Margin Trading Risk Limits and Margin Coefficient

Last updated: 01/30/2026

I. Introduction to Margin Trading Risk Limits

In order to mitigate risks in the leveraged market and protect the interests of leveraged traders, we have established a risk limit mechanism for Margin Trading based on the market liquidity of each token.

A maximum borrowing limit is set for each token. This is checked during the user's borrowing process. A user's borrowing amount for a specific token cannot exceed this threshold - the Borrowing Limit. If it does, further borrowing is blocked.

A maximum position limit is set for each token. This is checked when a user transfers assets into the leveraged account or places a buy order. The holding amount of that token after the transfer/buy order must not exceed this threshold - the Leveraged Account Position Limit. If it does, the transfer/buy order will fail. The user can only perform reduce-only operations (such as buying the owed token or repaying the loan).

Any outstanding buy orders for that token placed by the user will be cancelled.

A margin coefficient is set for each token. When calculating the value of assets held as collateral, the value of each token is multiplied by its corresponding margin coefficient. This directly impacts the user's Debt ratio and liquidation price.

Debt Ratio = Total Liability Value / Collateral Asset Value

Debt Ratio = Total Debt / Total Asset Value (Sum of [Holding Amount per token * coin Index Price * Margin Coefficient] for all held tokens)The risk limit for a user's sub-account is, by default, 1/10th of the risk limit set for the main account's leveraged trading. We will periodically adjust these limits based on factors such as market depth and the overall risk of the cross-margin leveraged market.

II. Borrowing Limit & Position Limit

1. Individual Borrowing Limit

This refers to the maximum amount of a specific token a user can borrow using Cross Margin or a specific Isolated Margin pair. The platform sets this limit per token based on its liquidity and the account type.

If a user has already borrowed some amount of a token and attempts to borrow more, the borrow operation will fail if the sum of the already borrowed amount and the new borrow amount would meet or exceed the current account's Borrowing Limit for that token. The user can only borrow up to the difference between the current Borrowing Limit and the amount already borrowed.

Borrowing Limits are account-specific. The Cross Margin account and each Isolated Margin account have their own independent Borrowing Limit allocations, which do not affect or correlate with each other.

2. Individual Position Limit

This refers to the maximum amount of a specific token a user can hold in their Cross Margin account or a specific Isolated Margin account. The platform sets this limit per token based on its liquidity and the account type.

If a user holds an amount of a token and attempts to transfer in more or place a buy order for it, the transfer/buy order will fail if the sum of the current holding and the new amount would meet or exceeds the account's Position Limit for that token. The user can only transfer in or buy up to the difference between the current Position Limit and the amount already held.

When a user's position reaches the Position Limit, they cannot transfer in or buy more of that token. If the position reaches 120% of the Position Limit, the system will cancel any outstanding buy orders the user has for that token.

Position Limits are account-specific. The Cross Margin account and each Isolated Margin account have their own independent Position Limit allocations, which do not affect or correlate with each other.

3. Margin Coefficient

The platform sets a margin coefficient for each token/token. When calculating the value of assets held as collateral, the value of each token is multiplied by its corresponding margin coefficient. This directly impacts the user's debt ratio and liquidation price.

Debt Ratio = Total Debt / Total Asset Value

(Asset Value = Position Quantity × Coin Index Price × Margin Coefficient)

The margin coefficient is applied when calculating the deb ratio for determining account health and potential liquidation. It is not used in calculations for borrowing assets or transferring assets out of the margin account.

