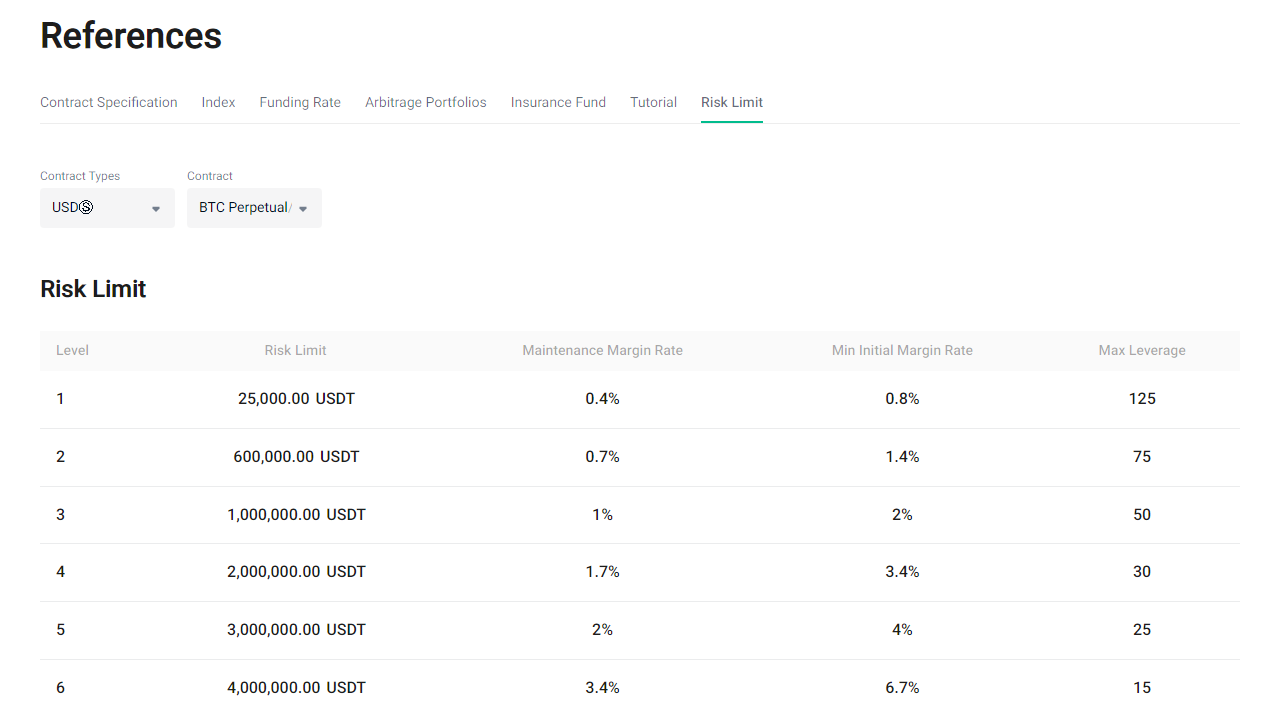

Coin-Margined Contract Risk Limits

Risk Limit Mechanism

Risk limits are a risk management mechanism used to limit the position risk of users. In a market with significant price fluctuations, users holding large positions with high leverage could cause substantial losses arising from negative balance. KuCoin sets risk limits for all trading accounts, meaning users with larger positions need more margin to hold their positions. This optimizes risk management and protects all users from additional risks.

As the contract value of a position increases, users need to select a higher risk limit level, which requires higher maintenance margin and initial margin.

You can visit Risk Limits to view the risk limit levels for each contract.

The risk limit for coin-margined contracts is set in the base currency of the contract.

Example

For the BTCUSD coin-margined perpetual contract, the risk limit unit is BTC, and 1 contract equals 1 USD.

If the current risk limit is at level 1, the maximum leverage is 50x and the maintenance margin rate is 2%.

When the BTC price is 40000 USD, the maximum order size at this level = 8/(1/40000) = 320,000 contracts.

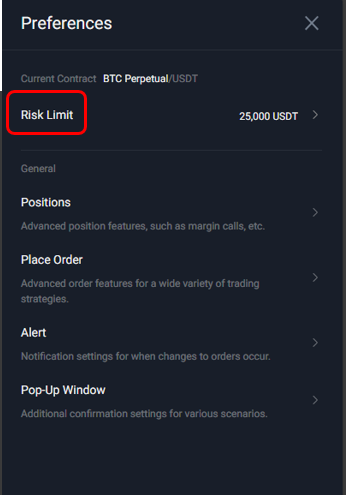

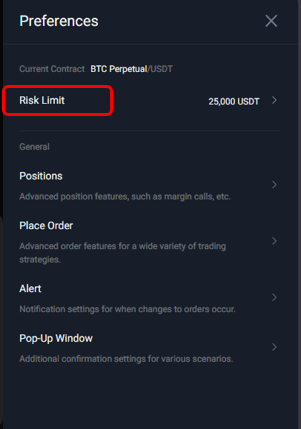

Adjust Risk Limit

KuCoin's contract trading sets the initial risk limit level for all users at the lowest by default. Users can flexibly adjust their risk limit in "Trade Preference Settings". After switching risk limit levels, the maximum leverage, initial margin rate, and maintenance margin rate before and after the adjustment will be displayed. You can confirm your changes to apply them.

Note:Please adjust the risk limit when there are no positions or open orders in the current contract.

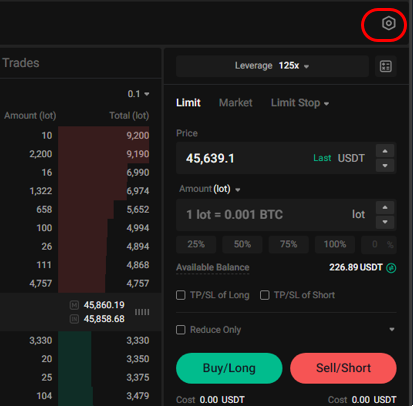

Website: Click the ⚙️ settings icon in the top right corner of the page and go to "Trading Preferences" - "Risk Limits".

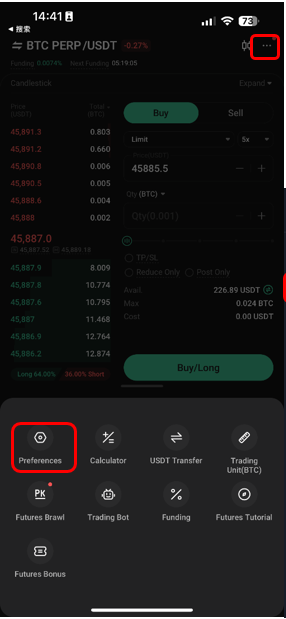

App: Click the "..." settings icon in the top right corner and go to "Trading Preferences" - "Risk Limits".

Tiered Liquidation

For users with high risk limits, KuCoin uses a tiered liquidation process in the event of liquidation. This process automatically reduces the risk limit level to the lowest. This approach prevents users' entire positions from being liquidated all at once.

Example

A user holds a position in the BTCUSD coin-margined perpetual contract at the third risk limit level and triggers liquidation. The system will downgrade the user's position to the second level, reducing the position size to the maximum value of the second level. It then assesses whether the position is out of liquidation risk. If it is, no further position reduction or liquidation will occur; if not, the system will continue to reduce and downgrade the position. If the position still triggers liquidation at the first level, a forced liquidation and takeover will be conducted.

KuCoin Futures Guide:

Thank you for your support!

KuCoin Futures Team

Note: Users from restricted countries and regions cannot open futures trading.