What Is Smart Rebalance Bot and How Does It Work

Smart Rebalance is a classic strategy that has been used for decades in the traditional industry. The core of the strategy is to increase the total amount of assets by selling high and buying low, at the same time maintaining the portfolio basically unchanged.

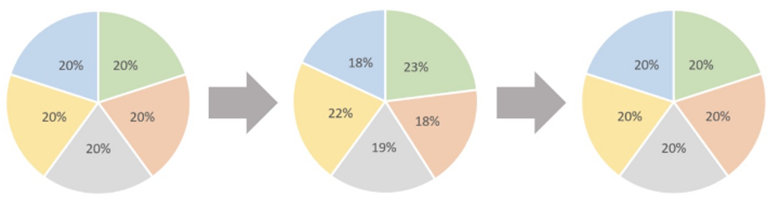

When the portfolio imbalance exceeds the ratio or when the rebalance day arrives, the rebalance will be triggered. By selling coins with a high ratio and buying coins with a low ratio, the coin ratio will be adjusted to the targeted one.

In the short term, selling high and buying low will make some coins more, whereas others less, however, due to the market volatility, the total assets will increase.

Part 1 - What is KuCoin Smart Rebalance Trading Bot?

1. The Principle of Smart Rebalance

To better understand the whole process of how Smart Rebalance works, we will take an example.

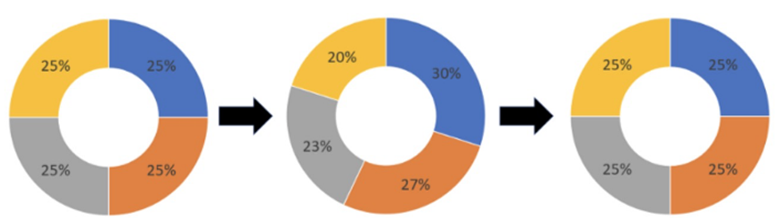

Assuming now your Smart Rebalance consists of four crypto assets which are BTC, ETH, LTC and KCS. Among the portfolio, four coins are equally sharing 25% value. If now the total value of the portfolio is 1,000 USDT, thus the value for four coins is 250 USDT.

Let’s take interval rebalance as an example. If the interval was set to 12 hours, within the following 12 hours, BTC has gone up, whereas ETH went down. When the rebalance timing of 12 hours arrives, rebalancing will be triggered which means the exceeding amount of BTC will be sold, to make the ratio of the portfolio to 25% again for four coins.

2.The Advantages of Smart Rebalance

Compared to the "hodl" strategy, the advantage of the Smart Rebalance approach with an intelligent portfolio robot lies in its ability to utilize rotational arbitrage between tokens through the robot's smart rebalancing conditions. This allows for capitalizing on the fluctuations between different tokens, thereby achieving the goal of increasing holdings.

With the trend of HOLDING strategy among the crypto investors, Smart Rebalance has brought a new way to hold for those investors, potentially increasing the return on holding crypto assets by taking advantage of rapid price fluctuations. When the price of the coin goes up reaching the targeted threshold, the Smart Rebalance bot will execute and distribute the additional value to other assets in the portfolio. Even if the price of the specific coin returns back to the original value before it has been rebalanced, the net profit has been achieved and naturally, the total amount of the assets increased.

Smart Rebalance right now offers 23 different types of portfolio which include 5 moderate asset class DCG Portfolio, A16Z Portfolio, AlamedaResearch(SBF) Portfolio, CEX and BSC; 2 aggressive asset class NFT and Privacy and 4 growth asset class Polkadot ecosystem, DEX, Defi and DAO. You could choose the portfolio based on your own risk appetite.

