Liquidation and Liquidation Price

Last updated: 01/05/2026

In futures trading, liquidation is an important risk-control mechanism used by the platform. When the actual risk of a position or account exceeds an acceptable threshold, the system will take over the position and automatically execute risk management actions to prevent further losses.

Once liquidation conditions are triggered, the system initiates the liquidation process, which may include: canceling open orders, reducing the risk limit tier, partially reducing positions, or ultimately closing the entire position. The specific trigger conditions and execution logic differ depending on whether the user is using Isolated Margin Mode or Cross Margin Mode.

1. Liquidation Mechanism in Isolated Margin Mode

In isolated margin mode, risk is managed on a per-position basis. When the equity of an isolated position reaches the maintenance margin requirement of its corresponding risk tier, liquidation will be triggered.

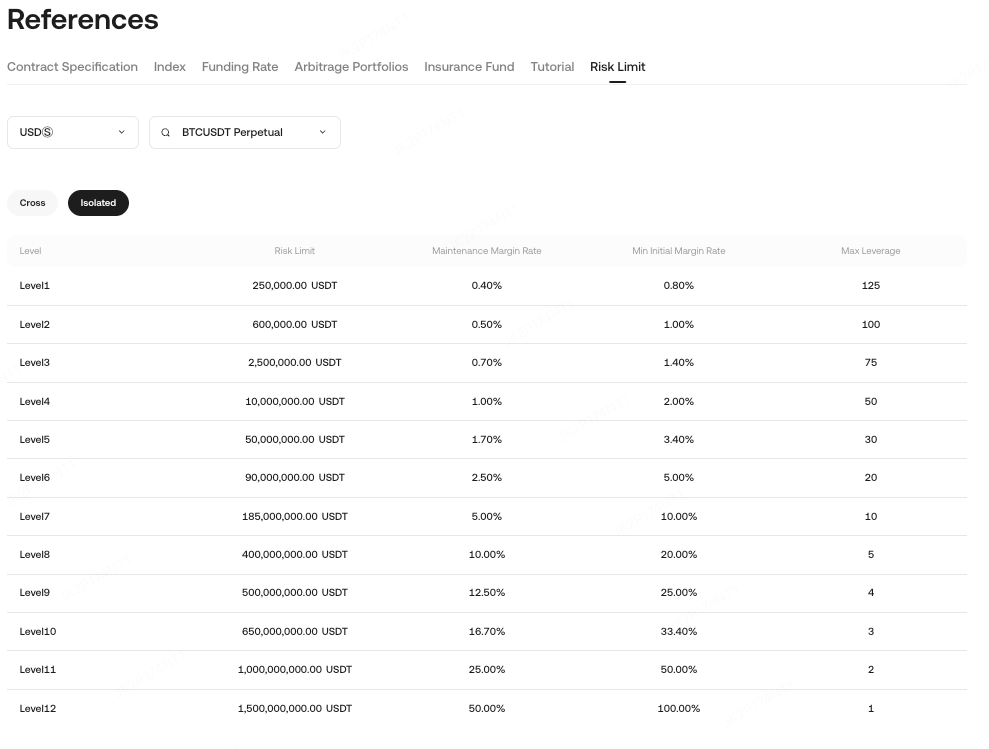

Maintenance margin rates vary by contract type and position size and can be viewed on the Risk Limit page. The applicable maintenance margin rate is determined based on the position’s opening value and corresponding risk limit tier.

Example

If you hold 10,000 contracts of BTCUSDT Perpetual, with:

-

Contract multiplier: 0.001

-

Average entry price: 30,000 USDT

Opening value = Position size × Contract multiplier × Entry price= 10,000 × 0.001 × 30,000 = 300,000 USDT

This corresponds to Risk Limit Level 1, with:

-

Maintenance margin rate: 0.4%

-

Maintenance margin amount: 300,000 × 0.004 = 1,200 USDT

When your position margin falls below 1,200 USDT, liquidation will be triggered.

1.1 Trigger Conditions for Isolated Liquidation

A position enters the liquidation process when the mark price reaches the estimated liquidation price. The system will then reduce risk tiers and positions based on the current risk limit level:

-

If the position is at Level 1, the system will directly take over the position and fully liquidate it.

-

If the position is at Level 2 or above, the system will reduce tiers step by step from high to low (e.g., Level 4 → 3 → 2 → 1).

