KuCoin Crypto Lending User Documentation

What is KuCoin Crypto Lending?

KuCoin Crypto Lending will match the funds of users who have successfully subscribed when other users have market borrowing needs so that the subscribed users would earn interest.

KuCoin Crypto Lending realizes current subscriptions and redemption on the user's lending side. At the same time, the lending income obtained by users will be based on the actual scale of lending funds and lending interest, distributed to users each hour.

How to use KuCoin Crypto Lending?

Subscribe to earn coins:

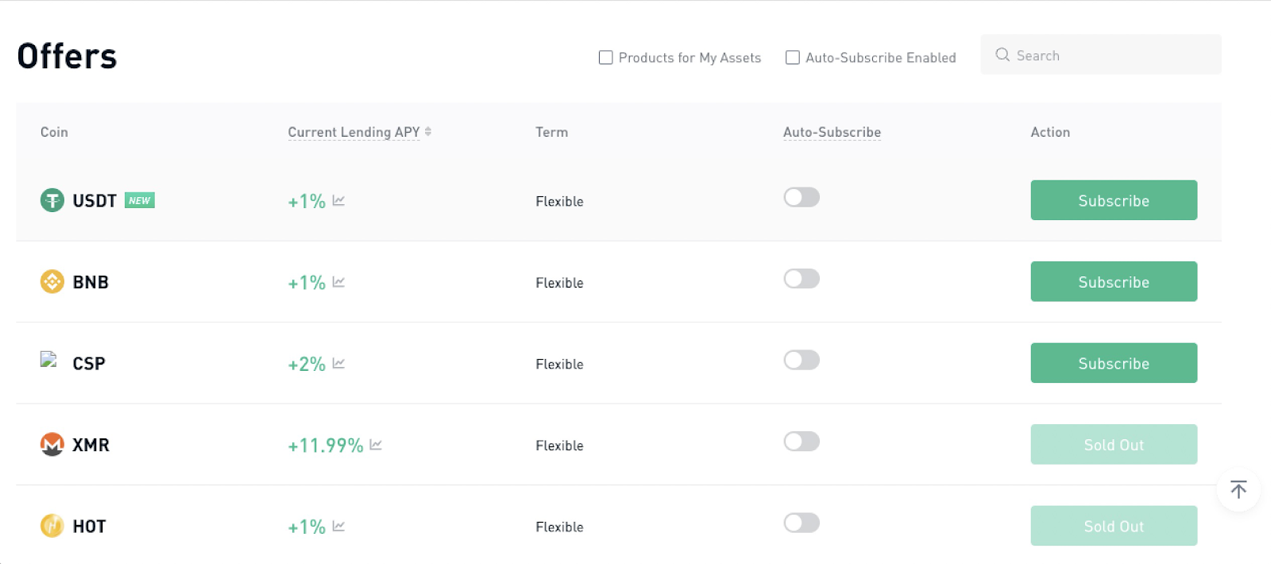

1. Log in to the KuCoin Website > Earn > KuCoin Crypto Lending. You can view all offers supported by the market or by searching for the currency.

