کیسے خریدیں Helium ( HNT )

Helium کی قیمت (24h)$0.8226321589151098 -5.11%Helium(HNT) خریدنے کے لیے لاگ ان کریں

-5.11%Helium(HNT) خریدنے کے لیے لاگ ان کریں

Helium ( HNT ) خریدنے یا دیگر کرپٹو کرنسیوں کو دریافت کرنے میں دلچسپی ہے؟ یہ آپ کے لیے صحیح جگہ ہے! KuCoin آپ کو جہاں کہیں بھی ہوں فوری طور پر Helium ( HNT ) خریدنے کی اجازت دینے کے لیے محفوظ اور آسان طریقے پیش کرتا ہے! وہ تمام طریقے چیک کریں جن سے آپ KuCoin پر HNT خرید سکتے ہیں۔

چار آسان مراحل میں KuCoin پر Helium ( HNT ) خریدیں

اپنا مفت KuCoin اکاؤنٹ بنائیں

- اپنے ای میل ایڈریس/موبائل فون نمبر اور رہائش کے ملک کے ساتھ KuCoin پر سائن اپ کریں، اور اپنے اکاؤنٹ کو محفوظ بنانے کے لیے ایک مضبوط پاس ورڈ بنائیں۔

اپنا اکاونٹ محفوظ کیجئے

- Google 2FA کوڈ، اینٹی فشنگ کوڈ، اور تجارتی پاس ورڈ ترتیب دے کر اپنے اکاؤنٹ کے مضبوط تحفظ کو یقینی بنائیں۔

اپنے اکاؤنٹ کی تصدق کریں

- اپنی ذاتی معلومات درج کرکے اور ایک درست تصویری ID اپ لوڈ کرکے اپنی شناخت کی تصدیق کریں ۔

ادائیگی کا طریقہ شامل کریں

- اپنے KuCoin اکاؤنٹ کی تصدیق کے بعد کریڈٹ/ڈیبٹ کارڈ یا بینک اکاؤنٹ شامل کریں۔

خریدیں Helium ( HNT )

- KuCoin پر Helium خریدنے کے لیے ادائیگی کے متعدد اختیارات استعمال کریں۔ ہم آپ کو دکھائیں گے کہ کیسے۔

منتخب کریں کہ آپ KuCoin پر Helium کیسے خریدنا چاہتے ہیں

KuCoin پر کرپٹو کرنسی خریدنا آسان اور بدیہی ہے۔ آئیے Helium ( HNT ) خریدنے کے مختلف طریقے دریافت کریں۔

- 1

KuCoin اسپاٹ مارکیٹ پر کرپٹو کے ساتھ Helium ( HNT ) خریدیں

700+ ڈیجیٹل اسیسٹس کی حمایت کے ساتھ، KuCoin اسپاٹ مارکیٹ Helium ( HNT ) خریدنے کے لیے سب سے مقبول جگہ ہے۔ یہاں خریدنے کا طریقہ ہے:1. فاسٹ ٹریڈ سروس، P2P، یا فریق ثالث بیچنے والے کے ذریعے KuCoin پر USDT جیسے مستحکم کوائن خریدیں۔ متبادل طور پر، اپنی موجودہ کرپٹو ہولڈنگز کو کسی دوسرے والیٹ یا تجارتی پلیٹ فارم سے KuCoin میں منتقل کریں۔ یقینی بنائیں کہ آپ کا بلاکچین نیٹ ورک درست ہے، کیونکہ کرپٹو کو غلط ایڈریس پر جمع کرنے کے نتیجے میں اثاثے ضائع ہوسکتے ہیں۔

2. اپنے کرپٹو کو KuCoin ٹریڈنگ اکاؤنٹ میں منتقل کریں۔ KuCoin سپاٹ مارکیٹ میں اپنے مطلوبہ Helium ( HNT ) تجارتی جوڑے تلاش کریں۔ اپنے موجودہ کرپٹو کو Helium ( HNT ) میں تبدیل کرنے کے لیے آرڈر دیں۔

