What Determines the BTC Price and How to Navigate the Current Extreme Fear?

2025/10/17 12:18:02

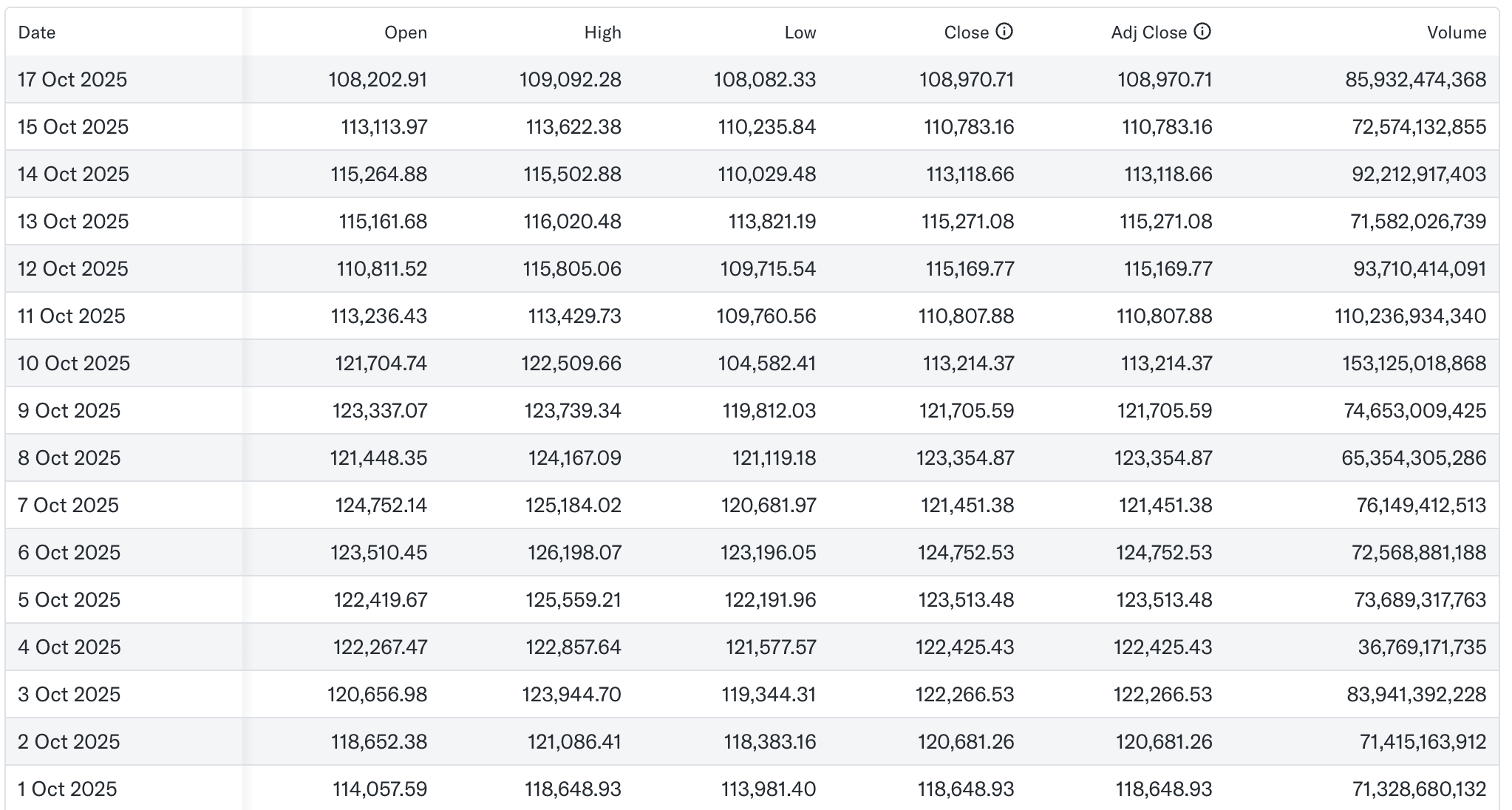

The global cryptocurrency market is at a critical juncture. According to the latest data, market sentiment has plunged entirely into the Extreme Fear zone. Even more impactful, the BTC Price has broken below the crucial $110,000 technical support level. This is not merely a change in numbers; it is a strong signal of collapsing market confidence.

As the market descends into panic, investors are asking a core question: What are the factors currently driving the BTC Price? And, given that Bitcoin's market dominance has paradoxically risen to 59%, what is the short-term and long-term outlook for BTC Price Prediction 2025? This article will analyze the current market situation from the perspectives of sentiment, technical analysis, fund flows, and macro correlation, providing strategies to help you understand What Determines the BTC Price.

💡 Real-Time Price Check: Investors can check the latest BTC Price movements and chart analysis on professional platforms anytime: https://www.kucoin.com/ur/price/BTC.

(Source: Yahoo Finance)

-

In-Depth Analysis of the Current BTC Price Status: Fear, Support, and Dominance

Sentiment Analysis: Extreme Signals from the Fear and Greed Index

Market sentiment, reflected by tools like the Bitcoin Fear and Greed Index, has fallen into the "Extreme Fear" zone. This extreme sentiment is usually the result of a combination of heavy selling pressure, rapid liquidation of Open Interest, and pessimistic media coverage.