2. Select the currency you want to lend and click Subscribe:

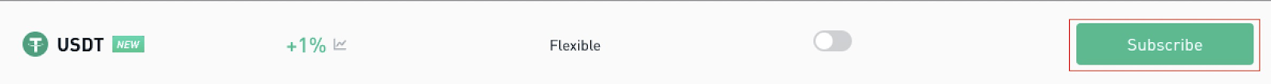

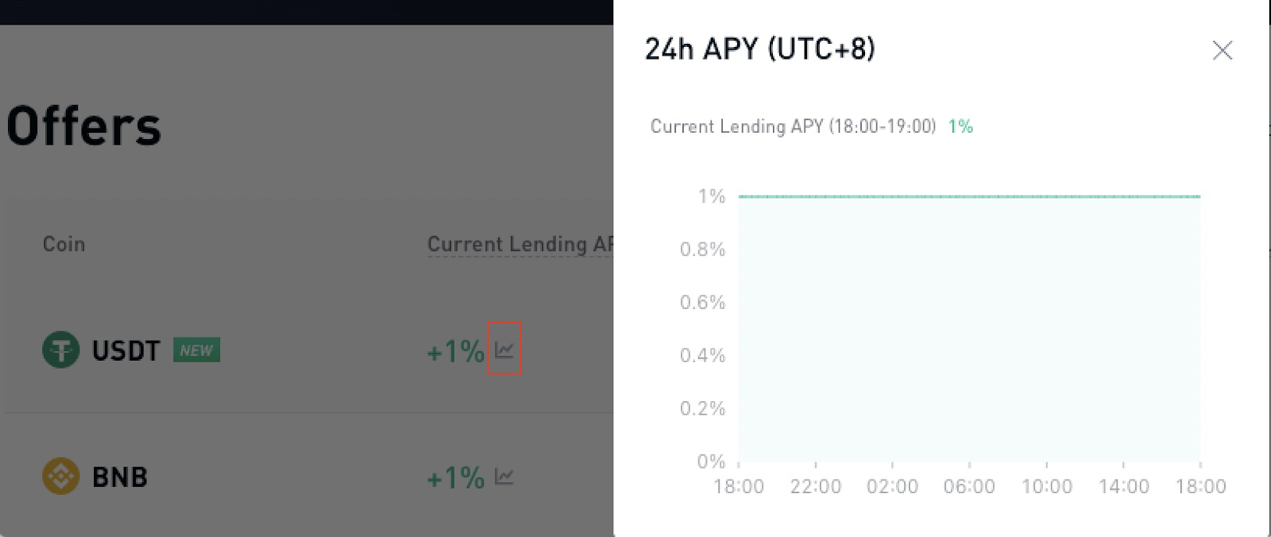

3. Configuring the "Minimum Lending APY" and the subscription amount, agree to the agreement and confirm.

Tip: Funds must be transferred to the Main Account before making subscriptions.

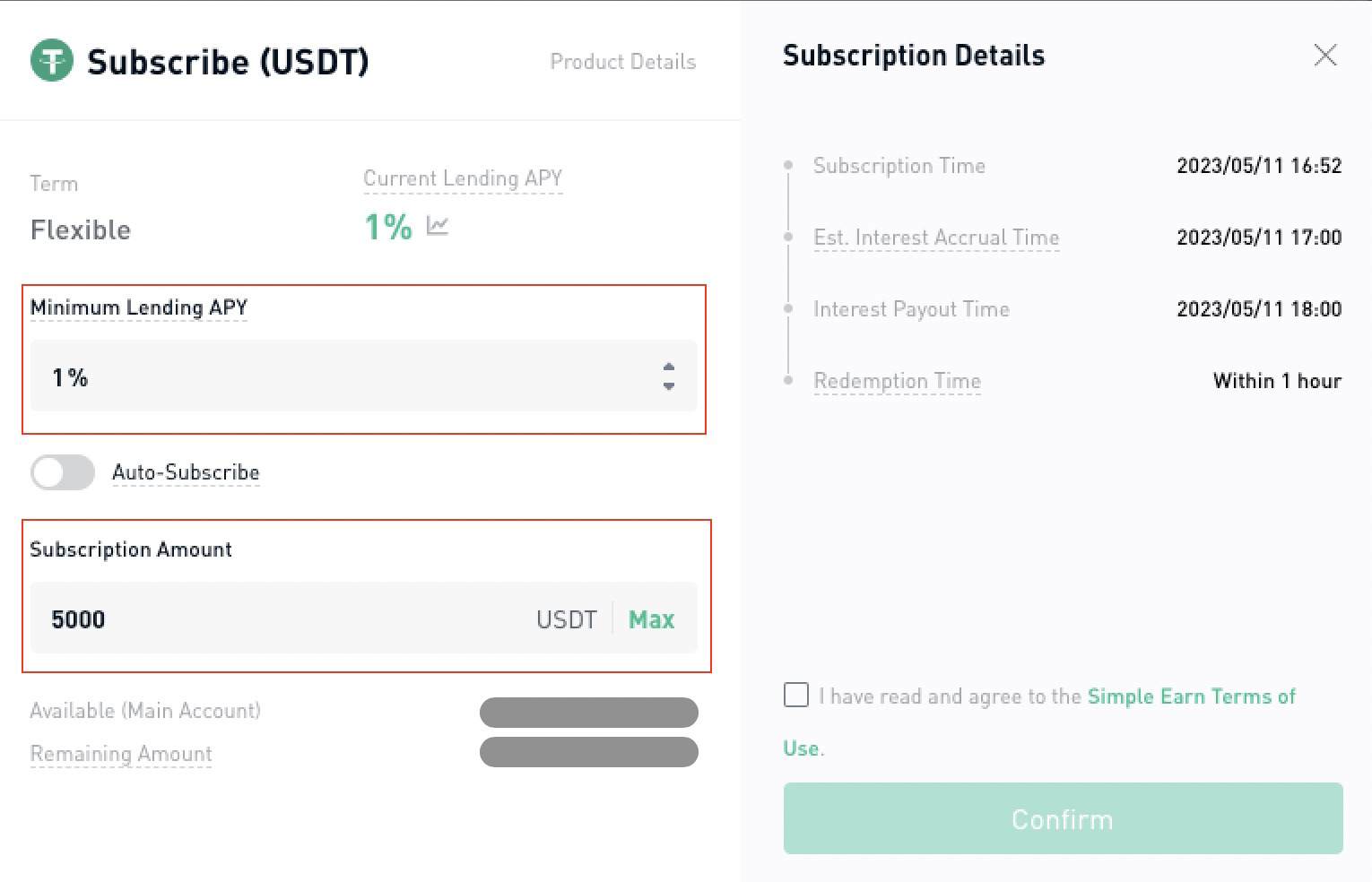

3.1 When your " Minimum Lending APY " is greater than the "Current Lending APY" in the market. This may result in your assets not being able to be lent out in the short term and no interest earnings being generated.