III. How to check risk limit metrics/levels

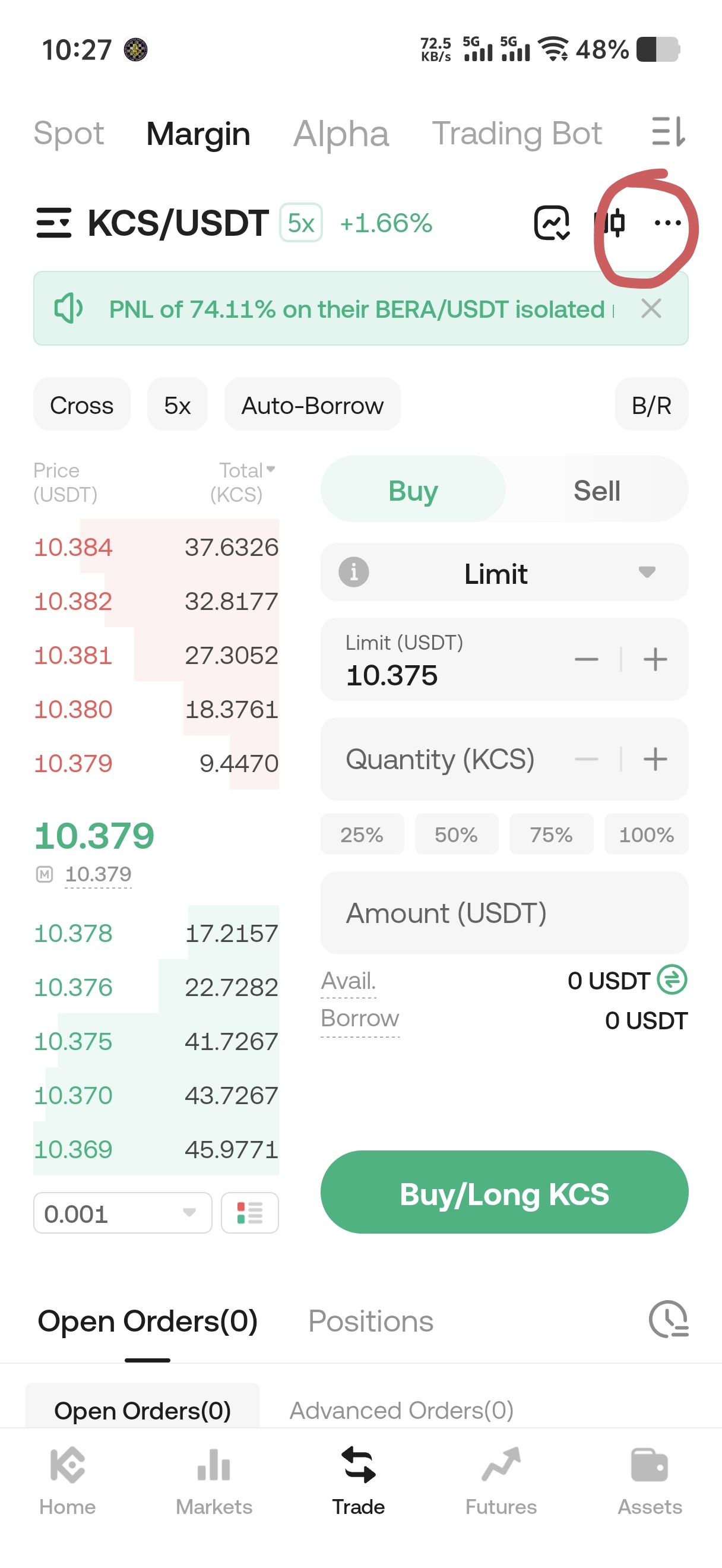

1. App

-

Within the Margin Trading interface on the App, tap the "More" option (usually represented by three dots "···") in the top right corner.

