What Is Spot Grid Trading and How Does It Work

One of the most classic trading strategies for making profits is grid trading. In this article, we’ll examine the KuCoin Spot Grid Trading Bot. Spot Grid trading is a trading strategy that seeks to profit from market fluctuations by positioning buy orders and sell orders. The Spot Grid trading bot places buy orders when the price drops and sell orders when the price climbs over the base currency at set intervals around the set price in order to profit from the market trends.

If you’re interested in learning more about Spot Grid trading and trading bots, read on – this article covers you everything you need to know about the Spot Grid KuCoin bot.

If you’re a novice crypto trader or investor, check out the detailed step-by-step guide at the end of this guide. Let’s get started!

Key Takeaways:

- The Spot Grid trading bot is an effective tool in volatile markets, enabling traders to make steady profits on small price changes.

- The Spot Grid trading bot executes trades automatically without letting traders’ emotions get in the way, and its minimum and maximum price limits help mitigate risks.

- You can maximize your profits with the KuCoin Spot Grid Trading Bot by leveraging advanced features that allow you to set the entry price, and take profit and stop loss orders.

Part 1 - What is KuCoin Spot Grid Trading Bot?

1.What is Grid Trading?

Before getting into the Spot Grid bot, it’s important to understand what grid trading is all about. In simple terms, grid trading is the process of placing buy and sell orders at regular intervals. It’s possible to determine these intervals by forming a grid with various levels on the price chart.

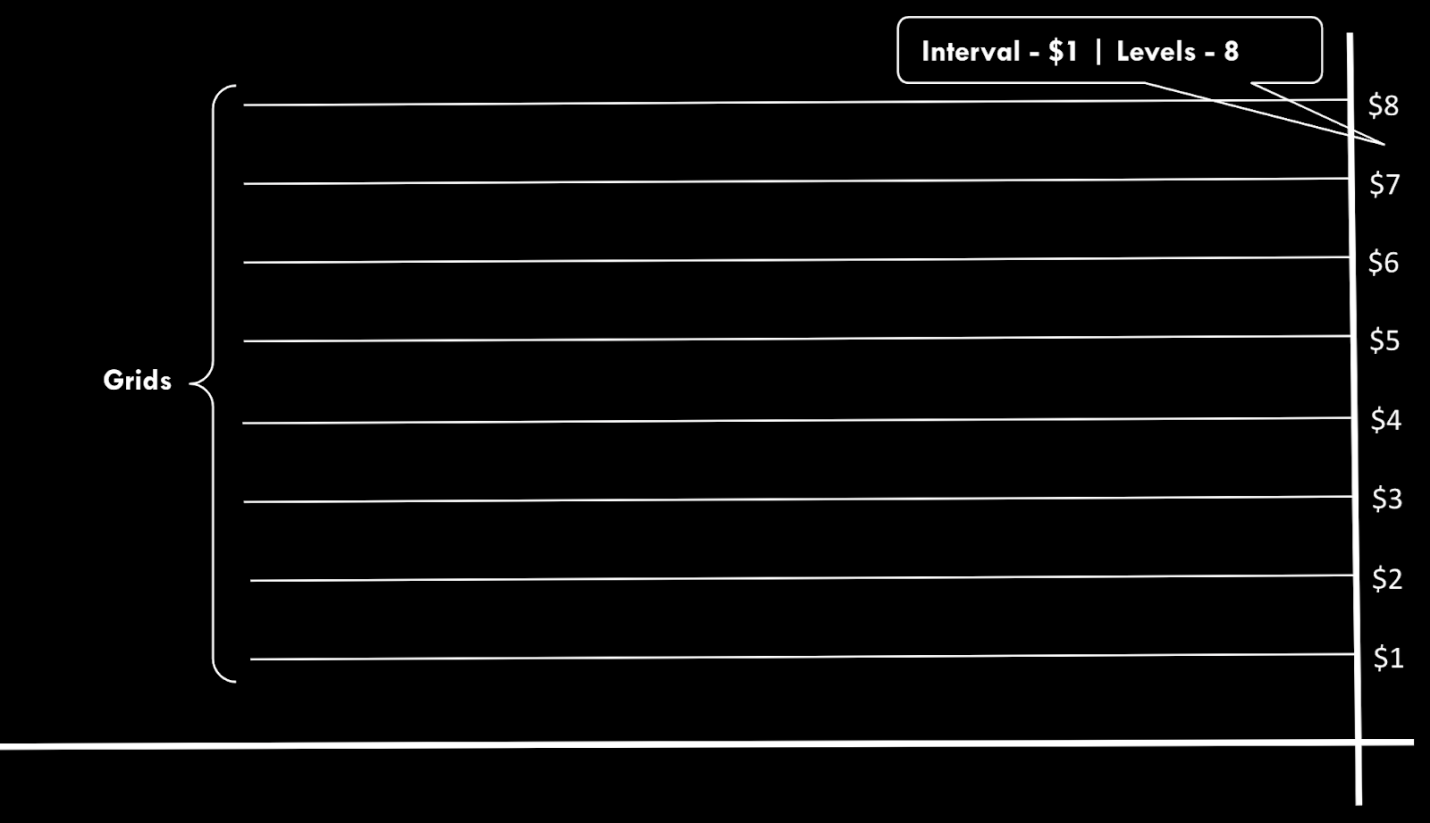

The illustration below shows a price chart with different grids/levels and a price interval of $1 between each level.