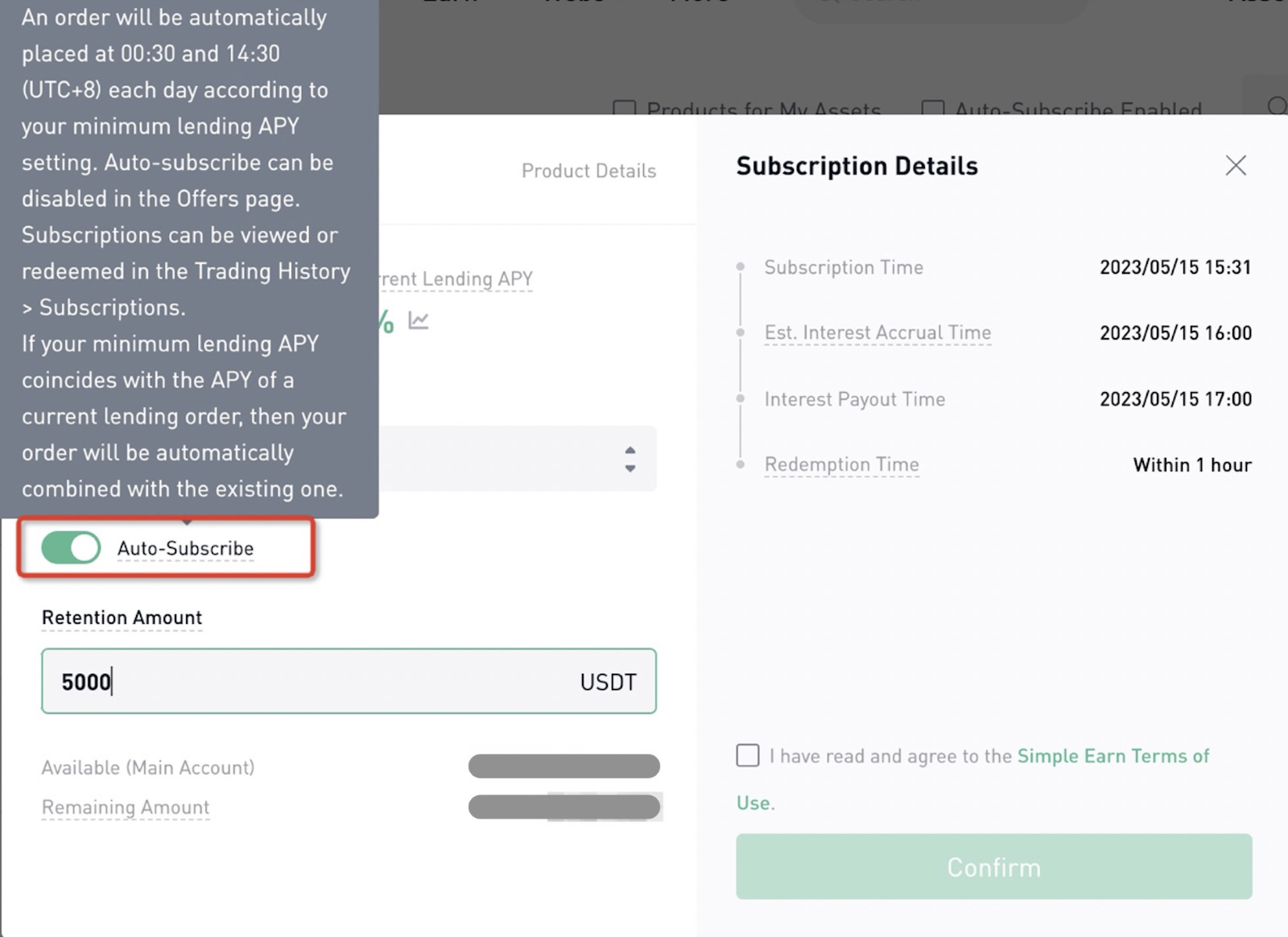

3.2 Users can regularly lend funds in the Main Account by using the "Auto-Subscribe" function.

Tip: Auto-Subscribe is mainly used to assist users in obtaining income. A full subscription will be made except for the reserved asset when the auto-subscription starts.

