How to Earn Passive Income With the KuCoin Margin Grid Trading Bot

You might have heard many stories about people making fortunes overnight through margin trading, right? Margin trading is a high-risk, high-reward investment method. It can carry you to success, yet it can also sink your boat. Without adequate preparation, it becomes a dangerous investment method, with the risk of liquidation looming at all times. This article will introduce important information about KuCoin's Margin Grid trading, including the operating process, to help you reduce the risks associated with margin trading.

Part 1 - What is KuCoin Margin Grid Trading Bot?

1.What is Margin Grid Trading?

Margin Grid trading is an upgraded version of Spot grid trading. It utilizes leverage to enhance capital efficiency and increase profits. It allows for both long and short positions, with the trading targets being Spot commodities, thus reducing the risk of price deviations between Futures and Spot trading. It is suitable for highly volatile, steadily rising, slow bear, or sideways fluctuating markets.

2.Margin Grid Trading has its unique advantages and risks

Its advantages are mainly in two aspects: first, it reduces risk and the probability of liquidation, thanks to its operation principle being similar to regular grid trading, and second, the profits from Margin Grid trading serve as additional margin, enhancing safety; lastly, it increases profits. Even with less invested capital, users still have a chance to earn significant income.

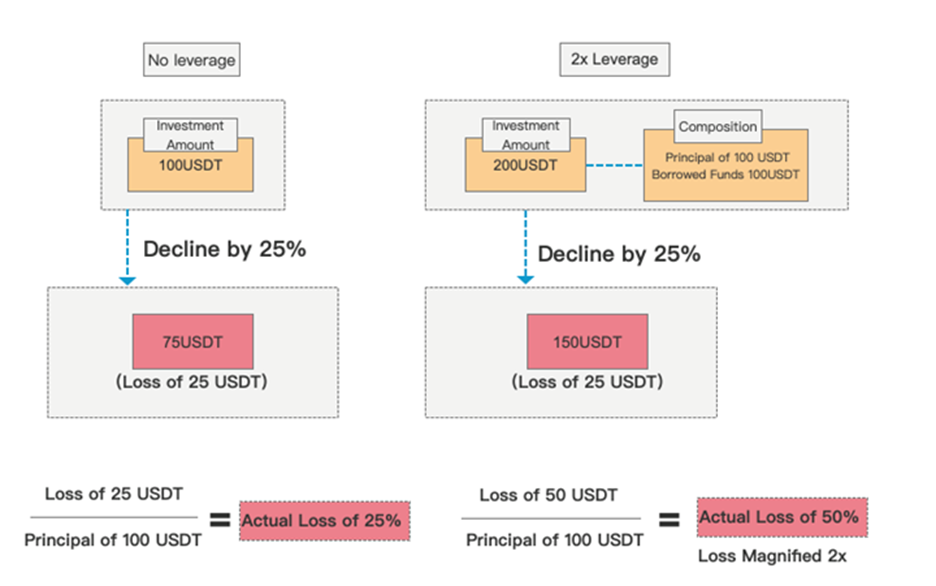

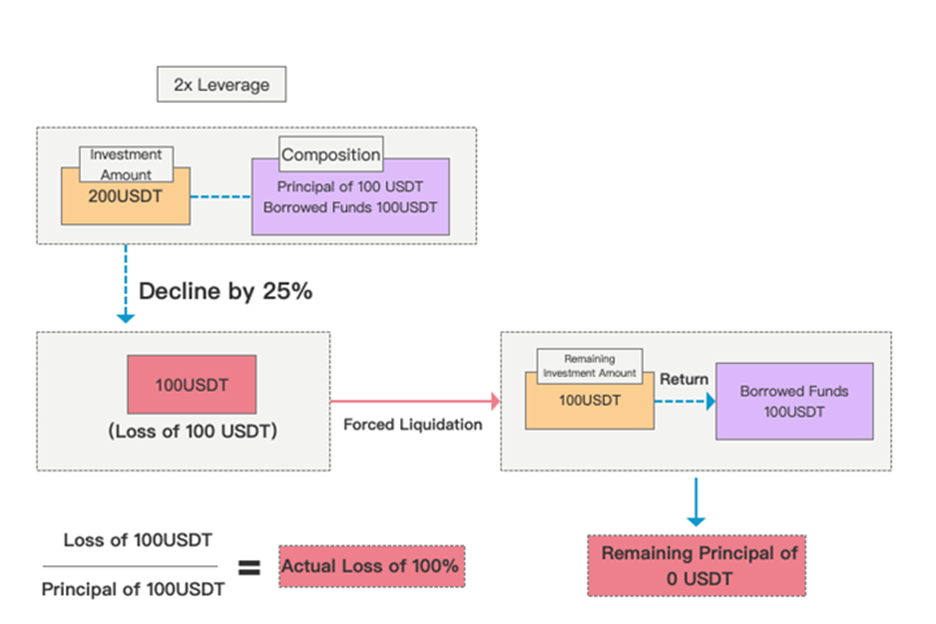

