SUI Boost Quest: Explore & Airdrop Rush

SUI Boost Quest: Explore & Airdrop Rush

Why SUI Ecosystem Demands Your Attention?

The SUI ecosystem is demonstrating explosive growth:

-

TVL Surge: Total Value Locked (TVL) soared past $2.2B

-

User Boom: Daily active users spiked 145% – unprecedented community engagement

-

Project Momentum: Ecosystem projects like WAL showcase massive adoption:

✓ 100+ integrations

✓ 1.1PB of data processed

115,000 USDT Giveaway

07/21/2025 10:00 ~ 07/28/2025 10:00 (UTC)

07/21/2025 10:00 ~ 07/28/2025 10:00 (UTC) 07/21/2025 16:00 ~ 07/28/2025 16:00 (UTC)

07/21/2025 16:00 ~ 07/28/2025 16:00 (UTC)SUI Market Strategies

Trading Bots Make Your Efforts Go Further

In the current market environment—marked by frequent fluctuations and uncertain trends—SUI, as a highly volatile asset, presents ideal conditions for deploying a Martingale strategy. Whether you choose the KuCoin Spot Martingale Bot or the Futures Martingale Bot, both are designed to average down entry prices during pullbacks and capitalize on rebounds for quick recovery and profit.

Compared to manual trading, KuCoin’s Martingale Bots offer automated execution and smart risk control, making them perfect for users who want to catch SUI’s price swings without constantly monitoring the market. If you’re expecting a short-term rebound or have a clear directional view, the Futures Martingale Bot can help you amplify profits. For more conservative traders, the Spot Martingale Bot provides a safer way to capture wave opportunities.

Volatile market + high-momentum token + smart strategy = your best shot at riding the waves.

Start your KuCoin Martingale Bot now—SUI’s market swings are your profit opportunity!