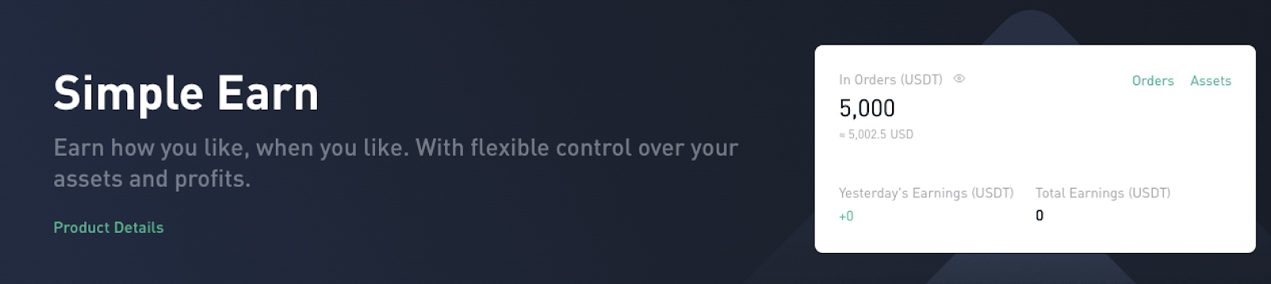

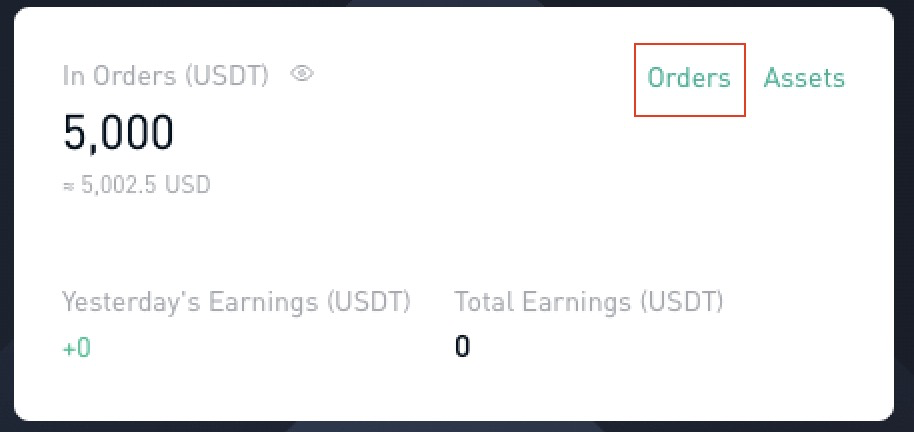

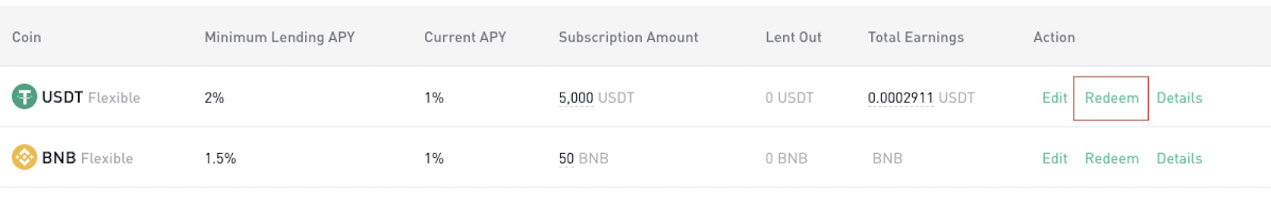

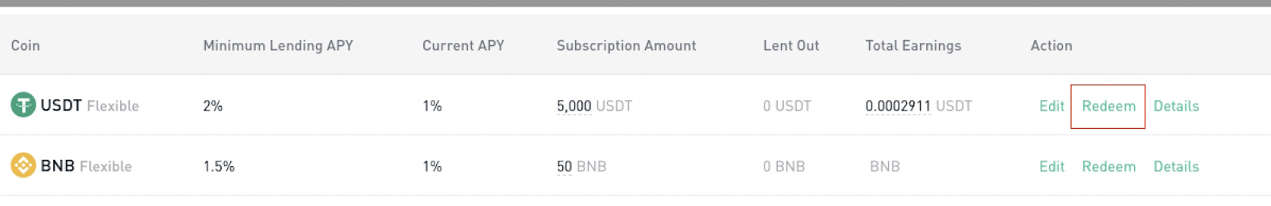

4. Once subscription is successful, you can view the status of the subscribed assets on the main page.

5. You can check the actual lending status of the subscribed assets through the order details.

6. The interest on the lending funds will be distributed to the lenders hourly. Check the Earnings Rules for details.

7. During the subscription process, if your order has not been lent out for a long time, you can modify the "Minimum Lending APY" to increase the probability of lent.

Note: After the adjustment, the "Minimum Lending APY" will take effect after the next full hour.