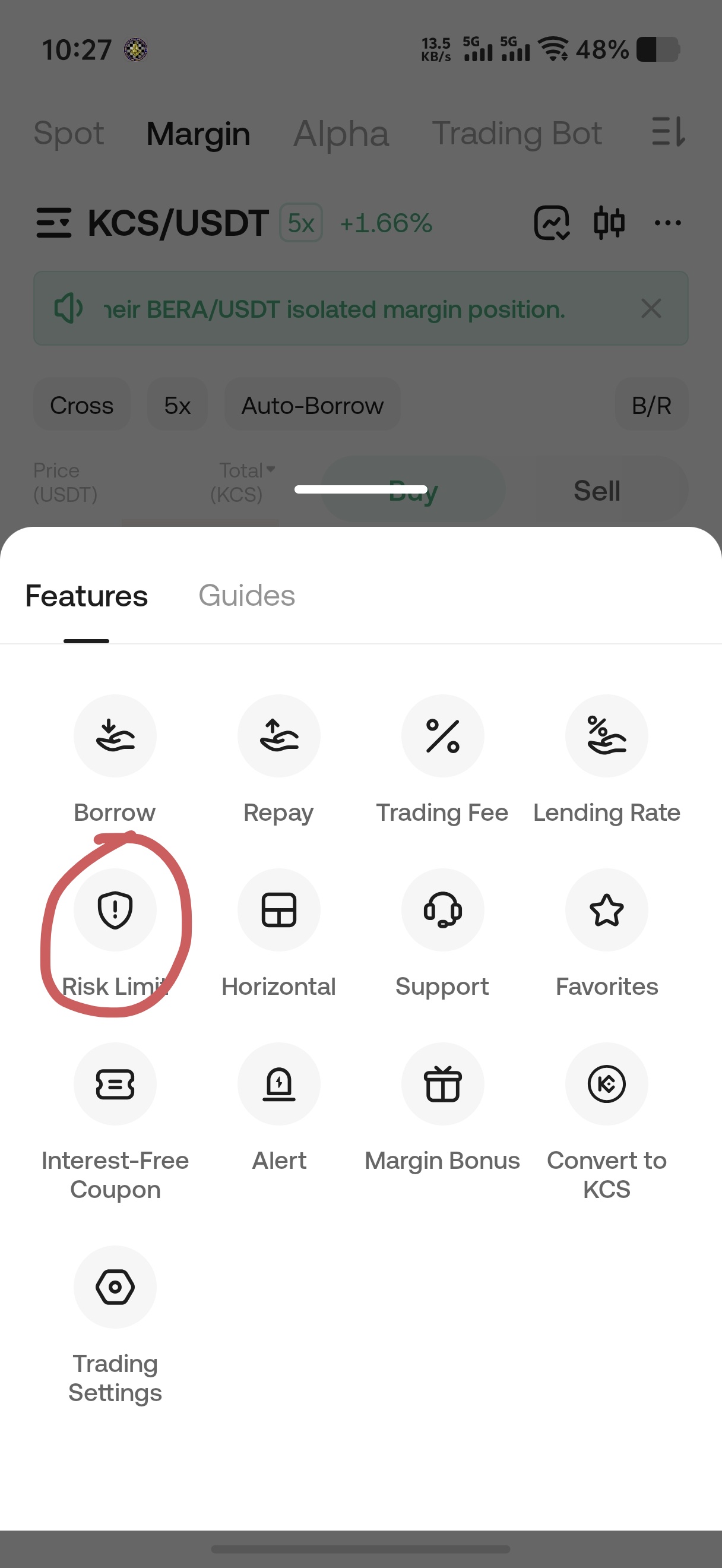

-

Margin - More option - Select 'Risk Limits'

