Calculating Unrealized and Realized PNL (Profit and Loss)

In KuCoin futures, there are two types of PNL (profit and loss): Unrealized PNL and Realized PNL.

1. Unrealized PNL

Unrealized PNL (aka floating PNL) is the profit and loss of your open positions. It is calculated as the difference between your average entry price, and either the current mark price or last price. You may choose your preferred calculation method while managing your positions. Unrealized PNL fluctuates as the mark price changes.

Unrealized PNL for USDT-Margined Contracts

Long Position: (Mark or Last Price - Entry Price) × Position Size × Contract Multiplier

Short Position: (Entry Price - Mark or Last Price) × Position Size × Contract Multiplier

E.g. You have a BTC/USDT stablecoin-margined position (1 contract = 0.001 BTC). You hold 100 long contracts at an entry price of 5,000 USDT. If the current mark price is 5,100 USDT, your unrealized PNL is: (5,100 - 5,000) × 100 × 0.001 = 10 USDT

Unrealized PNL for Coin-Margined Contracts

Long Position: [(1 ÷ Entry Price) - (1 ÷ Mark or Last Price)] × Position Size × Contract Multiplier

Short Position: [(1 ÷ Mark or Last Price) - (1 ÷ Entry Price)] × Position Size × Contract Multiplier

E.g. You have a BTC/USD coin-margined position (1 contract = 1 USD). You hold 100 short contracts at an entry price of 5,000 USD. If the current mark price is 3,000 USD, your unrealized PNL is: [(1 ÷ 5,000) - (1 ÷ 3,000)] × 100 × 1 = 0.013 BTC

2. Realized PNL

Realized PNL is the profit or loss incurred when closing or reducing positions. This includes the PNL from the actual trade, trading fees, and total funding fees for the period. The PNL of a trade is calculated using the difference between the average entry price and the average exit price.

Realized PNL for USDT-Margined Contracts

Long Position: (Exit Price - Entry Price) × Position Size × Contract Multiplier - Trading Fees - Funding Fees

Short Position: (Entry Price - Exit Price) × Position Size × Contract Multiplier - Trading Fees - Funding Fees

E.g. You have a BTC/USDT stablecoin-margined position (1 contract = 0.001 BTC). You hold 100 long contracts at an entry price of 5,000 USDT, and sold them all at 5,100 USDT. The trading fees incurred are 0.6 USDT, while no funding fees were incurred. Your realized PNL is: (5,100 - 5,000) × 100 × 0.001 - 0.6 - 0 = 9.4 USDT

Realized PNL for Coin-Margined Contracts

Long Position: [(1 ÷ Entry Price) - (1 ÷ Exit Price)] × Size Closed × Contract Multiplier - Trading Fees - Funding Fees

Short Position: [(1 ÷ Exit Price) - (1 ÷ Entry Price)] × Size Closed × Contract Multiplier - Trading Fees - Funding Fees

E.g. You have a BTC/USD coin-margined position (1 contract = 1 USD). You hold 100 short contracts at an entry price of 5,000 USD, and sold them all at 3,000 USD. The trading fees incurred are 0.0006 BTC, while no funding fees were incurred. Your realized PNL is: [(1 ÷ 3,000) - (1 ÷ 5,000)] × 100 × 1 - 0.0006 = 0.01273 BTC

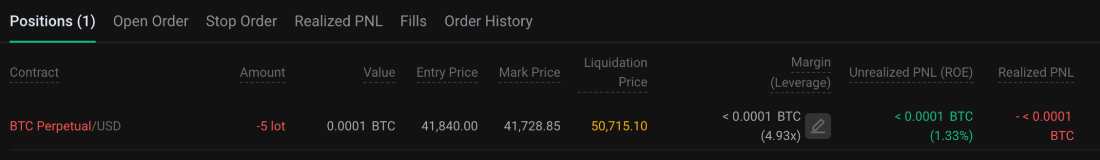

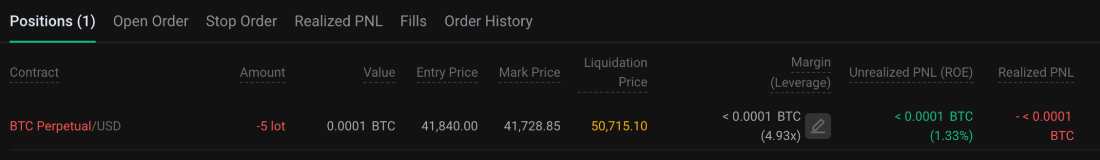

3. Why does my position show a green unrealized PNL, but the realized PNL in my trade history shows a loss?

i. This discrepancy occurs because realized PNL includes trading and funding fees, while unrealized PNL does not. If these fees outweigh your final profit, your trade history will show a loss. The table below highlights the differences:

| Unrealized PNL | Realized PNL | |

| PNL of the Position | Included | Included |

| Position Opening Fee | Not Included | Included |

| Funding Fees | Not Included | Included |

| Position Closing Fee |

Not Included |

Included |

| Estimated PNL | Calculated based on mark price | Calculated based on average exit price, minus trading and funding fees |

4.1 Quick Recap of Unrealized PNL

i. Unrealized PNL is an estimate of the profit or loss for open positions. It is not the finalized PNL.

ii. Calculations use the mark or last price, which fluctuates with market conditions.

iii. Trading and funding fees are not included in unrealized PNL calculations.

4.2 Quick Recap of Unrealized PNL

i. Realized PNL is the total profit or loss after closing a position.

ii. Calculations use the average closing price of the position, or part thereof. Visit your Trade History for more exact details.

iii. Realized PNL factors in all fees for opening, funding, and closing of the position.

KuCoin Futures Trading Guides:

Thank you for your support!

The KuCoin Futures Team

Note: Users in restricted countries and regions cannot enable futures trading.