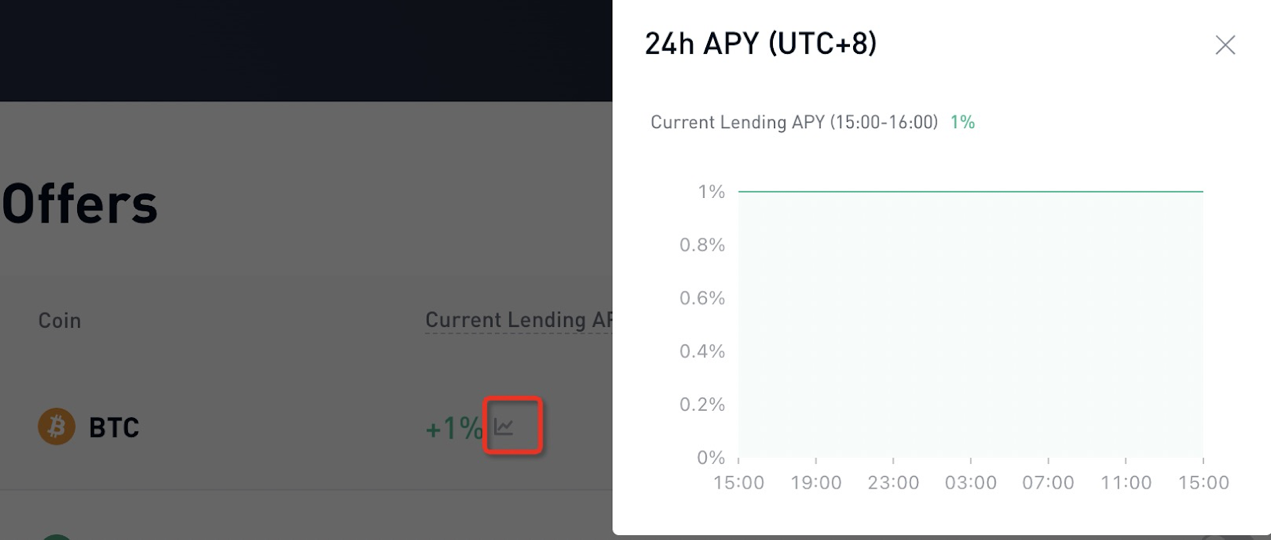

8. By observing the recent loan annualized performance, it will help you set the "Minimum Lending APY" more reasonably.

Redeem Assets

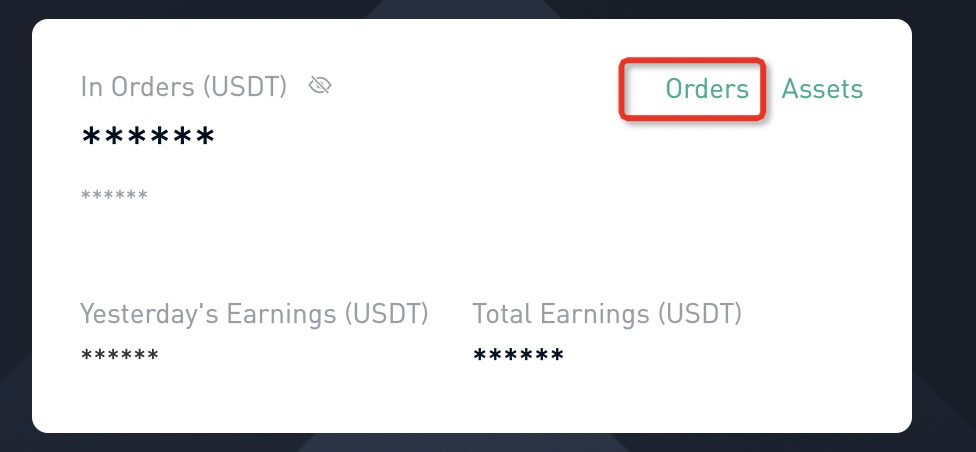

1. Click the orders to check the details:

2. Select the currency you want to redeem, and click "Redeem":

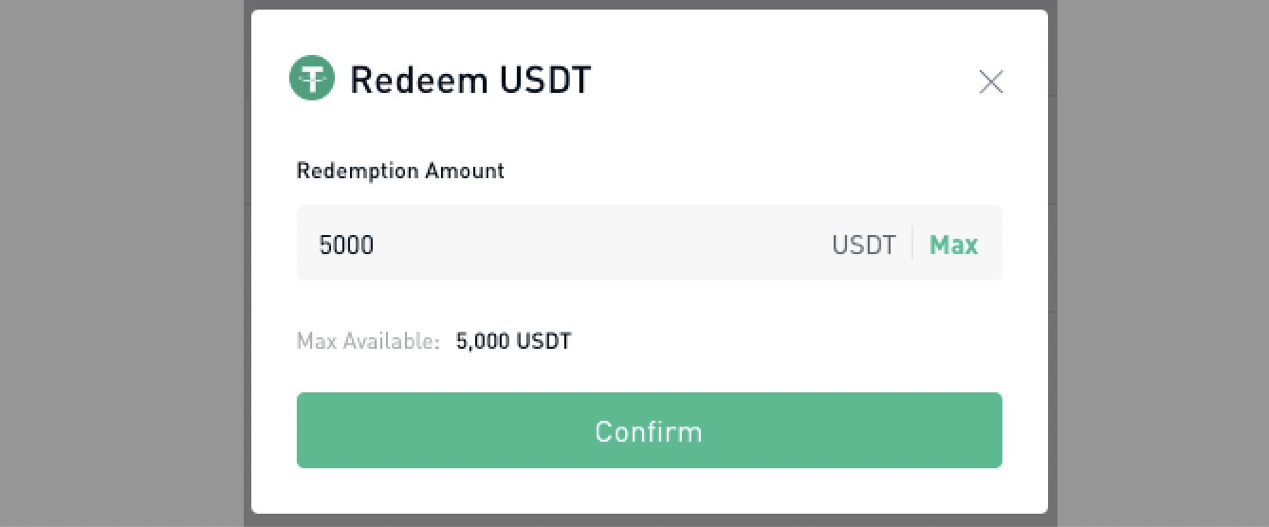

3. Fill in the amount you want to redeem and confirm:

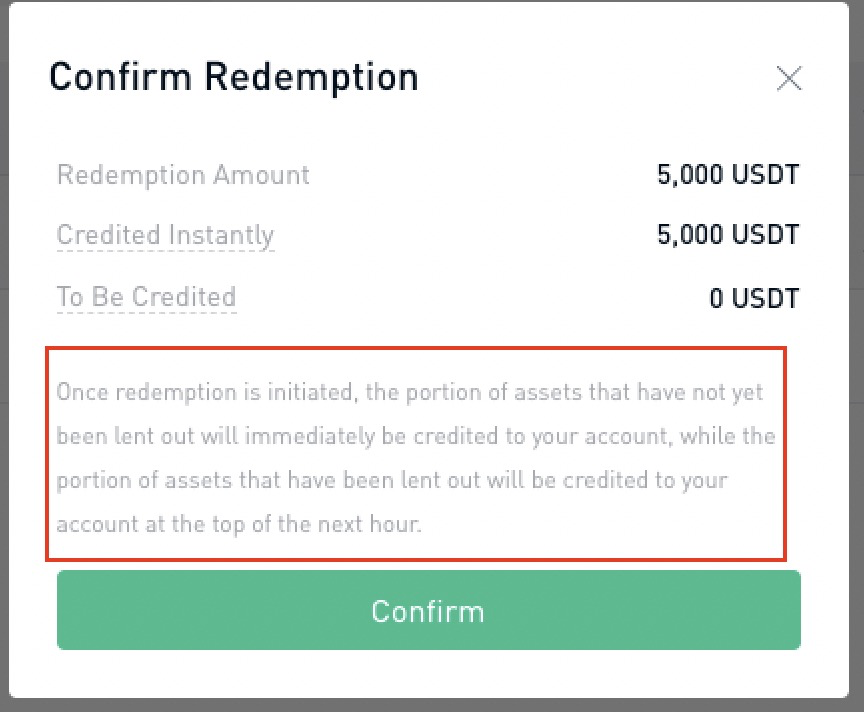

4. The asset redemption time will be executed based on the usage status of the subscribed funds, whether it has not been lent (real-time redemption) or has been lent (on the next hour).

Earning rules

If funds are successfully lent out at the top of the hour, your interest for this hour will arrive within the next hour.

Earnings Structure:

15% of earnings will be deducted to go into the Risk Insurance Fund, with the remaining 85% being paid out to users who lend out their assets. Therefore, interest paid out to users is calculated as follows: (amount lent out) * (current lending APY) / 365 / 24 * 85%.

Subscription & Redemption

Subscription

Supports lending at any time, and the rate follows the system's hourly interest matching mechanism.

Interest Matching:

Interest rate bidding is conducted each hour based on Minimum Lending APY, with the highest bid value being used as the Current Lending APY:

If, Minimum Lending APY < Current Market Lending APY, then assets will be successfully lent out using the Current Lending APY.

If, Minimum Lending APY > Current Market Lending APY, then assets will not be lent out, and no interest will be earned.

If, Minimum Lending APY = Current Market Lending APY, then either a portion of the assets will be lent out or no assets will be lent out.

Redemption:

Assets not lent out will be immediately credited back to your account. Assets that have been lent out will be redeemed at the beginning of the next hour.

How to Borrow Through KuCoin Margin “Crypto Lending 2.0”?

