Spot Trade: Order Types

You can set some order types to make your order filled under different conditions you need.

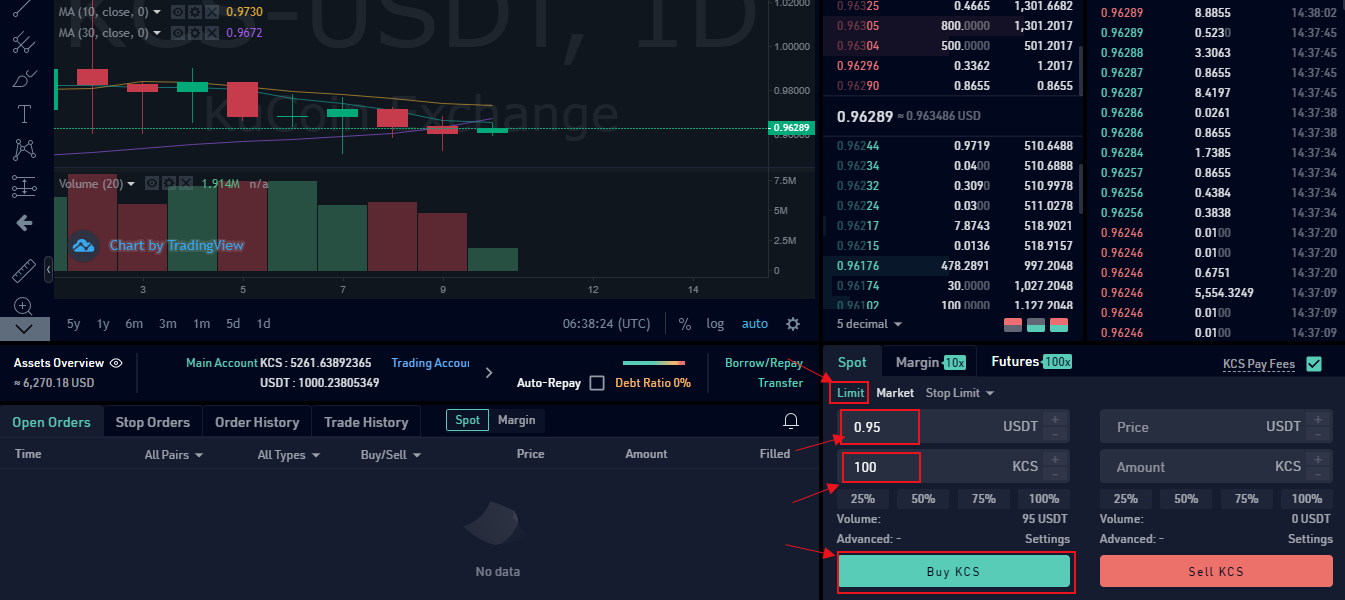

1 Limit Order

1.1 Definition:

A Limit Order is an order placed to buy or sell at a specified limit price.

1.2 Example:

If the current market price for KCS is 0.96289 USDT and you plan to buy 100 KCS when the price drops to 0.95 USDT, you can place a Limit Order.

1.3 Instructions:

Select Limit Order, enter 0.95 USDT in the price box, and enter 100 KCS in the amount box. Click Buy KCS to place the order.

