KuCoin Ventures Weekly Report: Policy and Capital Fuel Rally: 401(k) Green Light Sparks Market, ETH Retakes $4,000 as DeFi Pioneers New Rate Derivatives

2025/08/11 08:33:02

1. Weekly Market Highlights

Policy and Capital Dual-Drive: The U.S. Leads the Mainstream Adoption of Crypto Assets

A new executive order signed by U.S. President Donald Trump now permits 401(k) retirement plans to invest in crypto assets and halts "Operation Choke Point 2.0," a previous initiative that restricted banking services to the crypto industry. This marks a significant narrowing of the institutional gap between the mainstream U.S. financial system and digital assets. Currently, the total size of the U.S. retirement account system is approximately $12.5 trillion, with 401(k) plans holding about $8.7 trillion. These funds have long been restricted by the Employee Retirement Income Security Act of 1974 (ERISA), with portfolios primarily focused on traditional assets like stocks and bonds. This regulatory shift not only responds to the crypto community's long-standing call for mainstream acceptance but also implies that even a minimal allocation of pension funds could bring substantial new capital into the crypto market. On the day of the announcement, Bitcoin's price rose by 2.16% to $117,000 and subsequently broke through $121,000 on Monday morning, approaching its all-time high.

This move also demonstrates a clear synergy between politics and capital. Easing the investment restrictions on 401(k)s will open up a long-term, stable source of funding for private equity and hedge funds, key supporters of the Republican party. This aligns with President Trump's previously proposed concepts of a Strategic Bitcoin Reserve and a Digital Asset Stockpile, sending a clear, industry-friendly signal.

Simultaneously, the regulatory environment is warming up. On August 8th, the U.S. Securities and Exchange Commission (SEC) and Ripple Labs formally settled their four-year-long lawsuit. Both parties agreed to withdraw their appeals and uphold the initial court ruling, which confirmed that Ripple's institutional sales of XRP were in violation of securities law, imposing a $125 million fine and a permanent injunction. The conclusion of this lawsuit resolves a major long-term uncertainty for Ripple. The company is now accelerating its expansion in the stablecoin sector: following its $1.25 billion acquisition of multi-asset brokerage Hidden Road in April, it has announced another $200 million acquisition of stablecoin payment platform Rail, aiming to continuously enhance the payment and clearing capabilities of its native stablecoin, RLUSD.

Furthermore, the advancement of the "Genius Act" is accelerating Tether's localization efforts in the U.S. market. Tether's holdings of U.S. Treasury bonds have reached an impressive $127 billion, making it the 18th largest holder globally. The company has reiterated its plans to launch a native stablecoin specifically designed for the U.S. market. Through deep collaboration with local banks and financial institutions, Tether aims to leverage its extensive global distribution network to expand its customer base and optimize payment efficiency to seamlessly integrate with the mature U.S. financial system.

The United States is taking the lead among major global economies in providing institutional acceptance and a long-term capital channel for digital assets, creating a new paradigm driven by both policy shifts and capital expectations. From the entry of pension funds to regulatory settlements and the localization of stablecoins, these developments are not only introducing a more stable source of capital to the crypto market but also fostering an end-to-end upgrade of the industry chain, from compliance and clearing to payments. Although the implementation details of these policies and the level of market participation remain to be seen, and short-term volatility cannot be ignored, the long-term potential for growth warrants close attention.

2. Weekly Selected Market Signals

ETH Strongly Reclaims Above $4k, DeFi TVL Poised to Challenge New Highs

Driven by continued institutional inflows and the policy boost from U.S. President Trump signing an executive order allowing 401(k) retirement funds to invest in crypto, ETH surged over 20% in the past week, returning above $4k for the first time since mid-to-late December 2024. Calculated from this year’s price low, ETH has risen more than threefold. The ETH/BTC exchange rate has shown a strong structure, and with BTC consolidating at high levels, the ETH/BTC rate once exceeded 0.037.