-

At each tier reduction, the system calculates the required position reduction based on the target tier and executes it via IOC orders at the bankruptcy price.

-

If, during the process, the mark price recovers above the estimated liquidation price, the liquidation process will stop.

-

If risk requirements are still not met after reducing to Level 1, the position will be fully taken over and liquidated.

1.2 Liquidation Price Calculation

The isolated liquidation price is determined by factors such as position margin, leverage, and maintenance margin rate.

1.2.1 USDT-Margined Contracts (Long / Short)

Liquidation Price = (Opening Value − Position Margin) / [Position Size × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)]

Where: Long: side = 1、Short: side = −1

Example (USDT-Margined Long Position) Trader A buys 1 BTC at 30,000 USDT with 50× leverage, maintenance margin rate 0.4%:

-

Opening value = 30,000

-

Position margin = 30,000 / 50 = 600

-

Position size = 1 BTC = 1,000 contracts × 0.001 multiplier

Liquidation price = (30,000 − 600) / [1,000 × 0.001 × (1 − 0.4% − 0.06%)] = 29,400 / 0.9954 = 29,535.9 USDT

1.2.2 Coin-Margined Contracts (Long / Short)

Liquidation Price = [Position Size × Contract Multiplier × (1 − side × Maintenance Margin Rate − side × Liquidation Fee Rate)] / (Opening Value − Position Margin)

Where: Long: side = 1、Short: side = −1

Example (Coin-Margined Short Position) Trader B opens 1,000 BTC contracts short at 30,000 USDT with 10× leverage, maintenance margin rate 0.7%:

-

Opening value = 1 / 30,000 × 1,000 = 0.033 BTC

-

Position margin = 0.033 / 10 = 0.0033 BTC

Liquidation price = [1,000 × 1 × (1 − 0.7% − 0.06%)] / (0.033 − 0.0033) = 992.4 / 0.0297 = 33,414 USDT

1.3 Isolated Liquidation Handling Process

Isolated margin uses a tier-reduction + staged position reduction mechanism to minimize user losses while controlling system risk.

Process sequence:

-

Cancel all open orders for the affected position (only this position, not others).

-

Reduce the risk tier (e.g., from Level 5 to Level 4).

-

Re-evaluate position risk based on the new maintenance margin requirements.

-

Reduce position size as needed using IOC orders at the bankruptcy price.

-

If the lowest tier is reached and risk is still insufficient, the Insurance Fund takes over.

-

The Insurance Fund assumes the position at the bankruptcy price.

1.4 Isolated Liquidation Examples

Example 1: Position Not at Level 1, Risk Resolved After One Tier Reduction

Position Info

| Item | Details |

| Margin Mode | Isolated Margin |

| Contract | BTCUSDT Perpetual |

| Position | Short 2,000 Contracts |

| Mark Price | 40,000 USDT |

| Current Risk Tier | Level 3 (Maintenance Margin Rate: 1.0%) |

| Next Risk Tier | Level 2 (Maintenance Margin Rate: 0.7%) |

-

Margin mode: Isolated

-

Contract: BTCUSDT Perpetual

-

Position: Short 2,000 contracts

-

Mark price: 40,000 USDT

-

Current tier: Level 3 (MMR 1.0%)

-

Next tier: Level 2 (MMR 0.7%)

Process

-

The system takes over the position and cancels open orders.

-

Tier reduced from Level 3 to Level 2.

-

Bankruptcy price recalculated (~2,980 USDT).

-

The system reduces 200 contracts via IOC orders.

-

Margin ratio returns to safe level (>100%).

Result: Liquidation stops. Position reduced from 500 contracts to 300 contracts.

Example 2: Isolated Liquidation at Level 1 (Full Liquidation)

Position Info

| Item | Details |

| Margin Mode | Isolated Margin |

| Contract | BTCUSDT Perpetual |

| Position | Short 2,000 Contracts |

| Mark Price | 40,000 USDT |

| Current Risk Tier | Level 1 (Lowest Tier) |

-

Margin mode: Isolated

-

Contract: BTCUSDT Perpetual

-

Position: Short 2,000 contracts

-

Mark price: 40,000 USDT

-

Current tier: Level 1 (lowest)

Process

-

The system cancels all open orders.

-

No further tier reduction is possible.

-

Bankruptcy price calculated (~40,420 USDT).

-

All 2,000 contracts are taken over and liquidated.