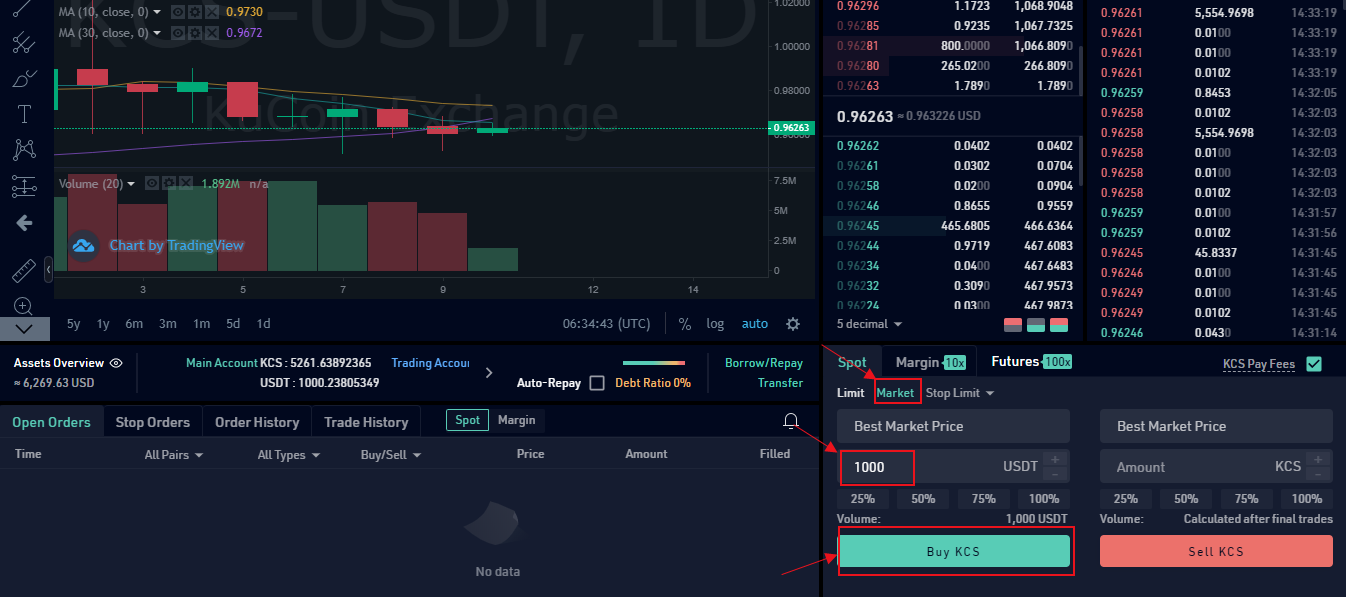

2 Market Order

2.1 Definition:

A Market Order is an order placed to buy or sell at the best available price in the current market.

2.2 Example:

If the current market price for KCS is 0.96263 USDT and you plan to buy KCS worth 1,000 USDT immediately, you can place a market order.

2.3 Instructions:

Select Market Order, enter 1000 USDT in the amount box, then click Buy KCS to place the order. The order will typically be filled in seconds.

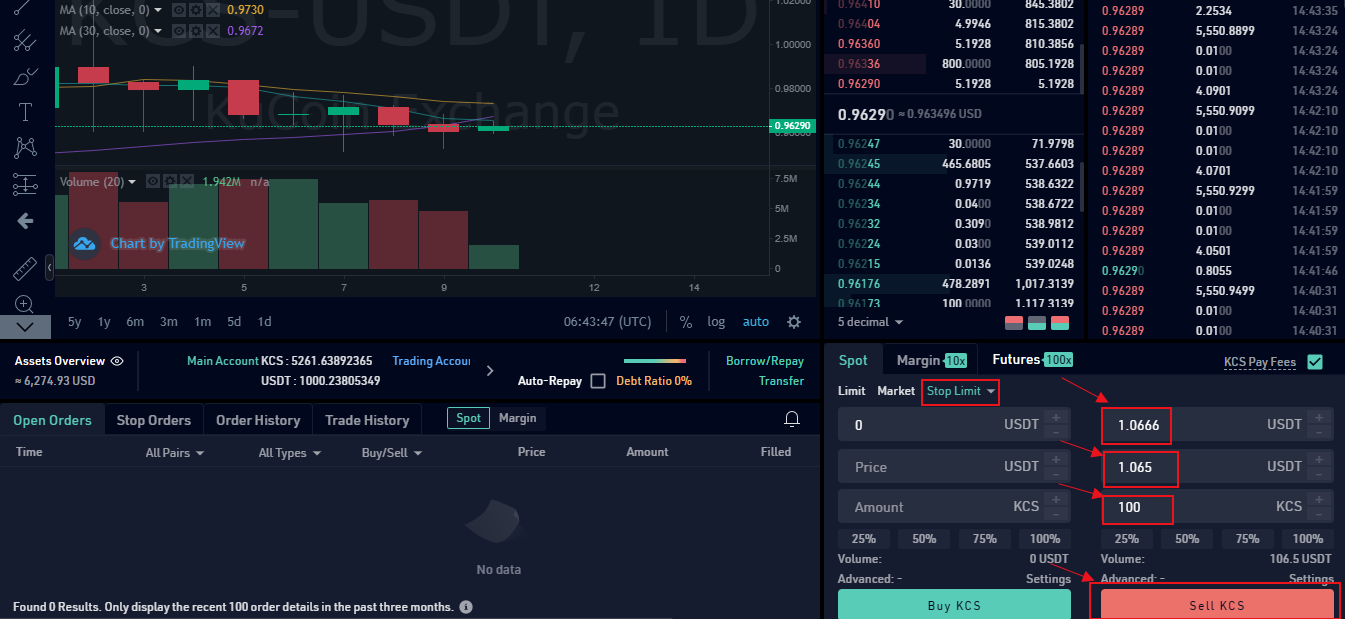

3 Stop Limit Order

3.1 Definition:

A Stop Limit Order is an order placed to buy or sell at a limit price when the price reaches the configured trigger price.

3.2 Example:

If the current market price of KCS is 0.9629 USDT and you assume the stop price will reach 1.0666 USDT and will not continue to rise when it breaks through, you can sell when the price reaches 1.065 USDT.