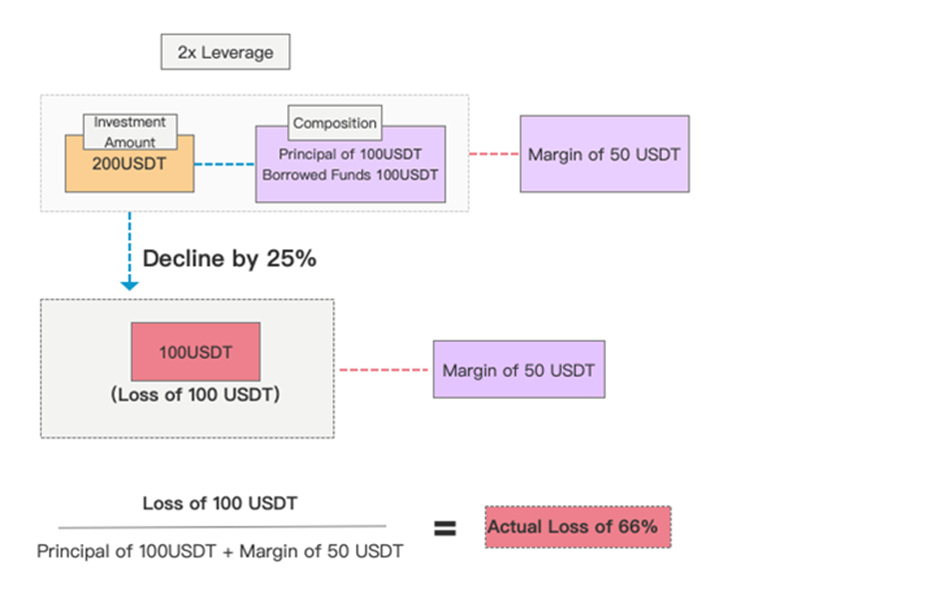

However, Margin Grid trading also has potential risks as it might magnify losses. Since the doubled capital through leverage is borrowed, it must be repaid, and all trading losses must be deducted from the user's principal. Coupled with potentially high daily interest on leverage, if the profit is less than the interest, it is equivalent to a loss. It also carries the risk of forced liquidation. If the loss exceeds the principal, the system will forcibly close the order, the borrowed money must be repaid in full, and at this point, the user's funds may be reduced to zero, which is commonly referred to as liquidation. Therefore, Margin Grid trading requires careful operation and comprehensive risk assessment and preparation in advance.

3.The operating principle of Margin Grid trading

The operating principle of Margin Grid trading is basically the same as that of regular grid trading. It magnifies your invested capital through leverage, thereby amplifying your grid profits. For example, if you have 500 USDT available for grid trading, and you open a 2x leverage, you can invest 1,000 USDT in the grid (where the extra 500 USDT can be considered borrowed from KuCoin). The actual investment is 500 USDT, but the grid profit is generated from 1,000 USDT, so the grid profit becomes doubled. The following figure explains the actual operating principle of the Margin Grid trading robot: When Margin Grid trading is opened, the price rises by 10% profit algorithm. Since opening leverage will borrow funds from the exchange, they must be repaid eventually.

