Risk Limit Rules for Isolated and Cross Margin

Last updated: 01/05/2026

On KuCoin, isolated margin and cross margin contracts each adopt independent risk limit rules: isolated margin follows a tiered limit structure, with positions and leverage constrained by fixed levels; cross margin uses an upgrade algorithm with non-tiered risk limits, allowing higher leverage and more available margin to increase the maximum open position, providing a more flexible and efficient trading experience.

Isolated Margin Mode

1. Introduction to Risk Limits

What are risk limit levels? Risk limit levels are a core risk management mechanism designed to restrict the exposure of individual traders and reduce the impact of large-scale liquidations on the market. During periods of high market volatility, high leverage and large positions that are forcibly liquidated can trigger sharp price swings, potentially causing additional risks to other traders. To prevent this, KuCoin applies a uniform risk limit mechanism to all users.

Under KuCoin’s risk limit rules:

-

Larger positions and higher risk require higher initial margin rates (IMR) and maintenance margin rates (MMR).

-

The maximum allowable leverage decreases as risk increases.

This tiered margin structure effectively limits the potential risk of large positions and, if necessary, mitigates market impact through a tiered liquidation process, gradually reducing the position rather than fully liquidating at once.

Risk limit levels consist of five key elements:

-

Level, Risk Limit (Position Value), Maintenance Margin Rate, Minimum Initial Margin Rate, Maximum Usable Leverage

When a trader’s open position value reaches a higher tier, KuCoin does not automatically upgrade the tier—the user must manually select and confirm the upgrade. If the user has not switched tiers, the system continues to use the maximum risk limit of the current tier as the position cap, and both the initial margin rate and maximum usable leverage are determined by the current tier until the user adjusts it manually.

If a large position triggers liquidation, the system uses a tiered reduction / ladder liquidation mechanism, gradually lowering the risk limit level and liquidating in smaller batches to minimize market impact and avoid a full single-step liquidation.

2. How to View Risk Limits

Open a contract → Click the top-right “Coin Info” → “Risk Limit”.

Note: Risk limits only apply to isolated margin mode, not cross margin mode.

Example:

-

Risk Limit (Position Value) = 5,000 USDT → Level 1, MMR = 0.4%, Minimum IMR = 0.8%, Max Leverage = 125×

-

Risk Limit = 500,000 USDT → Level 2, MMR = 0.5%, Minimum IMR = 1%, Max Leverage = 100×

As the risk limit level increases, margin requirements rise while available leverage decreases.

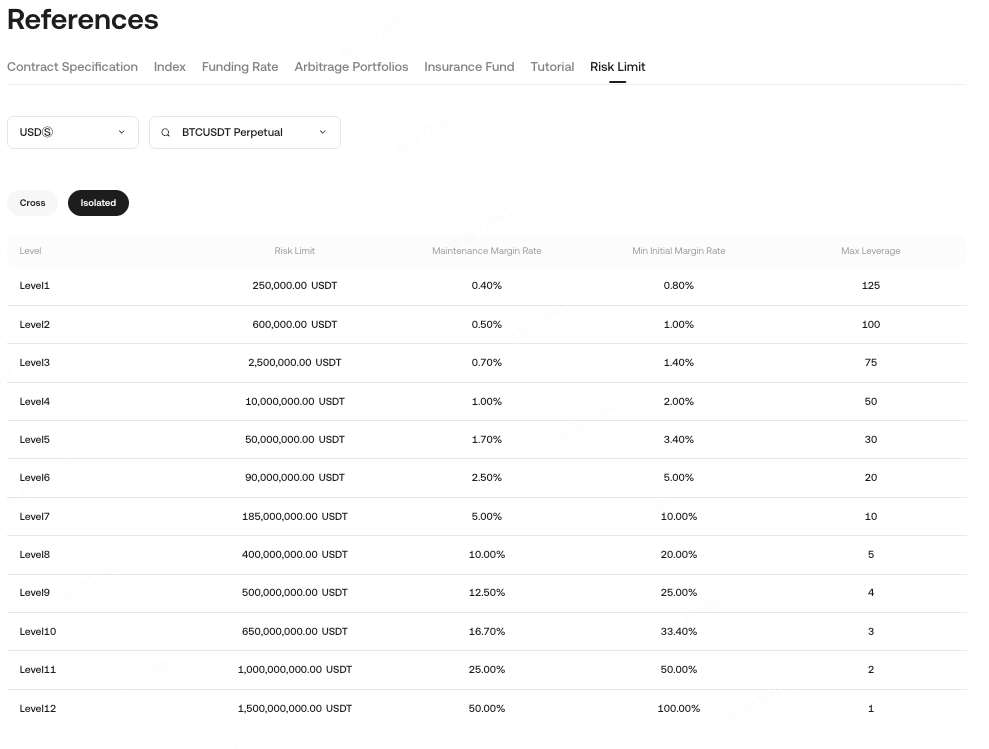

3. Risk Limit Tier Levels

Assume a contract’s risk limit tiers are as follows:

-

Level 1: Current position limit ≤ 100,000 USDT, IMR = 1%, MMR = 0.5%

-

Level 2: Current position limit ≤ 200,000 USDT, IMR = 2%, MMR = 1%

If a user wants to increase a Level 1 position of 100,000 USDT to 150,000 USDT:

-

They must manually switch to Level 2.

4. Calculation of Risk Limit Value

In isolated margin mode, risk limits are determined by the open position value. Risk limits are typically divided into tiers, with each tier corresponding to a specific position value range.

4.1 Risk Limit Calculation Formula

One-Way Mode Positions (Single Direction: Long or Short):

-

The risk limit is determined based on the tier corresponding to the position’s open value.

-

Open Position Value: Total open value of the position = Open Price × Quantity × Contract Multiplier

-

Risk Limit Factor: Defined according to platform tier rules, usually increasing as open value increases.

Hedge Mode Positions (Holding Long and Short Simultaneously):

-

Calculate risk limits separately for long and short positions based on their respective open position values.

4.2 Example: Risk Limit Calculation in Isolated Margin Mode

4.2.1 Single Direction Example:

| Open Position Value Range | Maximum Usable Leverage | Maintenance Margin Rate (MMR) |

| 0 - 10,000 USDT | 125× | 0.40% |

| 10,001 - 50,000 USDT | 100× | 0.50% |

-

Open position value: 25,000 USDT

-

Tier: 10,001–50,000 USDT → MMR = 0.5%

4.2.2 Bidirectional Example:

-

Long position open value: 35,000 USDT → Tier 10,001–50,000 USDT → MMR = 0.5%

-

Short position open value: 12,000 USDT → Tier 10,001–50,000 USDT → MMR = 0.5%

4.2.3 Summary:

-

One-Way Mode Positions: Use MMR of the corresponding tier based on open position value.

-

Hedge Mode Positions: Calculate risk limits separately for long and short positions.

-

Risk limit tiers allow the platform to set different parameters for different open value ranges, enabling more precise risk management.

5. Risk Limit Adjustment Reminder

Risk limits primarily affect order size, leverage usage, and liquidation. Manual adjustments directly impact available leverage and maximum position size.

-

Order Size and Leverage:

-

Risk limit level determines position size and available leverage.

-

Example: BTC perpetual contract Level 3 → Max Leverage = 75×, Max Position = 1,000,000 USDT

-

KYC level may also cap leverage: if KYC allows 5× leverage but risk limit allows 125×, the effective leverage is 5×.

-

Initial Margin Rate (IMR) = 1 ÷ Leverage, maintenance margin rate varies by risk limit tier.

-

Liquidation Mechanism:

-

Forced liquidation price is based on the MMR of the current risk limit tier.

-

The system may partially liquidate to reduce the risk limit level first, using IOC (Immediate or Cancel) orders, retrying until successful.

-

If the position is at Level 1 or IOC orders repeatedly fail, the system liquidates the remaining position entirely.

Example:

-

BTC perpetual contract, position value = 2,500,000 USDT, Level 4 → Triggering liquidation: system first reduces to Level 3 cap 1,000,000 USDT → Reduce 1,500,000 USDT → Risk limit drops to Level 3, MMR optimized, position restored.

6. Impact of Manual Risk Limit Adjustment:

-

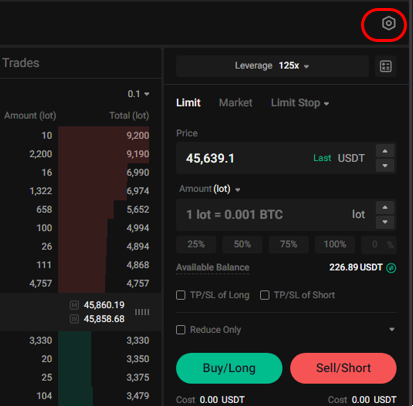

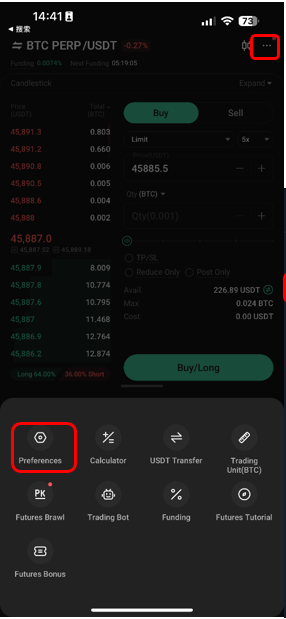

How to adjust risk limit level:

-

Website: Click ⚙️ → "Trading Preferences" → "Risk Limit"

-

-

App: Click "..." → "Trading Preferences" → "Risk Limit"

-

Upgrade Level: New tier’s max leverage may be lower than current position leverage; additional margin required, otherwise adjustment fails.