3.3 Instructions:

Select Stop Limit Order, enter 1.0666 USDT in the stop price box, 1.065 USDT in the price box, and 100 KCS in the amount box, then click Sell to place the order. When the latest price reaches 1.0666 USDT, the order will be triggered, and the100 KCS order will be placed at a price of 1.065 USDT.

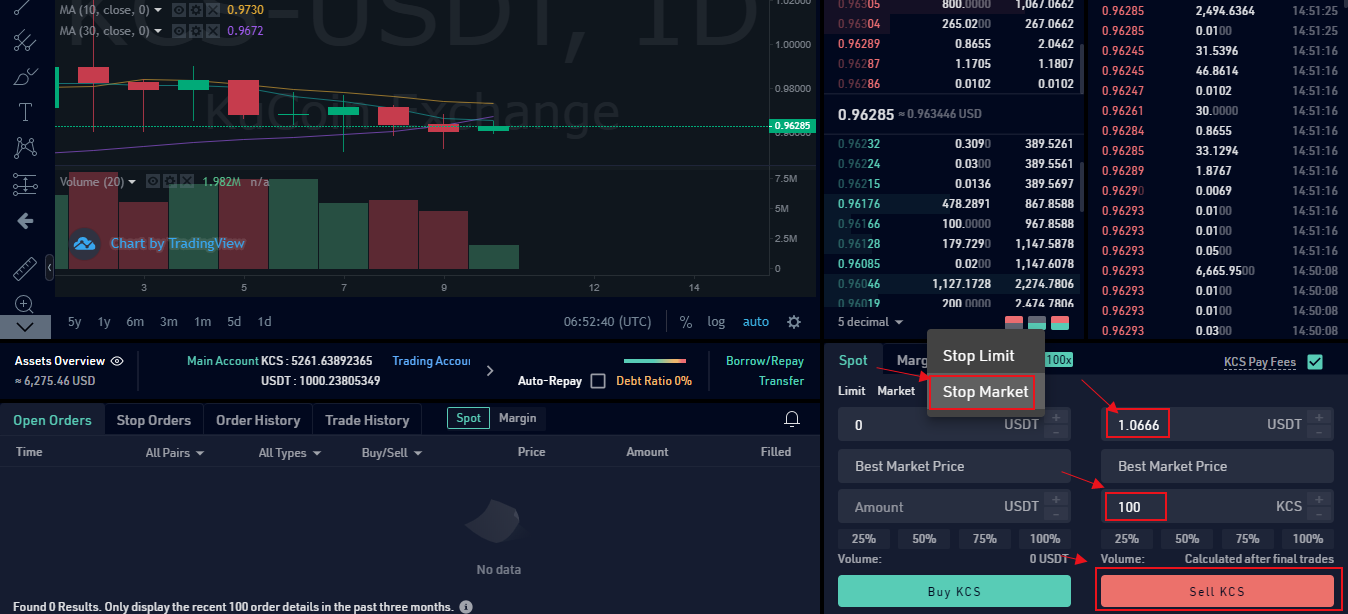

4 Stop Market Order

4.1 Definition:

A Stop Market Order is an order placed to buy or sell at the current price when the price reaches the configured trigger price.

4.2 Example:

If the current market price of KCS is 0.96285 USDT and you assume the stop price will reach 1.0666 USDT and will not continue to rise when it breaks through, then you can sell when the price reaches the support price.

4.3 Instructions:

Select Stop Market Order, enter 1.0666 USDT in the stop price box, and 100 KCS in the amount box, then click Sell KCS to place the order. When the latest price reaches 1.0666 USDT, this order will be triggered and the 100 KCS order will be placed at the best market price.

Tips:

- The Market Order is matched by the best available price in the current market. Considering price fluctuations, the filled price can be higher or lower than the current price, depending on the market depth.

- KuCoin upgraded the Stop Order function on October 28, 2020. After the upgrade, the system will no longer pre-freeze the assets in your account for the Stop Order until it has been triggered.

5 OCO Order

5.1 Definition:

A “One Cancels the Other” order, or OCO, is a special type of order that enables traders to place two separate orders at the same time. It works by combining a limit order with a stop-limit order, placing them at the same time, but only allowing one to be executed - as soon as one is executed, the other one is canceled.

5.2 Example:

You just bought 0.001 BTC at the price of 20,500 USDT because you believe the price is more likely to go up. However, you aren’t completely certain if the price will head up, or tumble further down, so you’d like to minimize your losses as well.