Auto-Borrow

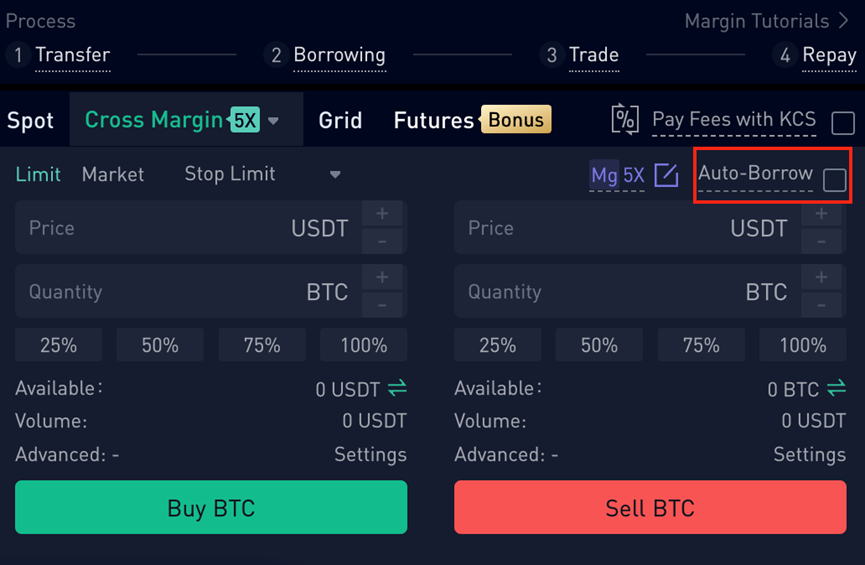

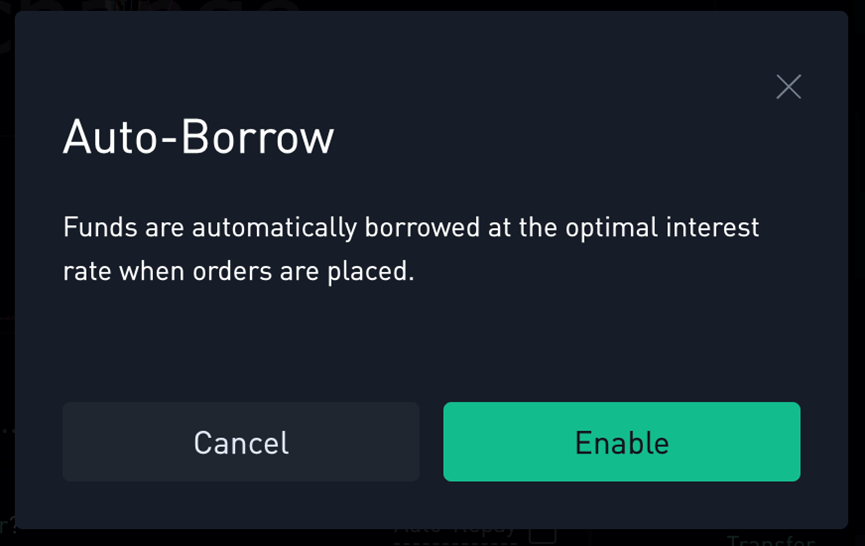

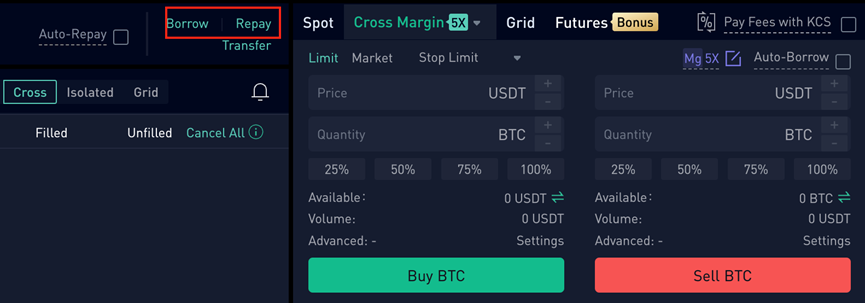

1. Select [Auto-Borrow] on the Margin trading interface (the same as the app);

2. After confirming, your order will be auto-borrowed at the current market rate, which changes hourly.

Manual Borrow

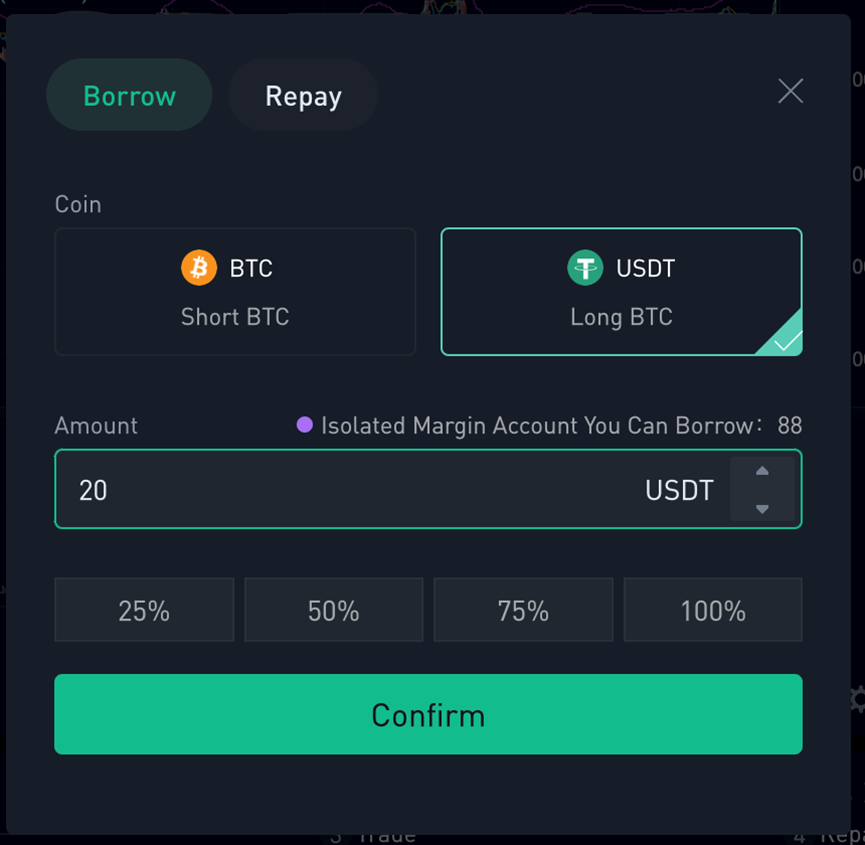

1.Select [Borrow] on the Margin trading interface (Manual Borrow on app);

2. Confirm the amount of the token you want to borrow (please also confirm your expected borrowing account if Isolated/Cross Margin before borrowing);

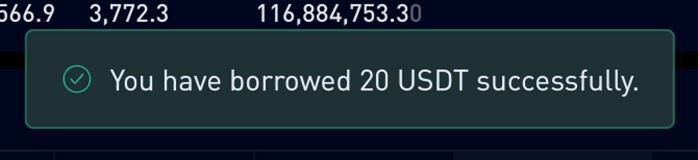