-

Example: Level 1 position = 125× leverage → Upgrade to Level 3 max 75× → Required Additional Margin = Position Value × (1/75 − 1/125)

-

-

Downgrade Level: New tier may limit max position; if current position exceeds limit, system prompts to reduce size first.

Cross Margin Mode

1. Overview of Cross Margin Mode

In isolated margin mode, the maximum open position size is limited by risk limit tiers, and higher leverage may paradoxically result in a smaller allowable position. For example, 100× leverage might allow opening only 1 BTC, while 50× leverage allows up to 5 BTC.

KuCoin’s cross margin mode uses a new maximum open position algorithm, linking the allowable position size to total account margin and chosen leverage, and implements a non-tiered risk limit:

-

Higher leverage → more openable positions, avoiding the abnormal situation in isolated margin mode.

-

No need to frequently adjust risk limits; the system automatically calculates maximum open positions based on total account margin and selected leverage.

2. Maximum Open Position Calculation

Formula (example for linear contracts):

Max Open Position = k * ln((C - F) * Lev * k + 1)

Where:

-

C: User’s total cross margin, i.e., account balance minus margin occupied by isolated positions. If there are no isolated positions, the full account balance can be used as cross margin.

-

F: Margin occupied by other contracts and orders. Subtracting this from total margin gives the available margin for the current contract.

-

Lev: User-selected leverage.

-

P: Approximate order price; actual calculation considers market depth and fees.

-

K: Amplification coefficient, ensuring that with the same available margin, openable position size increases with leverage, but at a decreasing rate. The platform adjusts K according to each contract.

Example: For a linear BTCUSDT contract purchased at 60,000 USDT with 10× leverage, account balance of 100,000 USDT, and no other orders or positions, and K = 490:

-

Max Open Position = 490 * ln(100,000 * 10 / (60,000 * 490) + 1) = 16.39 BTC

3. Optimization of IMR and MMR

Cross margin initial margin rate (IMR) and maintenance margin rate (MMR) are calculated more reasonably and efficiently:

-

IMR: Mostly determined by chosen leverage, typically 1/leverage, but also considering MMR limits, e.g., cannot exceed 1.3× MMR.

-

MMR: Primarily related to user positions and open orders. Larger positions and more open orders increase MMR. KuCoin’s method avoids very close IMR and MMR values, which could otherwise trigger forced liquidation due to small market fluctuations.

Example: For a user holding 1 BTC:

-

MMR = (1 + N/m) * (1 / (2 * MaxLeverageConstant)) = (1 + 1/300) * (1 / (2 * 100)) = 0.5%

4. Risk Rate Calculation and Liquidation Optimization

Cross margin risk rate = maintenance margin / equity. KuCoin considers both positions and open orders, not just positions. This prevents scenarios where unclosed orders in extreme market conditions suddenly increase account risk, potentially causing bankruptcy.

KuCoin’s method evaluates worst-case scenarios for long and short orders separately, allowing offsetting between directions. This results in a more reasonable MMR calculation, avoiding overestimation from simple aggregation.

Example:

Suppose a user holds 1 BTC and has 2 BTC in buy orders and 3 BTC in sell orders.

The maintenance margin required = max(1 + 2, 1 − 3) × Mark Price × MMR = 3 × Mark Price × MMR = 3 × 60,000 × 0.5% = 900

instead of 6 × Mark Price × MMR = 6 × 60,000 × 0.5% = 1,800

(Assuming the current mark price is 60,000 and MMR is 0.5%)

5. Dynamic MMR Reduces Liquidation Risk

-

Maximum MMR is only 30%; normal market fluctuations do not trigger liquidation if total risk ratio is below 100%.

-

MMR requirements for mainstream coins are lowered to improve capital efficiency.

-

Avoids the problem of traditional tiered risk control where partial liquidation of a position cannot restore equity.

KuCoin Futures Guide:

Thank you for your support!

KuCoin Futures Team

Note: Users from restricted countries and regions cannot open futures trading.