DeFi 101 - A Comprehensive Guide to the World of Decentralized Finance (Part 2/2)

In our first part of the DeFi 101 series, we introduced decentralized finance and discussed its history, importance, smart contracts as DeFi powerhouse, and how DeFi will eat away the world of traditional finance like a piece of cake.

In this second and final part of the DeFi 101 series, we will discuss financial primitives (money-legos), some of the most prominent DeFi applications, and the current state of the DeFi ecosystem.

Financial Primitives - The DeFi Building Blocks

Financial primitives are the building blocks, or money legos, that serve as the foundation for the financial services industry we see today. DeFi provides us with an entire alternative financial system and has the following financial primitives built into smart contracts.

Stablecoins - A digital asset that is stable in value.

Credit - Lending and borrowing, and the ability to earn interest on idle assets.

Decentralized Exchanges - Provide liquidity, and the ability to swap two different assets.

The whole DeFi ecosystem is standing on these three financial primitives. When you combine them in a proper way, you get an alternative decentralized financial services industry that is open, transparent, trustless, and borderless.

Stablecoins

As the name suggests, stablecoins provide a stable digital asset. Stablecoins are cryptocurrencies pegged to a stable external asset (like the Fiat US dollar) or a basket of different assets that limit price fluctuations and volatility.

Stablecoins are the backbone of DeFi. In just five years, stablecoins have surpassed a total market capitalization of $86.43 billion. The graph below shows the growth of the nine biggest stablecoins by their market cap.

Source: CoinMetrics

There are four types of stablecoins:

Fiat-backed - The price of a fiat-backed stablecoin is pegged to fiat currency like the US Dollar. Examples include USDT, USDC, PAX, and GUSD.

Crypto-backed - These are the kind of stablecoins backed by overcollateralized crypto assets. The over-collateralization is there because the underlying crypto assets (e.g., ETH, BTC) are volatile. Examples include DAI, sUSD, aDAI, and sUSD.

Commodity-backed - The kind of stablecoins backed by a commodity like gold or silver. Examples include DGX, XAUT, and GLC.

Algorithm-backed - These are the stablecoins backed by algorithms that control the price and sustain it at a certain level. Unlike others, these stablecoins don't require any collateral. Examples include LUNA, AMPL, ESD, and YAM.

Many stablecoins today also use a hybrid model. They use a combination of the categories as mentioned earlier to achieve a stable price and less volatility. RSV is one of the hybrid stablecoins that use a pool of different assets, including crypto-backed and fiat-backed assets like USDC and DAI.

One unique property of stablecoins is that they are 'chain agnostic' because they are pegged to external assets. They can exist on many different blockchains, e.g., Tether is a popular stablecoin, and it co-exists on Ethereum, TRON, OMNI, and a few other platforms.

Let's briefly discuss two of the most popular and distinct stablecoins in the market today; Tether (USDT) and DAI.

Tether (USDT)

Tether is currently the most popular and dominant fiat-backed stablecoin. Launched back in 2014, Tether wanted to re-imagine how we can digitally interact with fiat assets.

Tether isn't just one single stablecoin, but a platform with three different stablecoins pegged to US Dollars (ticker: USD₮), Euros (ticker: EUR₮), and the offshore Chinese yuan (ticker: CNH₮). Tether is gaining significant momentum in the crypto and DeFi ecosystem and has already surpassed $50 billion in market capitalization.

Source: CoinMetrics

As mentioned earlier, Tether tokens are chain-agnostic, and they exist on Bitcoin (Omni and Liquid Protocol), EOS, TRON, Ethereum, Algorand, OMG, and SLP blockchain platforms.

Tether tokens are backed by to the underlying assets in a 1:1 ratio (e.g., 1 USD₮ = $1). The team behind Tether stated that they focus on transparency, and that they publish a daily record of bank balances in the Tether reserves. Reputed third-party auditors have also audited them more than a couple of times in the past and found no discrepancy.

Since Tether exists on many different blockchain platforms, you can use any of the supported wallets. However, you can't use these wallets interchangeably, which means that you can't send Ethereum-based Tether to an Omni address and vice versa.

DAI

DAI is one of the earliest crypto-backed stablecoins out there. It was created by The Maker Protocol (MKR), and built on the Ethereum blockchain. The Maker Protocol generates DAI by leveraging ethers or any Ethereum-based asset approved by MKR holders as collateral.

DAI is also soft-pegged to the US Dollar, and together with the crypto-collateral, 1 DAI always equals to $1. DAI is over-collateralized, meaning that for every DAI token, the locked collateral value is higher, as it is trying to account for volatility of the underlying crypto assets as well.