Grid Trading Explanation

The lower the intervals, the higher the number of levels, and vice-versa. The core concept of Grid Trading is to trade the market by buying or selling the asset class when the price touches any given grid. The lower the intervals, the higher the trading frequency, due to the increase in the total number of grids.

Lower intervals also decrease the price difference between each grid – specifically, the amount traded per grid. This reduces the profit or loss generated per order. If you want to take more trades with less profit/loss per trade, for example, it’s best to keep the frequency high. Conversely, lower frequency creates fewer trades, with higher profit or loss.

Buy orders are placed below the current price, while sell orders are placed above the asset price.

2.What Is The KuCoin Spot Grid Trading Bot?

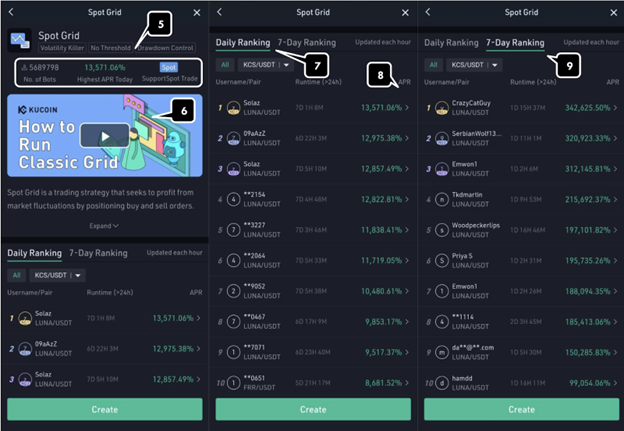

The Spot Grid trading bot is one of the market's most popular grid trading bots. As you can see in the screenshot above, close to six million bots are running on the Spot Grid strategy. This bot is very newbie-friendly and specializes in tackling the pressing issue of high volatility in the crypto market.

Once properly set up, the Spot Grid bot makes a profit by selling the asset at a higher price and buying the same when the price gets lower. In this low-risk strategy, it takes some time for you to see real profits even with lesser capital.

All the trading bot services on KuCoin are available on the KuCoin official mobile application. So to get started, all you need to do is to install the KuCoin app and create a Spot Grid bot with your preferences.

KuCoin offers an AI integration within the bot where the system decides all the details, such as price interval, number of levels, etc., based on the asset's historic price action. All you need to do is select the amount of funds you want to trade and click "Create."

KuCoin Trading Bot Page | Spot Grid

You can also follow other profitable users and copy their settings with the click of a button. If you are a professional trader and understand the bots functioning in-depth, you can use your preferred parameters and build your own bot.

3.How Does Spot Grid Bot Work

The Spot Grid trading bot is designed to thrive in the volatile crypto market by quickly buying and selling as the token’s price fluctuates. It does this by placing a range of buy and sell orders between the two specific price points (upper and lower limit prices) set by the user.

The spread of buy and sell orders creates a grid, and since we are trading the crypto spot market with this bot, it is called Spot Grid.

As an example, let's say you want the bot to trade MATIC, whose price is currently at $0.6. You can select the range based on how far you think the price can fluctuate in a given time.

For instance, consider the range of $0.4 and $0.8 and the interval of $0.05. So overall, the bot can buy or sell the asset at ten different price levels. When the price of MATIC goes below $0.6, the bot buys the asset. If it goes to $0.55, the bot buys and continues to buy every time it touches a grid line till the price drops to $0.4. If MATIC's price goes below the $0.4 lower limit, the bot stops buying.

Likewise, if its price goes above $0.6, the bot sells the token. It continues to sell every time it touches a grid line till the $0.8 upper limit and stops selling once the price goes above it. By doing this, the bot makes a profit as it successfully bought the asset at a lower price and sold it at a higher price.

Your profits can be maximized in this bot strategy if the asset is highly volatile and its price moves within your desired price range.

4.When Should You Use The KuCoin Spot Grid Bot

As mentioned, this bot works wonders in high-volatile markets, provided you are aware of the range between which the asset price fluctuates. Spot Grid bot trading can be compared to you shorting a crypto future if you are bearish on its price because this is what is required to get started with the Spot Grid bot, a strong estimate that the coin or token's price would hover around a certain level for some duration.

KuCoin Trading Bots Comparison

If you are a conservative trader, this bot is for you. Many traders use this bot for its amusing risk management features. You can profit from this process by buying low and selling high at predetermined intervals without the risk of human error.