-

Historical Lesson: Historically, periods of extreme fear often represent the "final drop" before the market eventually bottoms out. For long-term value investors, this can be a time to strategically position assets at market lows.

-

Short-Term Risk: Panic sentiment is self-reinforcing and could lead to market illiquidity and a price overshoot for the BTC Price in the immediate term.

Technical Analysis: The Severe Loss of the BTC Price Key Support

The fact that the BTC Price broke below the critical $110,000 threshold sends a clear bearish signal. This level served as a vital defense line for bulls; its failure typically triggers a chain reaction:

-

Liquidation Cascade: Massive long positions established around this price level are forcefully liquidated, further intensifying selling pressure.

-

Resistance Confirmation: Once a support level is lost, that price point transforms into a strong new BTC Price Support Level (now resistance), which the price will struggle against during future bounces.

Current technical focus now shifts to deeper historical volume profile areas to identify the next effective buying demand zone.

Fund Flow Analysis: The Anomaly of the BTC Dominance Trend

Despite the falling BTC Price, Bitcoin's market dominance has surprisingly climbed to 59%. This BTC Dominance Trend clearly illustrates the de-risking process currently underway in the market:

-

Money Squeeze Effect: During panic periods, institutions and professional traders rapidly reduce exposure to long-tail altcoins, moving funds into the relatively less risky Bitcoin, or directly into stablecoins. This Crypto Market Contagion accelerates the shrinkage of the altcoin market.

-

Bitcoin’s "Safe Haven" Status: Even as Bitcoin falls, it is still perceived as the most liquid and trustworthy asset in the entire crypto ecosystem, cementing its status as the relative safe haven or "digital gold."

The factors influencing the BTC Price are currently more complex than mere internal market panic, involving external macroeconomic conditions and structural shifts within the crypto market.

Hidden Macroeconomic Correlation

What drives BTC Price now is heavily dependent on global liquidity. The US Federal Reserve's interest rate policy, fluctuations in the US Dollar Index (DXY), and the performance of global stock markets (especially tech stocks) are all highly correlated with the BTC Price movement. If the market anticipates a deepening global recession, risk assets, including cryptocurrencies, will remain under pressure. High inflation and tightening monetary policy are two primary macro factors currently influencing the BTC Price.

Sector Rotation: The Significance of AI Coin Outperformance

Amidst the general downturn, AI Coin Outperformance stands out as a bright spot. The ability of the AI sector to rally against the trend is mainly due to its strong narrative and a boost from the US stock market. This structural divergence indicates:

-

Capital Efficiency: Capital becomes highly discerning during a bear market. It flows only into narrative-driven sectors that exhibit exponential growth potential and receive validation from external markets (like the traditional tech space).

-

Squeezing Traditional Altcoins: Funds are being pulled from older altcoins lacking innovation or narrative, exacerbating their declines and further contributing to the rising BTC Dominance Trend. This effect is a vital reference for investors evaluating the relative strength of the BTC Price.

In the face of extreme panic, it is crucial for investors to separate short-term volatility from long-term value, and to formulate strategies based on the potential BTC Price outlook.

BTC Price Prediction Short-to-Mid-Term Uncertainty

In the short term, the BTC Price trajectory will depend on whether the market can find sufficient buying demand at the next major support levels (such as historical highs or significant Fibonacci retracements). If a large-scale forced liquidation occurs, the price could quickly find a deep bottom. However, once panic subsides, massive short covering could trigger a sharp rebound. Traders should use professional charting tools (like those provided by KuCoin) to set stop-losses and target levels.

Long-Term Value and Strategic Deployment

Looking ahead to BTC Price Prediction 2025, Bitcoin's long-term value narrative remains strong. With institutional entry facilitated by ETF approvals, continued growth in blockchain adoption, and worsening global currency devaluation, Bitcoin's status as an inflation hedge and store of value is hard to shake. Every panic sell-off potentially offers a lower entry cost for long-term investors.

Investor Action Recommendations:

-

Prudent Risk Assessment: Avoid chasing the decline during moments of extreme panic.

-

Staggered Deployment (DCA): Employ a Dollar-Cost Averaging (DCA) strategy, buying in batches around multiple BTC Price Support Level targets to lower the average cost.

-

Safety First: Regardless of How to buy BTC, choose a secure and liquid platform like KuCoin for trading to safeguard your assets.

The current market environment reflects the cyclical nature of cryptocurrency. The BTC Price breaking key support and market sentiment being in extreme fear serve as the ultimate test of investor conviction.

Successful investors often remain rational during moments of greatest market panic. By understanding the risk-aversion logic behind the BTC Dominance Trend, focusing on the macro factors of What drives BTC Price now, and learning How to buy BTC and manage positions safely, you can prepare for the inevitable recovery projected for the BTC Price Prediction 2025.

Risk Warning: The cryptocurrency market is highly volatile. Please conduct thorough research before investing.