ٹپ: KuCoin اسپاٹ مارکیٹ میں Helium ( HNT ) خریدنے کے لیے مختلف قسم کے آرڈر کی پیشکش کرتا ہے، جیسے کہ فوری خریداری کے لیے مارکیٹ آرڈرز اور ایک مخصوص قیمت پر کرپٹو خریدنے کے لیے آرڈرز کو محدود کرنا۔ KuCoin پر آرڈر کی اقسام کے بارے میں مزید معلومات کے لیے، یہاں پر کلک کریں۔3. جیسے ہی آپ کا آرڈر کامیابی سے مکمل ہو جائے گا، آپ اپنے ٹریڈنگ اکاؤنٹ میں اپنا دستیاب Helium ( HNT ) دیکھ سکیں گے۔

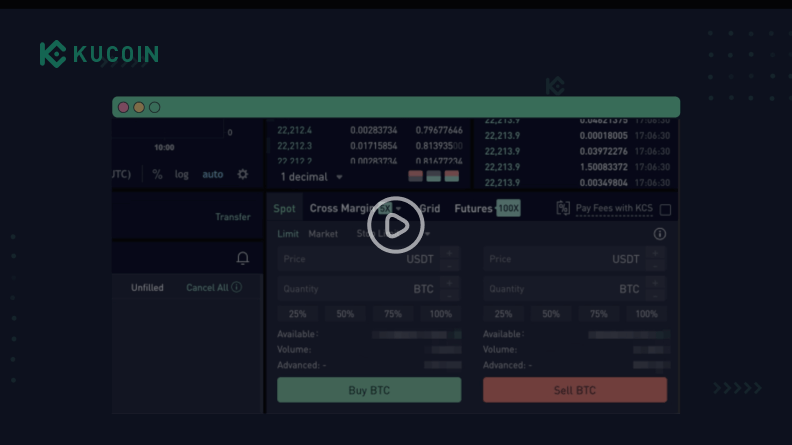

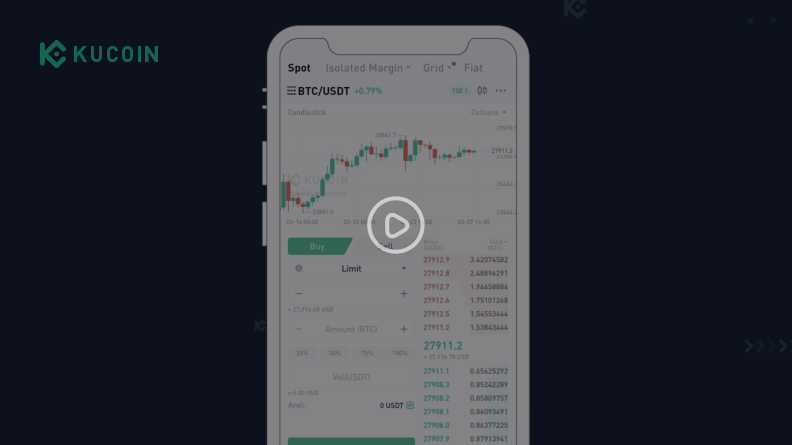

ویڈیو ٹیوٹوریل

How to Buy Crypto on the Spot Market Web

How to Buy Crypto on the Spot Market App

KuCoin کے ساتھ اپنا پہلا Helium ( HNT ) حاصل کریں۔

چلئے اب شروع کریں

کیسے ذخیرہ کریں Helium ( HNT )

ذخیرہ کرنے کا بہترین طریقہ Helium ( HNT ) آپ کی ضروریات اور ترجیحات کی بنیاد پر مختلف ہوتا ہے۔ Helium ( HNT ) کو ذخیرہ کرنے کا بہترین طریقہ تلاش کرنے کے لیے فوائد اور نقصانات کا جائزہ لیں۔