DAI is one of the largest crypto-backed stablecoins, with a total market capitalization approaching $4 billion. DAI is among the most popular stablecoins in DeFi applications, and due to a lower supply but higher demand, DAI attracts the best APYs in crypto credit markets (lending/borrowing).

Source: CoinMetrics

The Maker Protocol generates and issues DAI through unique smart contracts called Collateralized Debt Positions or CDPs. You can think of CDPs as secure vaults where users can lock their collateral and get DAI tokens in return. To prevent liquidation, DAI is over-collateralized (e.g., lock $400 worth of ETH to get $200 worth of DAI).

DAI holders who locked their collateral can reclaim their locked assets by returning the DAI loaned to them. If you don't want to lock your collateral, you can also buy DAI from a broker or an exchange platform like KuCoin. To save, spend, and receive your DAI, you need an Ethereum wallet that supports ERC-20 tokens (since DAI is an ERC-20 token).

Credit (Lending & Borrowing)

The credit market for lending and borrowing is the second financial primitive for the DeFi ecosystem. An entire banking sector worldwide stands on these credit markets, where lending and borrowing make up a significant portion of their business model.

The lending segment is the largest DeFi segment, with more than $39.25 billion locked in various DeFi lending protocols. As a comparison, the total value locked in DeFi stands at $77.32 billion at the time of writing, meaning that DeFi lending protocols represent more than 50% of the total market share.

Source: DeFiPulse

Lending and borrowing in the DeFi space are very different from the traditional mechanisms employed by banks and other financial institutions. You don't need to have a ton of documents or a credit score if you're borrowing money. All you need is two things; enough collateral and a wallet address.

DeFi also opens up the broader P2P lending market for those who want to lend their crypto assets to the borrowers and earn interest. The lending marketplace makes money on a net-interest-margin (NIM), just like banks or traditional P2P lending institutions.

Let's briefly discuss two of the most popular DeFi lending protocols; Aave and Compound.

Aave

Aave is a non-custodial, open-source, decentralized lending and borrowing protocol built on Ethereum. The team behind Aave launched ETHLend back in 2017, but the project had liquidity and loan-matchmaking issues. The team decided to overhaul ETHLend and release Aave in the first quarter of 2020.

Since then, Aave became the second-largest DeFi lending protocol with $10.57 billion locked on the platform and is on a steady growth trajectory.

Source: DeFi Pulse

Aave allows its users to borrow funds or earn a return by lending their assets, just like any other P2P lending platform out there. But at its core, Aave is very different. It is essentially an algorithmic money market where the funds are added to/or borrowed from a pool instead of a direct P2P manner.

The interest rate among different assets on Aave depends on what they call 'Utilization Rate,' which means that if an asset is performing well in a pool (higher utilization rate), then the interest rate will be higher. This dynamic interest rate based on utilization rate will incentivize liquidity providers to add more funds to the pool.

Similarly, if the utilization rate of an asset in a pool is lower, the interest rate will be lower. All loans on Aave are overcollateralized, meaning that if you want to get $200 worth of crypto, you will have to deposit much more collateral. The collateralization ratio varies with every asset and is decided by the protocol.

Aave also has an automated liquidation process due to high volatility among crypto assets. The protocol will liquidate your collateral if it falls below the pre-specified collateralization ratio.

Aave has a native governance token called AAVE, which can be used to vote for proposals. AAVE has become the largest DeFi project by market capitalization due to the popularity of the Aave protocol.

Compound

Compound is another money market protocol that is quite similar to Aave. Compound protocol is built on Ethereum and allows users to borrow crypto assets against their collateral or earn interest by adding their assets to the lending pool.

Compound is the third-largest DeFi lending protocol, with more than $10 billion locked on the platform. Unlike P2P lending, users contribute their assets directly to a lending pool, and the interest rates are determined algorithmically based on supply and demand.

Source: DeFiPulse

When you deposit your assets to Compound's lending pool, you get cToken in return. This token represents your share of the assets in the lending pool. If you deposit more funds, you accrue more cTokens. The earned interest isn't directly paid to your wallet, but instead, you get more cTokens equivalent to the amount of interest you have earned.

Let's explain that with an example: If you deposit ETH, you get cETH tokens in return. You also get your earned interest in cETH tokens. If you wish to take out your ETH from the lending pool, you can claim them back by depositing your cETH tokens. Since you will have more cETH tokens due to earned interest, the amount of ETH you will get after the withdrawal will be higher than the amount deposited.

Users can also send, receive or trade their cTokens. They can also borrow funds from the protocol equivalent to 50-75% of their cTokens value. Compound protocol supports various Ethereum-based ERC-20 assets that include Basic Attention Token, Tether, Wrapped Bitcoin, USDC, and 0x Token.