Also, the grid trading bot runs 24/7 throughout the year while not deviating from the given parameters. This eliminates the risk of panic buying/selling and gives you the convenience of sleeping at peace.

If you are really concerned about crypto volatility, the KuCoin Spot Grid bot allows you to trade stable coin pairs like USDT and USDC. The price fluctuations between these pairs are too small, so the profits will be low. But that also means that you carry very less risk.

All in all, if you are a novice with little crypto knowledge, conservative, and love risk management while making decent profits, the KuCoin Spot Grid bot is for you.

The Spot Grid bot supports all the trading pairs KuCoin Exchange offers, while the trading bot interface also shows the 10 most popular trading pairs used by the Spot Grid bot at that moment.

Part 2 - How To Create Your First Spot Grid Bot?

1.Creating a Spot Grid Bot On KuCoin App

KuCoin trading bots can be accessed via the official mobile application (IoS) and the web.

The first step is to log in to your account with your registered email ID or mobile number.

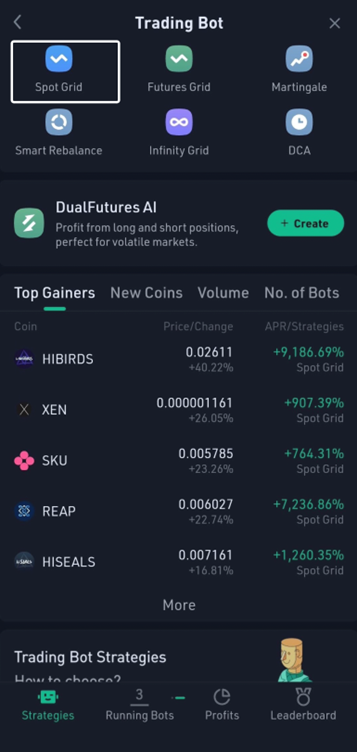

KuCoin Mobile App | Spot Grid Bot Creation Process

- Click the Trade button on the app's home screen.

- On the top right corner, click Grid.

- In the pop-up window, click Trading Bot Pro.