- اپنے KuCoin اکاؤنٹ میں Helium اسٹور کریں

آپ کے کرپٹو کو اپنے KuCoin اکاؤنٹ میں رکھنا تجارتی پراڈکٹ تک فوری رسائی فراہم کرتا ہے، جیسے کہ اسپاٹ اور فیوچر ٹریڈنگ، اسٹیکنگ، قرض دینا، اور بہت کچھ۔ KuCoin آپ کے کرپٹو اثاثوں کے محافظ کے طور پر کام کرتا ہے تاکہ آپ کو اپنی ذاتی کلیدوں کو خود سے محفوظ کرنے کی پریشانی سے بچنے میں مدد ملے۔ نقصان دہ اداکاروں کو اپنے فنڈز تک رسائی سے روکنے کے لیے مضبوط پاس ورڈ ترتیب دینا اور اپنی سیکیورٹی کی ترتیبات کو اپ گریڈ کرنا یقینی بنائیں۔

- اپنے Helium کو غیر کسٹوڈیل والیٹس میں رکھیں

"آپ کی چابیاں نہیں، آپ کے کوائن نہیں" کرپٹو کمیونٹی میں ایک وسیع پیمانے پر تسلیم شدہ اصول ہے۔ اگر سیکیورٹی آپ کی اولین تشویش ہے، تو آپ اپنے Helium ( HNT ) کو غیر تحویل والے والیٹ میں واپس لے سکتے ہیں۔ Helium ( HNT ) کو غیر تحویل یا خود تحویل والے والیٹ میں ذخیرہ کرنے سے آپ کو اپنی نجی کلیدوں پر مکمل کنٹرول حاصل ہوتا ہے۔ آپ کسی بھی قسم کے بٹوے استعمال کر سکتے ہیں، بشمول ہارڈویئر والیٹس، Web3 بٹوے، یا کاغذی بٹوے۔ نوٹ کریں کہ اگر آپ اپنے Helium ( HNT ) کو اکثر تجارت کرنا چاہتے ہیں یا اپنے اثاثوں کو کام میں لانا چاہتے ہیں تو یہ آپشن کم آسان ہو سکتا ہے۔ اپنی نجی کلیدوں کو محفوظ جگہ پر رکھنا یقینی بنائیں کیونکہ انہیں کھونے سے آپ کا Helium ( HNT ) مستقل طور پر ضائع ہو سکتا ہے۔

آپ KuCoin پر Helium ( HNT ) کے ساتھ کیا کر سکتے ہیں؟

پکڑو

- اپنا Helium ( HNT ) اپنے KuCoin اکاؤنٹ میں اسٹور کریں۔

ٹریڈ

- اسپاٹ اور فیوچر مارکیٹس میں Helium ( HNT ) تجارت کریں۔

کمائیں

- Helium ( HNT ) داؤ پر لگا کر یا قرض دے کر غیر فعال آمدنی حاصل کریں۔

KuCoin Helium ( HNT ) خریدنے کے لیے بہترین پلیٹ فارم کیوں ہے؟

محفوظ اور قابل اعتماد

ہمارا ریگولر پروف آف ریزرو (PoR) میکانزم اس بات کو یقینی بناتا ہے کہ کسٹمر فنڈز کو 1:1 حقیقی اثاثوں کی مدد حاصل ہو۔ 2021 میں فوربس کے ذریعہ KuCoin کو بہترین کرپٹو ایکسچینجز میں سے ایک کا نام دیا گیا تھا اور 2022 میں Ascent نے اسے بہترین کرپٹو ایپ کے طور پر منتخب کیا تھا۔

ہائی لیکویڈیٹی

تمام درج کرپٹو کرنسیوں کے لیے ایک اعلی لیکویڈیٹی آرڈر بک پر فخر کرتے ہوئے، KuCoin سخت اسپریڈز کے ساتھ مائع تجارتی تجربہ فراہم کرتا ہے۔

Home of Crypto Gems

KuCoin 700 سے زیادہ کرپٹو کرنسیوں کو سپورٹ کرتا ہے اور اگلا کرپٹو منی تلاش کرنے کے لیے بہترین جگہ ہے۔ Helium خریدیں اور KuCoin پر مختلف ڈیجیٹل اسیسٹس کے خلاف تجارت کریں۔

بدیہی انٹرفیس

ہمارے بدیہی انٹرفیس اور طاقتور ٹیکنالوجی کی بدولت KuCoin پر Helium ( HNT ) خریدنا تیز اور آسان ہے۔ جب آپ KuCoin پر خریدتے ہیں تو فوری طور پر HNT حاصل کریں۔