The protocol also comes with a governance token called COMP, which can be used to vote on things like protocol upgrades. Any person with more than 100 COMP tokens in their wallet can participate in the governance process.

Just like we saw in Aave, Compound loans are overcollateralized, meaning that users who wish to take out a loan have to deposit more collateral (ranges between 50-70%) due to the volatility and price fluctuations of the crypto assets. The collateral is automatically liquidated if the value of the borrowed funds approaches the value of the collateral.

Decentralized Exchanges

DEXs or decentralized exchanges is the third financial primitive for the DeFi ecosystem. Decentralized exchanges let users trade their crypto assets in a completely trustless and decentralized manner. They don't require any KYC and have no regional restrictions.

Decentralized exchanges have recently gained significant momentum, with more than $26 billion locked in value across all DEXs. Unlike many centralized exchanges, DEXs don't deal in fiat, and they only support crypto-crypto trades.

If we categorize decentralized exchanges, we see two most common types:

DEXs based on order-books - These decentralized exchanges operate on a commonly used order-book model employed by almost all centralized exchanges.

DEXs based on liquidity pools - These decentralized exchanges are also called 'Token Swap Platforms'. Unlike the traditional order-book mechanism, these DEXs employ liquidity pools, allowing you to trade (swap) one single pair at a time.

Let's briefly discuss two of the most dominant decentralized exchanges in the ecosystem today; Uniswap and Curve Finance.

Uniswap

Uniswap is a decentralized exchange based on liquidity pools, or commonly referred to as a Token Swap exchange. It is an on-chain liquidity protocol built on Ethereum and supports all kinds of ERC-20 assets with enough liquidity on the platform. Uniswap is the largest decentralized exchange in the token swap category, with more than $7.5 billion locked on the platform.

Source: DeFiPulse

Due to its widespread popularity, Uniswap has become the de-facto platform for small projects to issue their tokens. Unlike the traditional order-book mechanism used by many exchanges, Uniswap employs liquidity pools where anyone can create a pool with a swapping pair (e.g., ETH and any ERC-20 token).

The liquidity providers earn a portion of the fees on every successful swap. e.g., if someone swaps a pair (ETH/ERC-20 token), a fee is paid that goes to the liquidity providers of that pair. You earn a portion of the fees equivalent to your share in the pool. Uniswap charges a flat 0.3% fee for every successful transaction.

You might be wondering - if Uniswap doesn't use an order-book mechanism, then who sets the price? The pricing is determined through a mechanism called AMM, or Automated Market Making, which is a 'constant product market maker' algorithm developed by Uniswap.

In simple terms, the AMM algorithm sets the price based on some preDeFined rules. It takes into account the size of the pool and the size of the order placed. If the order size is greater, the price of the trading pair will be smaller and vice versa.

One drawback of Uniswap's AMM is the Impermanent Loss suffered by the liquidity providers, meaning that if a large order is placed, the price of your asset that you deposited decreases. Impermanent Loss is a risk associated with all kinds of AMM-based exchanges.

Uniswap has a governance token called UNI. Holders of UNI tokens can participate in the governance process, like voting for protocol upgrades, new features, or adding more pools, etc.

Curve Finance

Curve Finance is another decentralized exchange, commonly referred to as the 'Uniswap for stablecoins.' Curve Finance protocol is built on Ethereum and lets users swap between any Ethereum-based stablecoins or tokenized versions of Bitcoin such as sBTC, renBTC, and WBTC.

