AI Stocks Extend Selloff, Bitcoin Pulls Back in Tandem

Summary

-

Macro environment: Market expectations for the next Fed chair shifted as Jim Walsh’s nomination probability on Polymarket overtook Kevin Hassett’s, adding short-term uncertainty to monetary policy expectations. Ahead of the U.S. nonfarm payrolls release, markets remained cautious. Continued selloffs in AI infrastructure stocks dragged down tech shares and the broader market, with all three major U.S. equity indices closing lower. Meanwhile, expectations of Fed rate cuts, a softer U.S. dollar, and rising risk aversion supported gains in precious metals.

-

Crypto market: Total crypto market capitalization fell 2.08%, with Bitcoin finding brief support around $85k. Altcoin trading activity rebounded, with both market cap and volume share increasing; however, amid declines in major tokens, overall market sentiment remained fearful.

-

Project updates:

-

Trending tokens: XAUT, PIPPIN, FHE

-

XAUT: Gold prices rose, supported by Fed rate-cut expectations, a weaker dollar, and heightened risk aversion.

-

FHE / PIPPIN: Mind Network introduced FHE into the Solana AI Agent ecosystem and partnered with PIPPIN, allowing users to lock FHE to earn PIPPIN. FHE and PIPPIN posted cumulative two-day gains of 201% and 142%, respectively.

-

AXL: Circle acquired the Axelar development team, interop_labs; the Axelar Network, foundation, and AXL token were not included in the acquisition.

-

Binance: Ongoing Binance API updates added Chinese encoding support, improving expectations for new market listings.

-

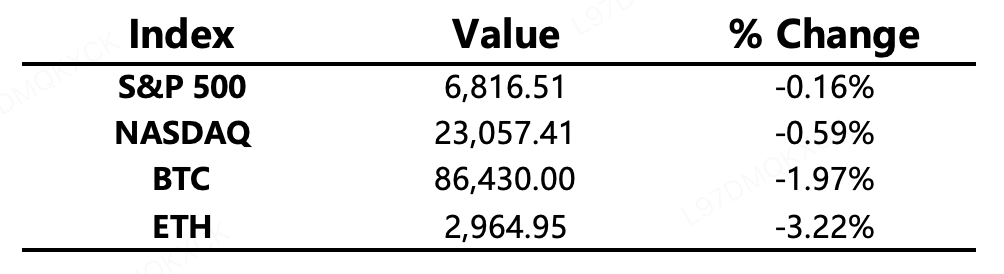

Major Asset Moves

Crypto Fear & Greed Index: 11 (16 twenty-four hours earlier), classified as Extreme Fear.

Today’s Agenda

-

U.S. releases November nonfarm payrolls and October retail sales (MoM).

-

Arbitrum (ARB) unlock of ~92.65 million tokens, valued at approximately $19.7 million.

Macroeconomy

-

Jim Walsh’s probability of becoming the next Fed chair surpasses Hassett’s, ranking first.

-

Probability of the Fed keeping rates unchanged in January next year: 75.6%.

-

Trump: The world is closer than ever to reaching a “peace agreement” to end the Russia–Ukraine conflict.

-

Fed’s Collins: Changes in the inflation outlook led her to support rate cuts.

-

Hassett: Trump’s views carry no weight; the Fed’s decision-making independence is paramount.

Policy Direction

-

The U.S. Senate has postponed consideration of the crypto market structure bill until next year.

-

SEC Chair: Crypto regulation must strike a balance between privacy and security.

-

UK Treasury is drafting new regulations for the crypto market.

Industry Highlights

-

JPMorgan launches its first tokenized money market fund.

-

CoinShares: Digital asset investment products recorded net inflows of $864 million last week.

-

Visa introduces stablecoin advisory services to keep pace with the crypto wave.

-

MetaMask adds Bitcoin support, continuing its multi-chain expansion.

-

Nasdaq applies for a 23-hour daily trading schedule, influenced by crypto markets’ 24/7 trading.

-

Strategy reports $9.618 billion in unrealized gains on its Bitcoin holdings; Bitmine reports $301.9 million in unrealized losses on its Ethereum holdings. Last week, Strategy spent $980.3 million to acquire 10,645 BTC; Bitmine added approximately 102,200 ETH, bringing total holdings above 3.96 million ETH.

-

American Bitcoin increased holdings by 261 BTC, totaling 5,044 BTC.

-

Do Kwon, after receiving a 15-year sentence in the U.S., may still face a second trial in South Korea.

In-Depth Industry Analysis

-

JPMorgan Launches its First Tokenized Money Market Fund.

Expanded Analysis: JPMorgan’s launch of its first tokenized money market fund represents a clear affirmation by a traditional finance (TradFi) behemoth that blockchain technology is viewed as core financial infrastructure, not merely a speculative asset class. Typically deployed on public chains like Ethereum, the fund aims to use tokenization to achieve instant settlement, 24/7 tradability, and greater programmability for assets. It provides qualified institutional investors with a tool to hold dollar-denominated, yield-bearing assets (Real World Assets or RWA) on-chain, significantly blurring the lines between traditional capital markets and Decentralized Finance (DeFi). This accelerates the era of "Hybrid Finance."