KuCoin Mobile App | Spot Grid Bot Creation Process

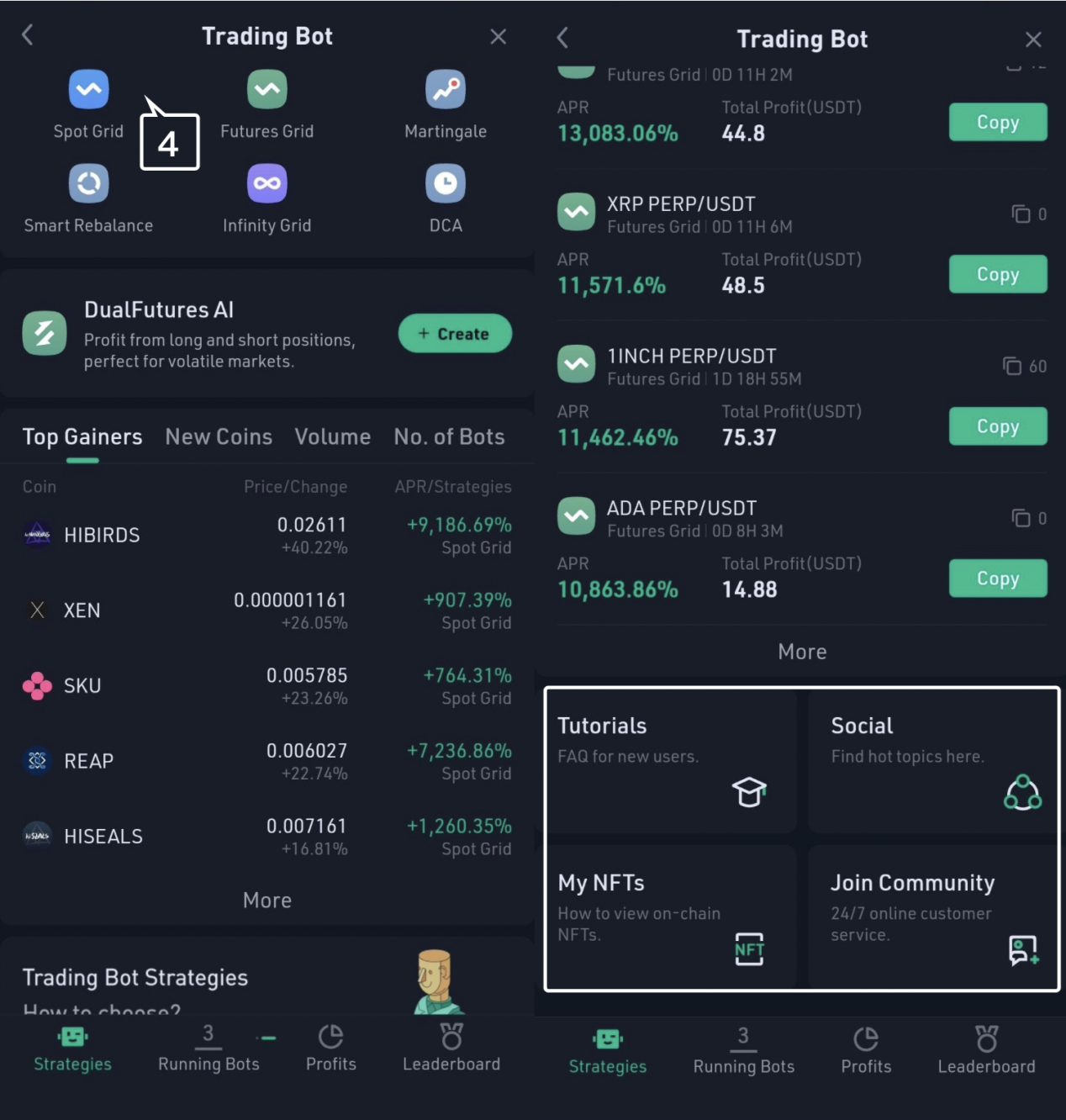

- Click Spot Grid. Scrolling down to the bottom, you can check many tutorials on trading bots and join the KuCoin community.

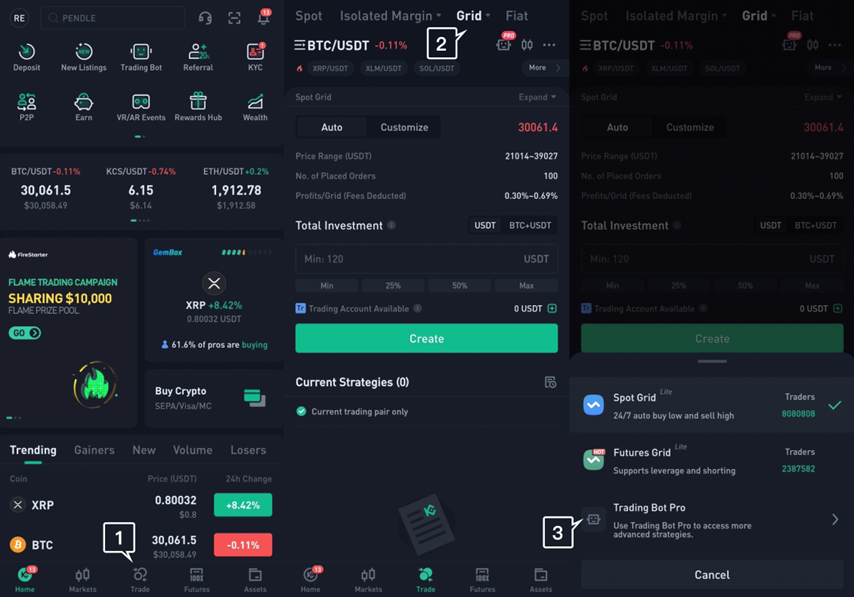

KuCoin Mobile App | Spot Grid Bot Creation Process

- You can see the number of Spot Grid bots currently running on the KuCoin exchange and the highest APR earned by a bot on a given day.

- Click the play icon to start watching a quick video on how to get started with the Spot Grid bot, along with popular do's and don'ts.

- Scrolling down will lead to the list of top users with the highest APR on that day.

- The APR number implies that the bot has made that much return on that day.

- Click the Daily Ranking or the 7-day Ranking tab depending on what you want to see. KuCoin allows you to click the user, copy their settings and apply them to your Spot Grid in a single click. Make use of this option if you are a novice crypto trader.

To get started, click Create at the screen’s bottom.