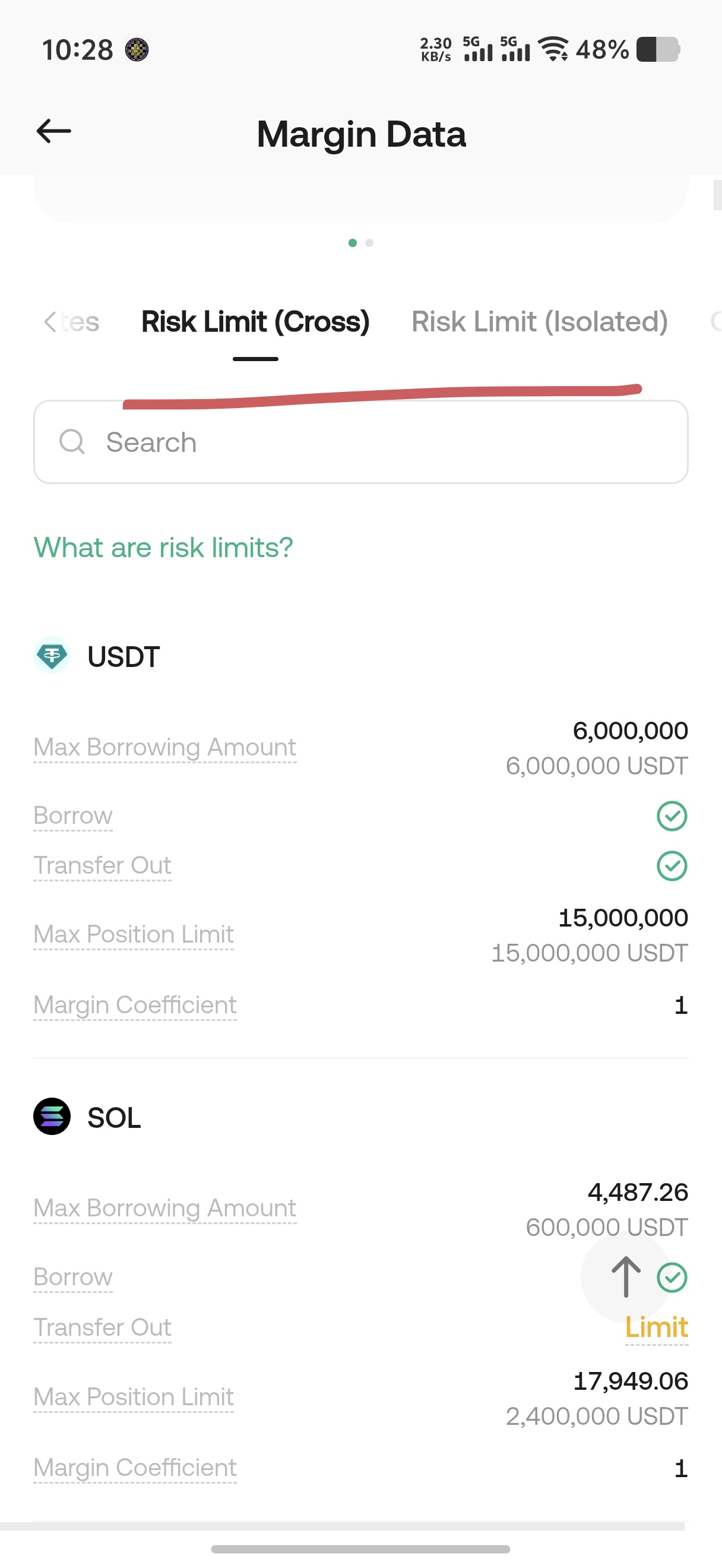

-

Margin Data Page - Risk Limit(Cross) and Risk Limit(Isolated)