After initiating Margin Grid trading, if the price drops by 10%, you're still obligated to repay the funds borrowed from the exchange.

As can be seen from the diagram, Margin Grid trading can double your profits but also double your losses. Therefore, thorough preparation is a necessity when using this tool.

Part 2 - How To Create Your First DCA Bot?

1.how can you initiate Margin Grid Trading?

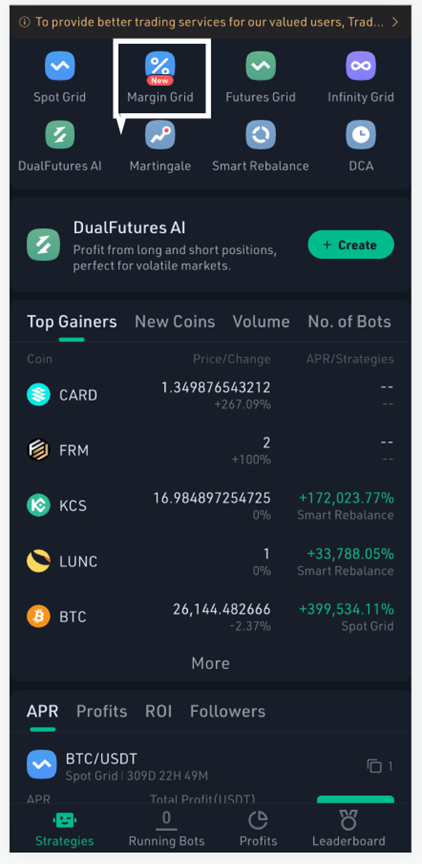

- Open the KuCoin APP and locate the "Trading Bot" on the main page.

2. Choose the Margin Grid trading bot.

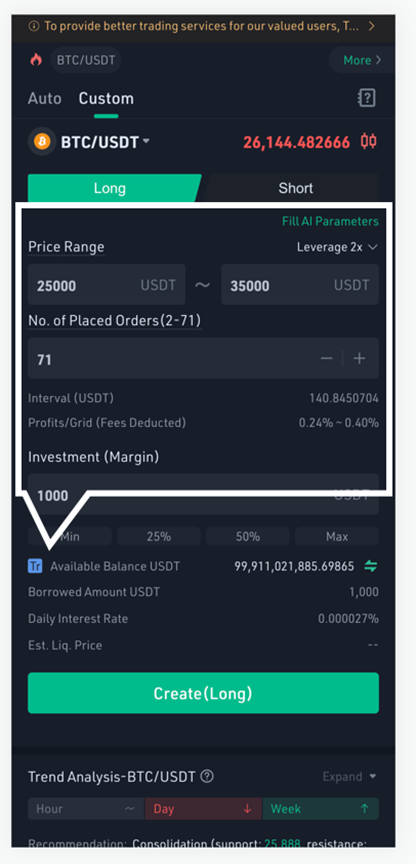

3. According to your risk tolerance, set a reasonable leverage ratio, price range, order quantity, and customize your settings. Please note, don't overlook the risks while pursuing high returns.

4. Finally, click on the "Start Trading" button, and the Margin Grid trading bot will start operating automatically.

2.Points to Note for Margin Grid

The current available borrowable fund pool displays the amount available for borrowing in the fund pool. If the funds in the pool are insufficient, you will not be able to create a Margin Grid bot.

The most important thing in Margin Grid trading is setting the leverage ratio. You need to set the leverage ratio before entering the investment amount. After the setting is complete, your maximum investable amount will be adjusted according to the leverage ratio set. The maximum investable amount = own funds + borrowed funds, that is, if you open a two-fold leverage, half belongs to your own funds, and the other half is borrowed funds.

