Introduction of Coin-Margined Perpetual Contract and Delivery Contract

What is Coin-Margined Contract?

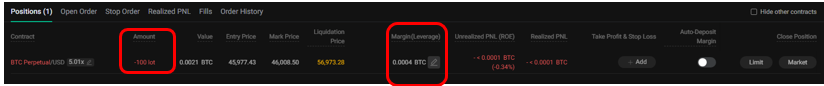

KuCoin supports coin-margined contracts, also known as inverse contracts. You can choose cryptocurrencies (such as BTC and ETH) as the base currency to calculate margin and profit/loss, and use the US dollar as the quote currency to set your trading volume. Therefore, to trade BTCUSD or ETHUSD contracts, you must hold the corresponding BTC or ETH in your contract account.

Example

Suppose BTC price is $30,000. You buy a BTC coin-margined contract worth $10,000 with a leverage of 50x. The calculations are as follows: Position value = 10,000 / 30,000 ≈ 0.334BTC; Initial margin required = 10,000 / 30,000 / 50 = 0.00668BTC.

When BTC price rises to $40,000, the position value = 10,000 / 40,000 = 0.25BTC. If you close your entire position, it means buying back contracts worth $10,000 and selling an equivalent amount of BTC, where profit = 0.334 - 0.25 = 0.084BTC (excluding trading fee and funding fee). Your initial margin of 0.00668 BTC generated a profit of 0.084 BTC, so the profit margin = 0.084 / 0.00668 = 1257.48%.

Coin-Margined Contract vs USDT-Margined Contract

Unit

USDT-margined contracts are priced in USDT, while coin-margined contracts are priced in USD.

Thus, their index prices differ. For example, the index price for BTC/USDT contracts is based on the spot price of BTC/USDT. For BTC/USD coin-margined contracts, the index price is based on the spot price of BTC/USD.

Contract Value

USDT-margined contracts have a contract value in the respective base currency, e.g., 0.001BTC for BTC/USDT. Coin-margined contracts have a contract value of 1USD, e.g., $1 for BTC/USD.

Collateral

USDT-margined contracts use USDT as collateral across all varieties, allowing trading with just USDT. Coin-margined contracts use the base currency as the collateral. Users must hold the corresponding cryptocurrency to participate in trading these contracts. For example, in a BTC/USD coin-margined perpetual contract, users need to deposit BTC as the collateral.

Profit/Loss Calculation

USDT-margined contracts calculate profit/loss in USDT. However, coin-margined contracts calculate it in the base currency. For example, when trading a BTC/USD coin-margined perpetual contract, the profit/loss is calculated in BTC.

Comparison of Coin-Margined and USDT-Margined Contract Margin (in BTC)

| Contract Type | Base Currency | Quote Currency | Settlement Currency | Index Trading Pair | Face Value |

| Coin-Margined Contract (Inverse Contract) | BTC | USD | BTC | BTC/USD | 1USD |

| USDT-Margined Contract (Forward Contract) | BTC | USDT | USDT | BTC/USDT | 0.001BTC |

Perpetual Contract vs Delivery Contract

Perpetual contracts have no expiration date and can be traded perpetually. In contrast, delivery contracts have an expiration date and are settled at a price derived from a target asset according to specific rules. Delivery and settlement incur a delivery fee of 0.025%.

Delivery contracts do not have a funding fee settlement mechanism. Since contract prices are settled close to spot prices on the delivery date, the delivery contract price does not deviate too far from the spot price. Currently, KuCoin only offers delivery contracts for coin-margined products.

KuCoin Futures Guide:

Thank you for your support!

KuCoin Futures Team

Note: Users from restricted countries and regions cannot open futures trading.