2.Creating a Spot Grid Bot Using KuCoin AI Parameters

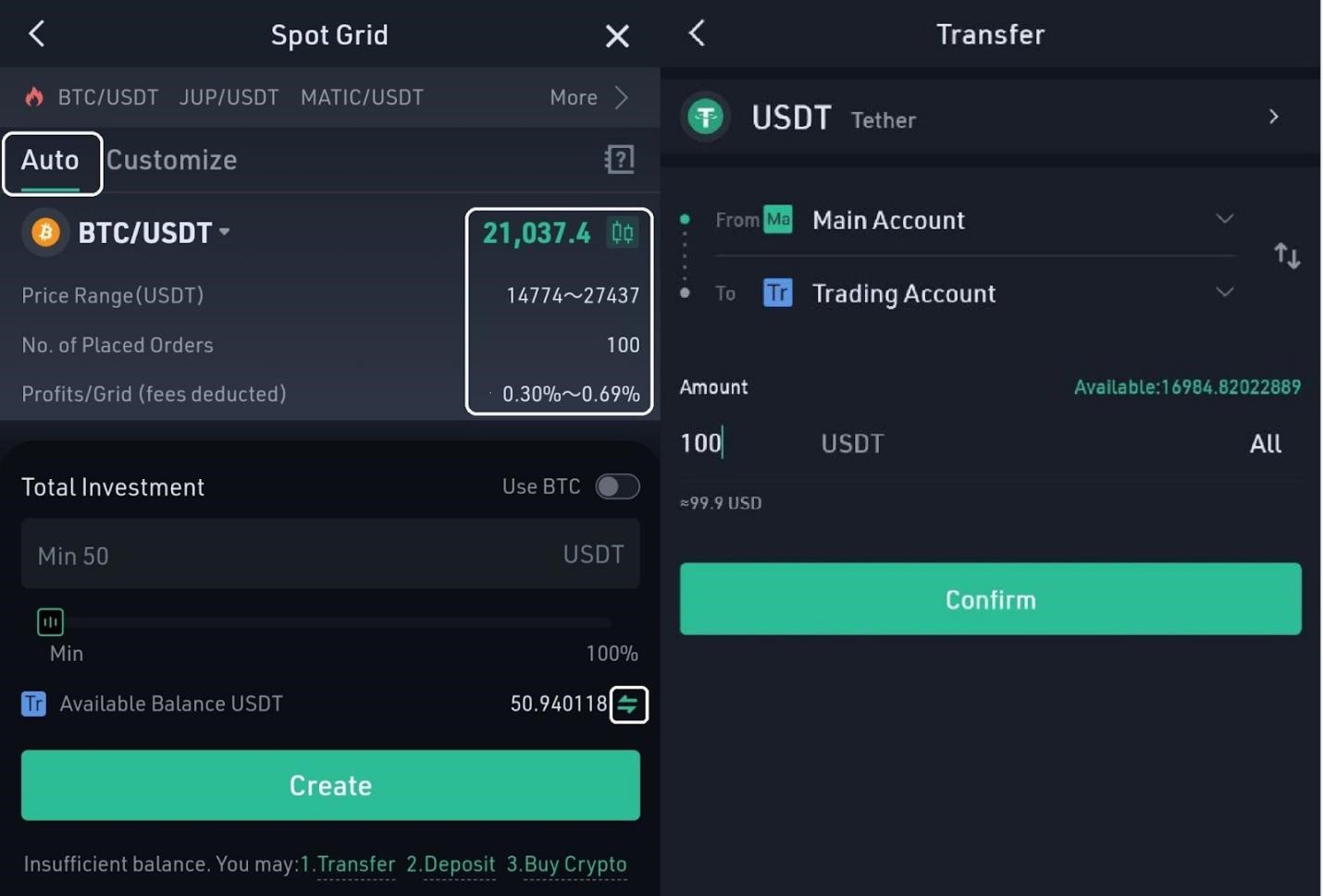

Once you are on the trading bot interface, you can choose between setting your parameters (Customize) and letting the bot take care of everything (Auto). When you select the "Auto" trading feature, the AI will determine the price intervals, the number of levels/grids, etc., based on the historic price action of the selected asset.

KuCoin Mobile App | Spot Grid Bot Creation Process

Select the crypto pair you want the bot to trade, check the details determined by the bot, enter the amount of funds you want to invest in the bot, and click Create.

It is important to transfer your funds from the main account to the trading account to initiate the bot. You can directly transfer funds by clicking the swap button, as shown in the screenshot above.

The minimum amount required to start the bot changes from crypto pair to crypto pair. In the above example, the bot requires a minimum of 10 USDT to start grid trading the BTC/USDT pair.

Unlike other bot services, KuCoin doesn't charge any subscription fee for using the bot. All we charge is the transaction fee during the bot's buying and selling of cryptos on your account.

3.Creating a Spot Grid Bot Using AI Plus

Once you click AI Plus on the top left, you will be redirected to the below page on the KuCoin app.

KuCoin Mobile App | Spot Grid Bot Creation Process

When you select the "AI Plus" trading feature, the bot will automatically adjust the price range in real-time based on indicators such as coin volatility and price fluctuations, ensuring that the coin price always fluctuates within the grid range. This feature allows the bot to generate consistent profits for you. Additionally, AI Plus dynamically adjusts the grid spacing and order amounts based on the coin price volatility, maximizing profit and capital utilization for each grid.

AI Plus also prevents the issue of idle funds when the coin price moves beyond the grid range. When the coin price moves beyond the range, AI Plus places orders above and below the current price to ensure that the coin price continues to operate within the grid range.

