Isolated Margin

Last updated: 12/31/2025

1. What is Isolated Margin Mode?

In isolated margin mode, the margin for each position is managed independently. If a position is liquidated, the maximum loss is limited to the isolated margin of that position and will not affect other positions in the account.

Advantages include:

-

Risk isolation: Loss from one position will not drag down overall account balance

-

Independent position management: Different margins can be set for different positions

-

Adjustable margin: You can manually increase or decrease position margin

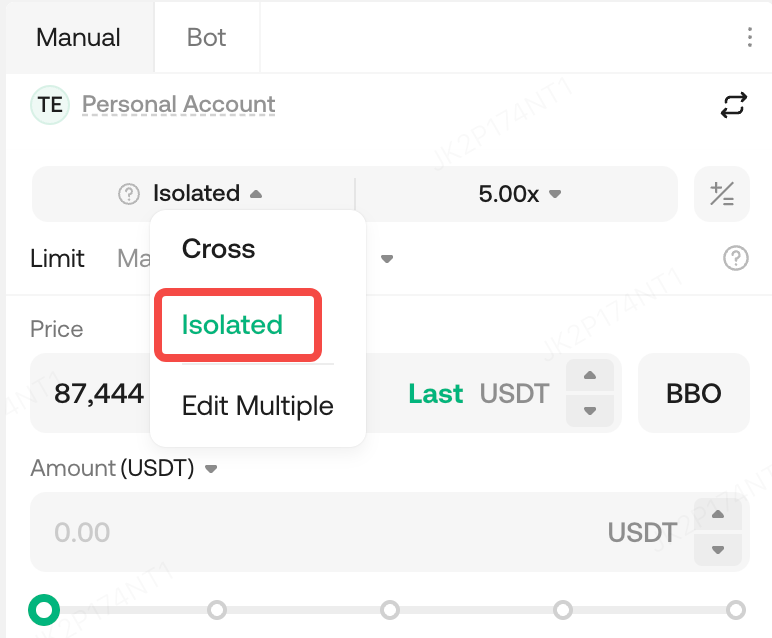

2. How to Use Isolated Margin Mode

-

Select “Isolated Margin Mode” before placing an order

-

Set the opening leverage (determines the initial margin)

-

During the holding period, you can:

-

Increase margin (reduce risk)

-

Decrease margin (increase risk)

-

View real leverage and risk rate

-

Set take profit / stop loss for risk management

3. Suitable Scenarios and Users for Isolated Margin Mode

Suitable scenarios:

-

Need to control the maximum loss for a single position

-

Multi-position strategies, want to manage risk separately

-

High-volatility assets, to avoid amplified losses

Suitable users:

-

Professional/quantitative traders

-

Users employing multiple strategies or positions

-

Beginners who want to avoid “one trade blowing up the whole account”

-

Users who like high leverage but want to manage risk

4. Why Does Isolated Leverage Change?

After opening a position in isolated mode, the “Real Leverage” reflects the real-time risk exposure of the position. This metric dynamically adjusts according to the isolated margin balance and floating (unrealized) PnL. Intuitive explanation: higher leverage indicates higher risk, while lower leverage indicates lower risk.

Formula

-

Real Leverage = Position Value ÷ (Isolated Margin + Unrealized PnL)

-

Isolated Margin includes the initial margin, added or removed margin, margin changes caused by funding fee settlements, and trading fees.

