About Coin-Margined Futures

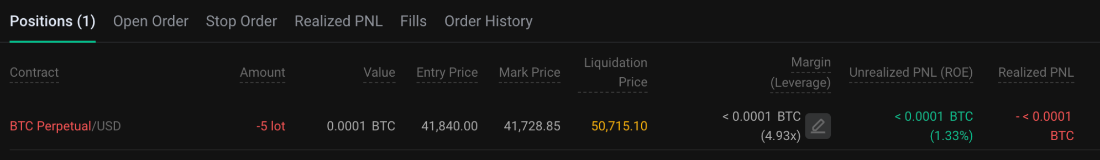

Web

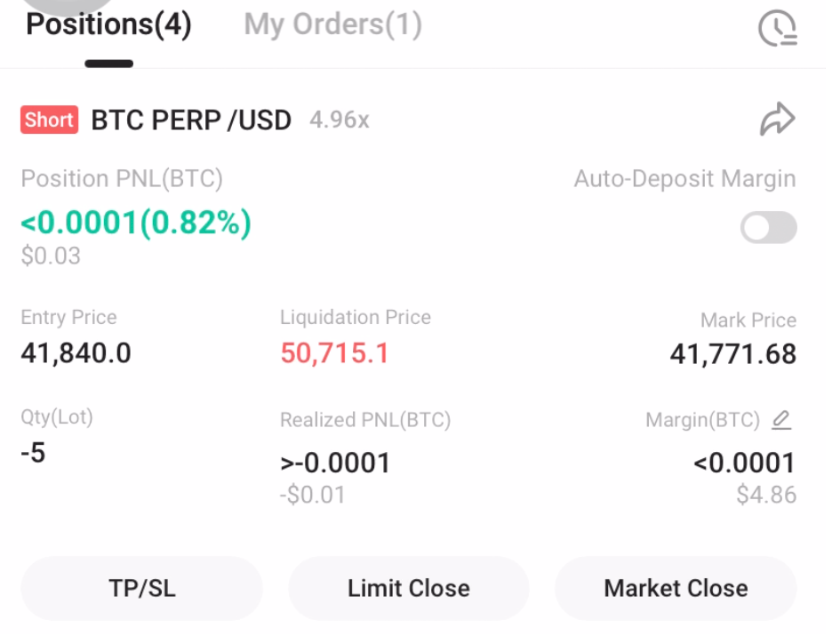

App

| Terms | Explanation |

|

Amount |

The amount of the coin-margined contract is calculated in the number of contracts, with 1 contract equivalent to 1 USD. Long positions are represented by positive amounts, while short positions are represented by negative amounts. |

| Value | The value of the coin-margined contract is calculated in terms of the underlying currency. Position Value = 1 / Mark Price × Amount. |

| Entry Price |

The average price for opening a position changes with each increase or decrease in the user's position. Example: You have a coin-margined BTC/USD futures position, going long for 1,000 contracts. Your entry price is 50,000 USD. An hour later, you decide to add 2,000 more contracts with an entry price of 60,000 USD. Then: Average Entry Price = Total No. of Contracts / Total Value of BTC Contracts

Average Entry Price = (3,000 / 0.053333334) = 56,250.00 USD |

| Mark Price | The current mark price of a coin-margined contract. |

| Liquidation Price | See the section on liquidation price calculation. |

| Margin | Current Position Margin = Initial Margin + Unrealized PNL + Frozen Fees + Added Margin |

| Position Leverage | Actual Position Leverage = Position Value / Margin |

| Unrealized PNL |

Users can choose whether unrealized PNL is calculated using the mark price or the last traded price. Unrealized PNL for Multiple Positions = Amount × (1 / Average Entry Price - 1 / Mark Price or Latest Fill Price) Unrealized PNL of Empty Positions = Amount × (1 / Mark Price or Latest Fill Price - 1 / Average Entry Price)

Long position example You have a coin-margined BTC/USD futures position, going long for 1,000 contracts. Your entry price is 50,000 USD. When the latest mark price is 55,000 USD, the unrealized PNL will be displayed as 0.001818 BTC. Unrealized PNL = No. of Contracts × [(1 / Average Entry Price) - (1 / Mark Price)] = 1,000 × [(1 / 50,000) - (1 / 55,000)] = 0.001818 BTC

Short position example You have a coin-margined BTC/USD futures position, going short for 1,000 contracts. Your entry price is 50,000 USD. When the latest mark price is 45,000 USD, the unrealized PNL will be displayed as 0.02223 BTC. Unrealized PNL = No. of Contracts × [(1 / Mark Price) - (1 / Average Entry Price)] = 1,000 × [(1 / 45,000) - (1 / 50,000)] = 0.002222 BTC

Note: The calculation of unrealized PNL does not include any trading fees or funding fees incurred during the opening, closing, or holding of positions. |

| ROI | ROI = Unrealized PNL / Initial Margin |

| Realized PNL |

Realized PNL = ∑(PNL From Reducing Positions) - Trading Fees - Total Funding Fees Since Opening The realized PNL includes all trading fees, funding fees, and the profit and loss realized from partially closing the position (the same formula as unrealized PNL). Example: You have a coin-margined BTC/USD futures position, going short for 1,000 contracts. Your entry price is 50,000 USD. You close 500 contracts of the position at a price of 45,000 USD, with a partial position of 500 contracts remaining. • Partial Position PNL: 500 × [(1 / 45,000) - (1 / 50,000)] = 0.001117778 BTC • Position Opening Fee: (1,000 / 50,000) × 0.06% = 0.000012 BTC • Position Closing Fee: (500 / 45,000) × 0.06% = 0.000006667 BTC • Total Funding Fee Paid: 0.00005 BTC Realized PNL = 0.001117778 - 0.000012 - 0.000006667 - 0.00005 = 0.001049111 BTC |

KuCoin Futures Trading Guides:

Thank you for your support!

The KuCoin Futures Team

Note: Users in restricted countries and regions cannot enable futures trading.