4.Creating a Customized Grid Bot On KuCoin App

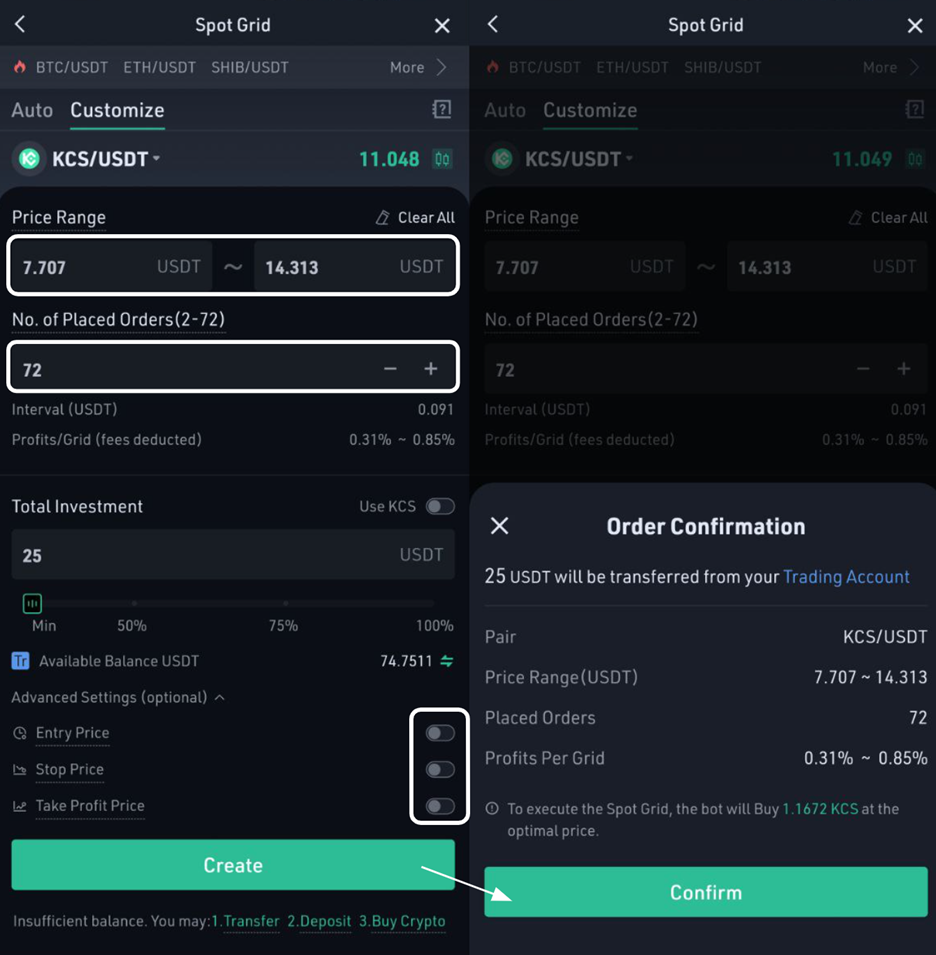

Once you click Customize on the top right, you will be redirected to the below page on the KuCoin app. We chose the KCS/USDT pair to explain the customized bot creation procedure.

KuCoin Mobile App | Creating A Customized Spot Grid

Here, you can see the current price of the selected crypto pair. You can determine your own intervals and the number of levels needed based on your analysis. Click the Tutorial button on the top right to learn more about determining these levels carefully.

The first thing to do is set your price range which involves a low and high. A low price is the lowest price at which the bot buys the asset. If the asset drops below this price, the bot will stop buying. You can also adjust your price range when your price moves beyond your set range.

Similarly, the high price is the highest in the range you have set for selling the asset. If the asset's market price climbs higher than this high price, the bot will stop selling.

As discussed in the earlier sections, the number of orders placed is nothing but the number of grids you want the bot to place on the price chart. The higher the number of grids, the higher the number of orders placed by the bot and vice versa.

KuCoin Mobile App | Order Confirmation Pop-Up Window

Total investment is the funds you want to put in the grid trading bot. The funds will be taken from your KuCoin trading account, and once the bot is done trading, all the funds will be transferred back to your spot account.

Click the Advanced Settings button to set up a specified entry price to start the bot. Once done, the bot will only get started after the asset reaches this entry price. Similarly, you can set up Stop-Loss and Take-Profit levels too.

As always, internal transfers (between internal accounts) are not charged by KuCoin. So you can transfer these funds back and forth any number of times without having to pay any fee.

After deciding which bot you want to create, it’s time to start the bot. After implementing the parameters, clicking the Create button will lead you to the order confirmation pop-up window.

