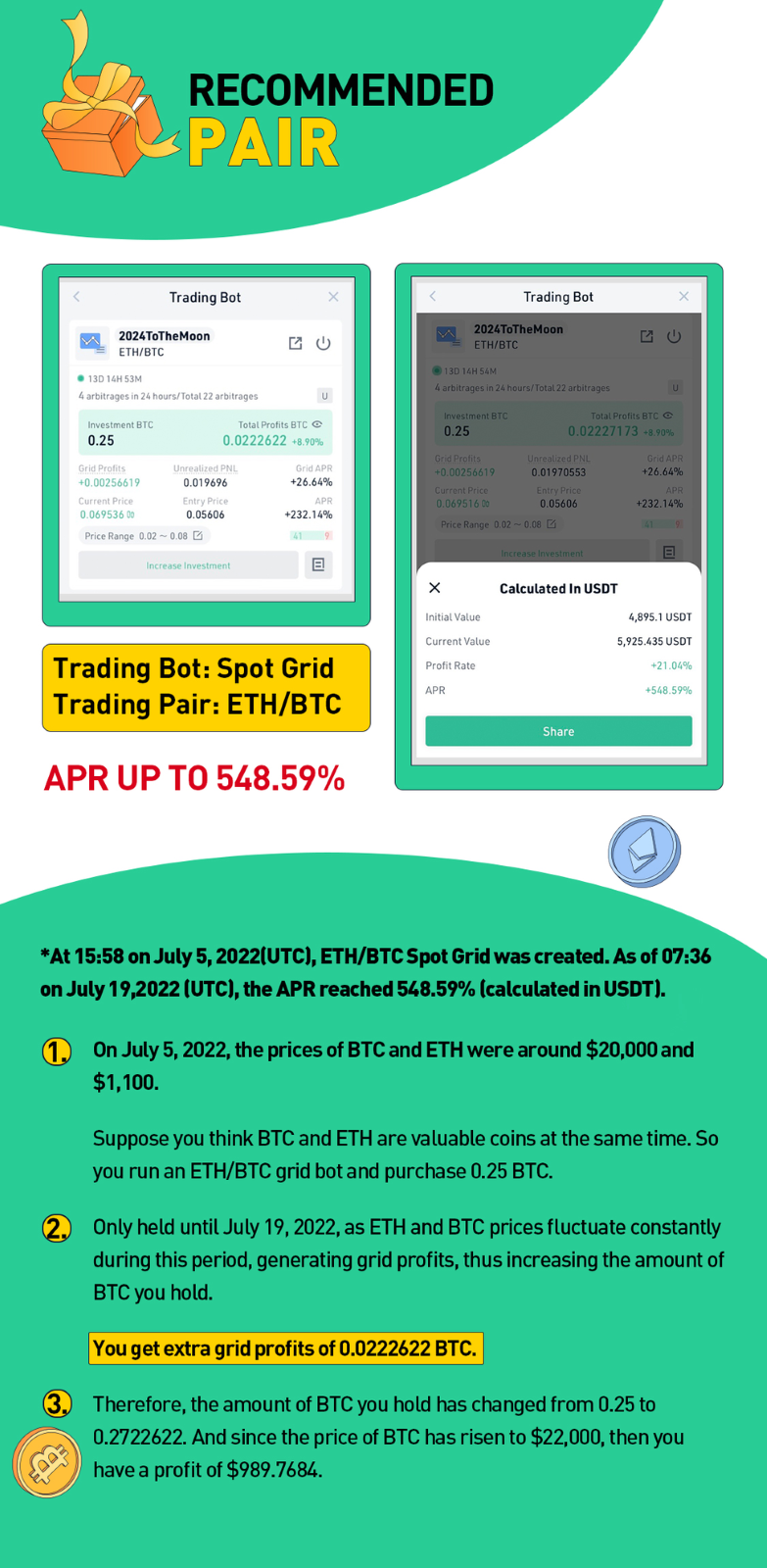

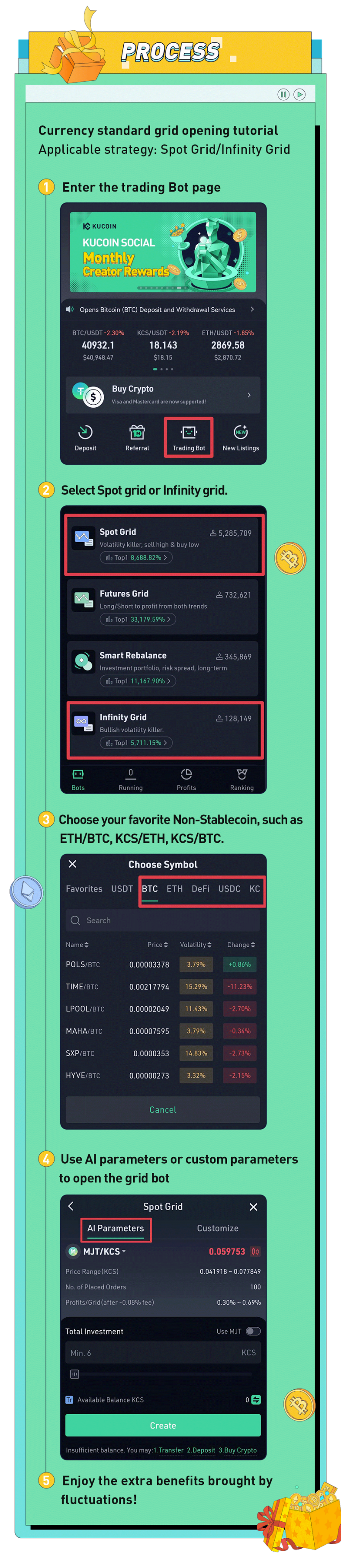

ETH/BTC Spot Grid Trading Bot Tutorial

According to a seasoned cryptocurrency trader, spanning the bull and bear markets with ETH/BTC Spot Grid orders had granted a return of investment of 24.6 times from an initial investment of 12,000 USDT, earning about 300,000 USDT in profit during the bull market.

No one believed that a single Grid trading order could yield such a high return after one cycle. Let alone earning a high return rate on BTC and ETH by using a Grid trading bot.

Slow Is Fast

In the trader’s view, investing in definite money is the best way to reap the bonus. As the crypto industry remains, investing in BTC and ETH will likely earn income. Having a clear image of your long-term gains is also essential.

What's the Winning Mentality?

One can achieve a winning mentality by establishing the correct investment values. Investing in BTC and ETH should not be like investing in contracts or altcoins – expecting short-term gains. Long-term holding and regular investment is the right way, as holding also gives an opportunity for you to keep arbitraging.

Why Can’t You Hold On?

Metaphorically, making big money is like catching a wave. This strategy can help you remain up top.

Riding the Waves: Much like how surfers follow the path of the wave, traders should follow the growth of the cryptocurrency industry – being adaptable and flexible to different types of market situations.

Many people have been in the crypto circle for several years; however, unable to make big money because they are too eager to get rich overnight. In the crypto circle, if you can't make money from BTC and ETH, where else can you make money?

What is the Principle of ETH/BTC Trading?

The core of the ETH/BTC Spot Grid is to transform the fixed amount of coins bought and sold in traditional grids into a form where a fixed amount of USDT is bought and sold.

It can not only obtain the profits of holding multiple value coins but also obtain the grid profits of fluctuations between value coins – even increasing the number of coins held. This is the trading charm of the coin-basis grid.

Why Trade ETH/BTC's Grid? What's the Advantage?

The ETH/BTC trading pair has always been oscillating. After running for many years, it fluctuates between 0.016 ~ 0.123 exchange rates, is often in oscillation, and is very friendly to users who like to hoard BTC and ETH. It can achieve mainstream coin hoarding while implementing grid range arbitrage.

Overall, the ETH/BTC grid has the following four advantages:

- Direct Coin Investment: Friendly to coin hoarders who already have coins by earning more of the same coin, so the number of coins held will increase over time;