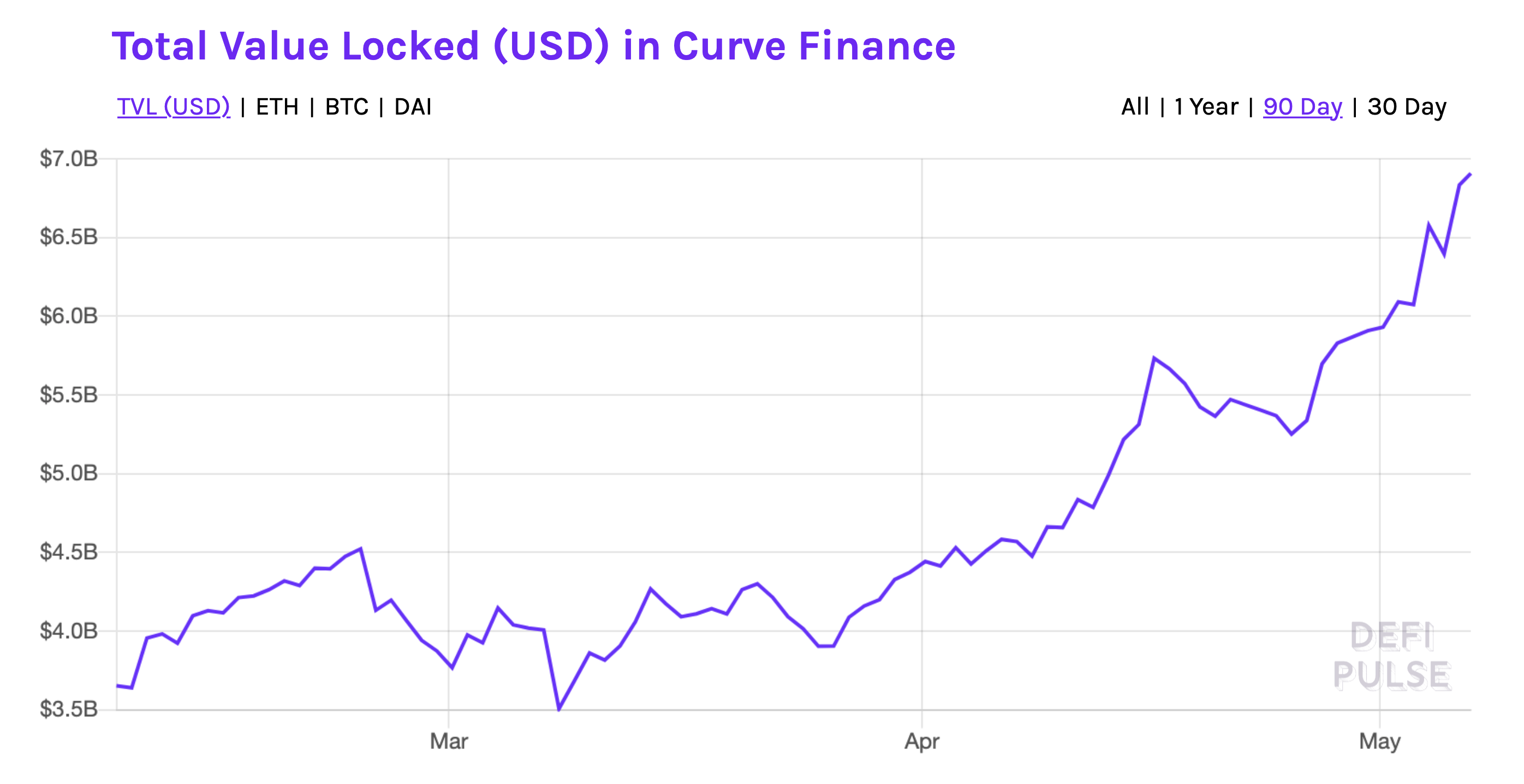

Curve Finance is the second-largest DEX with more than $6.8 billion locked on the platform. Instead of an order-book mechanism, Curve employs an AMM algorithm to determine the price. However, unlike Uniswap, Curve Finance offers significantly lower slippage when swapping between two different stablecoins.

Source: DeFiPulse

Slippage is the percentage difference between executed and quoted prices while making a trade. On Uniswap, slippage is a problem, especially when you're bringing in large order sizes. Curve Finance has lower fees and comparatively lower slippage when executing large trades.

Other crypto assets sometimes have high volatility and price fluctuations, but stablecoins retain their value with minimal volatility. Therefore, experiencing high slippage when executing large trades in stablecoins is a considerable risk when using AMM platforms. Curve's AMM formula is designed for these kinds of scenarios, as it minimizes slippage as much as possible.

Each successful trade on Curve Finance incurs a flat 0.04% fee going directly to the liquidity providers, compared to the high 0.3% fee charged by Uniswap. This lower fee makes Curve Finance an ideal platform for those looking to swap stablecoins and tokenized versions of Bitcoin, especially for larger order sizes.

The Curve Finance protocol is governed by a decentralized autonomous organization, CurveDAO, which comes with a native governance token called CRV. The CRV governance token is also distributed among all the liquidity providers on the platform, based on their share of the liquidity pool.

Wrapping up - The Current State of the DeFi Ecosystem

The DeFi sector has grown from just a few DApps to providing a whole new alternative financial services infrastructure that is open, trustless, borderless, and censorship-resistant in nature. The three financial primitives discussed here provide a foundation for building more complex and sophisticated applications in the DeFi ecosystem, such as derivatives, asset management, and insurance.

Source: The DeFiant

Ethereum clearly dominates the DeFi ecosystem because of the network effect and the flexibility it offers. However, alternative platforms are gaining traction, and they are slowly attracting the talent pool towards them. The ETH 2.0 scheduled upgrade has the potential to improve many things in Ethereum with sharding and Proof-of-Stake consensus engine, and we might see intense competition between Ethereum and alternative smart contract platforms.

Sign up with KuCoin, and start trading today!

Find the Next Crypto Gem on KuCoin!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>>https://www.kucoin.com/download