-

-

Example for reference (ignoring trading fees and funding fees)

|

Stage

|

Position

|

Price

|

Position Value

|

Isolated Margin

|

Unrealized PnL

|

Formula

|

Real Leverage

|

|

Initial Position

|

1 BTC

|

10,000

|

10,000

|

1,000

|

0

|

10,000/(1,000+0)=10

|

10 X

|

|

Price drops 5%, unrealized loss −500

|

1 BTC

|

9,500

|

9,500

|

1000

|

-500

|

9,500/(1,000-500)=19

|

19 X

|

|

Add 500 margin

|

1 BTC

|

9,500

|

9,500

|

1,500

|

-500

|

9,500/(1,500-500)=9.5

|

9.5 X

|

|

Price rises back to the entry price of 10,000

|

1 BTC

|

10,000

|

10,000

|

1,500

|

0

|

10,000/(1,500+0)= 6.66

|

6.66 X

|

|

Price rises 5%, unrealized profit +500

|

1 BTC

|

10,500

|

10,500

|

1,500

|

+500

|

10,500/(1,500+500)=5.25

|

5.25 X

|

4.1 What factors affect changes in Real Leverage?

During the holding period, the following factors continuously alter your isolated margin equity:

Mark price fluctuations, which change unrealized PnL (position value)

Manually adding or removing isolated margin

4.2 How to use it to assess current risk?

How to intuitively understand its trend:

Leverage is rising → Risk is building up; consider adding margin or reducing position

Leverage is falling → Risk is easing; you may continue to hold as planned

Sudden spike in leverage → Check for rapid price movements, insufficient margin, or unintended position increases.

4.3 Where Real Leverage applies

Real Leverage applies only to Isolated Margin in Classic Accounts. Cross Margin uses fixed leverage.

Entry Leverage: Used to calculate the required margin when opening a position; it does not change afterward.

Isolated Position Leverage (Real Leverage): The actual leverage during the position, which changes with unrealized PnL or margin adjustments.

4.4 Frequently Q&A

Q: I selected 100× leverage when opening the position. Why isn’t my Real Leverage 100×?

A: 100× is only the margin requirement at entry. Once the price moves or you adjust your margin, the position’s real-time risk changes, and Real Leverage reflects your current state accurately.

Q: Sometimes Real Leverage fluctuates a lot. Is that normal?

A: Yes. When a position loses value, the denominator in the formula becomes smaller, causing leverage to rise faster. At this point, consider reducing the position or adding margin.

Q: Does Real Leverage represent the “distance to liquidation”? A: No. It is an indicator of real-time risk to help you sense changes earlier. To determine how close you are to liquidation, check your Risk Ratio or reference the Liquidation Price.