3. You will then successfully borrow the corresponding token to the designated account (Cross Margin/Isolated Margin);

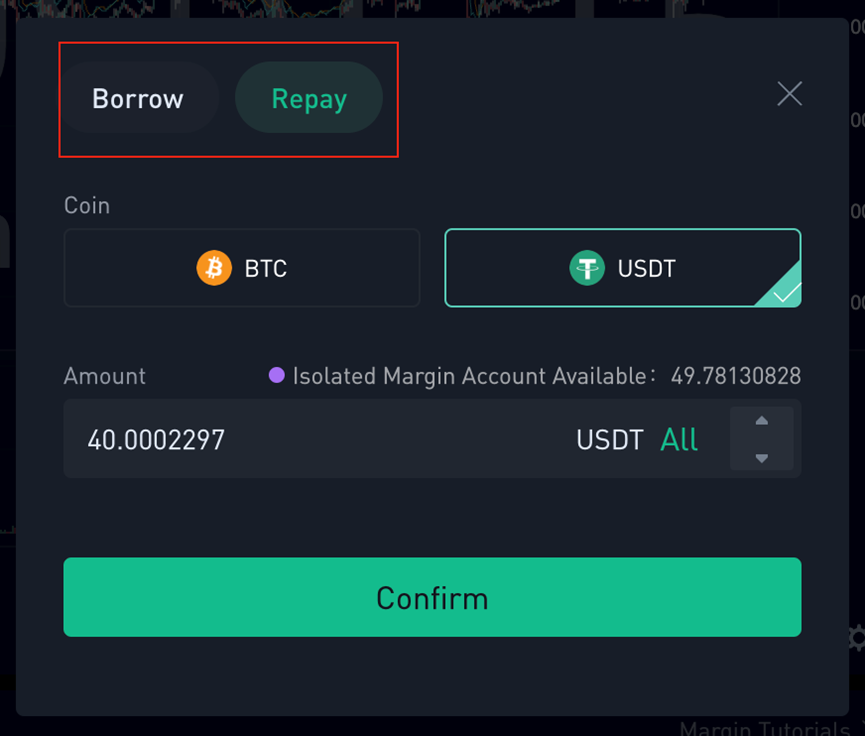

4.The repayment process is the same as the borrowing. Tick the repayment button to complete the repayment process.

*Due to the launch of Crypto Lending 2.0 on the website, the real-time interest rate cannot be seen while placing the order. We will upgrade the display soon. However, it does not affect the users' borrowing, and the loan will be borrowed at the current market real-time interest rate, which changes hourly with market interest rate fluctuations.