5.3 Instructions:

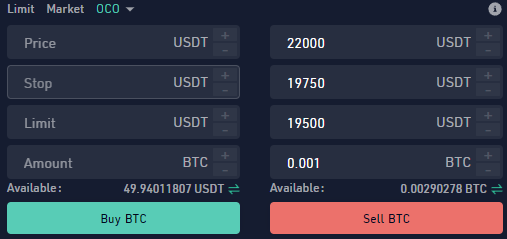

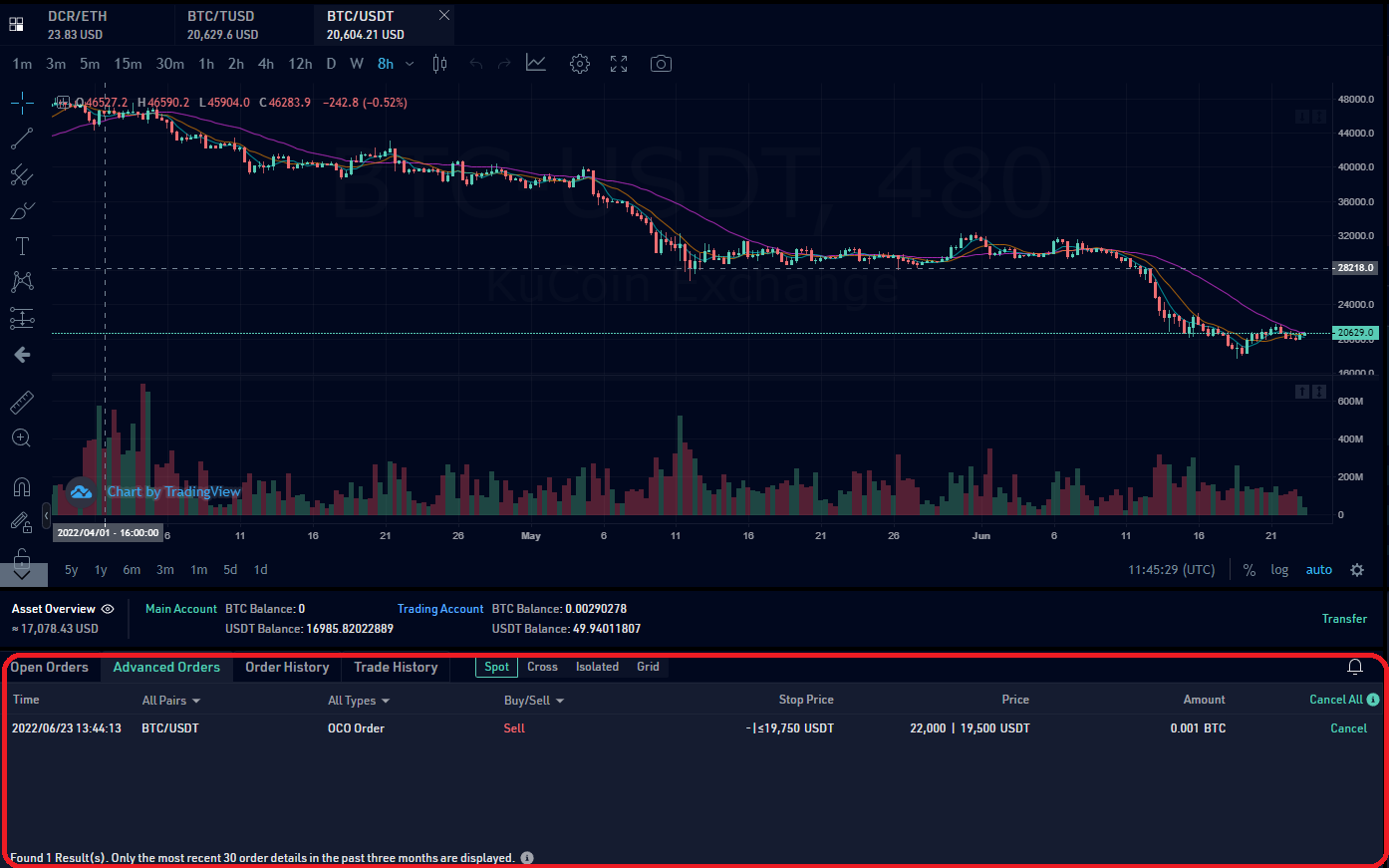

In this case, you can place an OCO order to utilize both a profit-taking limit order at 22,000 USDT, as well as a loss-minimizing stop-limit order at 19,500 USDT that triggers at 19,750 USDT.

You can find your open position in the Advanced Orders tab at the bottom of the KuCoin trading page, where you can monitor the position, or cancel it.

If your prediction is correct and the price of BTC does rise above 22,000 USDT, your sell order will be executed, and the stop-limit order will be automatically canceled. On the other hand, if you end up being in the wrong and the price drops to or below 19,750 USDT, your stop-limit order for 19,500 USDT would be triggered. This would potentially minimize your losses, in case the price drops even more.

Tips :

Your assets will not be locked unless your order is triggered. If your assets are insufficient by the time you meet the trigger price, your order will fail. Once your order is triggered, however, your assets will be locked.