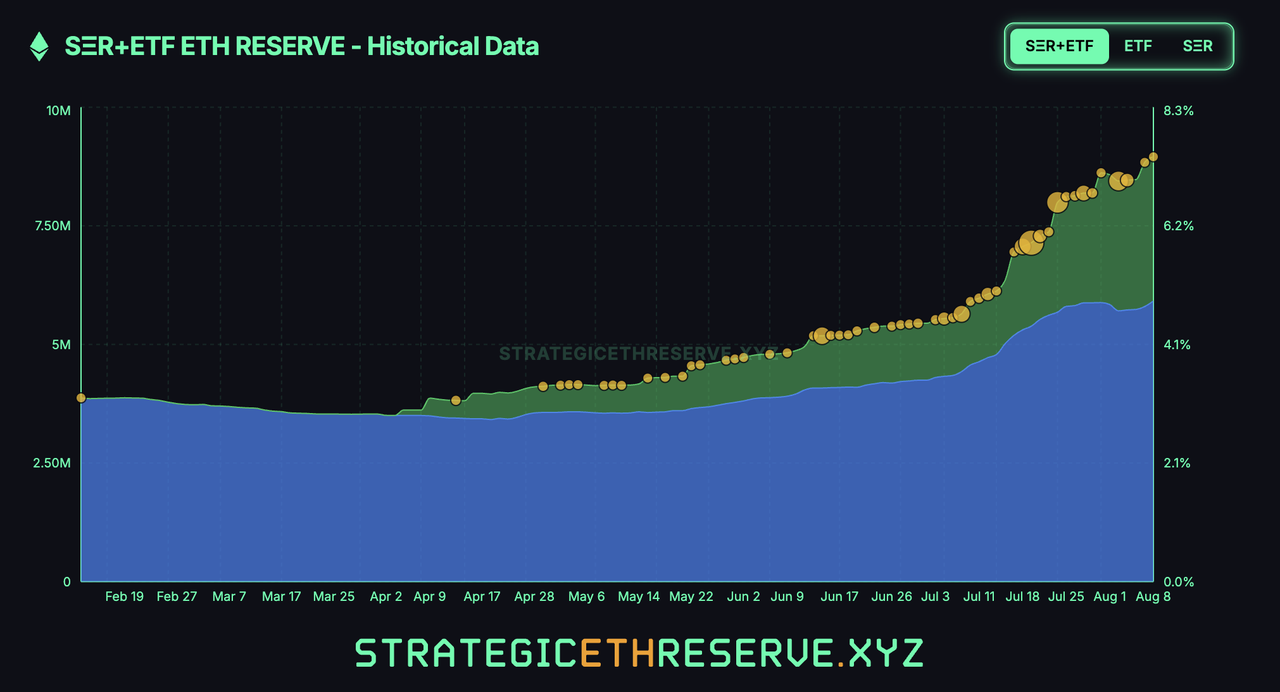

The capital inflows and purchasing power brought by the expansion of 401(k) retirement account investment options may still take some time to materialize, as cryptocurrencies are still considered high-risk, highly volatile alternative assets in traditional finance. Even after the decision to include them in employer plans, employers and plan administrators would still need a long period of screening. However, the purchasing power of publicly listed companies’ DATs remains considerable. According to SER data, there are currently three publicly listed companies whose treasury ETH holdings exceed those of the Ethereum Foundation, namely Bitmine (833.1k ETH), SharpLink (521.9k ETH), and The Ether Machine (345.4k ETH). Additionally, 60 disclosed publicly listed companies either support or are forming ETH DATs, collectively holding 3.04 million ETH, accounting for 2.51% of the total supply.