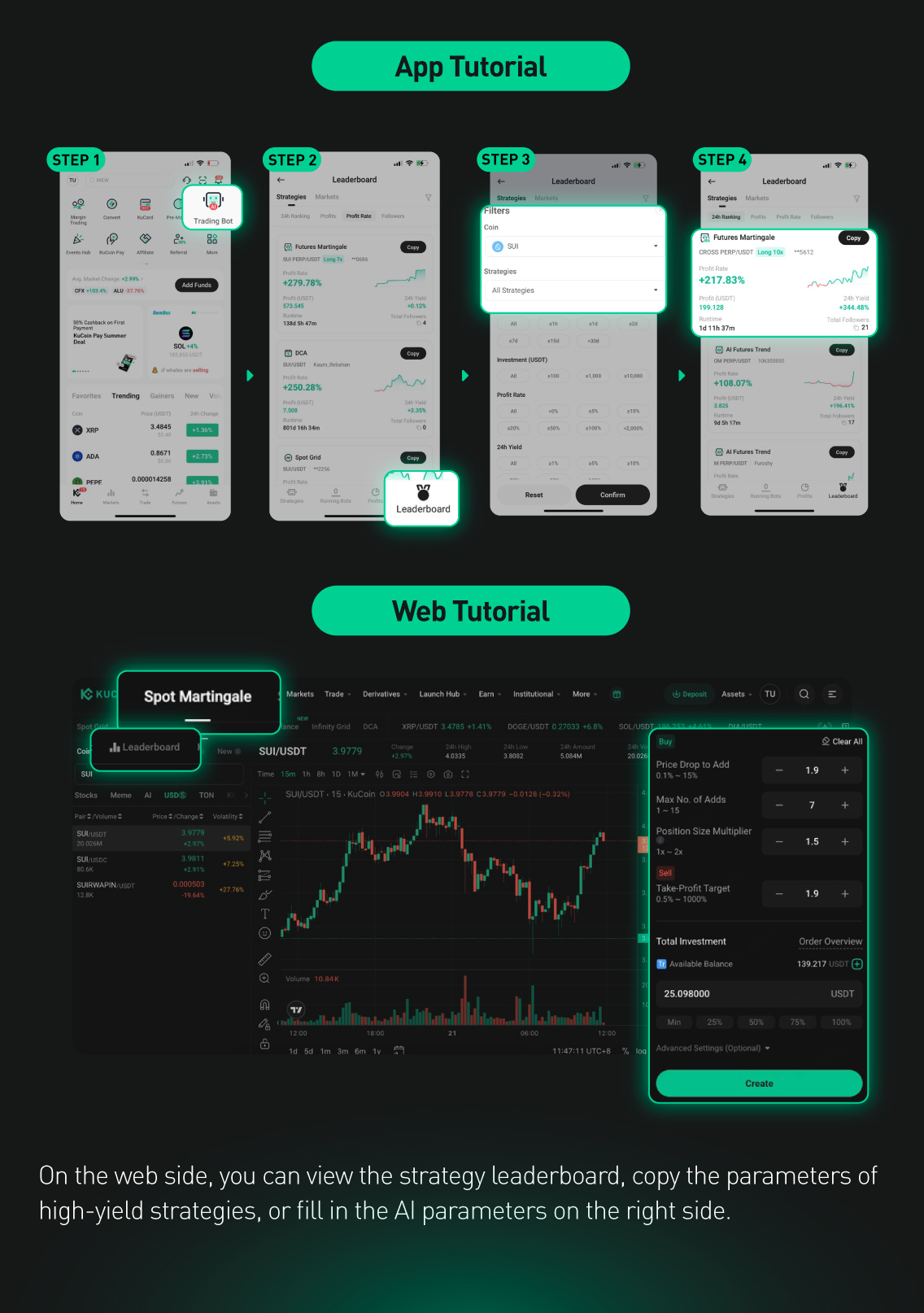

You can also use the KuCoin Bot Strategy to copy the robot strategy of the trading expert with one click, easily achieving a 550% return rate. [See below about how to copy] ⬇️

Learn More About SUI Ecology

Overview of Key Projects in the SUI Ecosystem

SUI's robust infrastructure has attracted a wide range of innovative projects, together building a vibrant and comprehensive ecosystem. Below is a brief look at some of the key projects:

| Project | Category | Key Function |

| Walrus (WAL) | Decentralized Storage | Programmable Data Storage & Availability |

| Cetus (CETUS) | DEX | Efficient Concentrated Liquidity Trading |

| Navi Protocol (NAVX) | Lending Protocols | One-Stop Lending Solution |

| Haedal Protocol (HAEDAL) | Liquid Staking | SUI Liquid Staking and Yield |

| Bluefin (BLUE) | Decentralized Derivatives Exchange | High-Performance On-Chain Trading |

| Hippo (HIPPO) | Meme Coin | Community-Driven Charity Meme coin |

| DMC | Decentralized Auto Finance | On-Chain Auto Trading and Tracking |

TVL and User Activity Surge

The SUI ecosystem is experiencing explosive growth, with Total Value Locked (TVL) reaching an impressive $2.2 billion—signaling strong capital inflow and rising confidence from users and protocols. User engagement is also surging: according to Artemis, SUI's daily active users (DAU) recently jumped 145%, reflecting a sharp rise in on-chain activity and new user interaction.

This growth aligns with a broader trend. As of April 2025, over 123 million user addresses had been created on SUI, and monthly active addresses quadrupled to over 40 million by mid-April. By July 14, 2025, SUI had 835,000 daily active addresses and 4.1 million daily transactions, with a market cap of $13.4 billion.

Key Ecosystem Developments and Market Trends

Since early 2024, SUI has been one of the best-performing assets in the crypto market, outperforming Bitcoin, Ethereum, and Solana.

A major milestone for mainstream adoption is the recent 19b-4 filing by Nasdaq for a U.S. spot SUI ETF, marking the SEC’s formal review process. Additionally, Grayscale Research has listed SUI as an “asset under consideration” for future investment products. These developments signal growing institutional interest and potential capital inflows. ETFs offer regulated, accessible exposure to SUI, expanding the investor base and highlighting its maturity and compliance progress.

The SUI Foundation continues to drive ecosystem growth, reallocating 117 million SUI tokens to support developer grants and key infrastructure like DeepBook (SUI’s shared liquidity layer) and DeFi protocols. In BTCfi, SUI made significant strides—tBTC is now live, bringing $500M in Bitcoin liquidity. This leverages SUI’s scalable framework to unlock Bitcoin’s DeFi potential securely and efficiently.

The upcoming launch of Ika in mid-July will allow direct trading of any crypto asset (from BTC to XRP) on SUI—no bridging or wrapped tokens required. SUI’s BTCfi efforts and Ika’s seamless trading highlight SUI’s strategy to integrate with the broader crypto market, not remain isolated. This boosts SUI’s utility, capital efficiency, and network effects, making it a more attractive and versatile platform.

KOL Perspectives & Market Outlook

SUI, as a Layer 1 blockchain designed for global scale and mass adoption, holds a unique position. It is driven by an experienced team from Meta’s Diem project. Its object-centric architecture, Move language, and horizontal scaling are crucial for high-performance consumer applications such as gaming, payments, and AI. SUI’s rapid expansion has been validated by soaring TVL, daily active users, and a diverse ecosystem covering DeFi, storage, and niche applications.

Growing institutional recognition through strategic initiatives like ETF progress and BTCfi positions SUI as a key player in the evolving crypto landscape. Cryptocurrency analysts and opinion leaders generally maintain an optimistic outlook for SUI’s price performance in 2025, driven by its strong fundamentals and ecosystem growth.

| Source | Forecast Ranges |

Key Insights |

| CoinCodex |

$10.42 – $15.92 (2025.6 peak: $13.42) |

Strong upside potential |

| Changelly |

$9.95 – $10.02 (2025.09 avg: $9.95) |

Stable growth expectations |

|

Investing- Haven |

$2.55 – $8.75 (2025 full-year range) |

$3.33 as critical Fibonacci level |

| Flitpay |

$3.44 – $11.50 (2025 range) |

Wide volatility range |

| CCN.Com |

$1.71 – $10.80 (2025 range) |

Technically supported bullish outlook |