Result: The entire position is forcibly closed.

2. Liquidation Mechanism in Cross Margin Mode

In isolated margin mode, liquidation occurs when the mark price reaches the liquidation price.In cross margin mode, positions are only liquidated when the risk ratio reaches 100%.The cross liquidation price is for reference only and does not directly trigger liquidation.

2.1 Cross Margin Liquidation Trigger

When Risk Ratio ≥ 100%, the account enters liquidation.

Calculation of Risk Rate

(Sum of the maintenance margin for cross-margin positions + Maintenance margin for anticipated open order execution + Expected closing fees) / (Total cross-margin position margin - Expected opening fees)

Example:

| User Positions and Open Orders | Risk Rate |

| Assuming your total margin in the cross margin account is 5,000 USDT, the account currently contains the following positions and open orders: Open Position You currently hold a long position in the BTCUSDT perpetual contract with the following details: BTCUSDT contract mark price: 62,000 USDT BTCUSDT contract position size: 100 contracts (contract multiplier: 0.001 BTC) Maintenance margin rate for the BTCUSDT contract: 0.5% Open Order At the same time, there is an open sell (short) order for the ETHUSDT perpetual contract in the account with the following details: ETHUSDT contract mark price: 3,000 USDT ETHUSDT open order size: 1,000 contracts (contract multiplier: 0.01 ETH) Maintenance margin rate for the ETHUSDT contract: 0.8% Fee Information Applicable taker fee rate: 0.06% |

At this point, your account’s risk ratio = 3,000 * 0.01 * 1,000 * 0.06%) / (5,000 – 3,000 * 0.01 * 1,000 * 0.06%) = 5.88% |

2.2 Cross Margin Liquidation Price Calculation

One-Way Position Mode

-

Liquidation Price of USDT-Margined Contracts

-

= (Mark Value − |Mark Value| × AMR) / (1 − side × MMR − side × taker fee rate) / Position Size

-

-

Liquidation Price of Coin-Margined Contracts

-

= Position Size / (Mark Value − |Mark Value| × AMR) / (1 − side × MMR − side × taker fee rate)

-

Where:

-

AMR = Total cross margin / Σ |Mark Value|

-

IMR / MMR can be viewed in positions or via API

-

long side = 1, short side = −1

| User Positions | Liquidation Price |

| Assume you hold a BTCUSDT Perpetual long position and an ETHUSDT Perpetual short position BTCUSDT Perpetual Contract Current mark price: 62,000 USDT Contract multiplier: 0.001 Position size: 10 contracts Maintenance margin rate (MMR): 0.5% Taker fee rate: 0.06% ETHUSDT Perpetual Contract Current mark price: 3,800 USDT Contract multiplier: 0.01 Position size: −100 contracts Maintenance margin rate (MMR): 1% |

AMR = 1000 / (62,000 × 0.001 × 10 + 3,800 × 0.01 × 100) = 22.62% BTCUSDT Contract Liquidation Price = (62,000 × 0.001 × 10 − 62,000 × 0.001 × 10 × 22.62%) / (1 − 0.5% − 0.06%) / (0.001 × 10) = 47,956 ETHUSDT Contract Liquidation Price = (3,800 × 0.01 × −100 − abs(3,800 × 0.01 × −100) × 22.62%) / (1 + 1% + 0.06%) / (0.01 × −100) = 4,610.7 |

Hedge Mode (Dual-Side Positions)

-

Liquidation Price of USDT-Margined Contracts = [Long Mark Value + Short Mark Value − AMR × |Dominant Side Mark Value|] / [Long Size + Short Size − max(Long Size, −Short Size) × MMR − (Long Size − Short Size) × liquidation fee rate]

Liquidation Price of Coin-Margined Contracts = [max(−Long Size, Short Size) × (MMR + liquidation fee rate) + min(−Long Size, Short Size) × liquidation fee rate − Long Size − Short Size] / [|Dominant Side Mark Value| × AMR − Long Mark Value − Short Mark Value]

-

AMR = Total cross margin / Σ |Single-contract dominant side mark value|

-

Dominant side mark value = max(Long Size, −Short Size) × Mark Price

-

Long size is positive, short size is negative

2.3 Cross Margin Liquidation Process

Cross margin liquidation is an account-level risk control and follows a stricter process.

