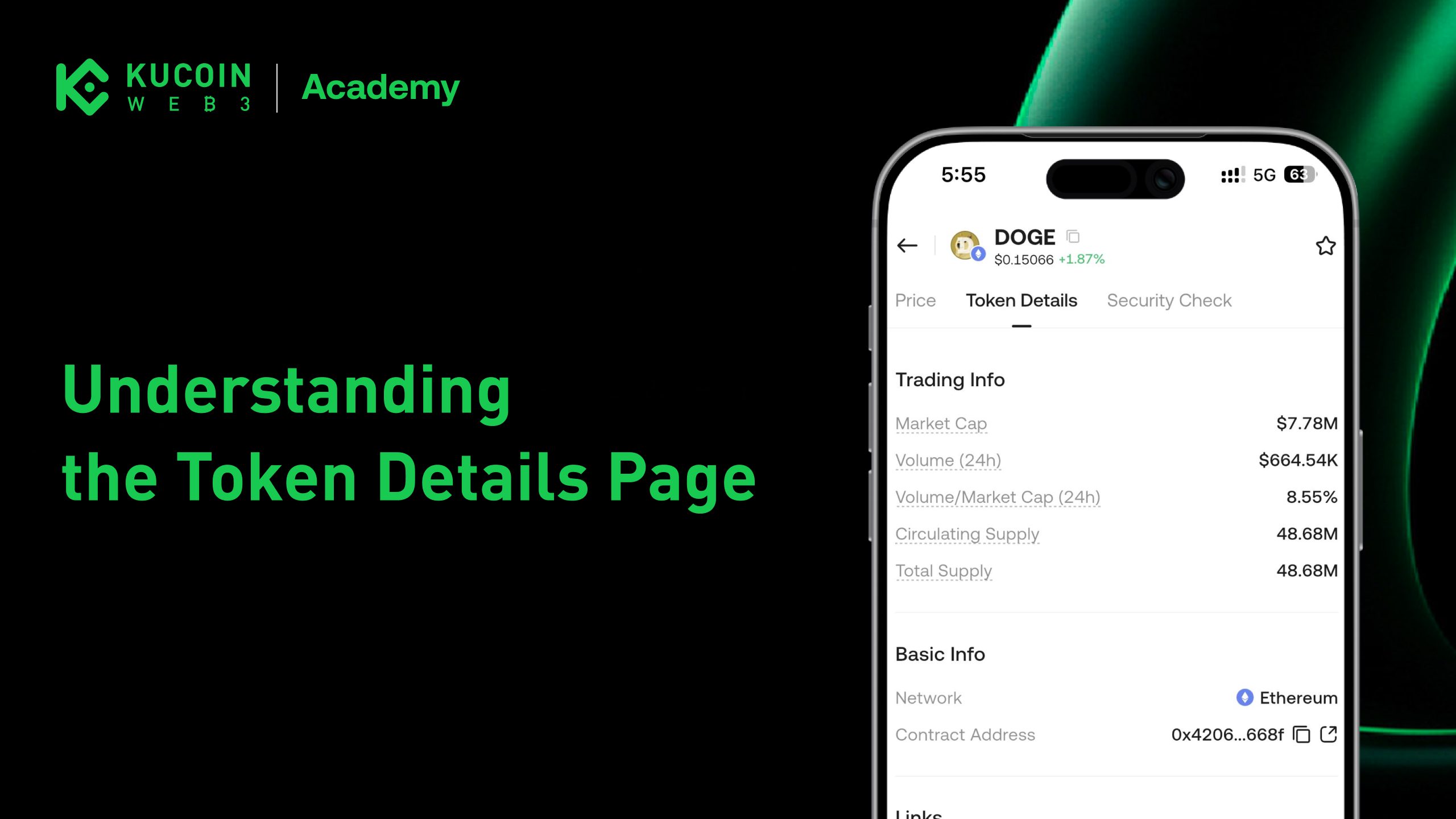

Understanding the Token Details Page

The Token Details Page in KuCoin Web3 Wallet provides a structured overview of key information for a specific token. It helps users verify token details, understand liquidity conditions, and security level before sending, swapping, or interacting with the asset.

1. Token Page Overview

The Token Page typically includes the following sections:

- Price

- Token Details

- Security Check

These sections work together to help users understand what a token is, how it behaves on-chain, and what risks may exist when trading it.

2. Token Details

The Token Details tab provides basic and market-related information about the token.

Trading Information

This section may include:

- Market capitalization

- 24-hour trading volume

- Volume-to-market-cap ratio

- Circulating supply

- Total supply

These metrics help users understand trading activity and relative market size. Sudden spikes in volume or unusually high ratios may indicate increased volatility.

Basic Information

This section displays:

- Blockchain network on which the token is deployed

- Token contract address

You can copy the contract address or open it directly in a block explorer to verify authenticity and review on-chain activity.

Links

When available, the Token Page may provide:

- Official project website

- Block explorer link

- Social media links

Always verify that external links match the official sources published by the project team.

3. Security Check

The Security Check tab highlights potential contract-level and trading-related risk indicators based on on-chain analysis. These checks are intended to provide transparency, not guarantees.

3.1 Risk Summary

At the top of the page, you may see:

- High Risk count

- Warning count

These indicators summarize how many risk signals have been detected.

3.2 Safe Trade Analysis

This section may include checks such as:

- Whether the contract can modify user balances. This reduces the risk of unauthorized balance changes.

- Whether liquidity pool tokens are burnt or locked. Burnt liquidity generally reduces the risk of sudden liquidity removal, though it does not eliminate all risks.

These checks help identify risks related to fund control or liquidity removal.

3.3 Swap Analysis

The Swap Analysis section highlights conditions that may affect a token’s tradability.

"Can Pause Trading" indicates whether the contract includes functionality that allows trading to be paused. Tokens with this capability may become temporarily or permanently untradeable at the discretion of the contract owner.

3.4 Contract Analysis

The Contract Analysis section reviews administrative permissions embedded in the token contract.

Common indicators may include:

Minting Not Revoked

Shows whether the contract owner retains the ability to mint new tokens. If minting is not revoked, the token supply may increase unexpectedly.

Accounts with Freeze Permissions

Indicates whether certain accounts can freeze token transfers. This may prevent users from transferring or selling tokens.

Can Modify Transaction Tax

Indicates whether transaction fees or taxes can be changed after deployment. Adjustable taxes may affect trading outcomes.

Cannot Shut Down Program

Indicates whether the contract lacks a function to completely disable itself. This can reduce certain shutdown-related risks.

No External Hooks

Indicates whether the contract avoids external callbacks or hooks that could introduce additional attack surfaces.

These indicators describe contract capabilities, not intent. Some projects retain administrative permissions for upgradeability or governance purposes.

4. How to Use the Token Page Safely

Before trading or interacting with a token, KuCoin Web3 Wallet recommends that users:

- Verify the contract address using a block explorer

- Review Security Check indicators carefully

- Be cautious with tokens that retain strong admin permissions or that with high warning/risk counts

- Avoid tokens with unclear ownership or abnormal trading behavior

No automated check can fully eliminate risk. Always perform your own due diligence.