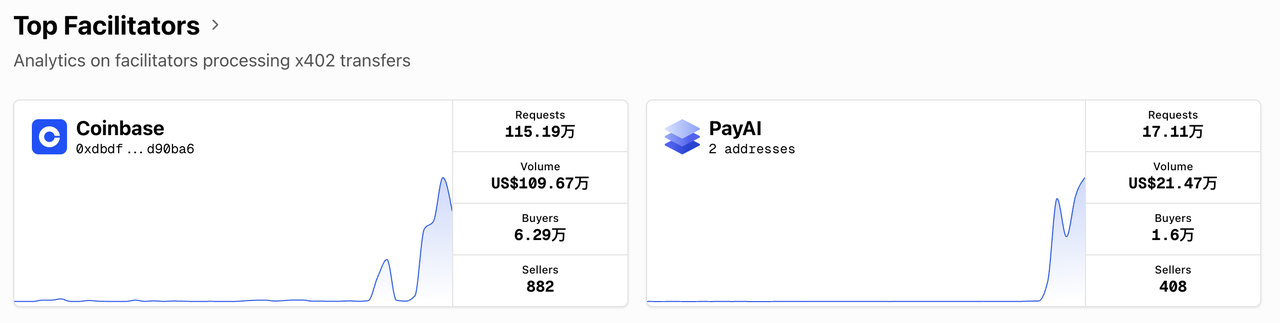

x402, in essence, “revives” the HTTP 402 “Payment Required” semantics on-chain. Previously a developer-centric topic, it became trader-readable once Binance, OKX, and others introduced visible entry points, discovery, and trade flows for x402-related assets. The technical story was effectively translated into a single screen of actionable information—constituents, relative strength, turnover, and mention velocity—with one-click buy. At the product level, Binance Wallet launched an “x402” list, while OKX Web3 rolled out tutorials, buy guides, and explainers in quick succession. This compressed the path from “see → understand → act,” allowing sentiment and liquidity to converge faster through the wallet front end.

Data Source: Binance Web3 & OKX Web3

Performance trends reflect the same pattern: growth in on-chain calls and transaction counts has largely moved in step with the rise in front-end visibility, and a “sector view” has started to take shape. CoinGecko added an “x402 Ecosystem” category to facilitate relative-strength and rotation tracking. Multiple trading venues and wallets have announced or launched dedicated sections and watchlists for x402, signaling intensifying competition where “entry equals distribution.” At the asset level, PING and PAYAI became focal anchors for speculative flows, helping to propagate the x402 narrative; meanwhile, prior AI-agent names such as Virtual and AIXBT saw meaningful elasticity via “concept convergence.” For monitoring, it helps to look at the cadence of new listings and changes in list weightings alongside underlying usage metrics—paid calls, active buyers, and resource-side activity—to distinguish durable flow from short-term noise.

Data Source: https://www.x402scan.com/

Looking ahead, sentiment pulses around Hanzi MEME are likely to recur and keep serving as ignition points. For x402 to extend the trend, the key is whether real paid demand in AI, data, and API scenarios can take over as the growth driver. Tracking two lines in parallel can make secondary-market timing more manageable: (1) whether wallet entries continue to iterate and add constituents, and (2) whether on-chain calls keep expanding. When both strengthen in tandem, sector Beta and leaders’ Alpha tend to persist; when wallet heat and usage data diverge, it can be a signal to de-risk and respect liquidity and drawdown discipline. Overall, this rotation reads like a “front-of-house” experiment in narrative transmission: once wallets open the channel, sentiment ignites faster and spreads wider—but it increasingly depends on on-chain data to sustain fundamental value.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.