Risk Warning (Risk Ratio ≥ 95%)

-

he system will first take the following action: Cancel all open orders in the account across all contracts (including isolated-margin orders).If the risk ratio remains ≥ 100% after order cancellation, the system will proceed to liquidation.

Liquidation (Risk Ratio ≥ 100%)

Once triggered, the system will execute risk handling in the following order:

-

Cancel Unfilled Orders (Executed) All unfilled orders across all contracts in the cross margin account will be canceled to release margin and reduce risk.

-

System Takeover Decision Based on the account risk ratio and total position size, the system will determine whether to:

-

Directly take over the positions for liquidation, or

-

Execute a staged risk-reduction process.

-

-

Operation Restrictions During Risk Handling During the risk handling process, user trading operations will be temporarily restricted until the risk is resolved.

2.3.1 Position Size and Handling Logic

-

Risk Ratio ≥ 100% and Total Position Value ≤ USD 600,000

-

The system will directly take over the positions.

-

-

Risk Ratio ≥ 100% and Total Position Value > USD 600,000

-

The system will prioritize risk reduction;

-

It will calculate the position value that needs to be reduced to bring the risk ratio down to 85%;

-

Position reduction will be executed based on the calculated amount.

-

2.3.2 Execution Rules for Reducing Risk Ratio to 85%

-

Single-Contract Position:If there is only one contract position in the cross margin account:

-

The system calculates the required reduction quantity;

-

Position reduction is executed by repeatedly submitting IOC orders at the bankruptcy price;

-

This continues until the risk ratio reaches 85% or the position can no longer be reduced.

-

-

Multiple-Contract PositionsIf multiple contract positions exist, the system will apply the following rules:

-

Contract Sorting:Contracts are sorted in descending order based on their maintenance margin rate.

-

Sequential Reduction Calculation

-

The system calculates the total position value that needs to be reduced to bring the account risk ratio down to 85%;

-

Starting from the highest-ranked contract, the system sequentially determines the reduction amount for each contract:

-

The full position value of higher-ranked contracts will be included first;

-

If the cumulative value of earlier-ranked contracts is insufficient, a partial reduction will be calculated for the next-ranked contract;

-

-

Once the cumulative reduction value reaches the required reduction target, the corresponding position quantities will be determined.

-

-

Example: If the full position value of Rank 1 plus a partial position value of Rank 2 equals the required reduction value, the system will reduce all of Rank 1 and part of Rank 2 accordingly.

-

IOC Order Execution

-

Based on the calculated reduction quantities, the system submits IOC orders at the bankruptcy price;

-

If all IOC orders are fully executed, the reduction process ends.

-

-

Re-ranking and Re-execution

-

If the IOC orders are not fully executed, the system will:

-

Recalculate the remaining positions;

-

Re-rank the remaining contracts based on maintenance margin rate;

-

Repeat the sequential reduction process and submit new IOC orders.

-

-

-

System Takeover Fallback

-

If, after multiple execution cycles, the required reduction cannot be fully completed, the system will directly take over the remaining positions and enter liquidation.

-

2.3.3 Post-Reduction Risk Assessment

After position reduction, the system recalculates the account risk ratio:

-

Risk Ratio < 100% The risk is considered resolved. The current risk handling process ends and account restrictions are gradually lifted.

-

Risk Ratio ≥ 100% The system will directly take over the positions and enter liquidation.

2.3.4 Bankruptcy Price and Parameter Definitions

All reduction orders are placed at the bankruptcy price, calculated as follows:

-

USDT-Margined Contracts Bankruptcy Price = Bankruptcy Value ÷ Position Quantity

-

Coin-Margined Contracts Bankruptcy Price = Position Quantity ÷ Bankruptcy Value

Related parameter definitions:

-

Bankruptcy Value = Position Mark Value − |Position Mark Value| × Total Position AMR

-

Total Position AMR = Position Margin ÷ Σ(|Mark Value of All Positions|)

In these calculations, both the position quantity and position value carry positive or negative signs.

-

Positive value:

-

Long positions in USDT-Margined contracts

-

Short positions in Coin-Margined contracts

-

-

Negative value:

-

Short positions in USDT-Margined contracts

-

Long positions in Coin-Margined contracts

-

Start your futures trading journey now!

KuCoin Futures Trading Guides:

Thank you for your support!

The KuCoin Futures Team

Note: Users in restricted countries and regions cannot enable futures trading.