Data Source: https://www.strategicethreserve.xyz/

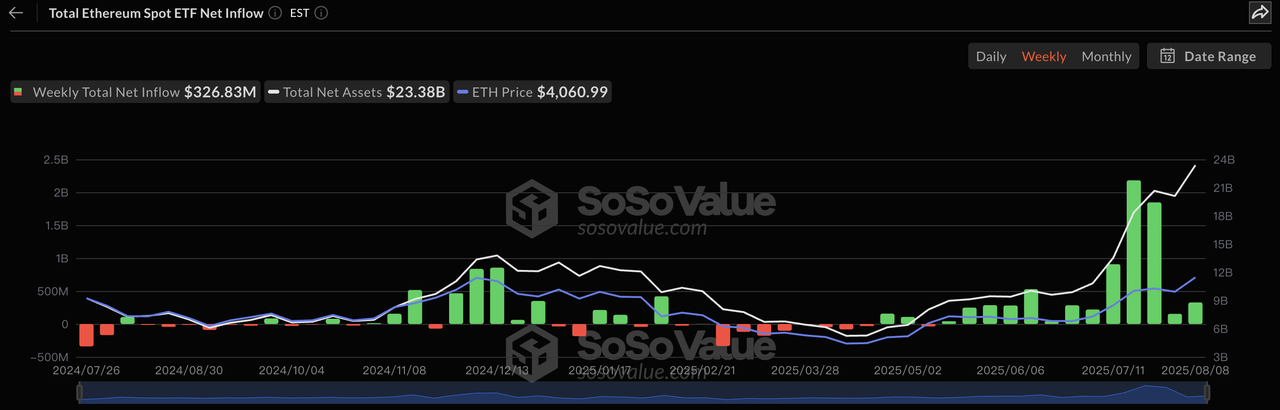

ETH ETFs have maintained 13 consecutive weeks of net inflows, and last week ETH ETF net inflows even surpassed those of BTC ETFs. However, compared with previous weeks, the net inflows of both BTC ETFs and ETH ETFs have shown a slowing trend.

Data Source: https://sosovalue.com/

Apart from external forces, Ethereum’s internal ecosystem is also recovering, with the DeFi sector being the most eye-catching. As ETH returns to $4k, DeFi TVL has also climbed back to $150 billion, only about $30 billion shy of its all-time high. Among them, blue-chip DeFi protocols such as Aave, EigenLayer, and Ethena have each seen TVL growth of over 30% in the past month. From a perspective similar to DAT, DeFi protocols themselves are major ETH-holding entities, and the two can form a strong synergy.

In addition, compared with the previous cycle—where returns largely depended on new protocols and token mining—this cycle’s DeFi income sources are healthier and more sustainable, including staking yields, basis yields, treasury yields, and lending interest. At the same time, the SEC’s statement that certain liquid staking activities do not constitute securities issuance or sales has removed regulatory barriers for DeFi development.

Over the past week, the supply of major stablecoins has continued a steady upward trend, with USDT supply increasing by about $646 million and USDC by $1.04 billion. Yield-bearing stablecoin USDe has, for the first time in history, exceeded a $10 billion market cap, with supply nearly doubling in the past month. This reflects the potential of yield-bearing stablecoins as a composable branch of DeFi—offering underlying yields while being widely used as collateral and in lending. Through leverage effects, they can achieve rapid expansion during favorable market conditions.

