Gold Price Rally Above $4,350: Why XAUT (Tether Gold) Is Emerging as the Leading Digital Gold Hedge

2025/12/18 03:45:02

Introduction: Gold Hits Seven-Week High, XAUT Emerges as the Digital Safe Haven

The global financial markets have once again turned their attention to gold. Driven by mounting expectations of further U.S. interest rate cuts and a weaker U.S. dollar, the price of the traditional safe-haven asset, gold, has surged past $4,350 per ounce, hitting a seven-week high. Although the price stalled near the all-time high resistance level of approximately $4,381 due to short-term profit-taking, its strong momentum and potential upside remain a central focus for investors worldwide.

Against this macroeconomic backdrop, XAUT (Tether Gold), a crypto asset 1:1 backed by physical gold, is emerging as the preferred gateway for investors to enter the gold market. XAUT not only captures the full gains of the Gold Price Rally but also, through its blockchain-enabled Digital Gold features, solves the pain points of traditional gold investment, making it the new favorite for Crypto Hedge in the current environment of uncertainty.

I. Macro Drivers: The Core Forces Behind the Gold Price Rally

Gold's robust performance is not accidental; it is being propelled by a "perfect storm" of complex global macroeconomic and geopolitical factors that clearly enhance gold's appeal as a non-yielding asset.

-

Fed Policy Shift and Rate-Cut Expectations

Market anticipation of a pivot in the U.S. Federal Reserve (Fed) monetary policy is the primary driver pushing gold higher.

-

Lower Opportunity Cost: Following the Fed's final 25-basis-point rate cut of 2025, markets are now pricing in the expectation of further rate cuts in 2026. Since gold pays no yield, a decline in interest rates lowers the opportunity cost of holding gold. The Impact of Rate Cuts on Gold causes capital to shift from fixed-income assets with dwindling yields toward gold for value preservation, thus pushing prices up.

-

Real Rates Trend: As inflation moderates and nominal rates drop, the decrease in real interest rates (nominal minus inflation) is a traditional condition for gold to thrive.

-

Weaker U.S. Dollar and Price Attractiveness

The struggling U.S. dollar directly impacts the price of gold, which is denominated in USD.

-

Near Two-Month Lows: The U.S. dollar has been weakening, hovering near a two-month low. The anticipation of the Fed ending its hiking cycle makes the dollar less attractive compared to other major currencies.

-

Increased Overseas Demand: A weaker dollar makes gold cheaper for buyers holding other currencies, which significantly boosts global demand. This buying pressure further contributes to the Gold Price Rally in USD terms.

-

Safe-Haven and Central Bank Structural Demand

Beyond monetary policy, two structural factors provide a strong floor for gold prices:

-

Geopolitical Tensions: Ongoing geopolitical conflicts, such as the Russia-Ukraine war, and persistent global economic and political uncertainty continue to drive investors toward gold for Crypto Hedge and value preservation.

-

Central Bank Gold Purchases: Central banks, particularly in nations like China, remain major purchasers of gold. This behavior is motivated by the desire to diversify reserves away from the U.S. dollar, providing a strong and consistent structural demand reflected in Central Bank Gold Purchases.

