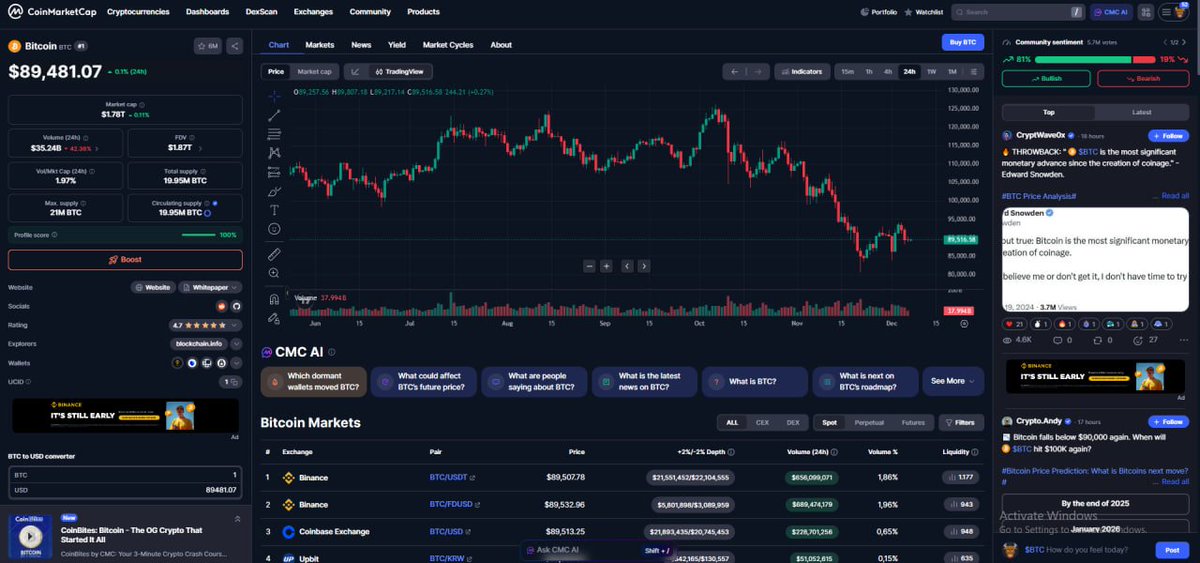

**Key Factors Driving $BTC Volatility** **ETF Inflows & Institutional Adoption:** Many analysts believe that the continuous inflows into spot Bitcoin Exchange-Traded Funds (ETFs), along with the increasing acceptance by major financial institutions, are the primary drivers behind the bullish trend projected for 2025. The most optimistic forecasts suggest that this support could push BTC to levels between $125,000 and $200,000 in 2025. **Four-Year Market Cycle:** Historically, the cryptocurrency market is considered to be entering a new growth cycle following the Bitcoin Halving event, possibly peaking in mid-to-late 2025 or early 2026. **Scarcity and Long-term Investor Confidence:** Bitcoin's scarcity model (with a maximum supply of 21 million) and the growing confidence of long-term investors are seen as solid support for its price, reducing selling pressure. **Technical Analysis:** Analysis indicates that BTC is currently trading above the 200-day moving average (200-day EMA), which supports a scenario of stability and recovery, barring any significant support level breakdowns. Some models predict that price levels between $120,000 and $125,000 could be achieved by December 2025 if macroeconomic conditions and capital inflows remain favorable. **Conclusion:** Although there has been minor volatility over the past 24 hours, the overall trend and market expectations for December 2025 remain bullish, supported by structural factors such as ETFs, institutional adoption, and Bitcoin's scarcity model. *Disclaimer:* The above data is for reference purposes only and does not constitute financial advice. Cryptocurrency prices can be highly volatile, and users should conduct their own research before making investment decisions. @EdgenTech #CryptoMarkets

Share

Source:Show original

Disclaimer: The information on this page may have been obtained from third parties and does not necessarily reflect the views or opinions of KuCoin. This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information.

Investments in digital assets can be risky. Please carefully evaluate the risks of a product and your risk tolerance based on your own financial circumstances. For more information, please refer to our Terms of Use and Risk Disclosure.