Data Source: https://www.coingecko.com/en/coins/ethena-usde

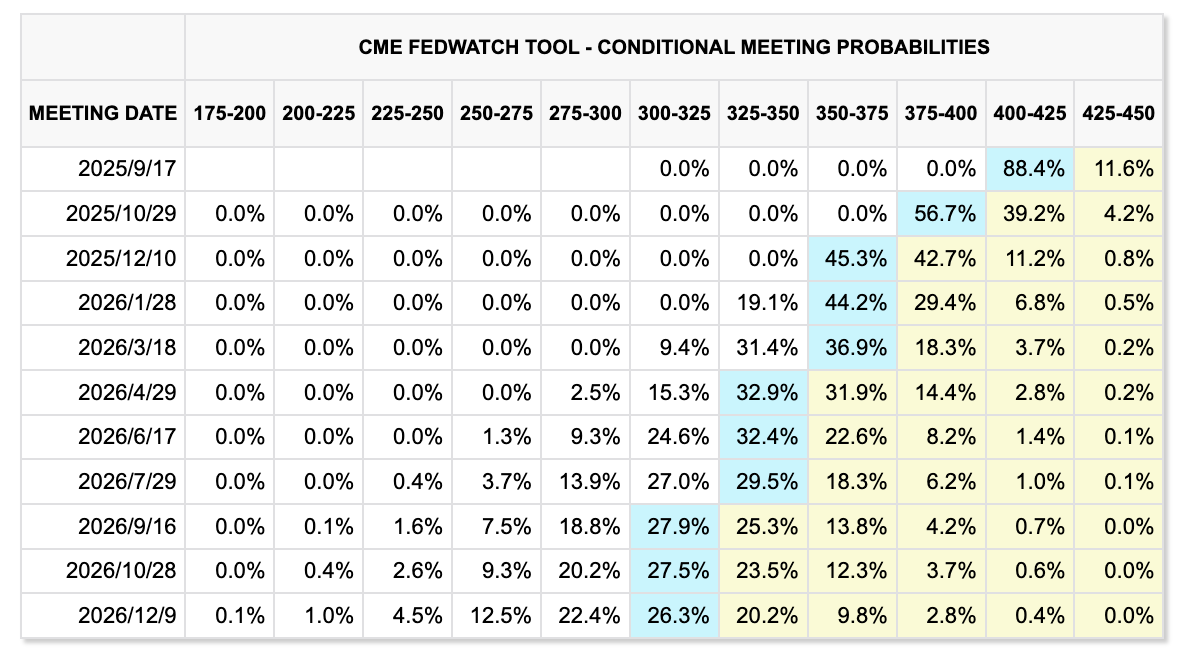

For the remaining three interest rate meetings this year, the market predicts that a rate cut is highly likely, with the main uncertainty being the extent of the reduction.

Major Macro Events to Watch This Week

-

Monday: China July M2 Money Supply YoY

-

Tuesday 20:30 UTC+8: U.S. July Seasonally Adjusted CPI YoY

-

Thursday 01:00–01:30 UTC+8: 2025 FOMC voting member and Chicago Fed President speaks on monetary policy; Atlanta Fed President speaks on the U.S. economic outlook 20:30 UTC+8: U.S. Initial Jobless Claims for the week ending August 9 and July PPI YoY

-

Friday: Meeting between U.S. President Trump and Russian President Putin

Primary Market Financing Watch:

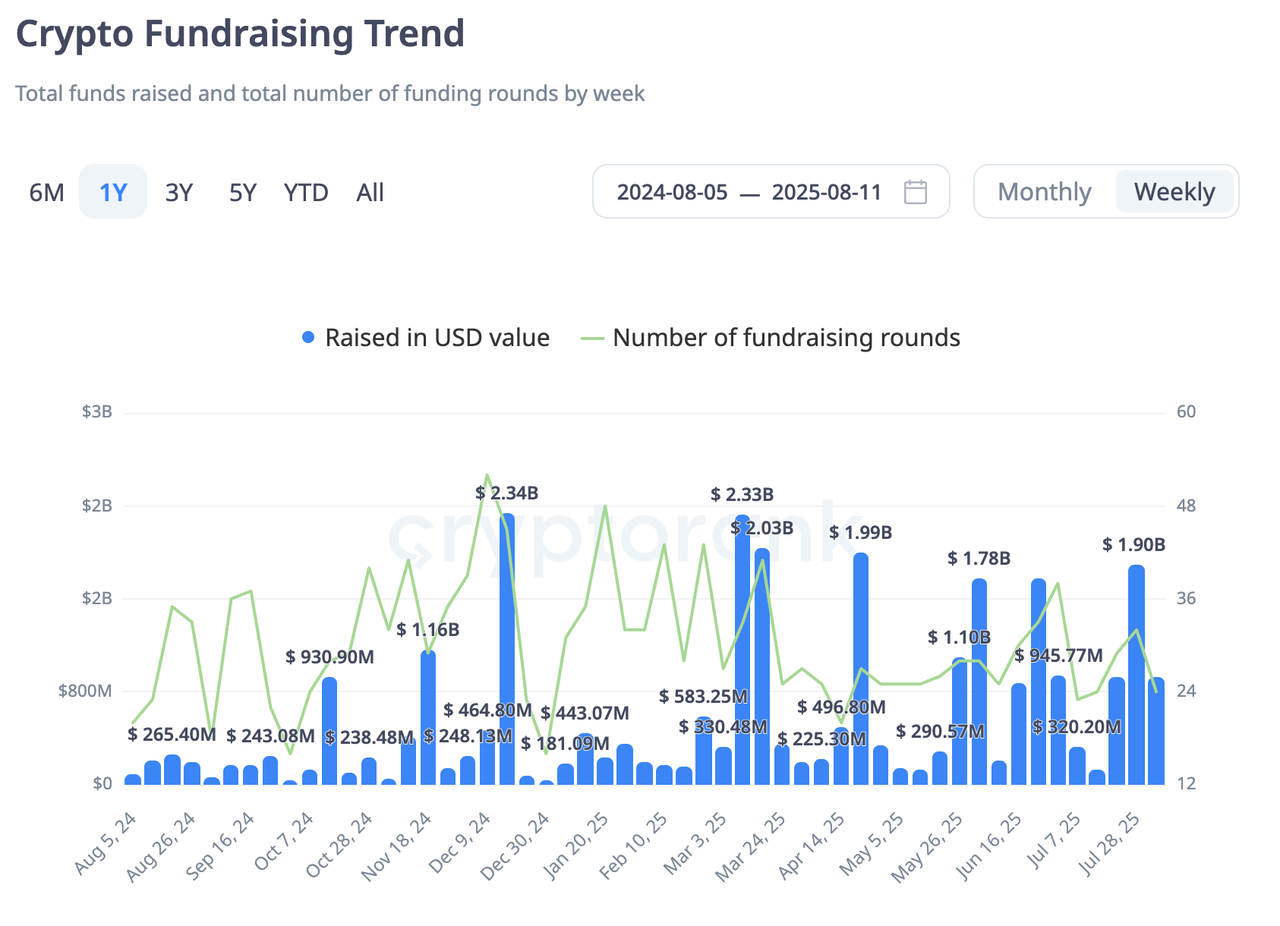

Last week, primary market financing totaled about $922 million, at a mid-to-high level for this year. The bulk came from listed companies’ DAT treasury financing. Other noteworthy deals include OpenMind securing a $20 million investment and Ripple acquiring stablecoin payment platform Rail for $200 million.

Data Source: https://cryptorank.io/funding-analytics

OpenMind: Building an Ethereum-like Smart Network for Humanoid Robots

Last week, OpenMind secured $20 million in funding led by Pantera with participation from Coinbase Ventures. The company is developing a cross-platform robot operating system called OM1, aiming to break the current limitation where robots are locked into single-vendor ecosystems. OpenMind’s flagship product is the FABRIC protocol, which enables robots of different types and from different manufacturers to authenticate, record data, and collaborate securely over a blockchain network, allowing them to operate in complex, multi-vendor environments.

According to its official positioning, OM1 handles local intelligence and interfaces, while FABRIC is responsible for trusted external connections and coordination—together forming an OS + network layer combination.

Based on public information and speculation, FABRIC’s architecture may be divided into:

-

Identity Layer: Provides verifiable identities for robots and operators, possibly akin to a combination of “handshake protocol + VPN + GPS.”

-

Communication & Context Layer: Offers end-to-end encryption and context sharing, allowing robots to exchange capabilities or be aware of each other’s status.

-

Coordination & Settlement Layer: Focuses on task publishing and matching, execution recording, automated settlement, and generating auditable collaboration evidence.

A possible workflow:

-

Device Onboarding: Device loads OM1 → obtains verifiable identity via FABRIC.

-

Discovery & Handshake: Nearby devices/schedulers confirm proximity/identity and establish an encrypted channel via FABRIC.

-

Context Synchronization: Share task-related status and capabilities.

-

Execution & Logging: Task starts → status updates → auditable execution records generated.

Ripple Acquires Stablecoin Payment Platform Rail, Expands RLUSD Use Cases

Rail is a stablecoin payment infrastructure provider that raised $10.7 million in a Series A round led by Galaxy in July 2024. Its core strengths include payment infrastructure plus compliance connections, high efficiency in cross-border B2B stablecoin payments, and a notable market share—it is projected to handle 10% of global B2B payments in 2025.

With this acquisition, Ripple can offer enterprise clients a more comprehensive stablecoin payment solution:

-

Integrating Rail’s tools to simplify account management and back-end operations.

-

Providing secure stablecoin exchange channels and a unified platform for internal and external payment flows.

-

Supporting multiple crypto assets including XRP and RLUSD, with liquidity backing.

-

Enabling global payment network access via a single API, offering 24/7 services.

-

Leveraging Rail’s multi-bank partnerships for redundancy, combined with Ripple’s 60+ regional licenses for enhanced coverage and regulatory compliance.

For RLUSD—Ripple’s stablecoin—this opens up broader business scenarios and distribution channels beyond internal circulation:

-

Cross-border B2B Payments: RLUSD can be used via the Rail network, with local bank conversion into fiat within hours.

-

Cross-border E-commerce Settlements: Platforms can pay sellers in RLUSD, with Rail converting it into locally receivable fiat.