3.Two Rebalancing Modes

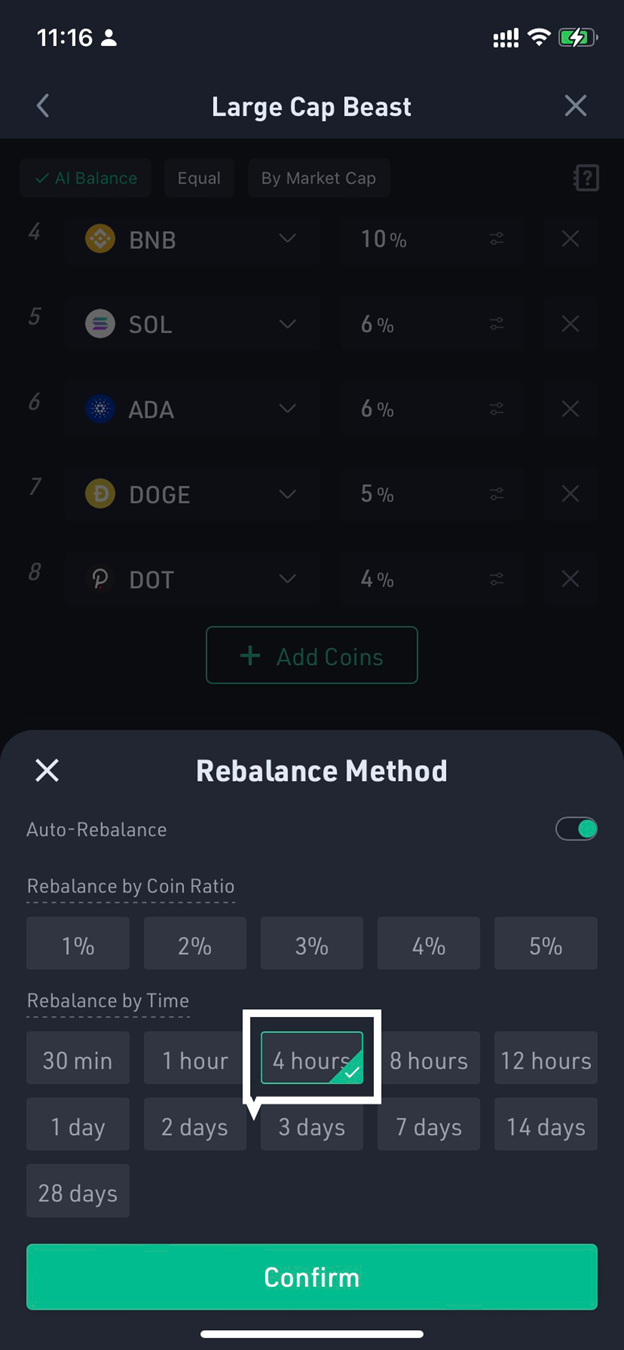

Smart Rebalance now provides two types of rebalancing modes which are Threshold Rebalancing (by coin ratio) and Periodic Rebalancing(by time).

Assuming the targeted threshold coin ratio is 3%, as shown in pie chart 2, the position in green has gone up from 20% to 23% which just matches the targeted 3% deviation, thus rebalancing will be triggered and the ratio of the coins will be adjusted to the initial settings.

Assuming the interval for rebalancing is 24 hours, when the 24 hours reach, the bot will automatically adjust the ratio of the position to the initial settings.

4.The disadvantages of Smart Rebalance

Profit accelerates during uptrends, while losses accelerate during downtrends.

Part 2 - How To Create Your First Smart Rebalance Bot?

Ready to start Smart Rebalance? Here is a tutorial that will guide you through the Smart Rebalance bot and show you how to manage your own portfolio via the KuCoin trading bot.

