Delivery Contract

Last updated: 12/31/2025

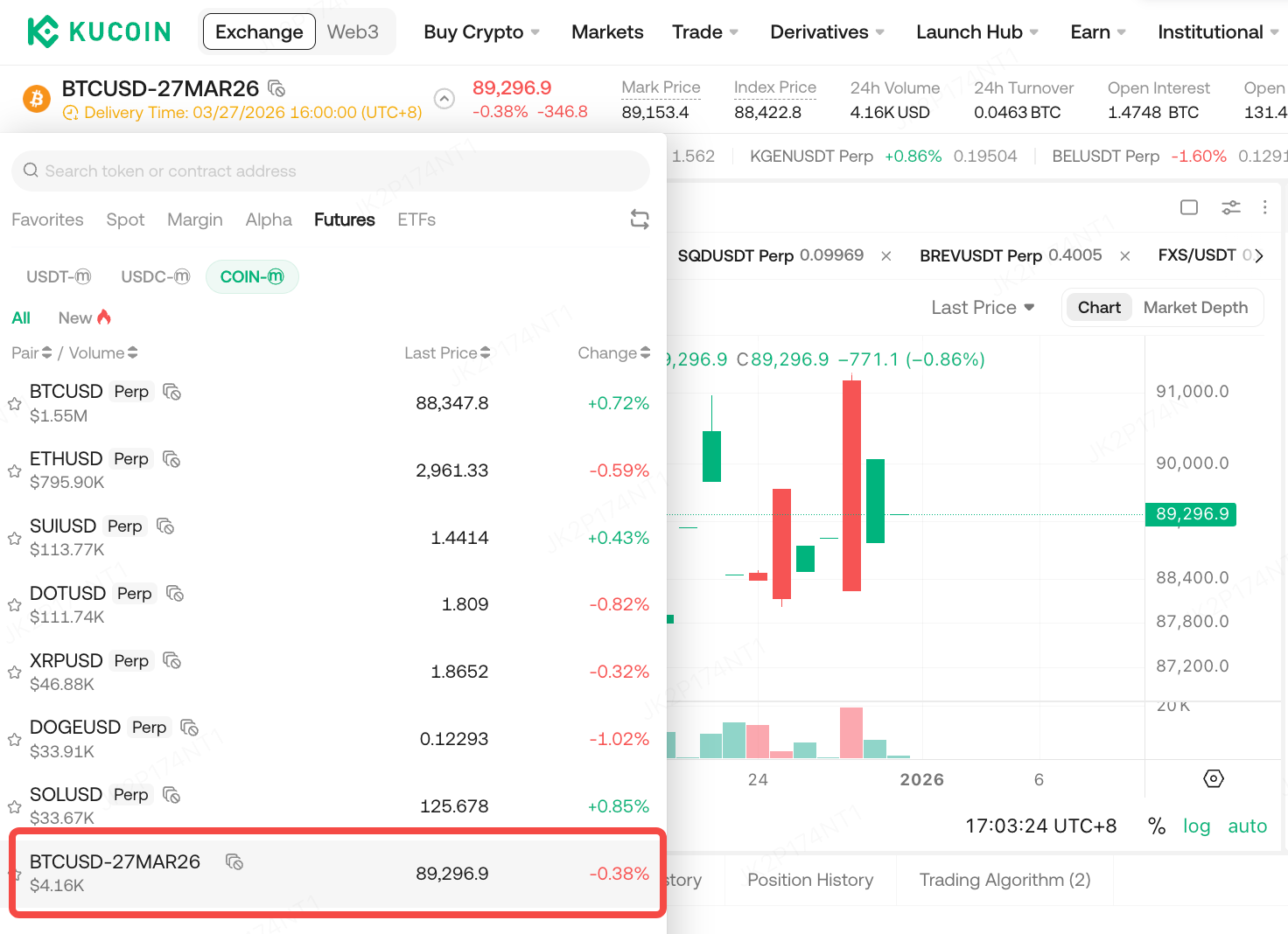

Currently, KuCoin only offers BTC coin-margined quarterly delivery contracts. One quarterly contract is launched each quarter (e.g., BTCUSD-26DEC25). Upon expiration, the contract will be settled according to system rules. The delivery uses a cash-settled price difference, so users do not need to physically deliver BTC.

1. Overview

Coin-margined delivery contracts use BTC as the margin and settlement currency, with price quoted in USD. Users trade by speculating on the price movement of BTC against USD.

Unlike perpetual contracts, delivery contracts have a fixed expiration date. Upon expiration, the system automatically settles all open positions at the settlement price.

2. Delivery Process

-

Quarterly contracts are settled at expiration using cash-settled price difference.

-

All open positions at expiration are automatically closed at the settlement price.

-

10 minutes before expiration, users cannot open new positions and can only reduce or close positions.

-

At settlement, all unrealized P&L is converted to realized P&L. The delivery process incurs a delivery fee.

-

Realized P&L is calculated as: Settlement P&L = Position Size × Contract Multiplier × (1 / Entry Price − 1 / Settlement Price)

-

Settlement P&L, after deducting delivery fees, is credited to the account balance. After clearing, all positions are closed.

-

After delivery, the quarterly contract is closed and can no longer be traded.

3. Delivery Time

The delivery date of a coin-margined quarterly contract is the last Friday of the contract month, and the last trading day is the same as the delivery date. After settlement, no further trading operations are supported for the contract.

4. Settlement Price

The settlement price is based on the BTC spot market index in the KuCoin index system. At 08:00 UTC on the settlement day, the 30-minute time-weighted average price (TWAP) of the spot index is used as the settlement price, labeled as

.KXBT30M. The index is calculated based on mainstream USD spot markets and does not use USDT or other stablecoin markets, ensuring objectivity and fairness.5. Delivery Fee

A fixed 0.025% delivery fee is charged at settlement. The fee is automatically deducted from the account balance during delivery.

6. Funding Fee Explanation

Coin-margined delivery contracts do not have a funding fee mechanism. No long or short funding payments occur during the holding period.Users only pay applicable fees when opening, closing, or settling positions.

7. Example

If you trade the BTCUSD-26DEC25 coin-margined quarterly contract and hold positions until expiration, the system will automatically settle all positions based on the settlement price of that day. All P&L will be credited to your BTC account, and the contract will close, making further trading unavailable.