Creating a Margin Grid requires paying certain interest (collected every hour), and the calculation of interest will be based on the current market daily interest rate (the daily interest rate is floating, determined by the supply and demand relationship of the lending market, and the daily interest rate refreshes every hour).

Another parameter that needs special attention is the estimated liquidation price. When the coin price falls to the estimated liquidation price, the liquidation mechanism will be triggered. However, the advantage of Margin Grid trading compared to ordinary margin trading is that the profits earned by the Margin Grid will become your margin, thus the security of the Margin Grid is much higher than that of the ordinary grid.

3.How to know when you will be liquidated?

Liquidation price

The system will calculate the "liquidation price" through your investment amount, leverage ratio, coin price at the time of order, daily interest rate of the loan, margin, etc.

If today's coin price reaches the liquidation price, it means that your current loss has reached the limit of this order, and you cannot bear more losses, the system will forcibly close the order and execute liquidation to return the borrowed funds.

So, you can monitor the liquidation price to see whether you are close to being liquidated.

4.How to reduce the risk of liquidation?

We can add more margin to prevent the initial capital from being unable to bear the loss when there is a deficit. After adding the margin, the system will recalculate the liquidation price, and you will see the liquidation price drop.

For example:

If the coin price was 150 USDT at the time of order, and the liquidation price is 100 USDT, it means that when the market falls to 100 USDT, you will be liquidated. By adding more margin, the liquidation price can be further lowered. Suppose you add margin when the coin price is 120 USDT, and after adding, the liquidation price becomes 80 USDT, which means your order will be liquidated when the coin price reaches 80 USDT.

Please note that since the added margin will also be used to bear losses, when you are liquidated, the margin will be cleared, so both your initial capital and margin will go to zero.

The margin is only used to bear losses, and does not participate in buying and selling operations, so the added margin cannot help you to magnify your profits.

Regular settings parameters:

Upper Limit Price: When the price is higher than the highest price in the range, the program will no longer execute orders outside the grid range.

Lower Limit Price: When the price is lower than the lowest price in the range, the program will no longer execute orders outside the grid range.

Number of Orders: The range between the upper and lower limit prices is divided into corresponding quotas.

Daily Interest Rate: The current market's real-time lending interest rate.

Estimated Liquidation Price: If the coin price drops to the estimated liquidation price, the bot will forcibly close the sub-account to control risks.

Part 3 - Key To Maximizing Your Futures Margin Grid Trading Bot Profits

1.Who is best suited to use Margin Grid trading?

Margin Grid trading is mainly suitable for two types of users. One is users who want to automatically achieve low buy and high sell in a fluctuating market, saving the hassle of manual trading, and increasing earnings on the basis of spot grid trading. The other is users who hold tokens and want to short when the market falls without complex contract trading.

2.Will the interest paid by the Margin Grid bot automatically be deducted from the total profit?

The interest paid each time by the Margin Grid will automatically be deducted from the floating profit and loss, and the total profit = floating profit and loss + grid profit, so it will ultimately be reflected in your total profit.

3.If my Margin Grid bot is liquidated, will all other assets in my account be lost?

No. The assets you put into the Margin Grid bot are separate from the other assets in your account. Even if your Margin Grid is forcibly closed, it will not affect the other assets in your account.

4.I chose to keep the coins and sell them myself when I closed the Margin Grid, but the bot still sold the coins for me, why is that?

Because part of the assets held by the Margin Grid are borrowed from the platform, the bot needs to return these assets first when it is closed, hence this situation may occur.

Bottom Line

KuCoin has 10 million Bot users globally, and you wouldn't think many people are wrong, would you? One reason, even more are using the trading Grid bot is its ease of setting up. It is also flexible or customizable, depending on how you prefer calling it. Although this bot works 24/7, the volatile nature of the crypto market requires that you often check your thesis and indicators to see if the market has not changed direction. The bot would not change its parameters unless you change it.

We hope you found this guide helpful and informative.