-

CoinShares: Digital asset investment products recorded net inflows of $864 million last week.

Expanded Analysis: The $864 million in net inflows reported by CoinShares signals continued strong demand for regulated crypto investment products (such as Bitcoin ETFs and EIPs). Inflows of this magnitude are typically interpreted as evidence of active institutional participation and a consolidation of market bullish sentiment. This demonstrates that despite short-term volatility, mainstream financial channels (like brokerage platforms and asset managers) are persistently allocating client capital into digital assets, increasingly tying crypto's price discovery and liquidity to traditional financial market cycles.

-

Visa Introduces Stablecoin Advisory Services to Keep Pace with the Crypto Wave.

Expanded Analysis: Visa's introduction of stablecoin advisory services indicates that the global payment giant is moving from early partnership and pilot stages to a comprehensive phase of strategic integration of stablecoin infrastructure. The service targets banks, fintechs, and large merchants, guiding them on the adoption of stablecoins for payments, settlements, and treasury management. Given Visa's immense global network, this move will not only accelerate the adoption of stablecoins (particularly those like USDC) as a global payment rail but also significantly enhance their regulatory compliance and trustworthiness for enterprise-level applications.

-

MetaMask Adds Bitcoin Support, Continuing its Multi-Chain Expansion.

Expanded Analysis: The addition of native Bitcoin support by MetaMask, the primary self-custody wallet for the Ethereum ecosystem, is a major milestone in the "multi-chain" trend within crypto wallets. MetaMask has traditionally been the gateway for EVM (Ethereum Virtual Machine) compatible networks. Its new BTC support signals an effort to become the universal entry point connecting the entire Web3 ecosystem. This will greatly improve user experience, allowing users to manage the two largest crypto assets within a single interface, while also facilitating liquidity and interoperability between the vast EVM user base and the Bitcoin ecosystem, and vice versa.

-

Nasdaq Applies for a 23-Hour Daily Trading Schedule, Influenced by Crypto Markets’ 24/7 Trading.

Expanded Analysis: Nasdaq's application to extend its trading hours to 23 hours daily is a direct response to the 24/7 model of crypto markets by a traditional stock exchange. The core driver for this move is global investor demand for trading U.S. equities outside of the traditional 9-to-5 Eastern Time schedule. If approved, this would mark a historic shift in the operating hours of U.S. financial markets, aiming to enhance global competitiveness, mitigate overnight market risk, and improve capital efficiency. It demonstrates the structural impact that the continuous operation of digital asset markets is having on legacy financial infrastructure.

-

Strategy reports $9.618 billion in unrealized gains on its Bitcoin holdings; Bitmine reports $301.9 million in unrealized losses on its Ethereum holdings. Last week, Strategy spent $980.3 million to acquire 10,645 BTC; Bitmine added approximately 102,200 ETH, bringing total holdings above 3.96 million ETH.

Expanded Analysis: The reports from Strategy (MicroStrategy) and Bitmine reflect a dual corporate treasury strategy and market divergence. Strategy's massive Bitcoin unrealized gains ($9.618 billion) and its sustained, nearly $1 billion weekly acquisition reinforce its market position as a "Bitcoin proxy ETF," highlighting its high-risk, high-reward strategy of long-term bullishness and debt-financed BTC purchases. In contrast, despite facing unrealized losses on its Ethereum holdings ($301.9 million), Bitmine's committed accumulation of 102,200 ETH, bringing its total to over 3.96 million, underscores its long-term belief in the Ethereum ecosystem and a corporate strategy focused on leveraging on-chain profitability opportunities like staking and node operation.

-

American Bitcoin Increased Holdings by 261 BTC, totaling 5,044 BTC.

Expanded Analysis: American Bitcoin's increase of its holdings by 261 BTC to a total of 5,044 BTC demonstrates the typical behavior of Bitcoin mining and holding companies during market uptrends: converting mining output or operational cash flow into a long-term asset reserve. While the 261 BTC increase is relatively small, its significance lies in the fact that these companies, through continuous accumulation, collectively form a persistent and stable buying force in the Bitcoin market, further reducing circulating supply, supporting the asset's price, and reinforcing the narrative of Bitcoin as a corporate treasury reserve asset.

-

Do Kwon, after receiving a 15-year sentence in the U.S., may still face a second trial in South Korea.

Expanded Analysis: The prospect of Do Kwon facing a second trial in South Korea, following a 15-year U.S. sentence, reflects the cooperative yet sovereign nature of global regulatory efforts to prosecute major crypto fraud cases. The U.S. conviction sets a crucial legal precedent regarding the severity of crypto fraud, given the estimated $40 billion in investor losses from the Terra-Luna collapse. South Korea's potential pursuit of a higher sentence (reports suggest possibly over 30 years) and direct victim compensation further underscores the zero-tolerance stance of international judiciaries toward large-scale crypto crime, which is essential for deterring bad actors and strengthening global investor protection.