- Holding either more BTC or more ETH is comfortable for those who are bullish on these two coins in the long term;

- The combination of the coin's rise and the oscillation profit of exchange rate fluctuation; the more severe the market fluctuation, the higher the return rate;

- A relatively stable exchange rate, large total market value of BTC and ETH, high trading volume, high turnover rate, and more reliable assets among many cryptocurrencies.

What is ETH/BTC Spot Grid Trading?

ETH/BTC Spot Grid Trading is based on the fluctuation of ETH's price by using BTC as the principal to automatically buy and sell ETH, invest in BTC, and earn BTC.

When the exchange rate between ETH and BTC rises, the Grid bot automatically sells ETH at a high position to gain more BTC; when it falls, it automatically sells BTC to buy more ETH at a low position.

For users who are long-term bullish on ETH and BTC, this trading pair can be a good tool for hoarding coins.

When is it Appropriate to Start an ETH/BTC Spot Grid?

One may start when the market turns into a "Bear Market" or a "Bull Market” in its early stages. By holding ETH and BTC at low prices and continuing to earn Grid profit in a volatile market, you simultaneously increase the amount of BTC held over time.

Because of the oscillating market, it can be considered as the natural fishing ground for Grid trading. When prices continue to oscillate, positions will continue to trade sideways, using Grid trading, buying low and selling high in tiers, and repeatedly cycling to earn range profit as the overall capital volume continues to rise.

ETH/BTC Spot Grid Trading Skills

The essence of ETH/BTC Spot Grid is suitable for an oscillating upward trend, meaning you think ETH's gains will surpass that of BTC's.

Of course, if the ETH/BTC market starts to oscillate downward, this means that BTC gains surpasses ETH. The grid will then use your invested BTC to bottom-fish ETH. In other words, in this situation, you will buy more ETH through the grid. However, when the ETH/BTC exchange rate rises, this part of the hoarded ETH will result in a higher return.

Therefore, in the case of short-term declines, there may be short-term losses.

Conclusion:

Simply hoarding BTC is not as good as holding an ETH/BTC Spot Grid; using trading bots to arbitrage during the hoarding process and earning more BTC while increasing returns is the best way.

ETH/BTC Spot Grid is not just an investment strategy, it is an investment philosophy that allows us to slow down, earn the money we should earn, and continuously compound. We must find the right way to walk after falling, avoiding stepping into the same pit once, twice, or maybe three times.