Mastering Bitcoin Perpetual Futures: What Are Trading Futures and How to Trade BTC Like a Pro

2025/11/13 13:48:02

The world of crypto derivatives continues to evolve, offering traders advanced tools to profit from both rising and falling markets. Among these, perpetual futures have become one of the most powerful and flexible instruments for both new and experienced investors. If you’re curious about what are trading futures, how to begin Bitcoin futures trading, and how the BTC perpetual futures funding rate affects your strategy, this guide will walk you through everything you need to know.

What Are Trading Futures?

Futures trading involves a contractual agreement to buy or sell an asset at a predetermined price at a specific time in the future. However, perpetual futures are a special type of contract that never expires, allowing traders to hold positions indefinitely. Instead of having a settlement date, perpetual contracts use a funding rate mechanism to keep prices close to the spot market.

In simpler terms, perpetual futures let you speculate on Bitcoin’s price movement without owning the actual BTC. Traders can open long positions if they expect prices to rise, or short positions if they predict a drop. This flexibility makes perpetual futures one of the most versatile tools in modern crypto trading.

How to Trade Bitcoin Futures on KuCoin

If you’re ready to explore the potential of futures, KuCoin Futures provides a secure, user-friendly environment to start trading. Here’s a step-by-step overview of how to trade Bitcoin futures effectively:

Open a Futures Account: Go to KuCoin Futures and register or log in. It only takes a few minutes to activate your account.

Fund Your Account: Transfer assets from your spot wallet to your futures account. You can deposit USDT or other supported stablecoins to begin trading.

Choose Your Trading Pair: Navigate to the trading dashboard and select BTC/USDT Perpetual Futures. KuCoin offers multiple perpetual pairs with high liquidity and deep order books.

Set Your Leverage and Margin: Futures trading allows the use of leverage, letting you control larger positions with less capital. Beginners should start small—typically 2x to 5x—to manage risk effectively.

Open Your Position: Choose between Long (Buy) or Short (Sell) positions based on your market outlook. You can also use stop-loss and take-profit tools to control exposure.

Monitor and Adjust: Once your position is live, keep an eye on the funding rate and market trends. You can close or reverse your position anytime.

Understanding the BTC Perpetual Futures Funding Rate

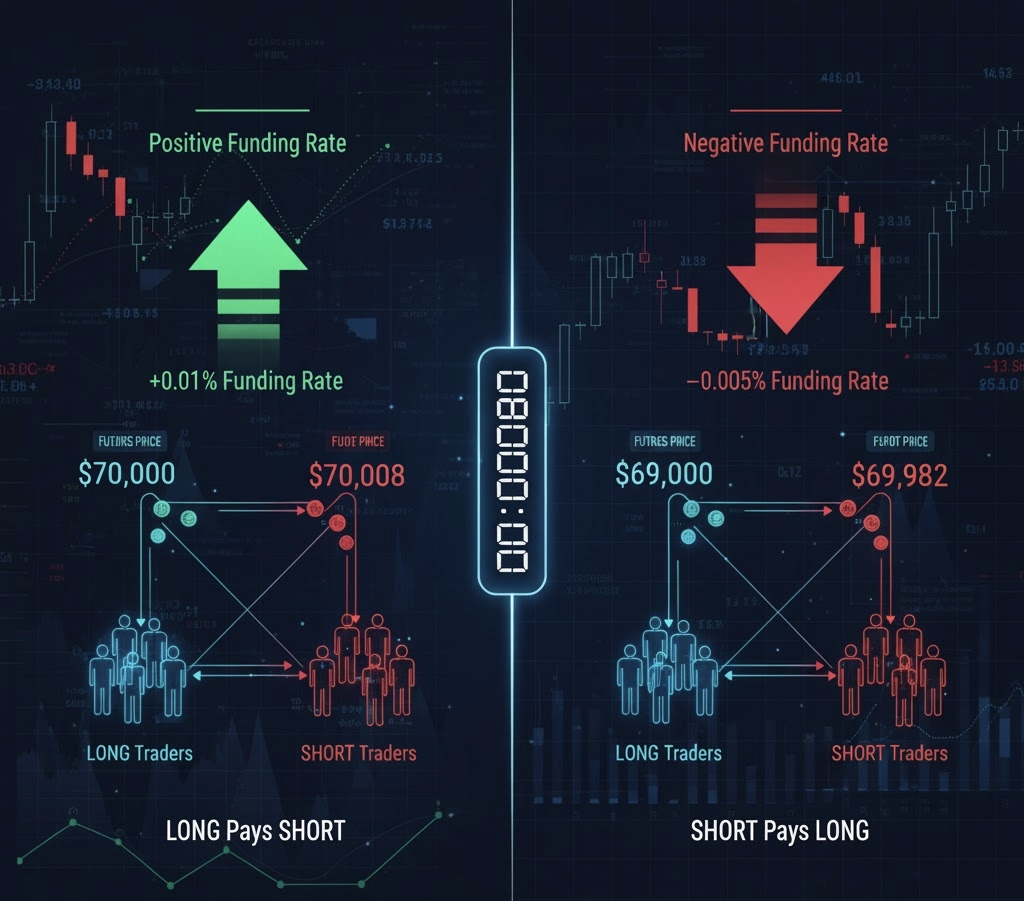

Since perpetual futures have no expiration date, exchanges use a funding rate system to keep futures prices aligned with spot prices. The BTC perpetual futures funding rate represents periodic payments made between long and short traders every 8 hours, depending on market conditions.

-

When the funding rate is positive, long traders pay short traders.

-

When the rate is negative, short traders pay long traders.

This mechanism helps balance the market and prevent large price discrepancies between the futures and spot prices. Smart traders monitor funding rates closely as part of their futures trading strategy, adjusting positions to minimize costs or capture rate differentials for profit.

Perpetual Futures Trading Strategies

Building a strong futures trading strategy involves combining technical analysis, leverage management, and emotional discipline. Here are a few key principles:

-

Risk Management: Always set stop-loss and take-profit levels.

-

Use Moderate Leverage: Overleveraging can amplify losses just as it boosts potential profits.

-

Follow Market Trends: Use chart indicators, moving averages, and volume data to confirm trends.

-

Stay Informed: Funding rates, volatility indexes, and macroeconomic data can all influence futures performance.

Why Trade Perpetual Futures on KuCoin

KuCoin’s futures platform is designed to cater to both crypto beginners and advanced traders, featuring:

-

Up to 100x leverage options with intuitive risk controls.

-

A demo trading environment for practice without real funds.

-

Real-time data tracking for funding rates and liquidation levels.

-

Smooth trading experience across web and mobile platforms.

With these advantages, traders can explore endless opportunities while maintaining full control of their risk exposure.

Final Thoughts

Perpetual futures are a gateway to the next level of crypto trading. By mastering what are trading futures, learning how to trade Bitcoin futures responsibly, and tracking the BTC perpetual futures funding rate, you can gain deeper insight into market movements and improve your profitability. Whether you’re hedging, speculating, or exploring new strategies, KuCoin Futures provides the tools and flexibility you need to succeed in this fast-moving market.

Start your trading journey today with KuCoin Futures — and take control of your crypto future.