-

Institutional Internal Settlements & Customer Payments: Direct integration into financial institutions’ workflows.

This creates a closed-loop ecosystem: RLUSD issuance → Rail network distribution & settlement → Ripple-powered cross-border financial services → capital cycling back into the RLUSD ecosystem.

3. Project Spotlight

Meme Sector Faces a Zero-Sum Game as DeFi Derivatives Forge a New Frontier

Pump.fun Launches New Initiative, Intensifying the Zero-Sum Competition

Pump.fun has announced a new initiative called the "Glass Full Foundation (GFF)" aimed at supporting projects within its ecosystem. According to the official plan, GFF will "inject substantial liquidity into ecosystem tokens to support community projects." The foundation has reportedly begun supporting its first batch of projects and plans to deploy more capital, hoping to continue driving the growth of the Solana ecosystem.

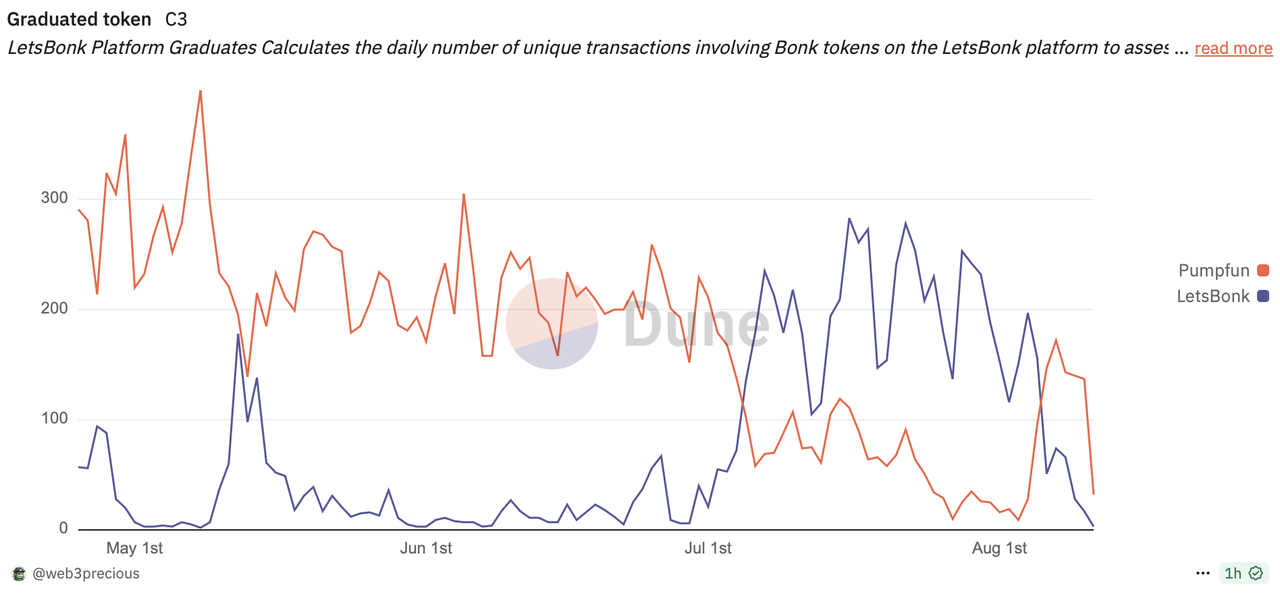

Data Source: https://dune.com/beincrypto/solana-launchpads

Data Source: https://dune.com/web3precious/pumpfun-vs-letsbonk

Although Pump.fun's series of self-rescue measures have temporarily increased its market share among MEME launchpads—currently surpassing LetsBonk again in daily active addresses and graduated tokens to reclaim the top spot—it has not reversed the overall downward trend of the MEME launcher sector. This indicates that with insufficient external demand, competition between platforms has evolved into intense involution A purely zero-sum game cannot solve the fundamental development issues of the sector.

