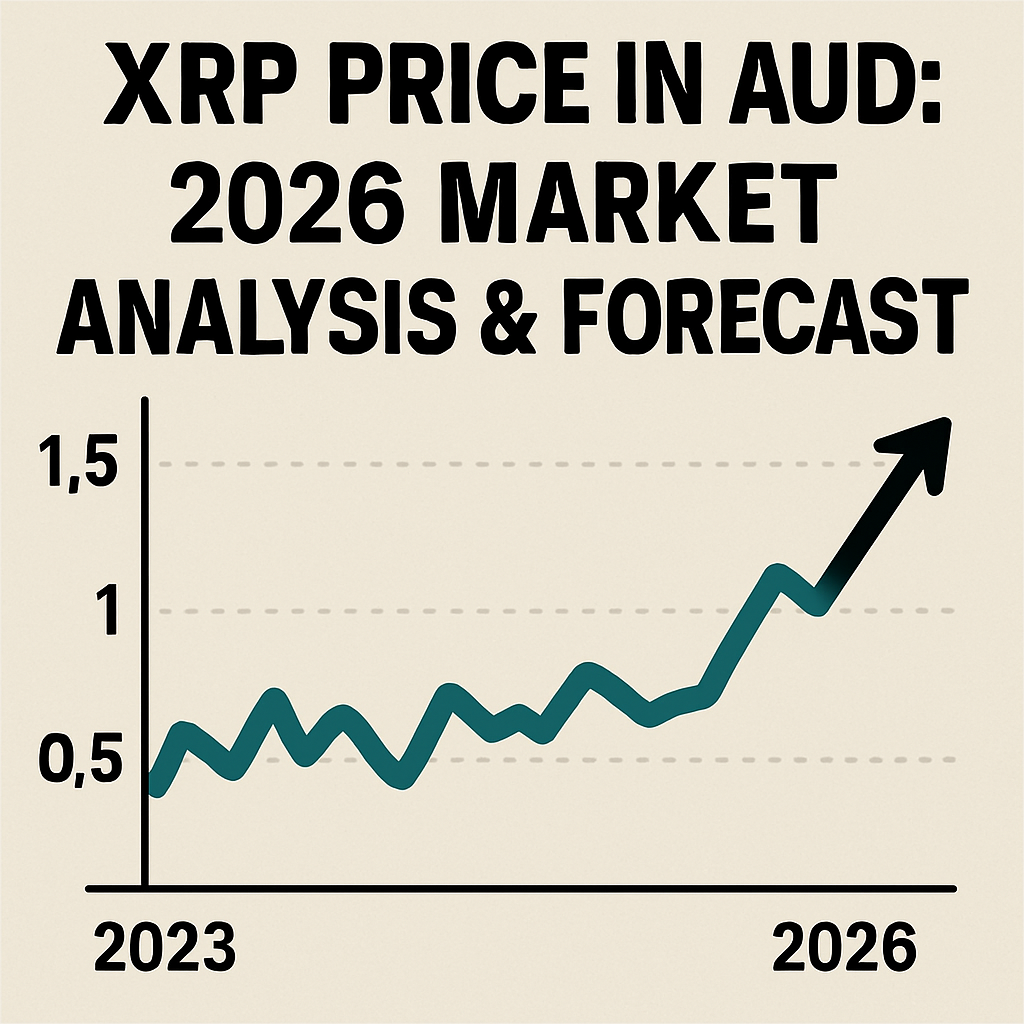

XRP Price in AUD: 2026 Market Analysis & Forecast

2026/01/07 13:57:02

In the dynamic landscape of 2026, XRP has transitioned from a subject of legal debate to a cornerstone of institutional finance.For Australian investors, understanding the XRP price in AUD is no longer just about tracking a digital asset; it is about monitoring a "bridge currency" that is actively reshaping global settlement.