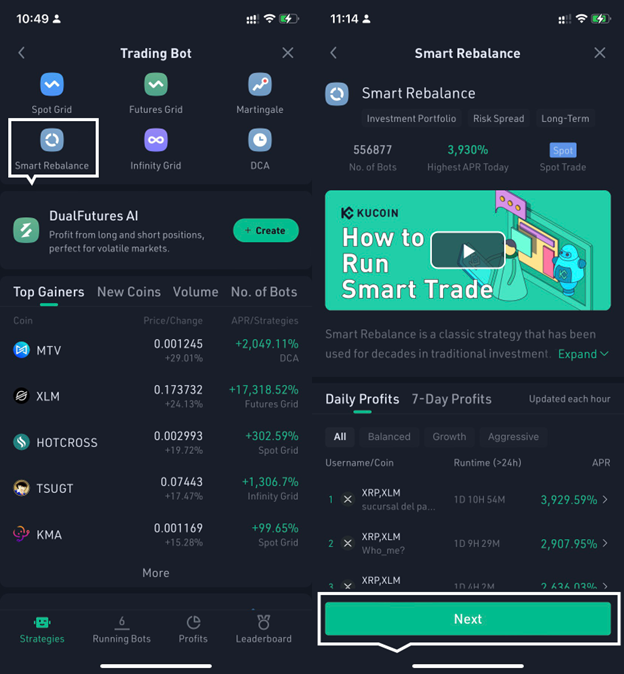

Step 1: Click【Smart Rebalance】, then click 【Start】,you will come to the 【Portfolio】page:

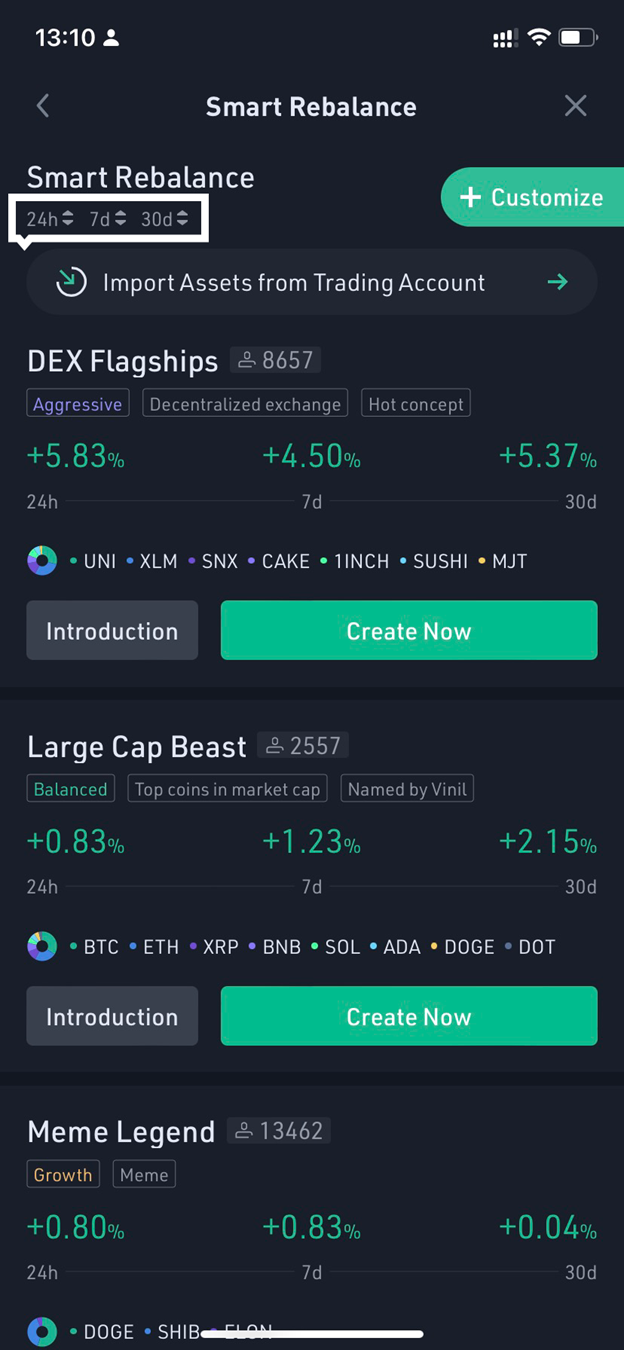

Step 2: You could choose【24D】or【7D】or【Market Cap】to rank the portfolio, then select the portfolio based on your investment needs and risk appetite, after that click【Create Now】:

Step 3: You will be guided to the parameters settings page

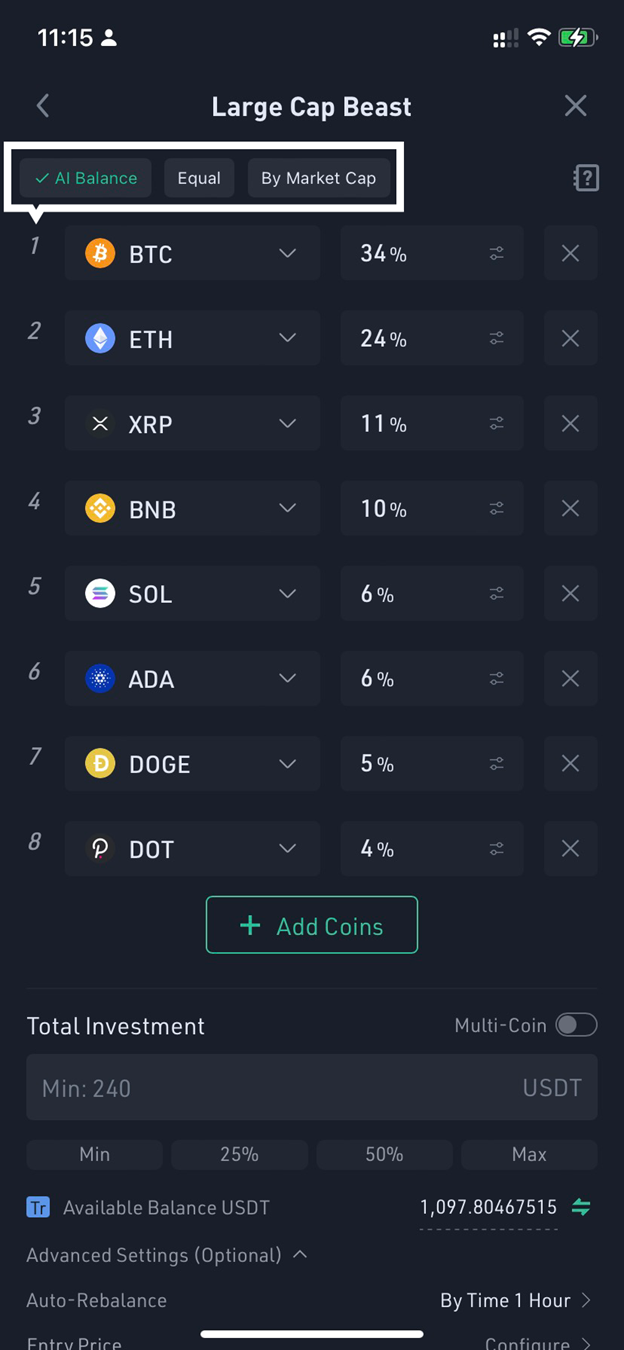

1. Choose 【Select coins】For each portfolio, maximum 6 coins are allowed, then select 【AI Proportion】or【By Market Cap】or【Equal share】 to distribute the individual coin ratio.

