Geopolitical Risks and AI Headwinds Converge, Pressuring Risk Assets

Summary

-

Macro Environment: The U.S. government restricted sanctioned cruise ships from entering and exiting Venezuela, while Russia may again face additional U.S. sanctions, significantly heightening geopolitical uncertainty. Meanwhile, financing obstacles for Oracle’s multi–billion-dollar data center project have reignited concerns over the sustainability of AI infrastructure investment, weighing on tech stocks. As risk-off sentiment intensified, major U.S. equity indices fell across the board, with the S&P 500 extending its decline to a fourth consecutive session, while precious metals and crude oil prices moved higher.

-

Crypto Market: Bitcoin volatility rose markedly. Supported by a higher open in U.S. equities, BTC briefly strengthened in early trading and tested the 90k level, but quickly reversed as risk appetite deteriorated, pulling prices back toward the 85k area. Altcoins broadly retraced alongside the market on lower volumes, with overall sentiment remaining in fear territory.

-

Project Developments

-

Trending Tokens: XAUT, CC, FHE

-

XAUT: Amid escalating geopolitical tensions and renewed AI valuation concerns, risk-off sentiment strengthened, pushing gold prices up to USD 4,350, near historical highs.

-

CC: The U.S. DTCC will launch a U.S. Treasury on-chain pilot on the Canton Network, driving an 8.5% rally in the privacy-focused chain CC against the broader market, and lifting other privacy tokens such as H, FHE, and NIGHT.

-

JTO: The Jito Foundation announced its return to the U.S., citing a clearer regulatory environment for digital assets.

-

AAVE: Aave released its 2026 outlook, outlining progress along three pillars: V4, RWAs, and the Aave App.

-

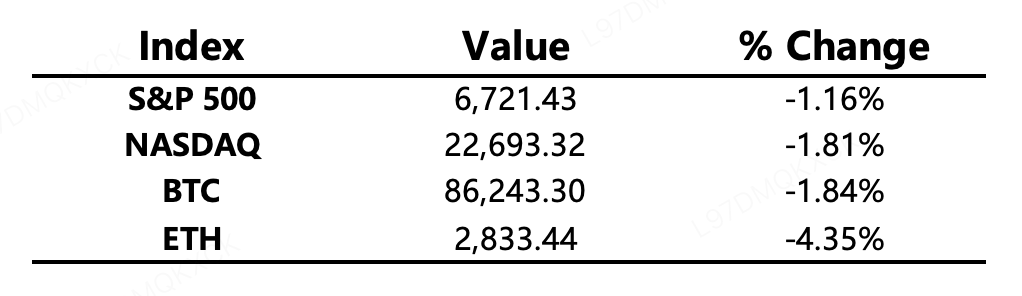

Major Asset Performance

Crypto Fear & Greed Index: 17 (vs. 16 24 hours ago), classified as Extreme Fear

Today’s Outlook

-

U.S. releases November CPI data

-

Atlanta Fed President Bostic (2027 FOMC voter) speaks on the economic outlook

-

Japan releases November core CPI (YoY)

-

ECB announces its interest rate decision

-

BoE announces its interest rate decision

-

Riksbank announces its interest rate decision

Macroeconomy

-

Fed Governor Waller: The policy rate is 50–100 bps above neutral; labor market conditions suggest the Fed should continue cutting rates; stablecoins will strengthen demand for the U.S. dollar.

-

Bessent: Any concerns about Hassett are “absurd”; Trump Accounts could help ensure all Americans own equities.

-

White House Official: President Trump has not yet made any new decisions regarding additional sanctions on Russia.

-

OpenAI: Exploring fundraising of “tens of billions, or even USD 100 billion.”

Policy Direction

-

The Fed formally rescinded its 2023 policy restricting banks from working with Bitcoin.

-

The UK plans to bring cryptocurrencies under financial-products regulation starting in 2027.

-

An SEC Commissioner solicited public comments on issues related to trading crypto assets on national securities exchanges.

-

The SEC’s Division of Trading and Markets issued a staff statement on broker-dealer custody of crypto-asset securities.