In the dynamic landscape of 2026, XRP has transitioned from a subject of legal debate to a cornerstone of institutional finance.For Australian investors, understanding the XRP price in AUD is no longer just about tracking a digital asset; it is about monitoring a "bridge currency" that is actively reshaping global settlement.-

XRP Price in AUD (January 2026)

Market Note: Ripple finalized its scheduled 1 billion XRP escrow release on January 1, 2026. While 700 million were re-escrowed, the temporary increase in supply contributed to early-month price fluctuations before a recent recovery above the $3.00 AUD mark.

-

Historical Context: The Road to 2026

To predict where XRP is going, we must look at how it survived the "Legal Era" and entered the "Utility Era."

-

The 2025 Peak: In July 2025, XRP hit a seven-year high (reaching $3.66 AUD) following the official settlement of the SEC vs.(4) Ripple lawsuit.

-

Regulatory Clarity: By August 2025, the SEC dropped all appeals, cementing Judge Torres's ruling that retail sales of XRP are not securities.

-

ETF Inflows: The launch of Spot XRP ETFs in late 2025 brought in over $1.14 billion in capital, creating a new floor for the asset.

-

XRP Price Forecast: 2026 and Beyond

Expert analysts are divided, but the overall sentiment for 2026 remains cautiously bullish.

-

Continued Spot ETF inflows of $4B–$8B.

-

Mass adoption of RLUSD (Ripple’s stablecoin) on the XRP Ledger.

-

Ripple successfully obtaining a U.S. Bank Charter.

Moderate Case: $3.00 – $5.00 AUD

Many institutional analysts, including those from Nasdaq and The Motley Fool, suggest a more grounded target. They argue that while the "legal shackles" are gone, XRP must now prove it can capture significant volume from the SWIFT system.

Bearish Case: $1.50 AUD

Technical analysts warn of a "double top" formation.(8) If XRP fails to hold support at $1.80 USD ($2.70 AUD), it could slide back toward 2024 levels.

-

How to Buy XRP in Australia (AUD)

Buying XRP is highly accessible for Australians in 2026. Follow these steps to get started:

Step 1: Choose an Australian Exchange

Local platforms are preferred for their ease of AUD deposits and tax-reporting tools:

-

CoinSpot: Best for beginners; supports instant PayID deposits.

-

KuCoin (Top Recommended): Now officially registered with AUSTRAC as a Digital Currency Exchange (DCE), KuCoin has become the premier choice for Australian users. It uniquely combines a global-tier selection of over 700 assets with local convenience, offering instant, fee-free AUD deposits via PayID. With its new physical office in Sydney and SOC 2 Type II security certification, it provides the advanced trading tools (like AI bots and deep liquidity) that local boutique exchanges often lack, while maintaining full compliance with Australian laws.

-

Independent Reserve: Best for high-volume traders and SMSF accounts.

Step 2: Deposit AUD

Use PayID or Osko for near-instant transfers from your Australian bank account. Most exchanges in 2026 do not charge fees for these deposit methods.

Step 3: Secure Your Assets

Once purchased, do not leave large amounts of XRP on an exchange.

-

Hardware Wallets: Use a Ledger or Trezor for "Cold Storage."

-

Software Wallets: Use the Xumm (Xaman) wallet for interacting with the XRP Ledger ecosystem.

-

Key Factors to Watch in 2026

Investors should monitor these specific triggers throughout the year:

-

RLUSD Integration: Watch how Ripple’s new stablecoin impacts transaction volume on the main XRP Ledger.

-

Institutional Custody: Look for announcements from major Australian banks (like CBA or NAB) regarding crypto custody services.

-

Global Liquidity: Central bank interest rate shifts will continue to influence "risk-on" assets like XRP.

Conclusion

The XRP price in AUD is at a pivotal junction in 2026. With the legal battle concluded and institutional products like ETFs now active, the asset's value is increasingly tied to its real-world utility in the banking sector.