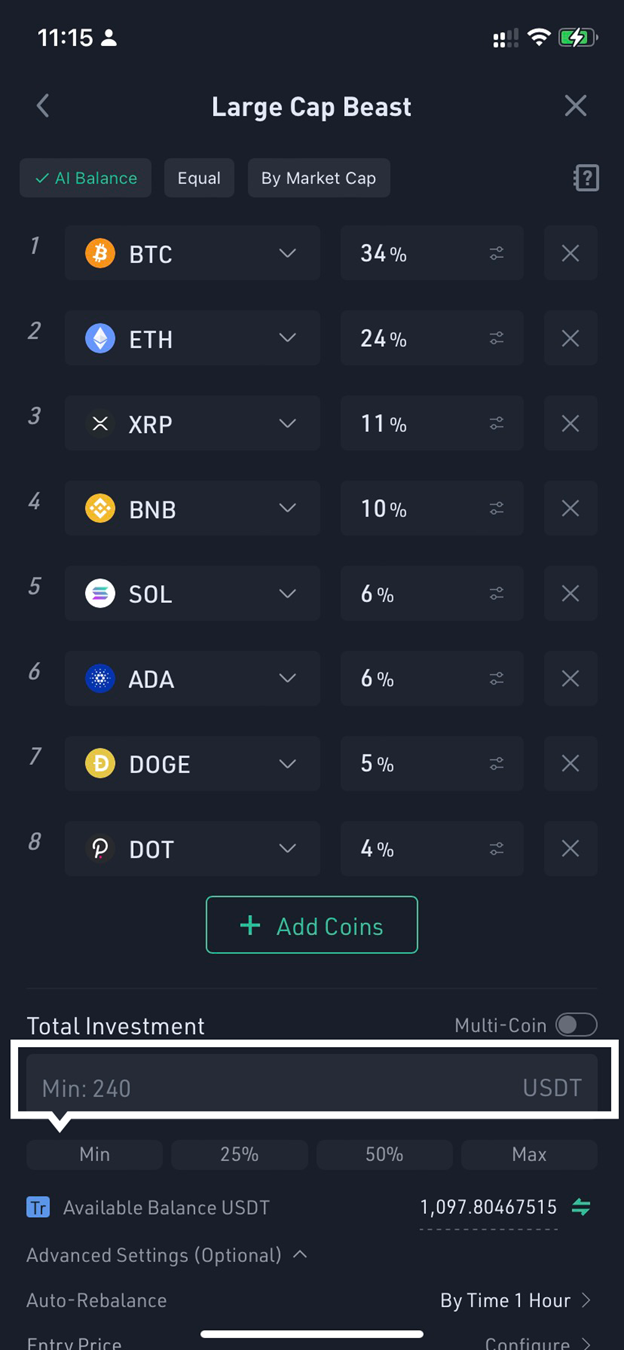

2. Enter the investment amount, please note that the total investment amount is ranging from 200 USDT - 10,000 USDT. You could also choose【Multi-coins】, which allows you to use both USDT and the assets in the portfolio from your Trading Account.

4. Then click【Create】and confirm all the order details, make sure everything is correct, click 【Confirm】, the Smart Rebalance bot will be running then.

Part 3 - Key To Maximizing Your Smart Rebalance Bot Profits

1.When is it appropriate to activate the Smart Rebalance robot?

You can activate the Smart Rebalance robot when the cryptocurrency prices are relatively low. If you're unsure about the current price being at a low point, you can adopt a gradual investment approach by starting multiple robots and patiently waiting for the market to rise.

2.What should I do if my holdings decrease after using Smart Rebalance?

When using the Smart Rebalance robot, it continuously rebalances between different tokens based on their exchange rate fluctuations. This process involves selling some tokens while buying others. So, if you notice a decrease in the quantity of a specific token in the robot's holdings, it means that the quantity of other tokens in the portfolio is increasing. If you run the Smart Rebalance robot over the long term, you will observe an overall increase in the quantity of all the tokens it holds.

3.Investment techniques and token selection logic for Smart Rebalance with dual-token and multi-token combinations

If you choose two tokens from the same category, it is recommended not to enable rebalancing but instead adjust their allocation ratio and simply activate Smart Rebalance as a portfolio management tool.

If you select multiple tokens from the same category, but their price correlation is not perfectly synchronous, it is advisable to enable rebalancing. However, the rebalancing time should be set longer, such as every hours or based on deviation values or deviations from high points, to achieve the best results.

The primary focus of the Smart Rebalance tool is not arbitrage but rather selecting assets and holding them for the long term. The longer you hold, the better.

If you choose tokens from multiple categories with weak correlations, exhibiting alternating upward and downward trends, and if the price fluctuations in different categories are significant, with the expectation that they will eventually converge and not continually move downwards, then you can enable rebalancing to maximize profits. However, if you have high uncertainty in token selection and the selected assets carry substantial risks, it's advisable not to enable rebalancing to avoid the risk of the portfolio becoming worthless.

Bottom Line

Now that you have learned so much, go ahead and activate the Smart Rebalance robot to put your knowledge into practice!