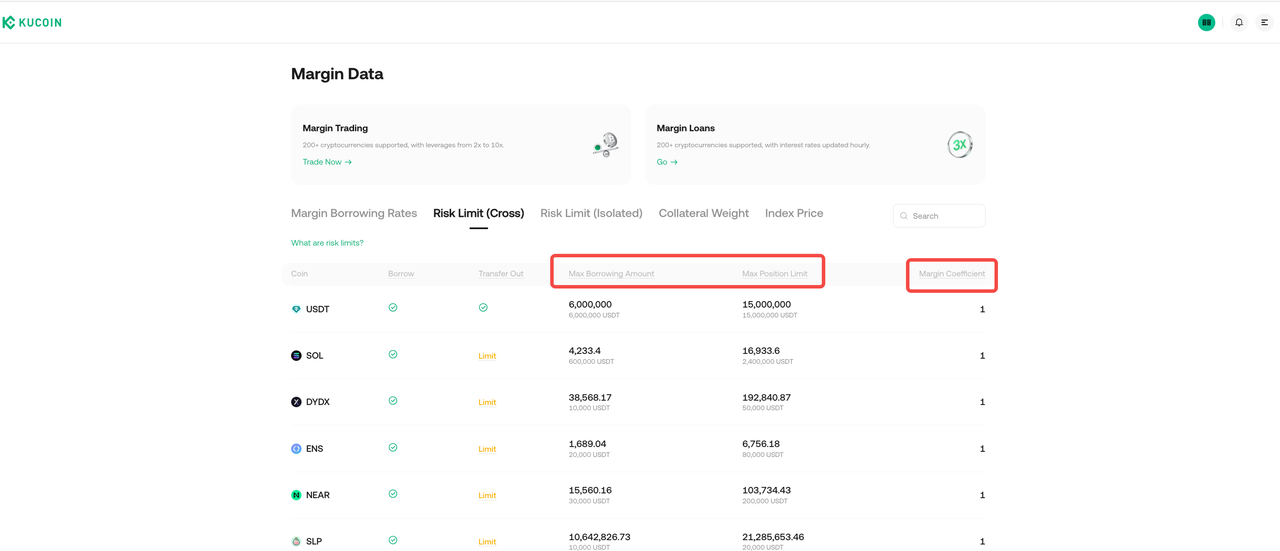

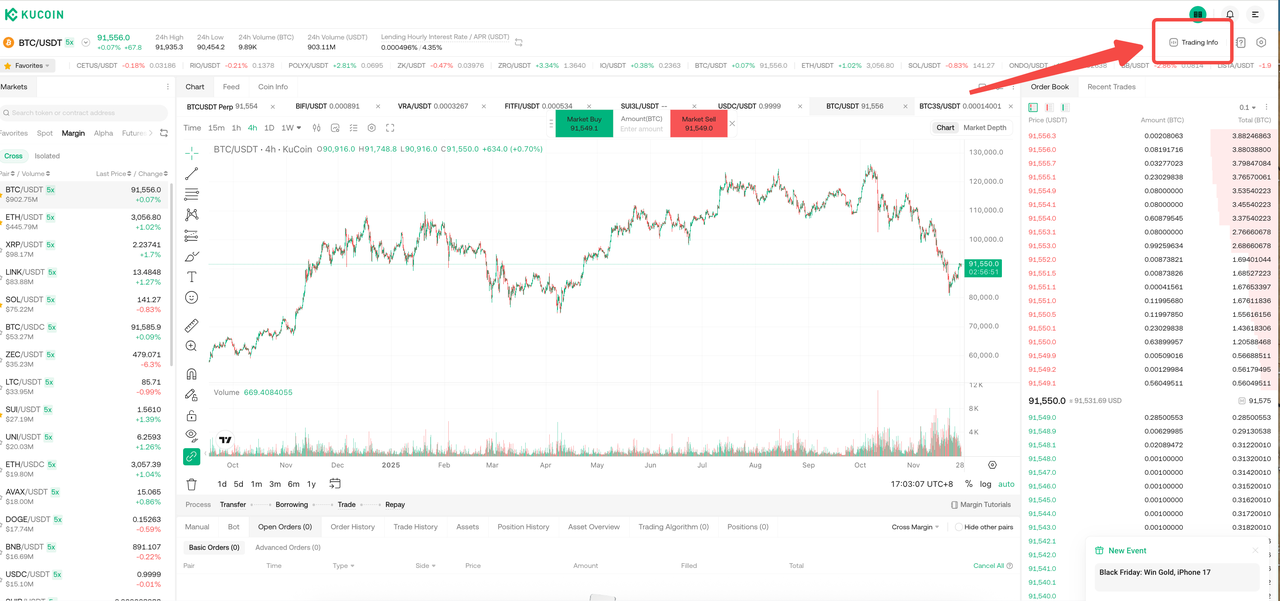

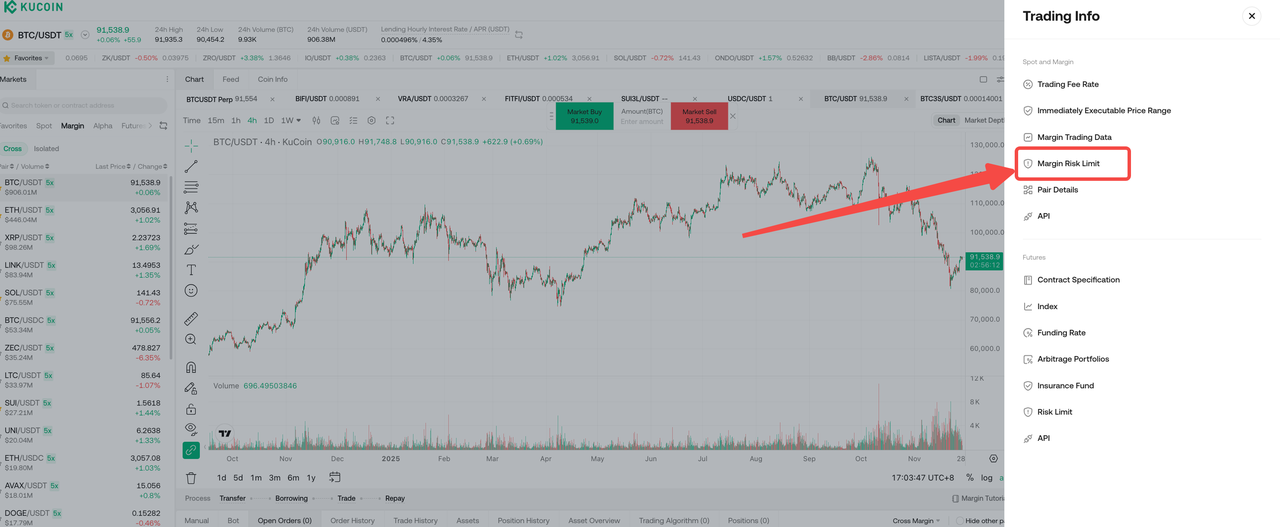

2、Web

-

Trade - Margin Trading - right top corner Trading Info

-

Trade - Margin Trading -Trading Info - Margin Risk Limit

-

Margin Data - Risk Limit(Cross): Max Borrowing, Max Position Limit, Margin Coefficient)