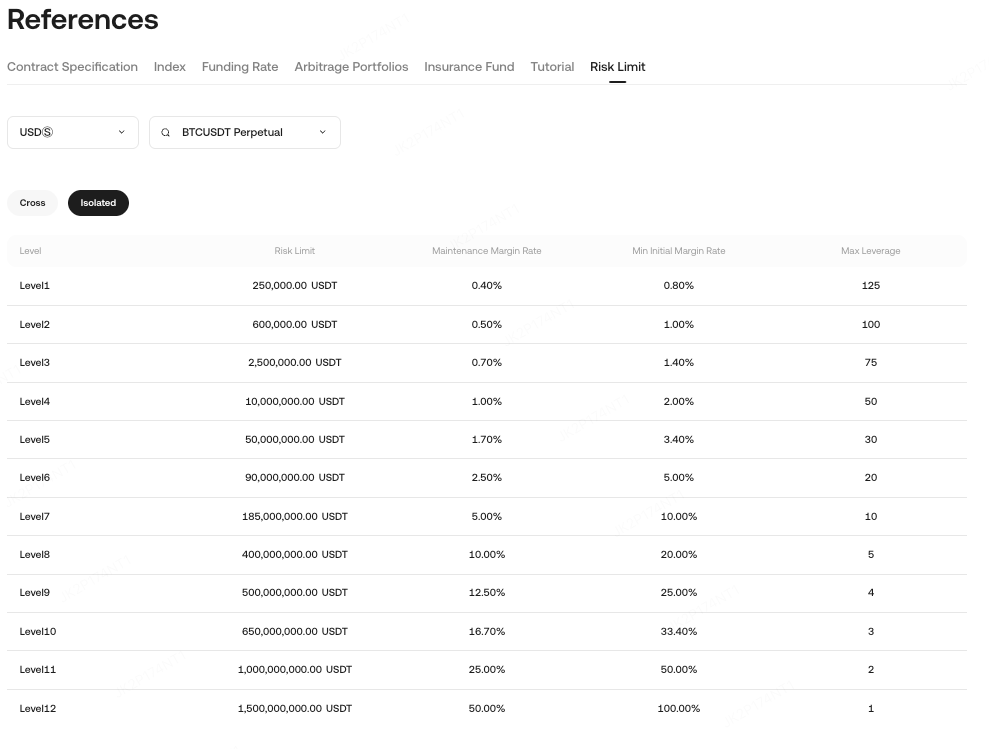

5. Isolated Margin Risk Limit and Liquidation Explanation

5.1 Risk Limit

Isolated margin mode still uses risk limits, and each level has the following parameters:

-

Maximum risk limit

-

Initial margin rate (IMR)

-

Maintenance margin rate (MMR)

In isolated margin mode, each position’s risk is managed independently. When the position value falls below its corresponding maintenance margin requirement, the liquidation process will be triggered. You can check the maintenance margin rate for different contracts and positions on the risk limit page. The maintenance margin rate is determined according to your position value and the corresponding risk level.

-

Example: Suppose you hold 1,000 BTCUSDT perpetual contracts with a contract multiplier of 0.001 and an opening price of 30,000 USDT. The position value = 1,000 × 0.001 × 30,000 = 30,000 USDT. The corresponding risk level is Level 1 with a maintenance margin rate of 0.4%, so the required maintenance margin = 30,000 × 0.4% = 120 USDT.

-

Note: Risk limits are calculated based on the opening price. The system will not automatically adjust levels. All contracts default to Level 1. To access higher position limits, you must manually switch to the corresponding level before placing an order.

-

For more details, see Risk Limits (Isolated + Cross).

5.2 Liquidation Trigger Conditions

When: Isolated equity ≤ maintenance margin of the corresponding level, the liquidation/reduction process is triggered.

The system will execute liquidation/reduction on the position, which only affects that isolated position and will not impact other positions or account assets. For more details, see Liquidation Price.

The liquidation price formula is as follows:

-

Direct contracts (USDT-margined contracts): Liquidation Price(Long/Short) = [Position Value − Position Margin] ÷ [Position Quantity × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)]

-

Inverse contracts (Coin-margined contracts): Liquidation Price(Long/Short) = [Position Quantity × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)] ÷ [Position Value − Position Margin]

Where, for direct contracts: long, side = 1; short, side = −1. For inverse contracts: short, side = 1; long, side = −1.

Example (USDT-margined contract)

Trader A uses 50× leverage to open a 1 BTC long USDT-margined contract at 30,000 USDT (1 BTC = 1,000 contracts × 0.001 multiplier). Maintenance margin rate = 0.4%:

Position Value = Price × Quantity = 30,000 × 1 = 30,000

Position Margin = Position Value ÷ Leverage = 30,000 ÷ 50 = 600

Liquidation Price = [Position Value − Position Margin] ÷ [Position Quantity × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)]

= [30,000 − 600] ÷ [1,000 × 0.001 × (1 − 1 × 0.4% − 1 × 0.06%)]= 29,400 ÷ 0.9954 ≈ 29,535.9 USDT

Example (Coin-margined contract)

Trader B uses 10× leverage to open 1,000 BTC coin-margined short contracts at 30,000 USDT. Maintenance margin rate = 0.7%:

Position Value = 1 ÷ Mark Price × Quantity = 1 ÷ 30,000 × 1,000 = 0.033

Position Margin = Position Value ÷ Leverage = 0.033 ÷ 10 = 0.0033

Liquidation Price = [Position Quantity × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)] ÷ [Position Value − Position Margin]

= [1,000 × 1 × (1 − 1 × 0.7% − 1 × 0.06%)] ÷ [0.033 − 0.0033]= 992.4 ÷ 0.0297 ≈ 33,414 USDT