Pendle Launches New Platform Boros, Pioneering the Funding Rate Derivatives Market

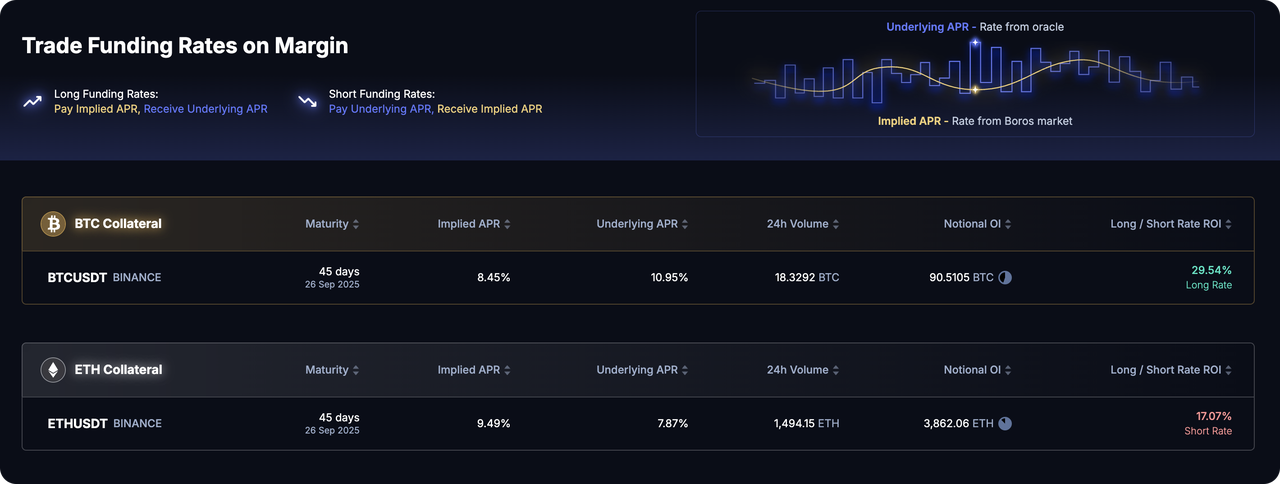

Data Source: https://boros.pendle.finance

The "self-revolution" of established protocols in the DeFi space has recently become a key highlight. Last week, Pendle launched its new platform, Boros, on Arbitrum. Initially, the product allows users to trade the funding rates of BTC and ETH perpetual contracts on Binance. It will later expand to include more platforms and assets. In theory, any yield-like or interest-rate-like product (such as staking yields for PoS assets) can be supported.

Following the same logic as Pendle V2, which separates principal from yield, Boros's core innovation is the introduction of the "Yield Unit" (YU). Through oracle price feeds and tokenization technology, it successfully isolates the floating funding rates from derivatives CEXs/DEXs and transforms them into a standardized, independent asset that can be traded, hedged, and speculated on-chain, thus creating an entirely new financial derivatives market.

Core Mechanics and Market Demand:

-

Boros materializes the floating funding rate streams from CEXs/DEXs into YUs. The essence of trading is a contest between the "implied annualized yield" and the future actual "underlying annualized yield."

-

Hedgers: A long trader who consistently pays high funding rates can go long on YU to convert an uncertain, floating cost into a predictable, fixed expense.

-

Cash-and-Carry Arbitrageurs: These traders earn funding rates by shorting perpetual contracts. By shorting YU, they can lock in this unstable, floating income as a fixed, high-yield return in advance.

In an era where Delta-neutral strategies, represented by Ethena, are becoming increasingly prevalent, their returns are highly dependent on positive funding rates. For such protocol treasuries, the need to hedge against the risk of funding rates turning negative or to lock in high positive rates is growing. The emergence of Boros provides these protocols with crucial risk management and yield enhancement tools, making it a timely product innovation that addresses a key market pain point. This also demonstrates the Pendle team's product foresight in the "interest rate swap" sector.

The product is currently in its initial testing phase. For risk management purposes, Boros has set low initial limits on open interest and leverage for both markets, along with a margin floor, to mitigate risks from product uncertainty. As of now, the current OI for BTC has reached 55.18% of its cap, while ETH's OI has reached 85.6% of its cap. The 24-hour trading volumes are 18.28 BTC and 1402.99 ETH, respectively.

In terms of revenue, Boros will charge trading fees, holding fees, and operational fees to subsidize gas costs, thereby diversifying its revenue streams. This allows the protocol to continuously capture value as it scales, making its business model more resilient. Overall, Boros is a bold and precise strategic product extension. It leverages the team's and product's existing strengths while keenly addressing current market needs and pain points with innovation.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.