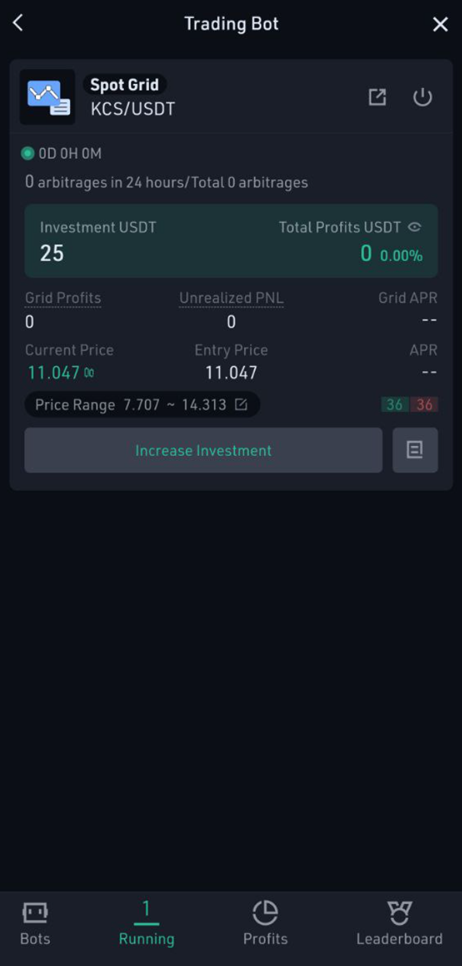

This is the final check before starting your Spot Grid bot. After clicking confirm, the bot will officially start running. You can always check how your bot is doing in terms of the number of trades and profits by clicking on the Running tab at the bottom of the screen.

Running Bot: Overview

5.Checking & Making Changes To The Spot Grid Bot

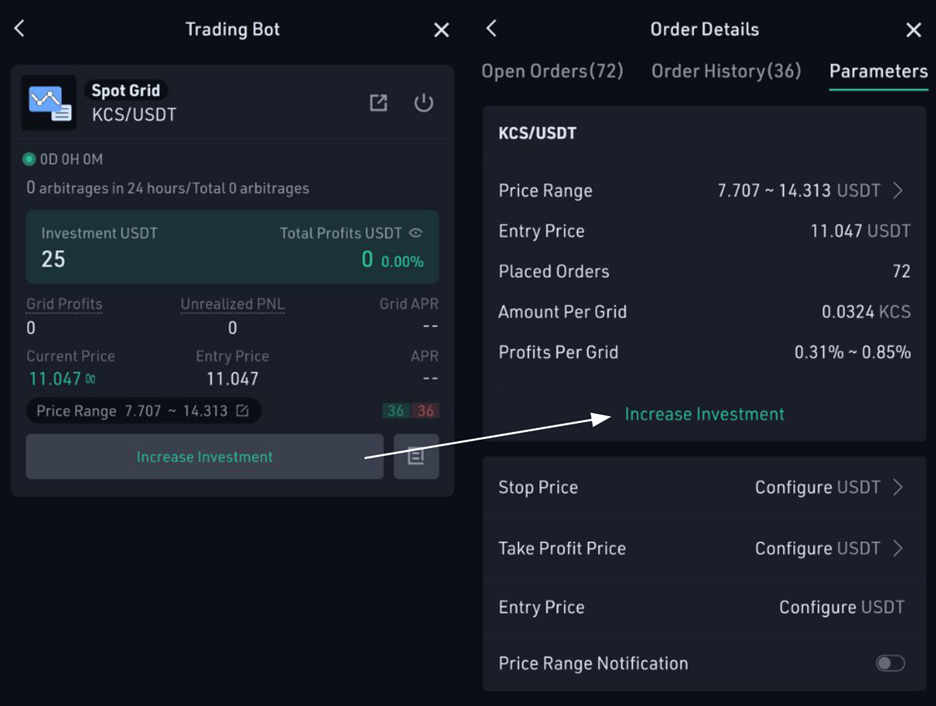

You can review your bot's performance and increase your investments by clicking the Increase Investment button. The Parameters section clearly explains all the details related to your asset class and bot performance.

Adding Investments To Your Spot Grid Bot

6.Exiting The Spot Grid Bot

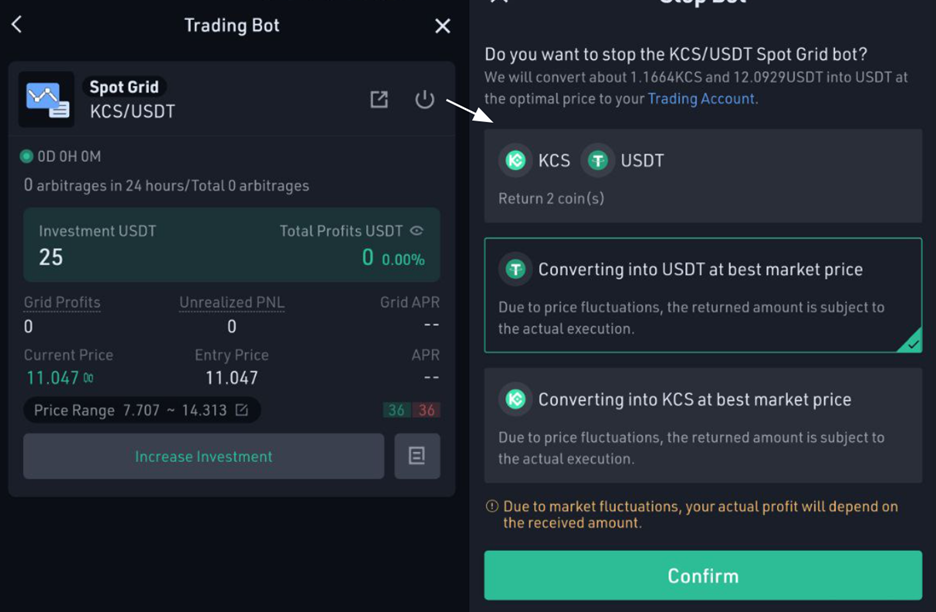

If you wish to quit the bot and withdraw all its funds, you can click the Turn Off sign on the top right corner. You can choose among three withdrawal options, as shown below.