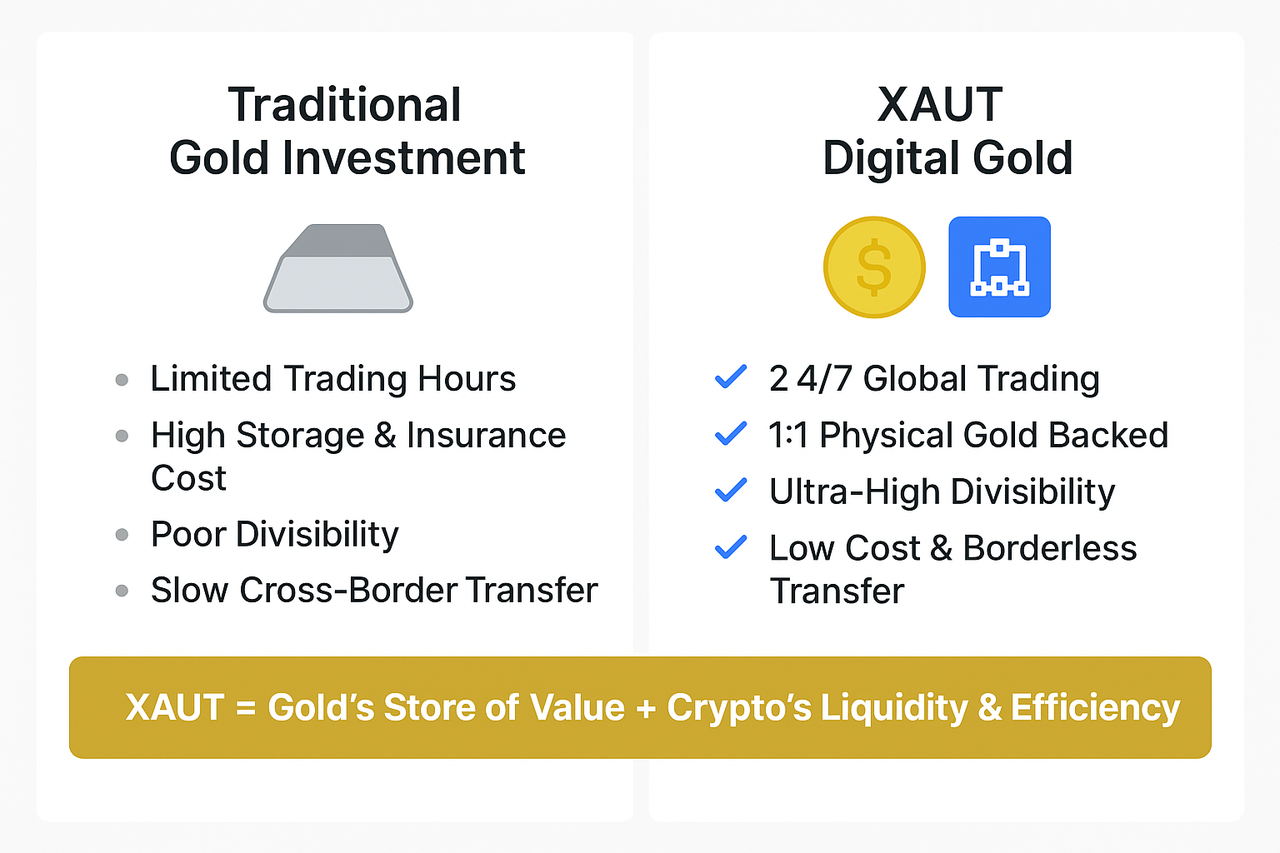

II. The Unique Edge of XAUT: Digital Gold's Value Reshaping and Efficiency

Faced with the inherent inconveniences of traditional gold investment, XAUT (Tether Gold), as a representative of Digital Gold, offers an innovative and efficient solution, fully unlocking XAUT Investment Value.

Physical Backing and Verifiable Ownership

The credibility of XAUT Coin stems from its solid backing by physical assets. Each XAUT token represents 1 troy ounce of London Good Delivery gold, securely stored in high-security Swiss vaults.

-

Transparency: XAUT holders have the right to specific gold bar serial numbers, meaning their tokens represent direct ownership of the physical gold, eliminating doubts about the asset's backing truthfulness.

Digital Advantages Enabled by Blockchain

As Digital Gold, XAUT possesses distinct advantages that physical gold bars or traditional ETFs cannot match:

| Feature | XAUT (Tether Gold) | Traditional Gold Investment |

| Liquidity & Trading Hours | 24/7/365 access with high liquidity in crypto exchanges. | Limited by bank or stock market operating hours. |

| Divisibility | Highly divisible, can trade fractions as small as 0.000001 oz. | Physical bars are hard to divide; ETFs have minimum trade units. |

| Storage Cost | Extremely Low (primarily minimal on-chain transaction fees). | High insurance, storage, and management fees. |

| Transfer Efficiency | Instantaneous and Borderless, facilitating rapid global asset transfer. | Slow and complex, involving physical shipping or international wire transfers. |

Through these advantages, XAUT allows investors worldwide to participate in the Gold Price Rally with extremely low costs and high efficiency.

III. Strategic Positioning of XAUT in a Crypto Portfolio

Given the high volatility of the cryptocurrency market, XAUT plays a crucial role as a hedge and stabilizer.

Hedging Crypto Volatility: Low-Correlation Asset

When the crypto market faces panic selling, capital often seeks low-correlation safe assets. XAUT, as a Crypto Hedge tool pegged to physical gold, provides relative value stability during severe market fluctuations. Including XAUT in a portfolio effectively lowers the overall volatility and facilitates asset diversification.

Institutional Gateway and Strategic Allocation

Due to its strict physical reserves and transparent audits, XAUT possesses an institutional-grade appeal. For professional investors and high-net-worth individuals who want to capture gold's appreciation while maintaining the high efficiency of blockchain assets, XAUT offers a more flexible alternative to traditional gold ETFs.

Authority Outlook on Gold's Long-Term Trajectory

Gold's future momentum is endorsed by top financial institutions. Despite temporarily stalling near the all-time high of $4,381, analysts like Morgan Stanley are optimistic about its long-term potential.

-

Bullish Forecasts: Morgan Stanley sees the potential for gold to exceed $4,900 per ounce by the end of 2026 if the current bullish momentum continues. This is underpinned by the fact that investor allocation to gold remains relatively low, leaving significant room for accumulation.

-

Strategic Allocation: With more institutions viewing gold as a strategic diversification tool against fiscal and monetary debasement, this structural shift is expected to provide strong support for the price in the coming years.

IV. Investor Guide and Risk Warning

As the gold market experiences a strong bull run, investors should rationally plan their XAUT investment strategy.

-

How to Safely Buy XAUT Coin: Buy XAUT Coin is the most efficient method for crypto investors to gain gold exposure.

-

Trading Venue: XAUT's liquidity is concentrated in crypto exchanges. Investors can use major stablecoins like USDT to quickly exchange for XAUT Coin and enjoy the benefits of the Gold Price Rally.

-

Risk Note: While the outlook is optimistic, gold prices may still fluctuate due to upcoming U.S. economic data releases or geopolitical shifts. Investors should view XAUT as a medium-to-long-term value preservation and hedging tool, rather than a short-term speculative asset, to fully capitalize on the Impact of Rate Cuts on Gold.

Conclusion: XAUT—The Modern Tool to Navigate the Gold Bull Market

With gold prices surging past seven-week highs and targeting all-time records, the focus on XAUT has peaked. Tether Gold successfully merges the millennia-old safe-haven attribute of gold with the modern efficiency of blockchain technology. It provides global investors with a transparent, efficient, and low-cost channel to Buy XAUT Coin and act as the optimal Digital Gold tool for capturing the returns driven by the Impact of Rate Cuts on Gold.