Industry Highlights

-

KuCoin announced a strategic partnership with Tomorrowland Winter and Tomorrowland Belgium for 2026–2028, becoming their exclusive crypto exchange and payment partner to connect global culture with digital finance.

-

Moon Pursuit Capital launched a USD 100 million crypto fund.

-

Hong Kong SFC quarterly report: Q3 spot virtual asset ETFs reached a total market cap of USD 920 million, up 217%.

-

The U.S. DTCC will launch a U.S. Treasury on-chain pilot on the Canton Network.

-

Vitalik: Improving protocol comprehensibility is a key path toward trust minimization.

-

Circle and LianLian Digitech announced a partnership to explore next-generation cross-border payment solutions.

Industry Highlights Extended Analysis

-

KuCoin and Tomorrowland’s Three-Year Strategic Partnership

This collaboration signifies that crypto assets are accelerating their transition from pure "financial tools" to a "lifestyle narrative." By aligning with a top-tier global electronic music brand, KuCoin gains immense brand exposure for 2026–2028. More importantly, as an exclusive payment partner, it validates the practical utility of crypto payments in real-world scenarios involving millions of young attendees. This "Web3 + Cultural IP" model is one of the most effective paths to break through the existing market and reach global non-crypto natives.

-

Moon Pursuit Capital Launches $100 Million Crypto Fund

The launch of a new $100 million fund in the current market environment sends a strong institutional bullish signal. It indicates that venture capital (VC) firms are re-evaluating the long-term value of the crypto industry and beginning a rhythmic deployment of capital. Such funds typically focus on infrastructure, Decentralized Physical Infrastructure Networks (DePIN), or AI-crypto intersections. Their entry provides essential liquidity to startups in the seed and Series A stages, driving the momentum for the next innovation cycle.

-

HK SFC Report: Spot Virtual Asset ETF Market Cap More Than Tripled

The 217% explosive growth in the market cap of Hong Kong’s spot virtual asset ETFs provides quantitative proof of the city’s policy appeal as an Asian Web3 financial hub. This data reflects the intense demand among traditional financial investors for compliant, licensed products. As the market cap expands, liquidity depth will further improve. This not only creates incremental business for local Hong Kong brokers and banks but also lays a solid foundation for more diverse crypto derivatives, such as Staking ETFs, in the future.

-

U.S. DTCC to Launch Treasury On-Chain Pilot on Canton Network

As the backbone of the global financial market’s back-office, the DTCC’s move to pilot U.S. Treasury bonds on-chain is a core milestone for Real-World Assets (RWA) entering mainstream finance. By operating on the Canton Network—a privacy-enhanced blockchain—the DTCC aims to explore how Distributed Ledger Technology (DLT) can reduce settlement risk and enhance capital efficiency. Once U.S. Treasuries, the "bedrock of global collateral," are tokenized at scale, the boundary between traditional and crypto finance will blur significantly.

-

Vitalik Buterin: Improving Comprehensibility for Trust Minimization

Vitalik’s insight strikes at the heart of decentralized governance. He emphasizes that "comprehensibility" is the foundation of trust: if a protocol's code and logic are so complex that only a few experts can understand them, users are essentially "trusting experts" rather than "trusting code." By simplifying protocol design and enhancing transparency, the Ethereum ecosystem aims to lower the barrier to participation and prevent the concentration of power among technocrats, thereby reinforcing the blockchain’s core promise of being "permissionless and trustless."

-

Circle and LianLian Digitech Partnership for Cross-Border Payments

The partnership between Circle (the issuer of USDC) and LianLian Digitech focuses on solving the primary pain points of cost and speed in global trade settlements. By using stablecoins as a settlement medium, this solution can bypass the cumbersome correspondent banking networks of the traditional SWIFT system, enabling 24/7 instant settlement. For LianLian Digitech, this enhances competitiveness in the global payment market; for Circle, it further solidifies USDC’s position as a compliant dollar-payment base, accelerating the penetration of Web3 technology into physical trade.