Quitting The Spot Grid Bot

If you pick the first option, the bot will return the existing KCS and USDT tokens separately to your trading wallet. In the second option, the bot converts your existing KCS to USDT at the best market price and transfers all the USDT to your KuCoin trading account. The third option is similar, but instead of KCS, the bot converts your existing USDT to KCS, and the entire KCS will be transferred to your account.

7.Grid Trading Bot — Pro Version

If you are an advanced trader and want to have an even more in-depth visual overview of your trading bot, KuCoin has something for you. You can use the KuCoin Trading Bot Pro version on PC — this will give you the option to view all your grids through a TradingView chart.

Spot Grid Trading Bot — Pro Version

Part 3 - Key To Maximizing Your Spot Grid Bot Profits

1.Which Trading Pairs Are Suitable For Spot Grid Bot?

Trading pairs with high liquidity and high volatility are preferred.

The high liquidity determines the depth of the market. If the liquidity is small, then the trading slippage will be large, and there may be a situation where you can buy but not sell. Generally speaking, mainstream currencies have good liquidity, such as BTC and ETH, which are the preferred targets for grid trading.

High volatility means that the currency is a two-sided market. The greater the volatility of the price, the higher the frequency of its trading, and the more grid profits it earns. Otherwise, if the currency is in a one-sided market, it will only buy or sell all the time, instead of buying low and selling high, then it will not be able to arbitrage. You can refer to the historical volatility of the currency to judge its volatility.

2.How To Pick The Right Entry And Exit Point For Spot Grid?

The right entry and exit points for spot grid depend on a variety of factors, such as market conditions, asset volatility, and risk tolerance. To determine the best entry and exit points, traders can use technical analysis tools like moving averages, relative strength index (RSI), and Bollinger Bands to identify trends and potential support and resistance levels. Fundamental analysis can also be used to evaluate market sentiment and assess the long-term potential of an asset.

For example, a trader using the Spot Grid bot may want to use technical analysis to identify a range of prices in which to place buy and sell orders. The trader can set the grid range and order sizes based on their analysis of market trends and volatility.

3.How To Choose The Correct Range And Number Of Grids For Spot Grid?

Choosing the correct range and number of grids for the Spot Grid bot requires careful consideration of market conditions and risk tolerance. The range should be set based on technical analysis, such as identifying support and resistance levels and assessing market volatility. The number of grids should be set based on the trader's risk tolerance and desired profit potential.

For example, a trader using the Spot Grid bot in a highly volatile market may choose to set a wider range and more grids to take advantage of short-term price movements. Conversely, a trader using the bot in a more stable market may choose a narrower range and fewer grids to minimize risk.

4.What should you do if spot grid bot runs out of range?

It depends on different situations.

If it is because the grid range is too narrow, causing the bot to run out of the range, then you should check your range and adjust it accordingly. The bot may have been set up with a range that is too narrow or may have been configured incorrectly. You can adjust the range and grid settings to ensure that the bot continues to function as intended.

If it is just a market callback, there is no need to stop the Spot Grid bot, but you can keep the bot running and wait for the rise.

If the market is clearly trending down, especially when a bear market signal comes, it is the best choice to close the Spot Grid bot and stop the loss in time, and wait for the bottom at a lower price with funds in hand.

If you do not stop the loss in time and encounter a sharp drop, you can close the Spot Grid bot, but be careful not to sell the coins. At the same time, you can consider starting a coin-based Spot Grid bot, such as ETH/BTC. Based on the principle of hoarding coins, it can continuously increase the number of coins in hand, so as to continuously reduce the average buying price, and wait for the price to return to the previous high.

In addition, it's important to regularly monitor the bot's performance and adjust settings as needed. Market conditions can change quickly, and traders should be prepared to adapt their strategies to ensure the bot continues to generate profits.

Bottom Line

Although the grid trading strategy is proven effective, it requires constant market monitoring. A grid trading bot can greatly help take advantage of the price fluctuations using the grid trading strategy. The KuCoin Spot Grid bot automates this beautiful strategy, works 24/7, is customizable, and, as you saw, it is extremely easy to set up.

So what are you waiting for? Download the KuCoin app now, create a Spot Grid bot, and be a part of 10 million KuCoin bot users worldwide.